Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

I hope you enjoyed last week’s issue on Creating the Diamond Standard.

After publishing, a few community members reached out asking about lab diamonds.

A few follow-up notes:

- Lab diamonds have the same quality and crystal structure as mined diamonds. All diamonds are forever.

- The diamond market is in a period of adjustment, as production of lab diamonds is ramping up

- There is some hesitation because they aren’t “real”

- Demand for lab-grown diamonds is rising, yet (incredibly) prices are falling

Today, we’re looking at another company creating a new market out of thin air.

They’re called Hoken, and they let you buy, sell, and trade hotel room reservations.

It’s a fascinating model. You bid on hotel rooms that are in high demand, and flip them to other investors or travelers. (Or use them yourself)

Let’s explore

Table of Contents

What’s happening in the hotel market?

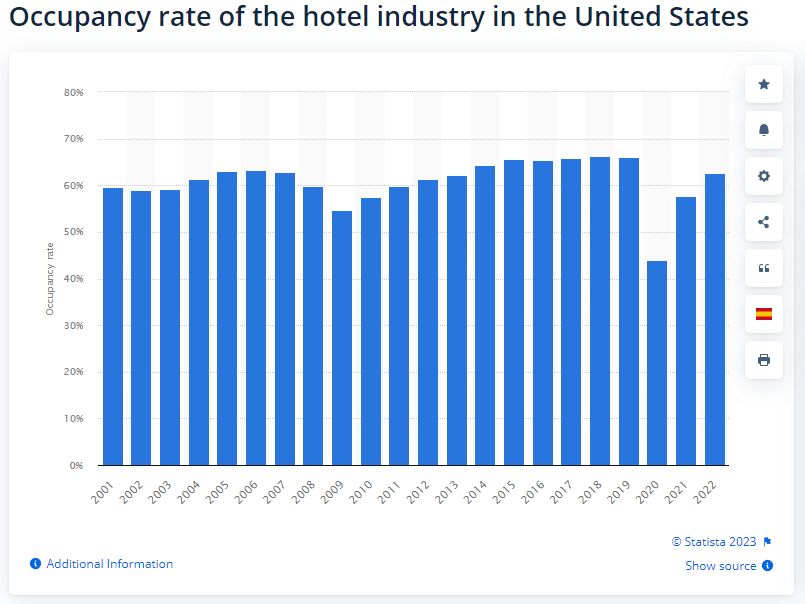

Covid destroyed hotel markets around the world, but the recovery is in full effect.

In fact, 2023 is shaping up to be a great year. Occupancy is just shy of 2019 highs, as humanity continues to brush off the bad memories of lockdowns and travel restrictions.

- Hotel bookings are up 6% YoY in the USe start of 2021

- Average occupancy in the United States is 64% in 2023 – only a slither less than the all-time high in 2018-9 (66.2%)

- Australia added 10,000+ new hotel rooms since th

- US hotels’ average daily rate (ADR) plummeted to $103 in 2020. By 2022, it had recovered to an all-time high of $148.83. (And in March it was $158.17 — a 6.7% increase

Consumption tastes are changing

Post-covid freedom isn’t the only thing driving the hotel market back to normal.

Society is changing. Gen X, Y, and Z prioritize experiences over possessions. They’re spending more on travel, events, sports, and dining.

Social media exacerbates this phenomenon. People are overspending just to flex. Pair this with millennials’ penchant for last-minute holidays, and it’s easy to see why average daily rates are soaring.

Now, there’s a company on the scene that’s carving out a unique opportunity

They’re called Hoken, and they’ve created an entirely market.

What is Hoken?

Hoken is a marketplace where you bid on, flip, and trade hotel room bookings.

The platform mainly revolves around events, because that’s when demand for hotels skyrockets.

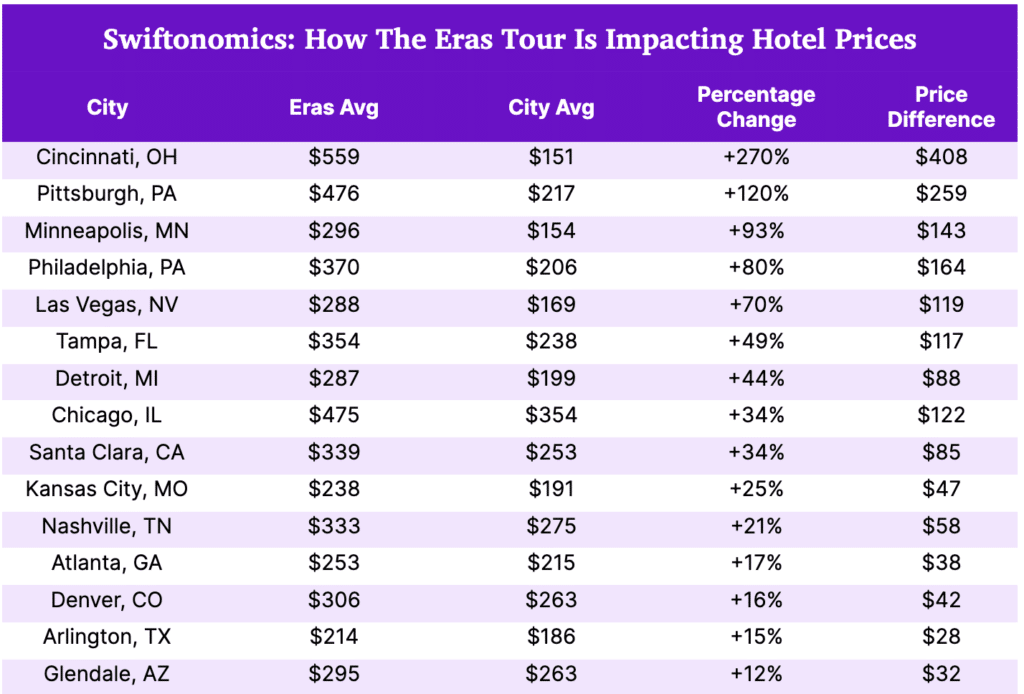

Think about when someone like Taylor Swift comes to town. We know getting tickets is nearly impossible, but what people forget is that finding a decent hotel room isn’t much easier!

Hoken partners with hotel chains to offer hotel rooms to travelers. As an investor, you can bid on these hotel rooms, and resell them to others.

The investor side is only half the story here. The other half is the demand side.

It’s not all about making a profit. Sometimes you just want to go on vacation and need to book a room. Hoken lets you do that.

Hoken works like any other hotel booking site. Find the room you want, pay for it, and away you go.

The big difference is:

- You won’t have trouble booking a room when a big event is on (this is why Hoken exists)

- You won’t have to worry about cancellation fees, and of course

- You can flip the room if you want to (or need to)

Since Hoken lets you resell your booking to another vacationer, you can book a room either to make money, or use it for yourself.

It’s a fascinating model. Nothing like this has ever been done before with hotels.

The closest parallel is probably something like StockX or StubHub. The company even bills itself as “StubHub for hotel rooms.”

How does Hoken work?

The first step is reserving hotel rooms.

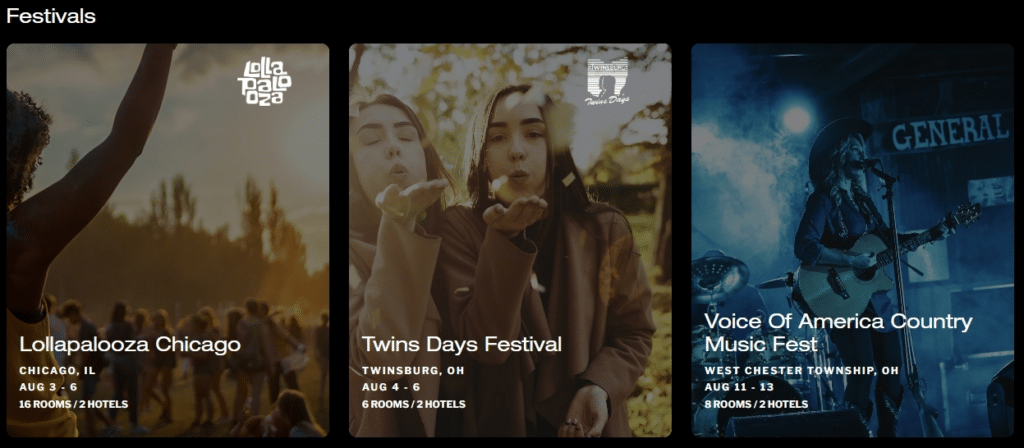

The team hand-picks hotels, targeting those within walking distance of event venues. They’ve forged supply relationships with popular chains, and at any given time there are 2,000+ hotel rooms live on the site (though for now, the platform is North America only.)

Investors or vacationers visit gohoken.com and search for an event they wish to attend. Think big. Formula 1 Austin. Lollapalooza in Chicago. The NYC Marathon. Etc.

“Roomfolio”

Once you book a room, you unlock Hoken’s most unique element – your Roomfolio.

This is the investment portion of the platform. All hotel stays you book appear here, with live market data showing how much each room is currently worth.

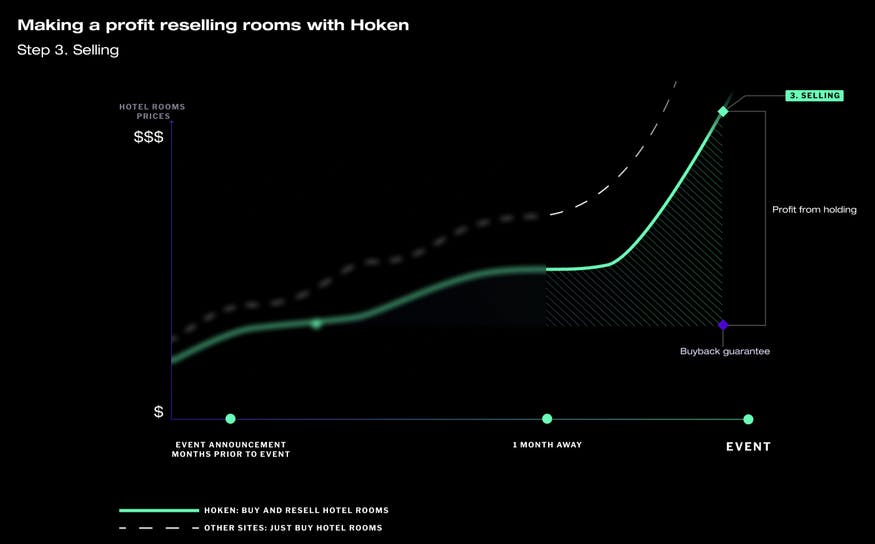

Let’s say you know T Swift is coming to town. Because you’re smart, you book a hotel room near the arena months in advance.

As the gig draws nearer, more people will flock to Hoken to buy rooms in this hotel, and this price change will be reflected in your Roomfolio.

If you want to keep the room, you can keep it. If you want to flip the room, you can resell it via Hoken’s marketplace. You basically just set the price and wait for buyers.

Now, not every hotel re-listed on the marketplace will sell. An event may not end up being that popular, or your price might be too high.

Which brings us to the coolest (and most surprising) feature they offer: The Buyback Guarantee

If a room can’t be used or sold, Hoken will buy it back from you at the original price! (As long as you confirm this at least 96 hours before the check-in time).

This is an incredible offer. When I first heard about it, I couldn’t believe it. Frankly, I don’t know how they make this work within their model.

Interesting things about Hoken’s model

By creating a new market for hotel rooms, Hoken’s unique business model creates some interesting dynamics:

- In theory, travelers should have an easier time booking during events (when demand surges)

- Hotels can forward-sell inventory, see real-time market insights and potentially better price rooms during higher demand periods.

- Travelers can also become investors, hedging against cancellation risk and unlocking liquidity for a once-inaccessible asset.

- Since Hoken rewards those who pre-book rooms in advance, in theory, travelers could hoard multiple rooms in a hotel, knowing Hoken will buy them back. (This may be against their T&Cs, I haven’t gone through and checked.)

- Similarly, sellers could use the guarantee to drive prices up, not down. While more competition typically drives prices south, the Buyback Guarantee may distort this dynamic. Hoken could end up with a slew of overpriced hotel rooms on its platform; ruining the experience, and eventually, the demand.

However, a quick price comparison between a competitor and Hoken proved enlightening.

For a one-night stay at a hotel in Minneapolis, Hoken customers are paying $430. That same hotel reservation, the same room, those same dates elsewhere? Around $580.

Other comparisons I did showed that, so far, Hoken was on par with competitors like Booking.com.

The Hoken team

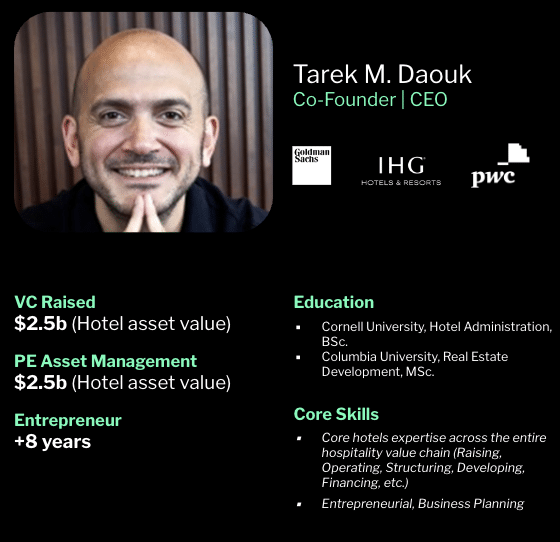

Tarek Daouk is Hoken’s CEO, and has great experience in the hotel industry.

Tarek was Head of Hospitality at Goldman Sachs from 2009 to 2013, managing hotel acquisitions worth over $2 billion.

He followed that up by founding Smartotels Group Holdings, who are active investors in global hospitality projects.

The other 4 co-founders include:

- Abhijit Pal is Hoken’s COO, bringing expertise from eBay and Expedia.

- Gaspard de Dreuzy co-founded several fintech apps, including Voyager, Minded, and sold TradeIt – an API solution for charting – to TradingView

- Fadi Arbid spent a decade as CEO of Amwal AlKhaleej

- Serge Kreiker Technophile with 15+ years of experience

What’s next for Hoken?

Currently, only hotel rooms reserved on Hoken can be resold on Hoken.

This makes total sense, of course. But the next logical step (not to mention a huge opportunity) is figuring out how to bring other hotel room reservations to the exchange.

This would essentially turn Hoken into a giant P2P platform for buying and selling hotel room bookings. Like StockX, but for hotel rooms. Pretty wild.

The team also wants to stretch its marketplace to include luxury cruise boats, restaurants, and vacation rentals.

How does Hoken stack up?

Return potential

Solid arbitrage opportunities

Thinking about returns on Hoken is interesting. I think picking the right events will be important for finding profitability here. The further out you buy a room, the cheaper it’ll be, and the more room left for price growth.

According to Hoken, the average increase in market value on rooms purchased through the platform was 58%. This is an excellent figure. Of course, you’re working with smaller numbers here. But they can add up.

Traction

On the up

Hoken has raised $9m in funding. Lead investors include Streamlined Ventures and BY Venture Partners.

The team’s seen exposure on Business Insider and Yahoo Finance. There are over 2,000 rooms available stretching until December 2023 – and more are being added each week.

They’ve also got a 4.9/5 star rating on TrustPilot.

Competition

Nothing quite like it

To be fair, there are a few other hotel room marketplaces out there.

But these platforms target travelers trying to sell non-refundable vacations, vs investors looking to flip high-demand accommodation near big events.

Hoken is the first company in history to marry investing in hotel stays, with the concerts, festivals and sporting matches that cause tourists to flock to a destination (and hotel room prices to skyrocket)

Leadership team

Excellent

Lots of experience here. Having five co-founders means the leaders each bring something unique to the table.

Check out their backgrounds. These guys know what they’re doing.

Fees

Competitive

Hoken doesn’t charge any fees for buying a room. They also don’t charge hotels any distribution fees, which helps keep costs low.

Selling on the exchange incurs a simple 5% fee, which is rather small compared to the 15-25% platforms like StockX and StubHub charge.

Risk

“95% risk-free” (according to Hoken)

Hoken claims to offer investors an almost risk-free opportunity. If your hotel flip doesn’t work, they’ll buy it back from you at the original price (in 95% of circumstances).

Hoken claims they don’t incur any losses on these room buybacks, as they leverage the free cancellation policy for certain hotels.

But this does bring up questions of profitability and sustainability, given the distorted market dynamics. It will be very interesting to watch this play out. And before you go flipping, definitely read through their Terms and Conditions.

Closing thoughts

The way I see it, Hoken is one of the first companies that enables travelers to become investors.

They recognized the delta between hotel room supply and demand — especially when big events are in town — and have created a platform for trading hotel rooms as if they were tickets, sneakers, or other fungible assets. In doing so, they’ve created an entirely new market out of thin air.

I do think there is some profit potential here. Take it back to our friend T Swift for a moment. Tomorrow night, she’s playing a gig in Denver, Colorado. Tickets originally cost $406. Today, the cheapest ticket on StubHub is ~$1,000.

Can you make money through Hoken? Sure, probably. It’s basically a time-arbitrage play.

I do think the challenge for Hoken is demand acquisition. They depend on buyers coming to the platform, and that may be difficult. Changing habits is hard. I imagine most travelers will just stick to Airbnb, Booking.com, Trivago, etc.

But what I like about it is how easily this could find a place in your traveling workflow. Next time you’re booking a hotel for a big event, why not use Hoken? Heck, why not book two? If you need to cancel for some reason, you can sell it to another traveler or investor.

And if nobody bites, if you can’t get the price you want, you can sell it back to Hoken.

What do you have to lose? 🏨

Disclosures

- Hoken is an Alts sponsor, and this was a paid deep dive.

- We have not invested in Hoken (the company), nor have we bought or sold any rooms on the Hoken platform.

- I am curious about this platform, and will likely book a hotel room through Hoken.

- This issue contains an affiliate link to StockX.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Hoken. Hoken has agreed to offer an unconstrained look at its business & operations. Hoken is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.