Hello and welcome to Alts Cafe

Lots going on last week. Today’s email should be a good jumping-off point for some tasty DYOR.

TLDR:

- Define Ventures just raised $460 million across two funds to invest in early-stage digital health startups. There’s a ton of money going into this space.

- India is now the most populous country on earth, having surpassed China last week.

- US real estate inventory is among some of the lowest levels on record. There’s only 2.6 months’ worth of homes for sale.

- Bitcoin is on a streak, ETH is flat. NFTs are really beginning to trail crypto in general.

- AI continues to find more real-world use cases. Dropbox just replaced 500 staff with AI, and Walmart is using AI chatbots to negotiate better deals with suppliers.

Caffeine up and let’s go, Alts fans.

Wyatt

Table of Contents

Macro View

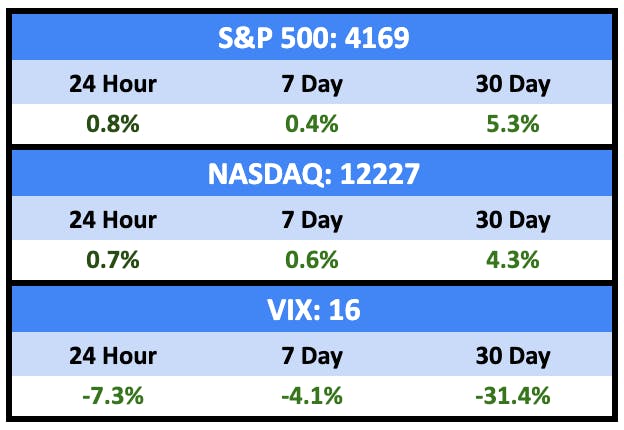

After a tepid week, equities smashed it Thursday and Friday to end slightly up.

- The S&P and the Dow posted their biggest daily percentage gains since Jan 6

- The NASDAQ recorded its biggest single-day advance since March 16

Bullish News

- Markets say there’s 90% chance of a 25bps rate hike on Wednesday, followed by rates coming back down starting in November.

- India is now the world’s most populous country, passing China last week.

Bearish News

- The other unemployment shoe — blue collar workers — has finally dropped. 3M and Gap both announced big layoffs last week.

- GDP rose at a 1.1% annualized pace in the first quarter, below the 2% estimate.

- Inflation was higher than expected in Q1, rising 4.2% against the 3.7% estimate.

- U.S. consumer confidence dropped to a nine-month low in April.

- The Bank of England told Britons to reinforce their softening upper lip. They’re going to be poorer from now on.

- Europe will keep raising rates until more people lose their jobs.

- Corporate lending is getting a lot tighter.

What are we doing?

ALTS 1 fund news:

No news here.

Real Estate

Bullish News

- Top-tier home prices continue to climb – the average price for a house in the Hamptons hit a record $3 million. The deal volume was down 57% this year.

- US new home sales were up 9.3% in March compared to February.

Bearish News

- Chinese property developer Evergrande is still trying to restructure its debt.

- Sales of existing homes, the vast majority of the houses sold in the US, dropped 2.4% in March. That’s down 22% YoY.

- US banks are becoming increasingly worried about falling commercial property valuations.

- In March, the median sale price of an American house was nearly $376,000 — that’s inched down by about 1% compared with a year ago, but it’s still nearly 40% higher than at the end of 2019. Some thoughts here:

- There’s still plenty of room for prices to fall before they’re back to historic norms.

- With just 2.6 months’ worth of existing homes for sale, inventory remains near some of the lowest levels on record.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

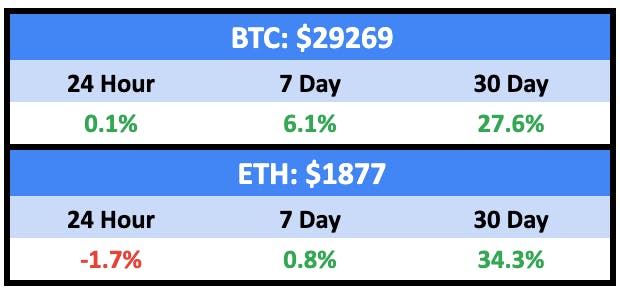

Bitcoin continued to climb while Ethereum was flat:

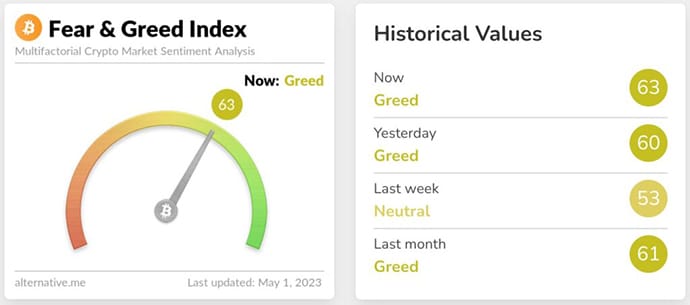

We’re greedy again!

A real schism is developing between NFTs and crypto.

Bullish News

- Visa is going big into crypto.

- Coinbase told the SEC that any enforcement action against the exchange would “fail on the merits” and would present “major” risks to the SEC’s regulatory model. Coinbase trading volumes have continued to slide under the regulatory scrutiny.

- Of the top five crypto markets, the UK is growing the quickest. The other four are the US, Canada, Japan, and Germany.

- Related, Westminster is working with crypto companies to hammer out sensible crypto regulation.

Bearish News

- Changpeng ‘CZ’ Zhao has reportedly hired lawyers to represent him personally as Binance faces multiple investigations from regulators.

- VC funding into Web3 startups is down 82% year-over-year.

- Binance abandoned its $1B acquisition of Voyager.

- South Korean prosecutors charged Daniel Shin, co-founder alongside Do Kwon, in the wake of the $40B Terra / Luna debacle from last year.

- Chamath Palihapitiya continues to say stupid things about crypto.

- US regulators continue to say stupid things about crypto.

- The SEC chair continues to say stupid things about crypto.

- Russians can now use Binance again.

- Zimbabwe is doing something insane that involves gold and crypto.

How to invest in Crypto & NFTs right now:

Accumulate.

Startups

Bullish News

- Dropbox is replacing 500 members of staff with AI. An anonymous (or possibly identified behind the paywall) Fortune 500 company already trialled this with some success.

- Hiring talent is getting a bit easier as new employees require less incentive to join than they did a year ago.

- Walmart has found a legit use case for AI, using chatbots to negotiate better deals with suppliers.

- Startups in Europe are looking to venture debt more and more.

- Digital health startups are about to raise a shitload of money.

- Global IPO volume for March and April doubled that of January and February (from an admittedly small base).

Bearish News

- ESG ratings are coming to venture portfolios. I’m sure they’ll somehow succeed where corporate ESG ratings have failed miserably.

- Clubhouse, which I guess is still a thing, laid off half its employees last week. Not sure what the other half do every day. The CEO said it wasn’t a financial decision and the San Francisco-based company has “plenty of runway.”

- Tiger Global Management’s $12.7 billion venture fund, launched near the peak of the tech stock boom in October 2021, is down 20%. Ouchie.

- Lyft is firing1,200 people, around 20% of its employees.

How to invest in startups right now:

This

We are now in Peak AI Grift mode.

— Natalia Burina (@Nale) April 28, 2023

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Fans of what we do here? Please send this email to five friends. We appreciate it.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Nada.co and OneFul Health.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.