Today’s WC is all about my favourite investing and business ideas from our community field trip to Mexico.

Want to come on the next trip? Check out Altea, our private community.

Today, we’ve got:

Table of Contents

Tequila Industry Cash Flow Part 1

The first thing you need to know about the tequila industry is that it’s massive. Well over $10 billion a year and growing.

The second is that there are four main types of tequila:

- Blanco (Silver or Plata) Tequila: Unaged or aged for up to two months, it is the purest expression of agave flavor.

- Reposado Tequila: Aged in oak barrels for a period of two months to one year, it has a light golden hue and a smoother taste with a subtle oak influence.

- Añejo Tequila: Aged for at least one year but less than three years in small oak barrels, it has a darker color, smoother taste, and more complex aroma compared to Blanco and Reposado tequilas.

- Extra Añejo Tequila: Aged for a minimum of three years in oak barrels, it is the smoothest and most complex of the tequila expressions, with a richer flavor and aroma.

From an investment point of view, age is what we’re looking at. Because it makes a big difference to price.

The price increases 63% in a year from plata to anejo, nearly doubling again over the next three years.

Aging tequila does cost money. The barrel itself is anywhere from $500 to $3000, and you need a warehouse (cheap) and insurance (even cheaper).

But those costs aren’t enough to justify the increased price.

It’s all down to cash flow.

Even though the tequila industry is worth more than $10 billion a year, distillers (and farmers, more on this in a minute) still live year to year.

They can’t afford to let their tequila age because they need the pesos today.

How to invest in this

This is the first, easiest, and most obvious investment opportunity in Mexico. The ROI is ridiculous if you have the cash and don’t need it for three years.

We own several barrels in our Alts 1 fund (the barrels are up 92% in 16 months) and are looking to buy more via our broker.

If you’d like an intro, please smash reply.

Tequila Industry Cash Flow Part 2

Ok, another quick lesson.

The value of an agave plant is determined by both its mass and sugar content. The older the plant is, the higher each becomes.

The blue agave plant, from which tequila is produced, is roughly a sphere.

The following formula can determine the volume of a sphere.

V=(4/3)*π*r^3

Every year, the radius increases, and the volume increases geometrically. So goes the plant’s mass.

Likewise, the sugar content of an agave plant increases as it ages as well. It’s more linear than geometric, but it’s still important.

Given those factors, it’s widely accepted that six to seven years is the optimal harvesting period for agave.

But most farmers are forced to harvest their plants at 2-3 years old.

Again, due to cash flow.

It’s even worse because the field lies fallow for two years after the crop is harvested. So, over the course of decades, the land is unproductive for two to three times as many years.

It gets worse because the price per kilo of agave plants is cyclical. Over any given 5 – 10 year period, the value can range anywhere from 8 pesos/kg to 31 pesos/kg.

When prices are high, farmers plant more agaves. When they’re low, fewer are put into the soil.

And this guarantees that the cycle will continue basically forever.

Gluts produce shortages; shortages produce gluts; ad infinitum.

How to invest in this

Two obvious ideas spring to mind.

First, agave field trade finance. Find farmers who feel forced to sell at 2 – 3 years, and give them a four-year loan at a rate that (a) makes them better off and (b) makes you rich.

Second, buy up agave farms and simply don’t sell your plants until it’s economically ideal to do so.

If you’ve got the cash flow and foresight, you could even combine both points one and two over a ten year cycle to print money.

If you’d like to look into any of these three options, let me know.

STRs in Puerto Vallarta

After the investor trip, we spent five or six days in a gorgeous villa just north of Puerto Vallarta.

We were very fortunately comped, but the place usually costs around $700 a night. I spoke with the owner about the economics of it.

- He bought and renovated the place for around $1.3 million, and it’s worth roughly double that today.

- It’s only rented out 1/3 of the time because he and his friends and family use it a lot.

- At only 1/3 the time, he still grosses $65k and could push that past $80k.

- He includes a tonne of amenities and tech to obscure the difficulties of living in a remote town in Mexico: a commercial cell phone repeater, Starlink internet, mobile monitoring, etc. That’s not cheap, but getting paid in dollars and spending pesos is a big advantage.

- North American summer is tough for rentals. Way too hot and too rainy.

All in all, you can expect perhaps a 5% to 10% yield on a property like this if you’re aiming to rent it out pretty much full-time. Factoring in appreciation, which has been and will continue to be significant, and there are a number of opportunities in the area.

How to Invest

The idea of fractional ownership of one of these places appeals to me and several of the Alts community members from our trip.

Four to eight parties (maybe families) put together an operating agreement, purchase a spot that’s both appealing to them as a vacation spot AND a good investment.

The groups can either agree to split the time there between paid guests and club use, OR agree to rent it at market rates whenever they want to use it.

It’s what Pacaso has done, except at a reasonable price and with STR potential.

Again, we have 3 – 5 folks interested in this already. If you’d like to learn more or get involved,

CDMX (AKA Mexico City)

We spent our last five or six days in Mexico City, and I’m incredibly bullish on it.

First, the cons:

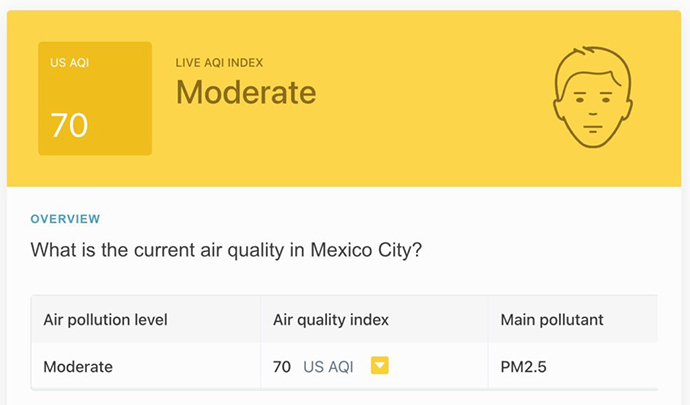

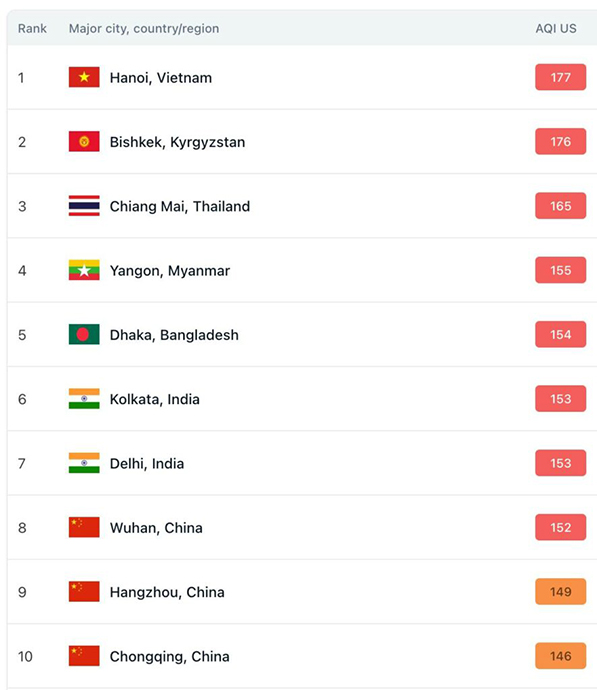

Pollution is bad, especially in the daytime.

But it’s not as bad as its reputation suggests when viewed against global rivals.

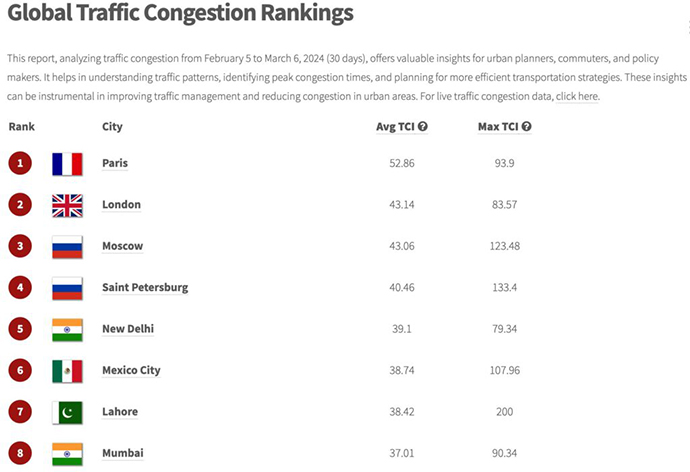

Second: traffic is awful. It took us two hours to get from the airport to our flat.

But again, it’s not as bad as a number of its global peers:

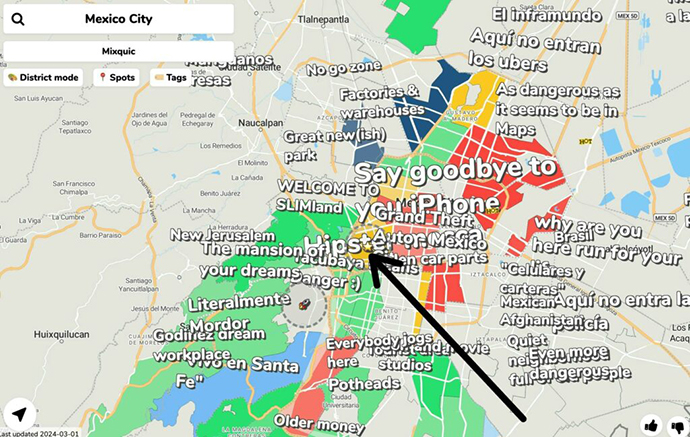

Third: crime is a factor

The top eight most homicidal cities in the world are in Mexico (the country).

There were 917 homicides in CDMX in 2021, which puts it in the top 20 globally.

But:

These are 2021 numbers, and the CDMX homicide rate is down 50% since then.

And:

When adjusted for population, it ranks 179th in the world and is surrounded by about 150 American cities.

So, while you want to stay away from drug shipping lanes and cartel strongholds in Mexico, the capital itself is really pretty safe.

OK, to the pros:

We stayed in a neighborhood called La Condensa, which reminds me a lot of Brooklyn.

Except you can buy beautiful 2bd flats for around $250k, and tacos are about $1 each. It’s immensely walkable, and I felt safe the whole time.

If you’re into suburban life, our tequila broker lives in the fancy green areas on the west side of the map above. He has a 4000-square-foot apartment, a maid, and two nannies. He pays around $2500 per month.

Loads of Americans are relocating to CDMX, and I can see property prices doubling in the next several years.

How to Invest

I would happily buy up all the flats in La Condesa and Airbnb them until prices rise.

Or simply move here.

Lucha Libre

Ok, so this is mostly an excuse to post this photo, which I took at the Lucha Libre event in Guadalajara.

Lucha Libre is super fun — a spit and sawdust throwback to what WWE could have become.

$6 liter-sized beers, enough swear words coming from the audience to make a sailor blush, and way more audience participation than I expected/was comfortable with.

How to Invest

I have no idea. Just go — it’s a great investment of your time.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt