Hello and welcome to Alts Cafe

This is a quickfire look at what’s driving your holiday-shortened week.

TLDR:

- Commercial real estate continues to collapse

- But crypto is ripping

- Are STRs crashing? Either definitely or not at all

Table of Contents

Macro View

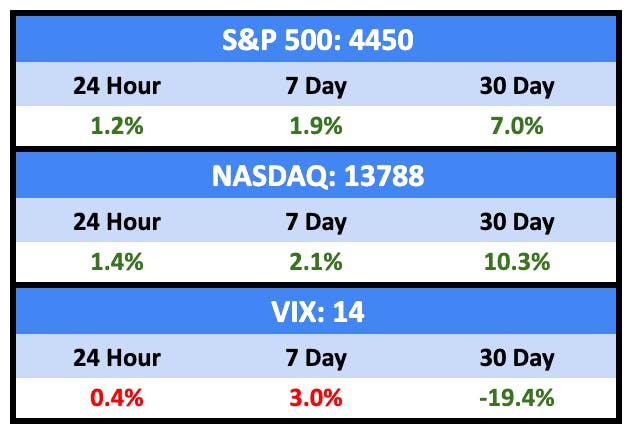

The stock market is ripping while the world falls apart. It’s a strange time.

Bullish News

- The US economy grew more in the first quarter — 2% — than analysts thought.

- The UK is trying to get on top of inflation. Sort of.

- Australia’s inflation slowed more than expected in May.

Bearish News

- Corporate defaults rose last month, with 41 in the U.S. so far this year. That’s more than double the same period last year.

- US jobless claims fell by the most in 20 months — rate hikes will continue until the hot labor market cools.

- Corporate bankruptcy filings in the US are at a thirteen-year high.

- PE dealmaking is at a four-year low.

- IPO and M&A deals are off over $1 trillion year over year.

- There’s currently an 87% chance the Fed raises rates by 25bps in July and a 23 % chance of another hike at their next meeting in September.

- Economists are predicting a modest recession in the US.

What are we doing?

ALTS 1 fund news:

Nothing here

Real Estate

Bullish News

- Prologis, a warehouse REIT, was able to successfully issue $2 billion in bonds.

- 60% of office vacancies are concentrated in only 10% of offices, and 90% are in only 30%.

- US home prices rose 0.5% month to month, and they’re only 2.4% the June 2022 peak.

Bearish News

- Two more Chinese homebuilders defaulted on debt payments.

- A recent viral (but disputed) twitter thread illustrated the collapse of AirBnb revenue in cities like Phoenix and Austin.

- Studio to two-bedroom apartments saw a year over year rent decline for the first time since Realtor.com began tracking data.

- $4 billion worth of multifamily loans will come due in October.

- Distressed US commercial property assets rose to $64 billion last month with another $155 billion on the way.

- U.S. commercial property pricing continued falling in May with all major property sectors posting steeper annual declines.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

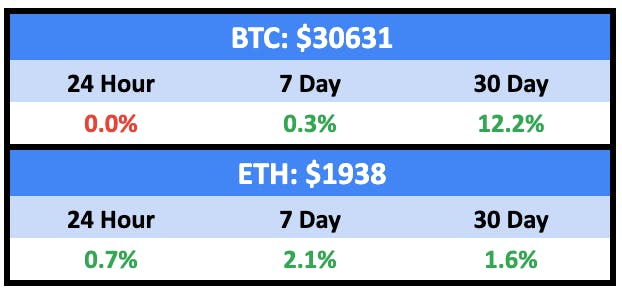

Bitcoin jumped more than 15% last week, rising above $30,000 for the first time since April, its best week since March, driven by BlackRock filing an application to launch a BTC ETF.

Loads of good vibes last week.

But NFTs continue to be a dumpster fire.

Bullish News

- Bitcoin jumped more than 15% last week, rising above $30,000 for the first time since April, its best week since March, driven by BlackRock filing an application to launch a BTC ETF.

- Fidelity is also launching a BTC ETF.

- Metatime, a blockchain technology company, has hustled its way to $25 million worth of investment.

- MicroStrategy, the most useless company, bought $347 million worth of Bitcoin from April to June.

- More than 130 countries are studying the use of digital currencies.

Bearish News

- Binance was shut down in Belgium, and Germany said nein to Binance’s application to operate there.

- FTX is dead and doesn’t seem to realise it yet.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- Elon is selling $750 million worth of SpaceX shares valuing the company at $150 billion. I guess he needs the money to pay Twitter’s server bills.

- Three big AI exits last week:

- Meanwhile, Inflection AI raised $1.3 billion.

- OpenAI is planning a ChatGPT personal assistant for the workplace.

Bearish News

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our alcoholic friends at House of Rare. If you click on the advert for Percent, we get a buck.

- We hold BTC, ETH, and lots of tequila in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.