Hello and welcome to Alts Cafe

[Remember, I’m off on holiday the next couple weeks, so you’ll be treated to two special issues of Alts Cafe while I’m away.]

This is a quickfire look at what’s driving your alts week.

TLDR:

- Altcoins like SOL crashed back to earth

- Homeowners are fleeing Florida

- VC funding is down in nearly all sectors and geographies

- It was a no-good very bad quarter for wine

Table of Contents

Macro View

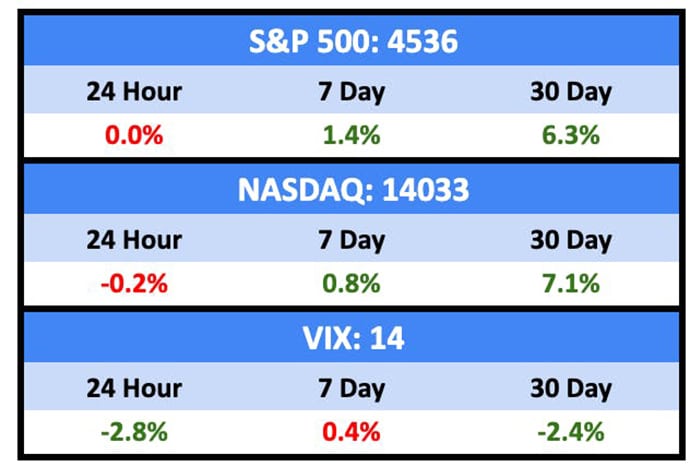

All signs are pointing to a recovery. Both real and armchair economists are willing it to be. Keep an eye on the consumer debt report out August 8th. If you see credit card and auto loan rates rising, that’s a leading indictor of trouble.

Bullish News

- After inflation slowed to 3% last month, a number of economists are calling for no more rate hikes.

- US Treasury Secretary Janet Yellen make some remarks that would give the Fed cover to stop hiking rates.

- US consumer sentiment jumped to the highest level in nearly two years in July.

- Retail sales rose slightly in June.

- Canadian inflation fell to a 27 month low.

Bearish News

- One key measure points to a recession starting in Q3.

- Stricter lending regulations will hike rates on many credit products, making everything more expensive.

- Company earnings for S&P 500 companies are down 8% year over year.

- China missed GDP growth expectations. Possibly worse, the unemployment rate among young people ages 16 to 24 was 21.3% in June, a new record.

What are we doing?

ALTS 1 Fund news:

We’ve got our eyes on a blue chip Pokemon card but have questions beyond our expertise. If you’re a Pokemon card expert, please get in touch.

Real Estate

McKinsey published a report last week that confirmed what everyone already knows:

“Hybrid work is permanent, suburbs are booming, demand for retail and office space in urban cores could fall by nearly 40 percent its 2019 levels within a few years.”

I’d be surprised if this surprises any of my readers, but it’s worth calling out that the idea / reality has gone mainstream now.

The headline clickbait number is that McKinsey expects $800 billion worth of office space to be wiped out by 2030. Sounds like a lot until you realise that’s less than 1/3 of Microsoft’s market cap.

It’s also worth nothing the global office space market is perhaps $25 trillion.

Bullish News

- Senior living properties are looking at a 3% price hike this year.

- Boston is offering tax breaks for office to residential conversions.

- The WSJ says the US housing recession is over.

- US single-family homebuilding fell in June, but permits for future construction rose to a 12-month high.

Bearish News

- US home foreclosures are up 15% year over year to pre-Covid levels.

- Florida is staring down a net negative migration for the first time in years.

- Office vacancies in Los Angeles have topped 22%.

- With fewer office workers to buy their wares, urban retail is struggling as well.

- Both Starwood and Ares REITs lowered their reported NAV.

- JPMorgan and Wells Fargo have set aside a combined $2 billion as they prepare for CRE losses.

- Only 1.4% of US homes changed hands in the first half of 2023. That’s the lowest in ten years.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

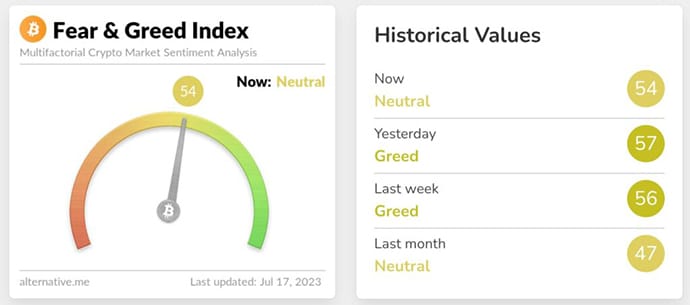

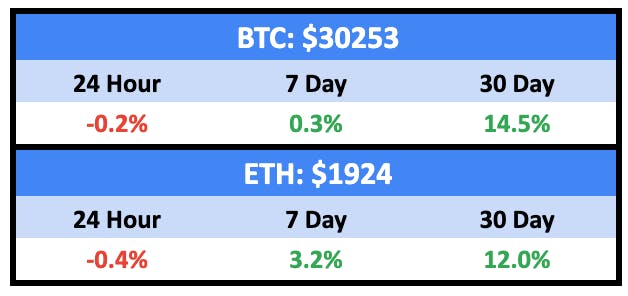

Another mixed week for crypto, but the tickers keep ticking up.

Fairly flat week on week.

A great week for NFTs!

Bullish News

- Aave, a peer-to-peer crypto lender, is launching a stablecoin.

- Societe Generale has become the first bank in France to obtain a license for crypto services.

- The US SEC has accepted applications to create spot bitcoin exchange-traded funds from six firms.

Bearish News

- Alt coins like SOL crashed back to earth last week after the Ripple decision sent them ripping the week prior.

- Ron DeSantis continued his campaign against central bank digital currencies, saying he’d ban them on day one of his hypothetical presidency.

- Binance fired 1,000 people as it continues to lose market share.

- NASDAQ killed its plans to launch a crypto custodian service.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- While most startup sectors have seen diminished funding in recent quarters, carbon capture- and storage-focused companies look like a notable exception.

- Two crypto VC funds raised a combined $358 million last week

Bearish News

- Carvana was downgraded and shed 16% of its share price last week. It’s still up — incredibly — 900% on the year.

- Bolt is being investigated by the SEC.

- Proptech startup Latch is laying off 59% of its US and Taiwan-based workforce — 82 positions.

- Cameo axed more than 80 employees as well.

- VCs that raised funds during the tech boom are scaling down their megafunds.

- Lots of 💩 data:

How to invest in startups right now:

Do you think things will get better or worse? Or both? It all feels very Dickensian, doesn’t it?

Quick Hits

Wine and Spirits

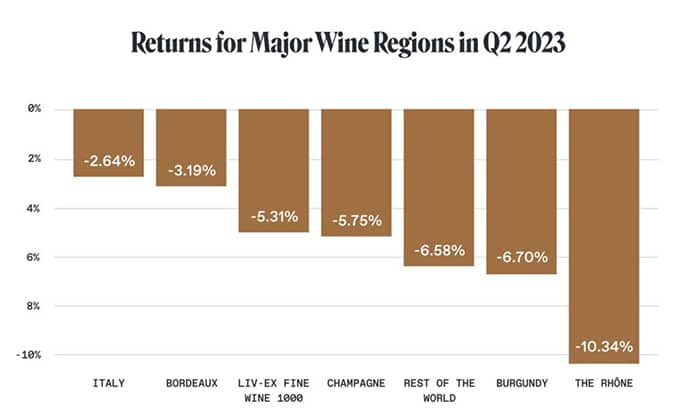

From Vinovest’s quarterly report:

No matter how you measure performance, the wine market unquestionably hit a lull in the second quarter. The average Vinovestor saw their portfolio decline -4.45% in value in that time. This downturn bucks a trend of positive growth in five of the last six quarters.

The average portfolio was down around on the quarter. The three biggest headwinds, according to Vinovest:

- China’s slowdown — it’s a big market

- Champagne and Burgundy have cooled after a red hot 2021 – 2022

- European economic troubles

Vinovest is, unsurprisingly, optimistic about Q3.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at AKUA and Diamond Standard.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.