We’re often so worried about how our investments will affect our bottom line, that we forget a crucially important fact – our investments affect other people too.

Classic investing analysis is concerned with one thing and one thing only: financial returns. i.e., how an investment impacts the investor.

But lately, a new way of looking at investments has emerged: analyzing each investment’s impact on the world. And for good reason — we’re all on this planet together.

Historically, this idea was captured under the term, “socially responsible investing.” But in recent years, a new term has taken over: ESG (Environmental, Social, and Governance).

In this issue, we’ll examine ESG through an impartial lens: Why its intentions are good, what the problems are, and how it turned into a Frankenstein monster.

We’ll also talk about some real solutions.

Let’s go 👇

Table of Contents

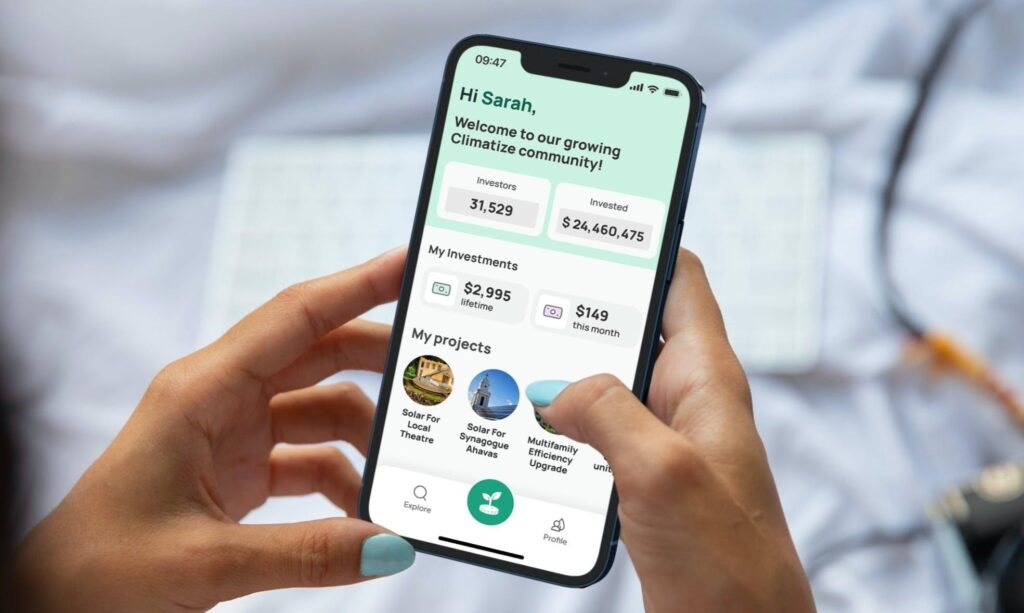

Invest directly in solar & energy efficiency projects with Climatize

As you’ll see later in this issue, the biggest problem with ESG is accountability. You don’t always know exactly where your money is going.

The best solution is to invest directly into projects that earn a return, and actually help the planet.

This is why Climatize exists.

Climatize lets you invest in real, impactful, shovel-ready projects on their growing marketplace:

☀️ Solar ⚡ Energy efficiency 🔋 EV infrastructure 💨 Wind energy 🧪 Bio-energy

I’ve invested in a solar power project for a local theater in NJ. I’m grateful that this type of opportunity exists for investors. – Dakota Bishop, Climatize investor

Have a real impact. Sign up for Climatize.

What is ESG?

What ESG investing really means is a matter of debate. But broadly speaking, it means investing that focuses on measuring impact across three areas:

- Environmental factors, like carbon emissions, pollution, and energy sustainability.

- Social factors, like employee diversity, workplace safety, and a company’s human rights record.

- Governance factors, like shareholder rights, and how accountable corporate executives are to the board.

Let’s say you had a choice between two investment opportunities: one was another social media company, and the other would cure cancer. Let’s assume both would give you the exact same financial outcome,

Nobody would struggle with this decision. Even the most capitalistic, ardent profit-seekers would agree that all else being equal, curing cancer is the better choice.

Of course, real-world choices aren’t so simple! In practice, things are a lot more complex.

Lots of ESG controversy focuses on how we actually measure the impact of each investment (not to mention deeper arguments around our values, ethics, and the role of corporations in society.)

But before we get entangled in that philosophical web, let’s take a step back and contextualize the market with a short history of ESG.

A short history of ESG

The intent of ESG investing wasn’t to bring “woke capitalism” to Wall Street. Rather, ESG was designed to be a useful metric to help investors assess a company’s long-term health and profitability.

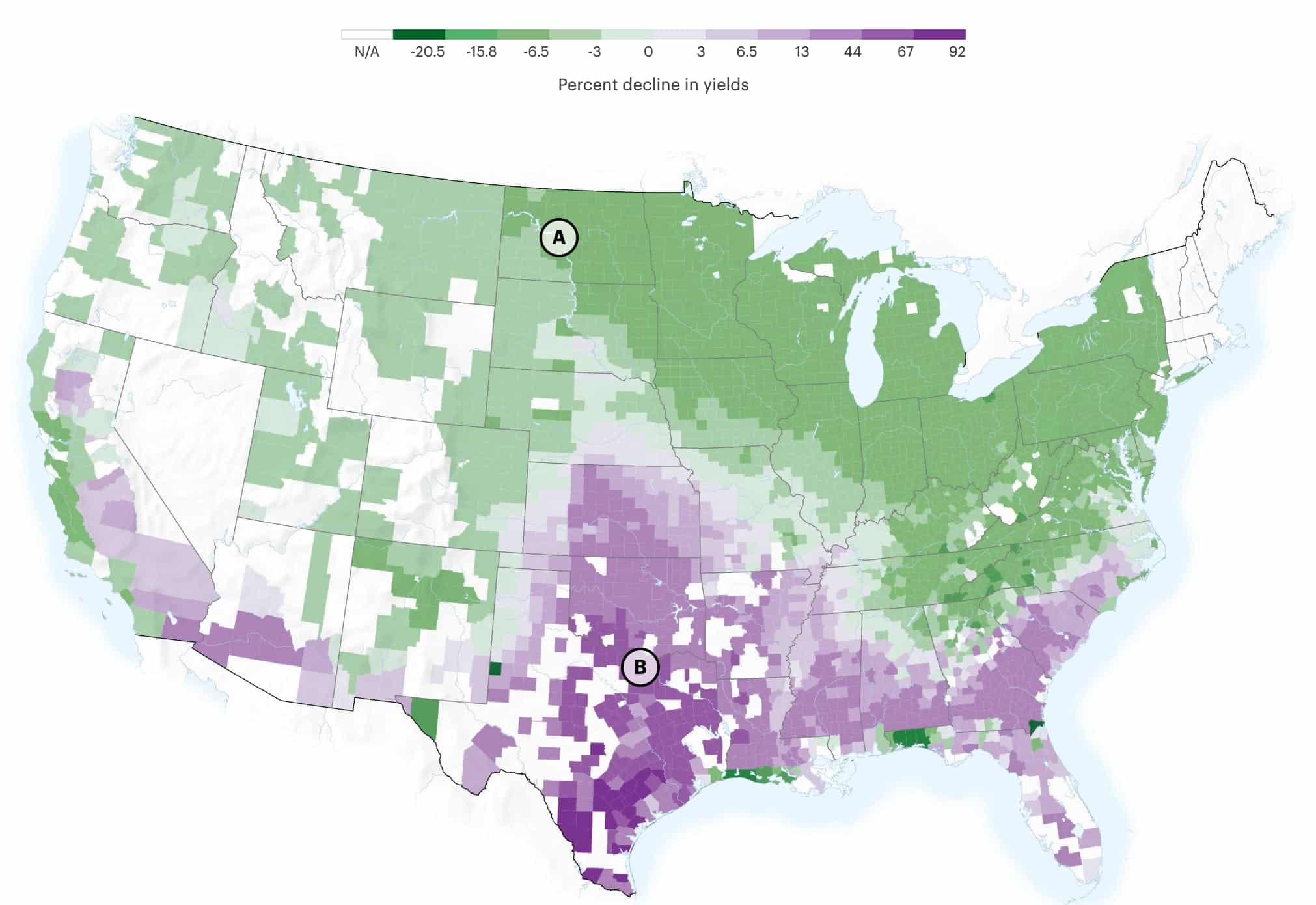

For example, if a company is too heavily invested in coal, it probably won’t do well in a global economy that’s swiftly moving to renewables.

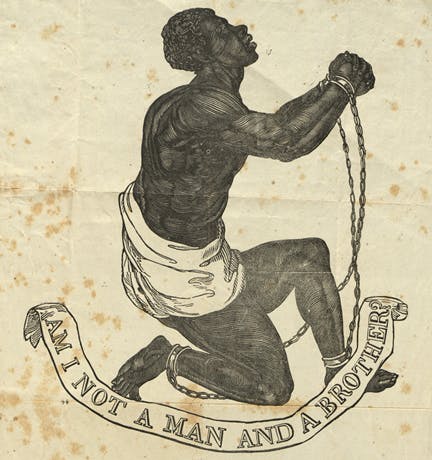

ESG might seem like a recent phenomenon, but the idea that investing and social good are not mutually exclusive is at least several centuries old.

In the 1700s, abolitionists campaigned against the slave trade and any business owners who invested in it. The Methodists and Quakers were the first religious movements to condemn slavery. They forbid their members from owning slaves, and advised their followers against investing in sinful industries.

Responsible investing has always aimed to direct capital away from “bad” companies and towards “good” ones. As the logic goes, by making it more difficult for irresponsible companies to finance their activities, fewer such companies will exist.

As the responsible investing market has matured, two general trends have coincided to shape the modern ESG landscape.

- Formalization. The concept of ‘socially responsible investing’ transitioned from a vague idea to a structured analysis based on the three ESG dimensions.

- Institutionalization. The creation of financial products like indexes, funds, and ETFs along socially responsible lines. Some of the biggest examples include ESGU (an iShares ETF) and VFTSX (a Vanguard mutual fund).

One of the first efforts toward institutionalization was the founding of the Pax World mutual fund in 1971. This fund (the descendants of which you can still invest in today) was created by two Methodist ministers who opposed the Vietnam War.

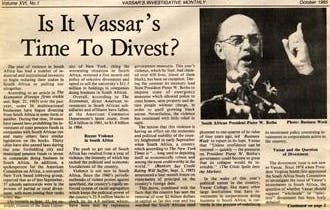

A decade later, a forward-thinking collection of countries, institutions, and investors launched a campaign to divest from South Africa in protest against the country’s racist apartheid laws.

Another step towards institutionalization was taken in 1990 when KLD Research & Analytics launched the first socially responsible index. But it wasn’t until the 21st century that the “ESG” framework was truly formalized.

In 2004, a group of financial institutions created a landmark report for the United Nations outlining how analysis of environmental, social, and governance factors could be used to integrate responsible investing into modern financial markets.

Since that report, the formalization and institutionalization of ESG analysis has been rapid. In 2006, just 60 socially responsible investing funds existed. By 2019, that had grown to 303 funds.

How big is ESG today?

Today, sustainable investing is a massive market.

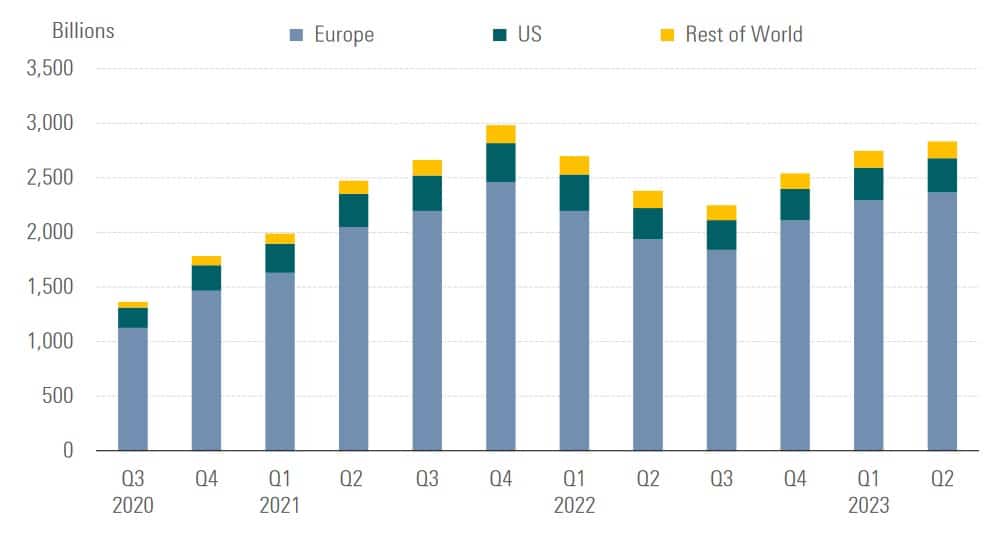

ESG funds hold more than $2.5 trillion under management (compare that to about $5 trillion managed by all hedge funds!) While most of these ESG funds are located in Europe, the American market has been growing as well.

There’s no simple answer for why the European ESG market is so much larger than the American one, but the primary driver is regulation.

Europe has an alphabet soup of corporate sustainability legislation, including the CSRD, the SFDR, and the EU taxonomy. These clearly define what is and is not sustainable, making it much easier for funds to perform ESG analysis.

But culture likely plays a role as well. In one survey, 41% of European asset managers who use ESG principles say they do so for ethical reasons, compared with just 19% of American managers.

In perhaps the clearest sign that ESG has become both institutionalized and formalized, Larry Fink, CEO of Blackrock (the largest asset manager in the world), has made repeated calls for executives to incorporate ESG into their decision-making.

In his 2022 annual letter, Larry made it clear that he views ESG initiatives as closely linked to delivering long-term shareholder value:

Stakeholder capitalism is all about delivering long-term, durable returns for shareholders… As stewards of our clients’ capital, we ask businesses to demonstrate how they’re going to deliver on their responsibility to shareholders, including through sound environmental, social, and governance practices and policies. – Blackrock CEO Larry Fink

Clearly, there’s been a lot of activity in the ESG market. But this hasn’t always translated to achieving the goals of ESG in practice.

What are the problems with ESG?

The aim of ESG is both admirable and very popular with investors. ESG-focused investments are expected to make up about 21.5% of assets under institutional management by 2026 – up from 2.9% in 2015.

But aiming at a target and hitting that target are two very different things. And, as currently practiced, ESG has some issues that put its effectiveness in serious trouble.

Greenwashing

One of the biggest issues with ESG in practice is that it’s very difficult to tell whether a firm is actually engaging in sustainable practices, or just pretending. Hiding irresponsible practices under the guise of sustainability is known as greenwashing.

Partly, this is driven by a lack of mandatory reporting about ESG activities. In contrast, public companies have tight regulations surrounding their financial activities, with audited statements published quarterly.

Europe has led the charge in requiring ESG reporting with their Corporate Sustainability Reporting Directive (CSRD) set to take effect in 2024. In America, the SEC is pushing for similar oversight, but has been met with resistance due to worries about the compliance burden on businesses.

Without mandatory reporting, many investors rely on rating agencies to publish ESG scores. These are the same agencies that publish business credit ratings, like Standard & Poor’s, Moody’s, and Fitch. (And yes, the same agencies that gave their blessing to sh*tty products that led to the 2008 crash)

Companies routinely pay up to $500k per year for ESG certifications. A whopping 95% of companies say they paid for the ratings under pressure from investors.

Another issue is that these ratings vary like crazy! While business credit ratings have a 99% correlation across the big agencies, ESG ratings have a correlation of just 61%.

So, there is widespread disagreement between the agencies on how each company scores. The agencies cannot agree on how ‘ESG’ each company really is.

No governing body or clear definition

There’s little agreement about exactly how ESG responsibility should be defined.

This is particularly pronounced with social issues, which can be expansive.

The “S” in ESG can range from issues like workplace diversity, to whether or not a firm relies on slavery in its international supply chain. But who decides? Who listens to the objections? Who makes the call? There’s no governing body for this stuff, and thus no standardization here.

Moreover, the governance factors sit somewhat awkwardly within an ESG framework.

- Should a coal company be included in an ESG index just because it has wonderful shareholder protections and its executive team is highly accountable to the board?

- Should an electric vehicle company (that has arguably done more to set us on a path to lower vehicular carbon emissions than any other company in history) be excluded from an ESG index because its CEO acts erratically and has essentially no oversight from the board?

ESG scores aim to assign each company a simple black & white number. But the world is complicated and interconnected.

Incentive contradictions

Apart from definitional and oversight issues, ESG investing is also rife with internal contradictions that create financial difficulties.

As with all responsible investing approaches, ESG is meant to divert capital away from firms that don’t meet certain criteria. In financial terms, this is known as raising a firm’s cost of capital.

The cost of capital is just the amount a firm needs to pay investors in order to use their funds.

Say an oil company is courting three potential lenders to borrow money, but two of them drop out for ESG-related reasons. The company has no choice but to go with lender #3. Lack of competition means companies pay a hefty interest rate to borrow money, making it harder to run their business.

Of course, even though the oil company is paying a higher interest rate, the lender is earning a higher interest rate.

What does this mean?

Non-ESG lending can actually be more financially attractive in the short term.

This creates issues for asset managers like BlackRock and Vanguard, whose support for ESG initiatives may violate their fiduciary duty to act in their client’s best financial interests.

(Interestingly, President Biden’s first veto was to protect the rights of retirement fund managers to consider ESG principles in their investment decisions.)

Like I said, it’s a complicated mess.

But that doesn’t mean we shouldn’t try and find solutions.

Direct investing

As an investor, you can still do good for the world. But you should consider alternatives to the current ESG market.

Lots of ESG issues have to do with the surrounding infrastructure. Rating agencies, executives, regulators, etc. So why not make investments that avoid this infrastructure altogether?

I think direct investing is one of the most practical solutions to ESG’s problems, and Climatize is leading the charge in this area.

Climatize was founded by Will Wiseman and Alba Forns — two Forbes 30 under 30 Honorees — and have developed a niche in finding and financing eco-friendly solar installation projects.

The company launched earlier this year to allow everyday investors to directly finance ESG projects. In the past 90 days they’ve already raised over $1 million for ESG projects, and are on a path to greatness.

In the words of CEO Will Wiseman, the idea for Climatize was sparked after he and Alba attended a climate rally in Barcelona in 2019. Despite the raw passion and good intentions of the crowd, they found themselves frustrated by political inaction on climate issues.

The idea surfaced that maybe everybody had a little bit of spare change, maybe 50 cents kicking around some drawer in their house, which wasn’t a meaningful amount of money to an individual. Yet, collectively, it could be a lot of money… We recognized that we needed to create a channel where the public could be active stakeholders in the energy transition.

But Climatize isn’t just focusing on the E of ESG – their projects come with social good too. In fact, Climatize raised more than half a million dollars in 30 days to fund a solar project that will provide 10% electricity savings for low-income families.

They also helped the Shakespeare Theatre of New Jersey raise funds for solar to combat rising electricity prices. The project is expected to help lower the theatre’s electric bill by 50%.

Bypassing the traditional financial infrastructure can help improve the bottom line. That solar project for low-income families came with an 8% annual interest rate for a term of five years. That’s impressive given 5-year corporate bonds are currently giving you about 5%.

Earn more and have a direct impact. What’s not to love?

Other ESG startups to watch

Startups have a huge potential to effectively advance ESG’s goals.

Here are some of the ESG startups that have caught our eye:

ZeroCircle

Earlier, we discussed ESG’s lack of mandatory reporting.

ZeroCircle has built sustainability reporting software that offers firms insight into their ESG performance, and lets them report their performance to external stakeholders, the media, etc.

Their platform goes beyond just measurement: ZeroCircle helps source sustainable suppliers, in what’s known as green finance.

As more organizations prioritize sustainability, companies like Zero Circle will help them track and report their performance.

Joby

Joby is creating flying electric vehicles which will offer aerial ridesharing. Think of Uber, but in the sky.

Appropriately enough, Joby counts both Uber and Delta as investors. If this type of ridesharing takes off, it could significantly reduce vehicular carbon emissions.

But remember: the inconvenient truth in this industry is airspace rights.

Voltpost

Voltpost designs lamp posts that double as electric vehicle chargers.

This could be huge in pushing electric vehicle adoption for EV owners who rely on street parking. Voltpost recently raised a seed round led by RWE Energy Transition Investments.

Cruz Foam

Cruz Foam is making sustainable foam-based packaging that is much more eco-friendly than traditional styrofoam.

Styrofoam is an environmental nightmare. This could go a long way toward reducing packaging waste.

They recently raised a Series A, with investors including Hollywood stars like Leonardo DiCaprio and Ashton Kutcher, whose fund portfolio includes Uber, Lyft, Flexport, Robinhood, and Affirm.

Shareholder activism

Shareholder activism is another potential avenue for ESG investors to make a real difference. Shareholder activism takes the inverse approach to standard ESG investing; instead of shunning irresponsible companies, activists invest in irresponsible companies to turn them into responsible ones.

Perhaps the most famous example of ESG activism in recent history was Exxon’s 2021 battle with the activist-focused hedge fund Engine No. 1. Despite owning a small stake in the company, the fund launched a successful campaign to elect its own directors to Exxon’s board in order to push the firm to transition away from fossil fuels.

This is an interesting, impactful model, and I’m surprised it doesn’t happen more often.

Carbon credits

We recently wrote about buying and selling carbon credits.

A carbon credit is basically a ticket that represents the removal of some carbon dioxide from the atmosphere. That ticket can then be purchased by an emitter in order to “offset” their own pollution.

While carbon credits cover just the “E” of ESG investing, the environment is usually at the forefront of ESG investors’ concerns.

Obviously, carbon credits don’t do much good if they’re voluntary for high emitters like a coal company. But if regulations mandate enough carbon credit purchases to offset emissions, they can be an effective way to make emitters ‘internalize the externality,” and pay for the pollution they cause.

The carbon credit market is a bit of a mess right now, with lots of competing standards and systems. But there are a few good options for individual investors to purchase carbon credits and thereby offset some of their own emissions – you can read our full exploration of carbon credits here.

Ideally, the system will become globally centralized and mandatory for high emitters. While there’s a chance that such a global crackdown on carbon emissions leads to a big increase in the demand for carbon credits, the chances may be slim. Politicians have shown resistance to expanding the use of carbon credits, so regulation is likely to come in other forms.

Closing thoughts

As I’ve said before, investing is about more than just raw financial returns. It’s about what you value, trust, believe in, and increasingly, the impact your dollars can have.

Yes, ESG is rife with problems. There’s greenwashing galore, the reporting and ratings ecosystem is a mess, and the term has become controversial and politicized.

But that shouldn’t distract us from what it stands for. We should look after the environment. We should look after people. We should punish boards and executives who are doing shady stuff.

I really like what direct investment firms like Climatize are doing. What a huge difference it would make if more investment dollars were community and socially-guided.

Despite all the doom and gloom, this is a good time to be alive.

Money talks, and it has ultimately never been easier to invest directly in what you believe in. 🌱

Further reading

- There’s a newsletter called Acclimate, which is probably my single favorite climate/investing newsletter. If you want to know more about the challenges and opportunities in the energy transition, and how it can benefit you personally and professionally, sign up here.

- CarbonBot is also good.

- These guys helped create ESG. Two decades later, they see a mess.

- The ESG rating system is at a crossroads. Hundreds of funds will soon be stripped of their ESG rating

- The International Sustainability Standards Board just released a voluntary framework that gives companies a standard way to disclose ESG info. Expect to start seeing this in financial reports in 2025 — a big opportunity for companies like ZeroCircle.

- Does ESG investing generate higher returns?

- Do boycotts actually work? Most go nowhere, but here are the most effective boycotts of all time.

Disclosures

- This issue was sponsored by our friends at Climatize and ZeroCircle

- Our ALTS 1 Fund has no investments in any companies mentioned in this issue

- This issue does an affiliate link to Acclimate