While the British throne is returning back to a man, today we’re exploring women and investing. This issue is the first one ever written by our lovely editor, Ivana Slavcheva.

It’s no secret that women are underrepresented in finance. A few months ago, we ran a community survey to see who invests in alternative assets & why. Of the 800 investors who took part, barely a quarter were women.

Yet, data shows that women have higher educational qualifications, are generally better at saving money, and slightly outperform men in investing. There are now more women going to college, working in real estate and law, and simply more women living in the US.

So why are women under-invested in financial markets?

We gathered some research to explain the phenomenon and its consequences.

And while we’re at it, we’ve also put together a list of interesting women-led startups to consider investing in (including this week’s sponsor, LUXUS.)

Let’s go! 👇

Table of Contents

Women in investing today

Good news first: More women are investing than ever before.

A 2021 Fidelity Investments study showed 67% of women in the US are now investing outside of their retirement accounts, led by Millennials:

50% of women also say they are more interested in investing since the start of the pandemic, and 20% have made their first investments in new asset classes in just the past year.

Morgan Stanley says that women are no longer a niche demographic but rather a major force in wealth management, controlling one-third of total US household financial assets.

“Women control more than $10 trillion. By 2030, women in the US are projected to control much of the $30 trillion in financial assets that baby boomers possess. Women are also the largest beneficiaries of the current transfer of wealth, living an average of five years longer than men.”

And with that wealth comes influence. Women today control more investable capital, voting shares of stock, and corporate board seats than ever before.

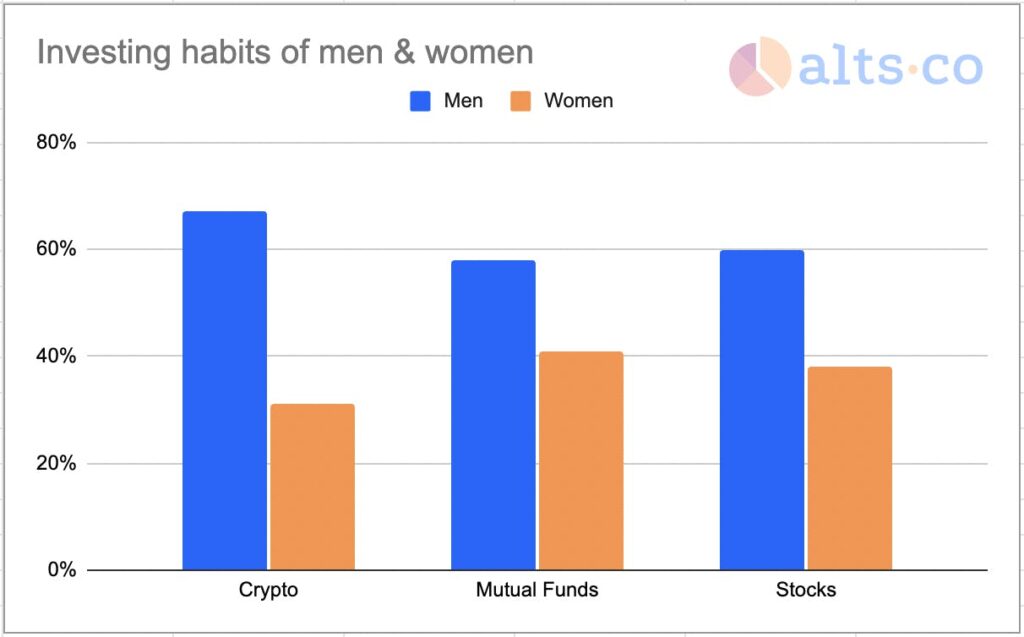

This is fantastic news, But when compared to men, there’s still some work to be done:

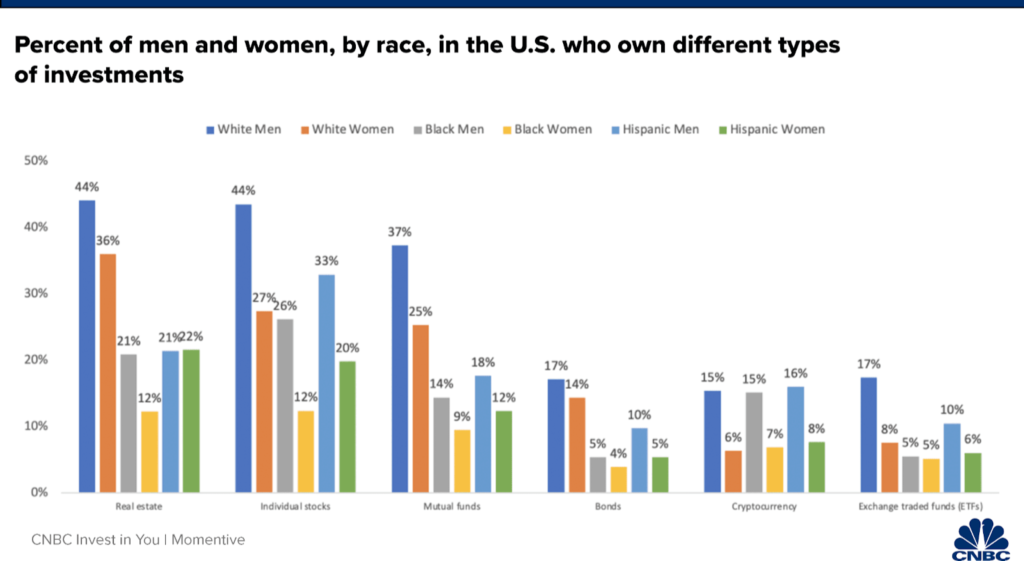

All women invest less when compared to men, but women of color (especially black women) face the highest investing barriers.

So while women finally feel more comfortable investing, they still don’t invest nearly as much as men.

There are likely a few reasons for this.

The gender pay gap

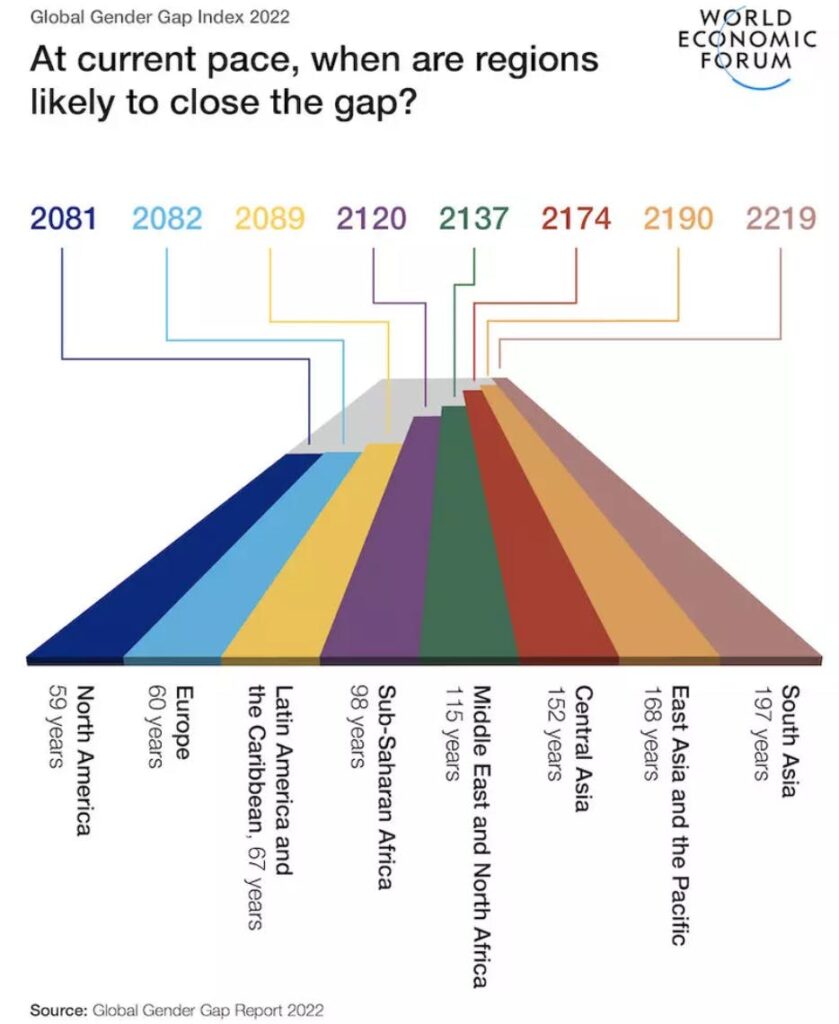

The gender pay gap is the average difference between the working wages for men and women. Women are generally paid less than men everywhere in the world. But in some countries, the difference is striking:

Ultimately, the pay gap reduces women’s lifetime earnings, seriously impacting their retirement savings, which is a significant cause of poverty in later life for women.

But on a more positive note, despite setbacks during the pandemic, the global gender pay gap is narrowing, and North America is actually projected to close its wage gap first:

The gender leadership gap

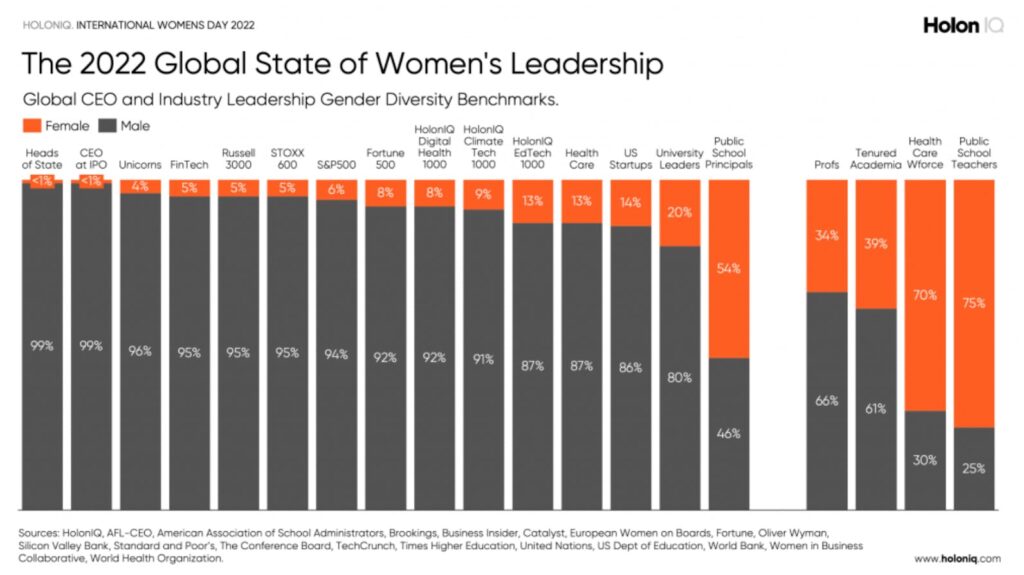

Though more women are gradually entering the workforce, and the pay gap is slowly closing, many women are still stuck in lower-pay positions, which they’re often over-qualified for.

When women do the majority of the less well-paid jobs within an organization, it negatively impacts the gender pay gap. While hiring 5 female secretaries for a company with 5 male executives improves the company’s gender diversity, it doesn’t offset the uneven leadership diversity.

The gender balance in leadership is not just a women’s issue; it’s an important economic issue.

The gender composition of investment decision-makers significantly impacts the allocation of investment capital. Meaning not only do women earn less (thus can invest less) but they’re also invested in less.

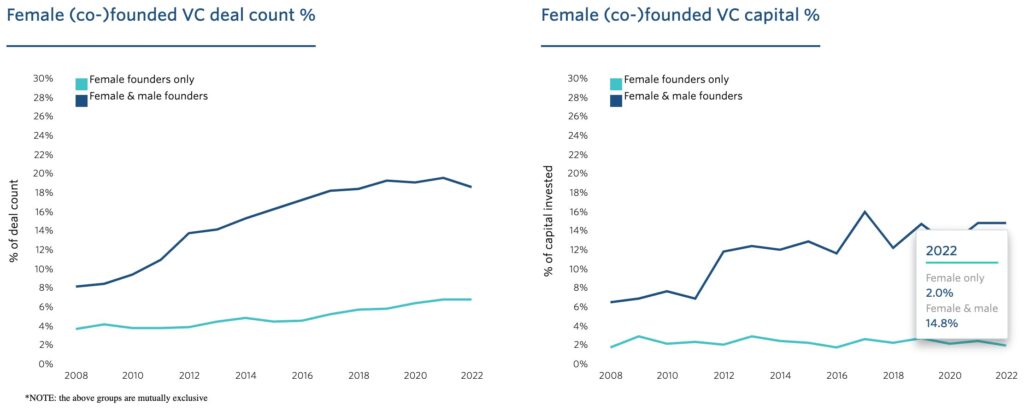

Most women-owned startups do not get funded by VCs because of conscious and unconscious gender biases. Women-led startups receive just 2% of venture funding! (Wowza, that is low)

But that number doesn’t tell the whole story. It was recently reported that since 2010, the percentage of women executives has increased across all developed regions. Asia has been leading the way, doubling participation since 2010.

And Pitchbook reported that startups founded by women accounted for nearly 7% of America’s VC deal count in 2022 — the highest ever.

The gender investing gap

Okay, this is what we really wanted to explore.

Finance and investing are not just male-dominated but also predominantly male-oriented (men investing in other men).

Evidence suggests that the lack of female leaders in VC makes firms less likely to invest in other female-led startups, leading to an imbalance in startups, services, and products aimed at females.

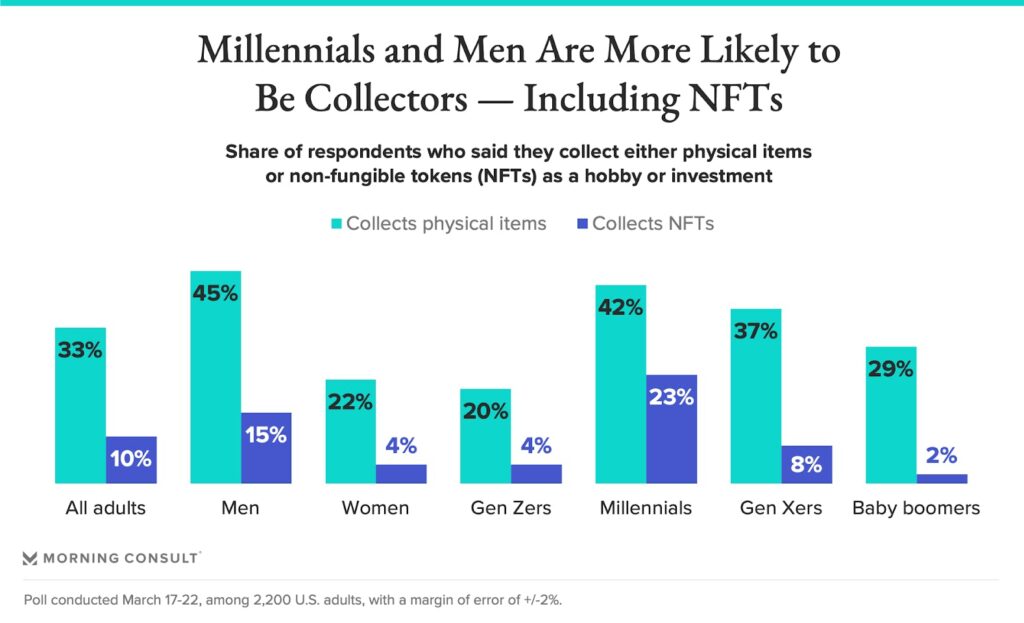

When it comes to alternative assets, this is especially visible. Take collectibles, for example:

Okay, it’s recap time.

We’ve established that women are:

- Paid less in general

- Less likely to be in positions of power that allow them to be paid more

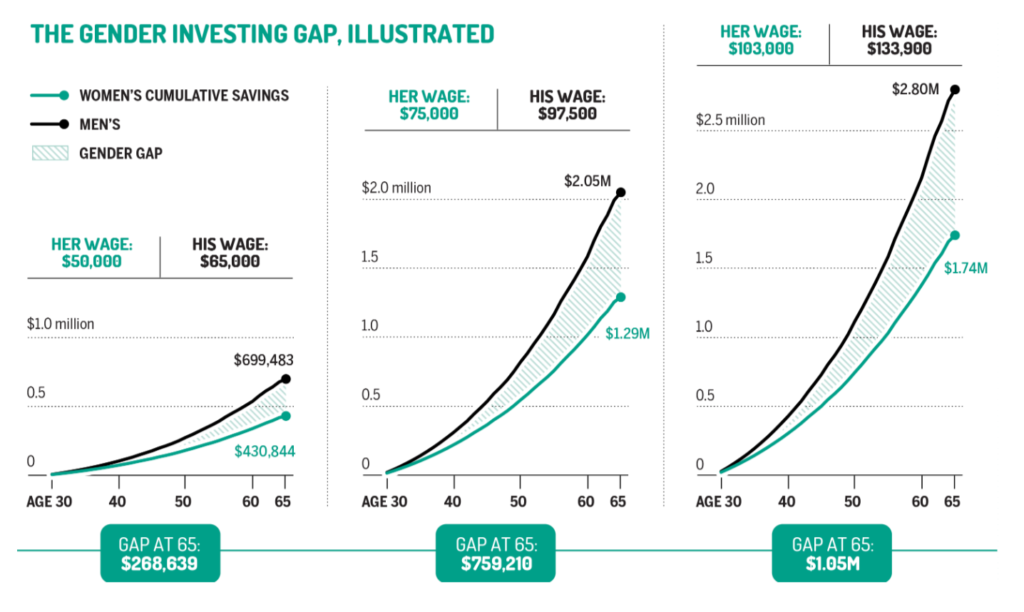

This double-challenge results in a sizeable gender investing gap:

And while traditional investments are already harder for women to obtain, data shows the gap is even wider when it comes to alternative investments.

This is especially disheartening given that cryptocurrencies like BTC and ETH were initially promoted as ways to increase investor diversity, improve inequality, and allow fresh blood into the previously heavily-gated field of finance.

Why we should close the gaps

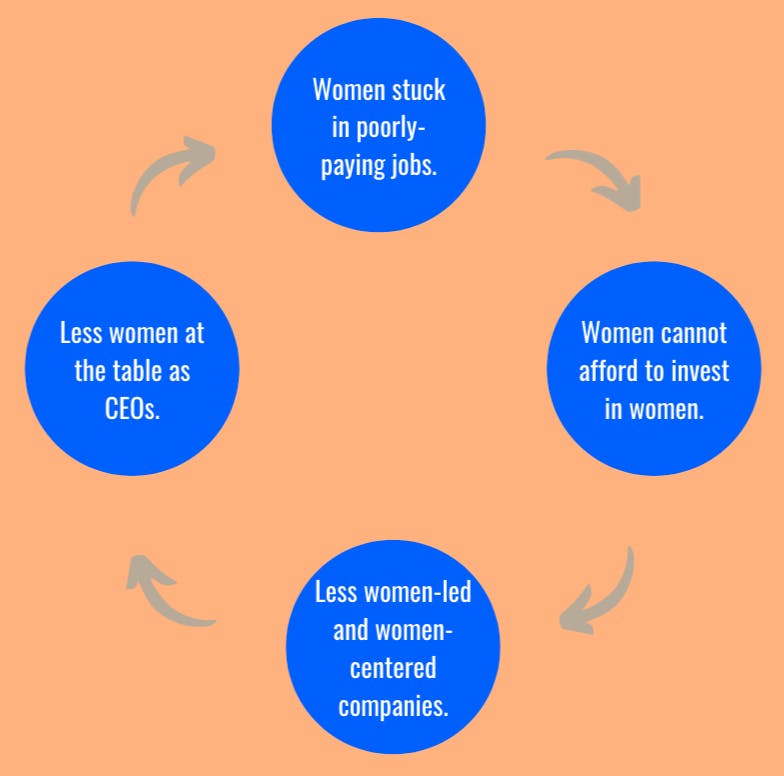

These three elements above — the pay gap, the leadership gap, and the investing gap — all negatively reinforce each other in an unfortunate loop.

When the wage gap is wider and women have lower-paying roles, fewer women can afford to invest. Fewer women investors mean less startup funding for other women, leading to fewer options for women to invest in, and round and round we go…

But remember that this feedback loop can work both ways!

Closing the gaps and including more women in finance and investing will not just be great for women, it will be great for the economy.

Here’s why:

- Pure numbers. There are more women than men, and they live longer. ‘Nuff said.

- Preferences. Women prefer to invest in women-led companies. More women in finance should then drive even more women to invest.

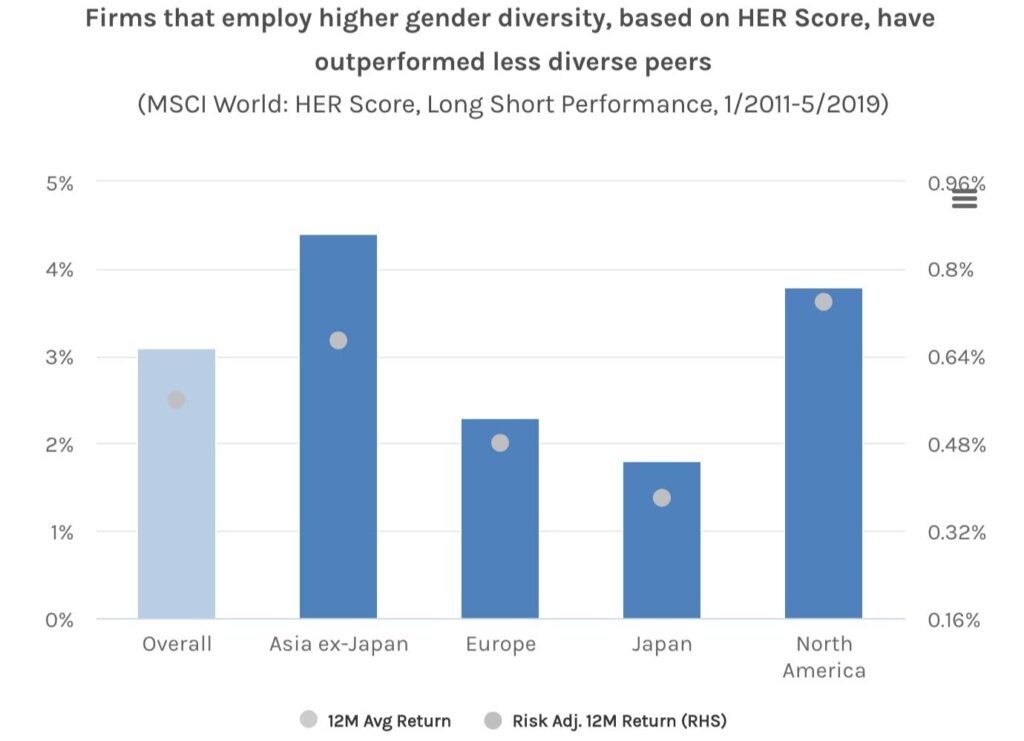

- Performance. Multiple studies have shown that S&P 500 companies with diverse boards outperform. Qualities like patience, high risk aversion, and humility have helped women invest more successfully than men. More women at the executive table means more commendable investment qualities, and more successful businesses in the economy.

With awareness, effort, and luck, women can reverse the spiral, and create a positive reinforcement loop that benefits all of society.

“Female founders tend to seek out female investors, and the chances of a female-founded company successfully securing financing can rise with a female investor in the room.” – Pitchbook

What do women invest in?

Asset classes

When there’s less investable capital, people tend to be more conservative. Thus, women have long-preferred lower-risk, lower-reward investments.

23% of women “invest” in simple banking products (savings accounts, checking accounts, money market accounts, etc), followed by stocks and bonds, mutual funds and ETFs (22% each).

On the alternatives side, real estate seems to be women’s favorite. (And for good reason. Real estate is probably as safe as you can get with alternative investments.)

Values

Women are not just more conservative in their investing, but tend to invest according to their values.

They favor more ethical and environmentally conscious businesses. The 2018 Boring Money Ethical Investing Report found that 32% of women believe ethical investing is extremely important, compared to just 14% of men.

Similarly, according to Cerulli Associates, 52% of women would rather invest in companies with a positive social or environmental impact.

Despite a raging debate around ESG investing, ESG-positive funds have outperformed globally over 5 years.

How to invest in women

We put together a list of some fantastic women-led startups from around the world.

Obviously, this is just a small sliver of the female-led companies out there. There are loads of others that we would love to include.

But these are a batch of interesting startups & syndicates on our radar; including some which are raising right now. (Big thanks to HERmesa founder Marla Shapiro for helping curate this list!)

Aura Fertility

Fertility rates are dropping globally, and the IVF market will be a billion-dollar market by 2028. Aura is an evidence-based support platform that offers pioneering care for IVF cycles. It was founded by Abi Hannah and Jo Living.

Ruggable

Ruggable makes ethical, eco-friendly machine-washable rugs (along with runners and doormats). Founded by Jeneva Bell, their products are designed and created to withstand whatever life throws at them.

Deep Planet

Deep Planet uses deep tech to help wine growers cope with climate change. (We’ll be doing a future issue on wine & climate change). Two of their three founders are women: Natalia Efremova and Sushma Shankar.

Valla

Valla is a legal tech company providing access to justice. Interestingly, it was founded by two non-lawyers with a compelling story: Danae Shell and Kate Ho.

LUXUS

LUXUS offers fractional ownership of precious gems, jewelry, and other bespoke luxury accessories. Their CEO and Founder is Dana Auslander, an investment management exec with 23 years of experience in product structuring, marketing, fundraising, investor relations, and corporate communications.

Evofem

Evofem is revolutionizing women’s sexual and reproductive healthcare with an innovative hormone-free contraceptive and STI prevention compound in development. The CEO Saundra Pelletier has 25+ years of experience in the pharmaceutical industry.

Xworks Tech

Xworks Tech is a sustainable waste & recycling trading platform backed by TechStars and founded by Electra Coutsoftides.

We Do Solar

We Do Solar makes smart solar systems for your balcony that save you money on bills and reduce your CO₂ footprint. The startup was launched in February 2022 by Ukrainian entrepreneur Karolina Attspodina 🇺🇦

Junee

Junee is on a mission to replace single-use takeaway containers. Their co-founding team includes Caroline Williams as CEO and Mary Liu as COO.

Textio

Textio, founded by Kieran Snyder, is the world’s most advanced workplace language guidance, helping you see the social bias in your writing, job posts, and feedback.

Synd.io

Synd.io was founded by Maria Colacurcio on the belief that organizations must do more than say employees are their most valuable asset. They build expert-backed technology that helps companies measure, achieve, and sustain workplace equity practices.

TheyGotAcquired

TheyGotAccuired.com is a media company that redefines startup success by highlighting unique startup stories founded by Alexis Grant.

FA-Bio

FA – Bio was founded by Ángela de Manzanos Guinot, and they are revolutionizing sustainable agriculture with the discovery of superior microbes in the soil.

Beatvest

Beatvest helps guide and educate beginner investors and make investing more inclusive and easier for everyone through their app. Sophie Thurner and Julia Kruslin are the two co-founders.

WOWverse

WOWverse — the blue-chip NFT collection is the work of artist Yam Karkai. Recently, they announced the launch of their highly-anticipated WoWVerse. Earlier this year, they partnered with The Fabricant to develop a digital fashion collection.

Avvinue

Avvinue is a pet travel startup that provides enterprise solutions to airlines for the management of pet policies, inventory, and ancillary services for pets. It was started by Nicole Caba.

WRF Capital

WRF Capital, dir. Meher Antia supports groundbreaking medical research & early-stage companies through grants and investments, focusing on life sciences and enabling technologies.

Ellevest

Ellevest helps women build wealth by offering private management, investment coaching, and more. The CEO is Sallie Krawcheck.

Angel Academe

Angel Academe invests in female-founded tech startups and introduces more women to angel investing, led by CEO Sarah Turner.

All Raise

All Raise is a venture-backed ecosystem that arms female founders and funders with access, guidance, and support to exponentially accelerate their success and propel the entire industry forward. Mandela Schumacher-Hodge Dixon is the CEO.

Closing thoughts

Women are increasingly moving the markets and changing how we look at (and talk about) money. It’s not just about equality; it’s about economics. More women in investing will create new products, markets, and huge economic tailwinds.

The future is female. Women’s investing strategies outperform, and women are transforming financial markets and economies across the globe. Their risk tolerance, confidence, and willingness to invest will impact our world for decades.

We’re not quite there yet, but this is rapidly changing right before our eyes. Soon, businesses will need to adapt and find better ways to meet the needs of female customers and investors. If the last two decades are any indicator, the future of wealth (and the future of financial markets) might very well be written by women. 👩