Hello and welcome to Alts Cafe

This is your weekly briefing on the world of Alts investing. Buckle up, it’s bumpy.

TLDR:

- Unemployment claims in US are at their highest levels since Nov 2021. Could a drop in rates come soon?

- More people live at home than they used to. It’s going to affect the shape of the Real Estate investment market.

- Terrible week for ETH and NFTs, but institutions are optimistic about the longterm future of BTC.

Caffeine up and let’s go.

Wyatt

Table of Contents

Macro View

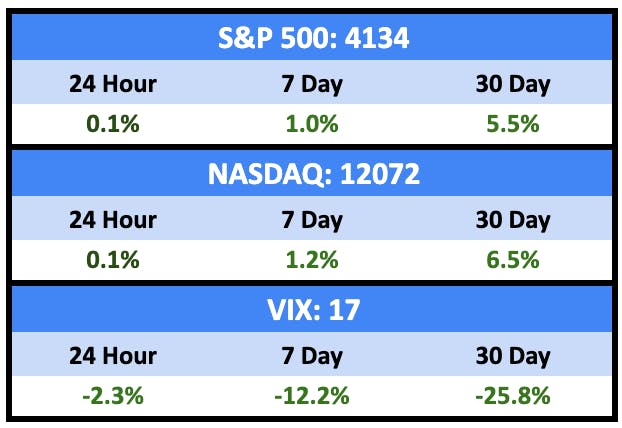

A quiet week from a macro point of view as earnings continued to roll in.

Bullish News

- Recurring US unemployment benefit claims jumped to the highest level since November 2021. More unemployment = lower rates.

- More prime age workers are entering the workforce, which should drive unemployment stats up.

- More than 90% of companies reporting this quarter beat estimates.

Bearish News

- Unemployment among high-earning households is up 500% since last year.

- More than 25% of people aged 59 and older have no money set aside for retirement.

- England and Wales are setting records for business insolvency.

- Consumers are starting to fall behind on their credit card and loan payments.

- More American consumers are using Buy-Now-Pay-Later apps to pay for groceries than ever before.

What are we doing?

ALTS 1 fund news:

Our quarterly report went out last week.

Real Estate

I read an Urban Institute report this week that, as a Real Estate investor or analyst, sheds some light on upcoming trends that would affect my investment thesis.

The key takeaway is: The behavior that drives home-buying is changing.

Over 20% of Americans aged 25 to 34 live with their parents. It was half that in 2000.

One of the reasons?

In 2021, only 38.6% of young Americans were married, compared to 59.4% in 1990.

Further, of young Americans who have married, more than a third have subsequently got divorced before the age of 34. Back in 1990, only one in nine had divorced by the same age.

Overall, this feels like a trend that’s going to continue to escalate, which means there will be more demand for:

- Parental homes that can accommodate an ADU

- More rental apartments

- Smaller, cheaper starter homes

- Longer duration (50 years) mortgages

The study I looked at didn’t break out the data by geographic region or urban vs. rural, but I suspect there’s a lot of variation here. People marry earlier in the country and divorce more in cities, etc.

Bullish News

- Redcar Fund Management announced it closed on $418 million to convert warehouse spaces in LA and Texas into “creative offices.” I hope they’ve also invested in “creative accountants.”

- Cap rates for Class A multifamily properties saw their first significant quarterly deceleration since the Fed started raising rates last year, suggesting the asset class could be less risky for investors going forward.

- After positive inflation news last week, the market expects mortgage rates to drop.

- Cities are giving away money to help developers transition offices to residential spaces.

- China’s new home prices rose in March at the fastest pace in 21 months.

Bearish News

- A $161.4 million commercial mortgage-backed securities (CMBS) loan backing nine Brookfield-owned Class B office buildings defaulted.

- Office space vacancy rates hit a record high in March.

- Some are calling for office buildings to be demolished, because conversions are too difficult.

- Around 14% of investors sold their homes for a loss in February and March. A bit more depth on this:

- That’s the highest since 2016 but well off numbers from 2009 to 2011, which saw two thirds (66%) of investors take a loss.

- Phoenix and Las Vegas were hit hardest, with 31% and 28% of investors losing money.

- The typical investor who sold a home in March sold it for 45.9% more ($145,714) than the price they paid, down from 55.3% ($173,458) a year earlier and a pandemic peak of 67.9% ($199,274) in June 2022.

- 10% of homes currently on the market are owned by investors. That’s down from 12% late last year but up from 3.8% in 2013.

- The top three US markets at risk for home declines are in Utah. Florida and Idaho round out the top five.

- The median US home sale price fell 3.3% in March to $400,528, the largest year-over-year drop since 2012.

- Opendoor fired 22% of its staff — 560 people. Redfin fired another 201 members of staff in its third round of layoffs since last summer.

- WeWork is facing delisting from the NYSE.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

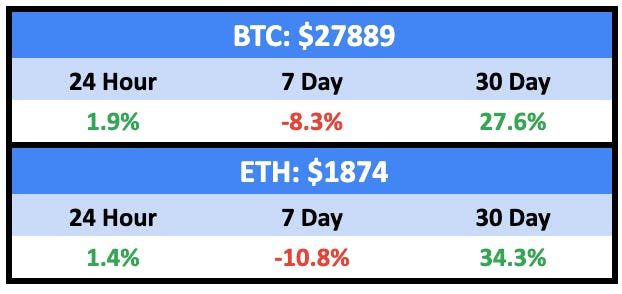

Crypto & NFTs

Here’s what you need to know:

Big time correction last week as both BTC and ETH shed recent gains.

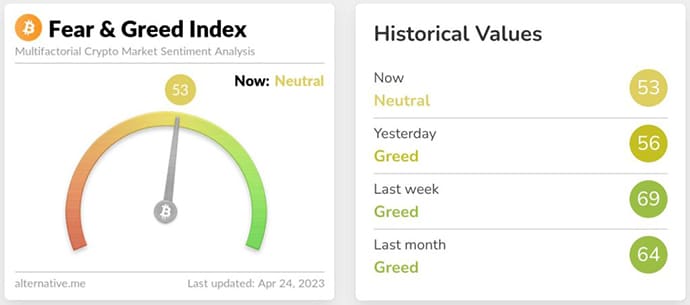

We’re back to neutral, as the F&G index slid to 53.

And it was an awful week for NFTs as they followed ETH down.

Bullish News

- Standard Chartered thinks Bitcoin may hit $100k by the end of 2024.

- A Hong Kong court has recognized crypto as property.

Bearish News

- Coinbase may leave the US.

- Crypto companies are struggling to find banking partners.

- Sweden is abolishing tax incentives for data centers in July – potentially putting the last nail in the coffin for the Bitcoin mining industry in the region.

How to invest in Crypto & NFTs right now:

Buy the dip!

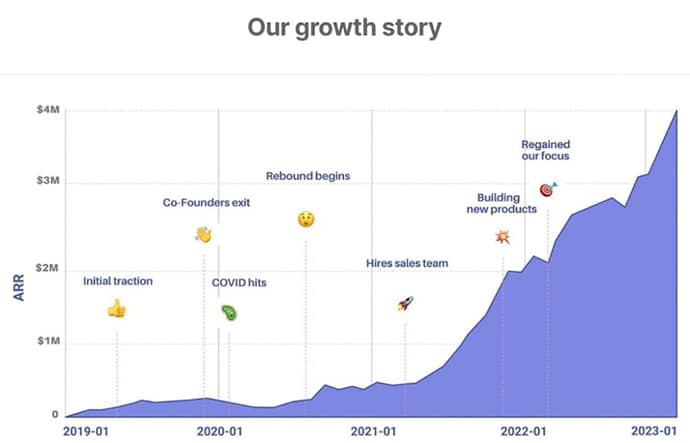

Taking a quick break here to talk to you about Athyna, a super-smart, AI-based startup who are closing a raise on 29th April, and I don’t want you guys to miss out.

They’re raising via Republic, and In a nutshell, this looks like a no-brainer to me 🔥

- They’re building a talent-matching platform driven by AI – smarter matches = better value for hiring companies

- They’re already profitable at $5.2M ARR, with 15% MoM revenue growth for 2.5 years

- The team is made up of Ex-Amazon, Meta, WeWork, Uber, DiDi etc etc

- Angel backers in this round are working at Google, AWS, Deel, YouTube, Uber etc etc, and they’ve already put in over $500k for this raise so far (note: you won’t see that on the Republic site as they’re angel investors)

Having worked and hired remotely since 2011, this is something I’d 100% use. And in terms of purpose, I like the globalization of opportunity which comes through as a key raison d’etre for these guys; the founder lives in Argentina 🇦🇷

And I mean, anyone with a growth story like this, who can see it and tell it as clearly as this, is worth a look.

Check ’em out on Republic here.

Startups

Inspired by the above, perhaps you’re looking to found a startup? Or are you a tech employee considering a change of scene? Miami was rated the number one city in the US for Gen Z tech workers.

Miami was cited for its percentage of Gen Z residents, 22.7%, average tech salary of $105,790 and overall internet connectivity.

The entire top ten:

- Miami

- Orlando

- Cincinnati

- Richmond, Virginia

- Atlanta

- Pittsburgh

- Rochester, N.Y.

- Norfolk, Virginia

- Tampa

- Newark, N.J.

Florida takes three spots, and nothing west of the Mississippi made the top ten.

Bullish News

- Female-led Versey Ventures closed its first fintech fund with $78m. This fund doubled the amount raised by women-led firms in 2023.

- Global fintech funding totalled $15 billion in the first quarter of this year, growing 55% from the fourth quarter

- But…fintech companies raised over $131B in 2021.

- But…$6.5B of that was Stripe’s slightly strange raise to pay taxes.

- The European Investment Bank (EIB) group and the governments of five EU countries have announced a new €3.75bn fund of funds to invest in VCs that back European scaleups.

Bearish News

- In Europe, PE deal value fell 6.8% YoY in Q1 while VC deal value fell more dramatically, by 32.1% YoY. More detail:

- Buyout multiples are at their lowest level since the 2008 global financial crisis.

- Exits were down more than 69%

- There was only one FinTech unicorn in the first quarter, the lowest in seven years.

- Startups in India raised just $2 billion in the first quarter of 2023, 75% lower than the same period of last year.

- First Citizens’s takeover of Silicon Valley Bank is not going well.

- Launched on 4/20, Elon’s spaceship blew up, possibly because he was high or busy trolling celebs on Twitter.

How to invest in startups right now:

I’m hearing chatter about pre-seed index funds. Perhaps there’s something to it.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

And, at the risk of boring you, please share this wherever you have a platform. Twitter, LinkedIn, the pub… I’m not fussy.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Future Cardia and Athyna.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.