Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite.

Table of Contents

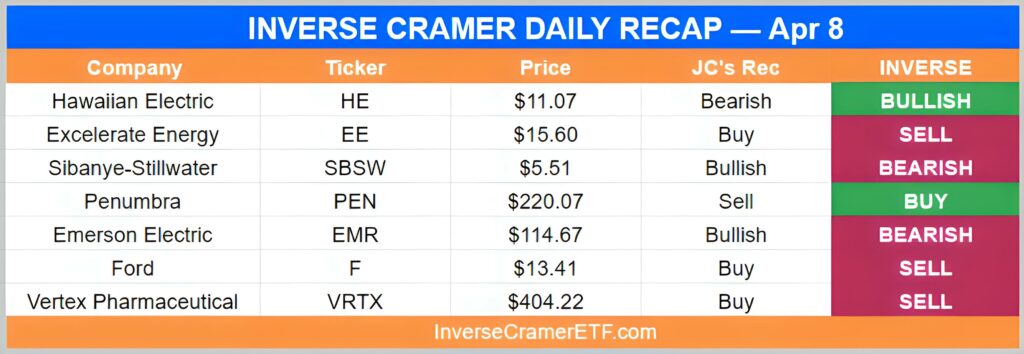

Monday, Apr 8

I still fear it. I still fear it after the environmental damage. I’m concerned that you can’t really put a price on it. I understand that $11 seems like the price, but I am concerned that the stock could be worth still too much. The fires are too great and therefore the stock could go lower.

-On Hawaiian Electric ($HE)

That’s a strange company and we don’t know more about it. We know that it has yield. We know that it has good properties. Historically, I like it but I don’t know other parts about it. You’re okay but I don’t like to recommend something and turns out it doesn’t have the right assets.

-On Sibanye-Stillwater ($SBSW)

I think Ford is doing well. I mean, it yields four and a half, the stock is starting to come back, and it underperforms GM. It’s up 10% of the year. I don’t think that’s all that’s bad. I do think that GM up %23 must make Jim Farley feel like ‘wow I got to do something’, but I do like the story. The trust has a big position and I feel very good about it.

-On Ford ($F)

Uh oh pic.twitter.com/kyj2kUcsSk

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 9, 2024

Tuesday, Apr 9

Medtronic is a buy (Buy, Buy, Buy). Martha is being undervalued here. I like what they’re doing in AI. You’ve got a good one with a good yield.

-On Medtronic ($MDT)

That’s a very cheap stock that has a good yield. I don’t understand why it’s here. You should buy it.

-On Riley Exploration ($REPX)

It has the wind behind its back (Buy, Buy, Buy), that’s why it keeps on coming back.

-On Wesco ($WCC)

I like Cliffs. People think they might pay up and get the letter x, that’s the problem. I would buy that stock for under $20, that’s my level.

-On Cleveland-Cliffs ($CLF)

"Reddit has never turned a profit in nearly 20 years, but filed to go public anyway"

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 12, 2024

Seems about right https://t.co/QkYtkKz13c

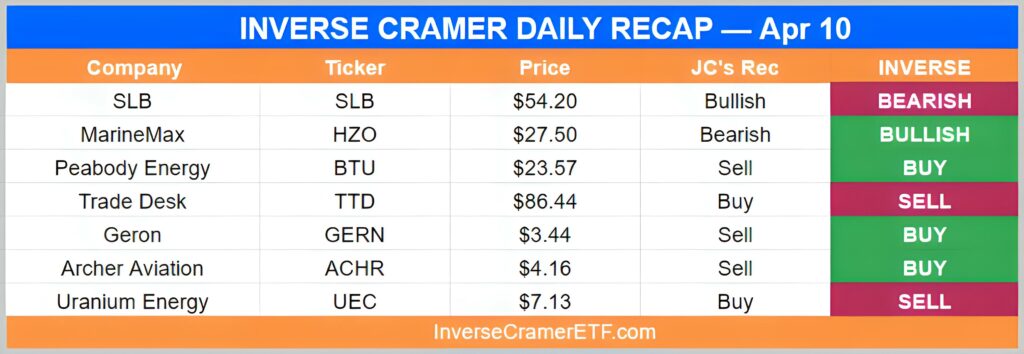

Wednesday, Apr 10

No, it’s too risky right here. I know the multiples are really low but I just like that sector of the market as of the moment.

-On MarineMax ($HZO)

No, I’m not a coal guy. Coal is up a lot because of different flows from overseas. But I do not want to own BTU, and I think it should be sold.

-On Peabody Energy ($BTU)

Just okay. We’ve got so many great biotechs these days. I mean let’s stick with the really good ones. Don’t care about excitement, care about something like a Vertex. I’ve made a good acquisition.

-On Geron ($GERN)

Banks and analysts (Jim) continue get inflation wrong

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 10, 2024

Remember when they said inflation was transitory? https://t.co/wqkI30BzGA

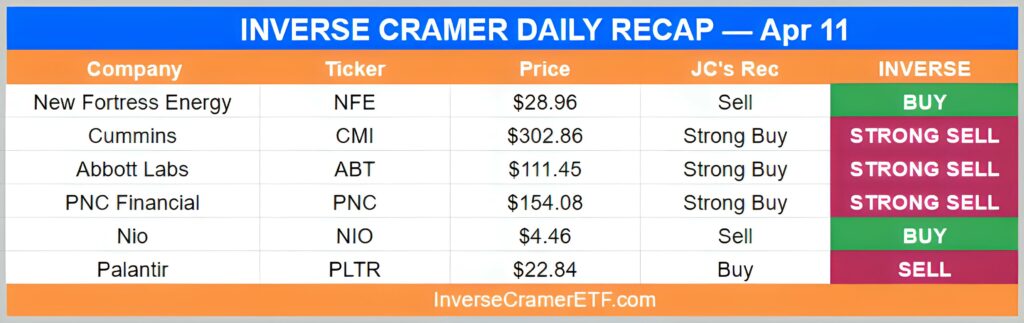

Thursday, Apr 11

Yes, I really want you in Abbott Labs. It’s quality diagnostics, it’s a medical device company. If the fed overreaches it might be the right call. It’s got great growth.

-On Abbott Labs ($ABT)

You’ve got horse sense (Buy, Buy, Buy). I don’t understand why PNC is down here. It’s got a 4% yield, you buy half here and then when the company likes their report next week you can buy more. That’s how good I think about that stock.

-On PNC Financial ($PNC)

I think they have unbelievable technology and they work closely with the government. As far as I’m concerned $23 goes to $28, make a move and buy some.

-On Palantir ($PLTR)

Friday, Apr 12

No show Friday

Weekend Bonus

Oh my god… TikTok Ban odds just jumped to 75%.

— Tarek Mansour (@mansourtarek_) April 9, 2024

Is it actually the end of TikTok in the US? pic.twitter.com/YSIzqnDGqb

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue is sponsored by Percent

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.