Today, we’re looking at which American residential real estate markets will benefit most (and least) from climate change.

Note: This special report only focuses on the United States. But we think our international readers will find it informative and useful.

Let’s go 👇

Table of Contents

How will climate change affect American residential real estate?

It’s complicated.

The specific path the global climate will take is unknowable. Indeed, increased variance and deeper extremes are part of the problem.

And each of those paths are multifaceted:

- Rising seas

- Increasing temperatures

- Profound humidity

- More (violent and destructive) hurricanes and tornados

- Drought

- Increased / decreased crop yield

- Frequent mega wildfires

Some states will be crushed by climate change. Others will benefit.

Many residential mortgages will be underwater while other regions thrive.

Let’s get a few things straight

There are a few points and terms to understand before we begin.

Wet bulb temperature

You’ve probably been hearing this term a lot lately.

This is a measurement technique that factors in both temperature and humidity.

The wet bulb temperature is measured by wrapping a wet cloth around the thermometer, which cools the mercury inside as the water evaporates. The drier the ambient air is, the more quickly water evaporates, and the cooler the wet bulb temperature.

- 40 Celcius (104 °F) with 25% humidity reads as 24 °C (75 °F)

- But 40 Celcius paired with 75% humidity reads as 36 °C

If your body can’t regulate it’s temperature because it’s too hot and humid, you’ll die.*

The generally accepted survivable wet bulb temperature is between 31 – 35 °C over a six hour period

*This is why you can die from swimming in very warm (32 C+) water (100% humidity).

Scenarios

There are a number of climate change prediction models and scenarios, and their impacts and outcomes vary widely.

As far as I can tell, the RCP 4.5 scenario is the most widely accepted today, and it generally aims to show what America (and the rest of the planet) will look like given current policies and marginal improvements.

The most extreme scenario that’s widely accepted as plausible is RCP 8.5, which assumes no action taken at all, and climate change (and global temperatures) continue linearly through the end of the century.

There are problems with every scenario, and each is imperfect, but RCP 4.5 seems the most mainstream today.

Therefore, my analysis below is based on RCP 4.5 projections unless otherwise noted.

You may disagree

Not everyone believes either / both climate change is real or that humans cause it.

If you’re one of those people, but you invest in American real estate, you still need to know what everyone else is thinking.

Because these trends — or the perception of them — will move markets.

The big (American) picture

Over the next several decades, more than 150 million Americans will experience decreased quality of life due to climate shifts -— mostly increased temperatures and decreased access to clean water. A great many of them will pick up and move. 250k Americans have already moved.

Experts estimate somewhere between 10 million and 60 million Americans will either choose or be forced to move in the coming decades. That’s an order of magnitude larger than the continent’s previously largest shift — The Great Migration — when six million African Americans left the south and moved to the north, west, and midwest.

That shift redefined the country.

So what might this new shift look like?

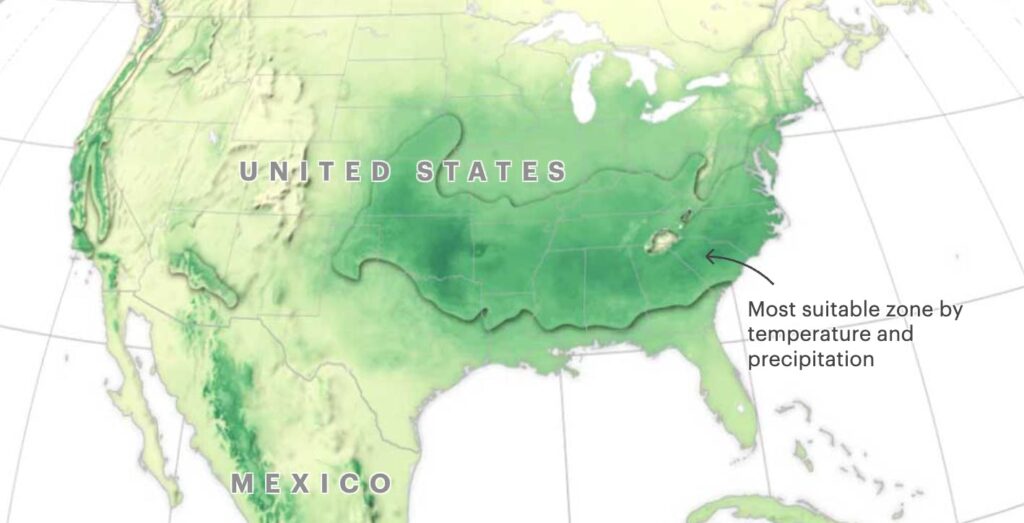

Generally speaking, the green bits here are where humans like to live in America today. The heart of the country, from the Atlantic seaboard through northern Texas and Nebraska, and the California coast are most suitable.

It’s called the “human climate niche,” which is where temperature and precipitation have best aligned with human preferences over the last 6,000 years.

Note: This is a good opportunity to pause and note that climate (and its change) isn’t the only factor when it comes to real estate values. There are tons of big cities with expensive property outside the American human climate niche — Miami, Houston, Austin, Denver, Las Vegas, Phoenix, New Orleans, Chicago, Indianapolis, Cleveland, etc etc etc.

But it is important, and it’s what this essay is about, so let’s move on.