Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite 🙃

Table of Contents

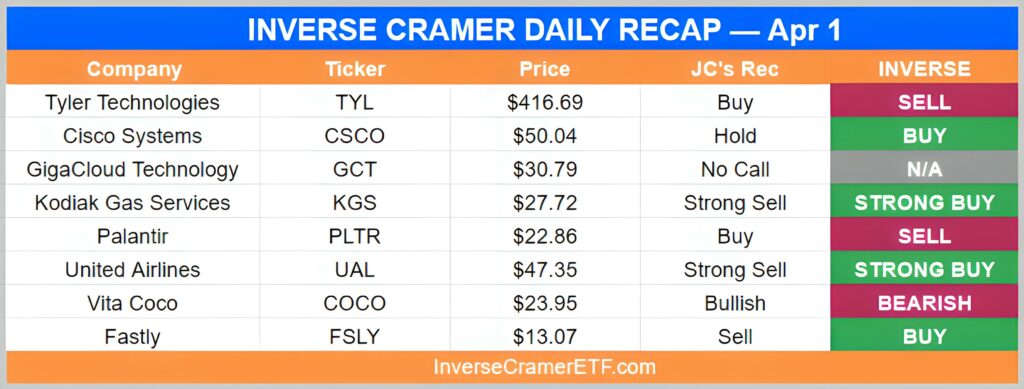

Monday, Apr 1

That’s a very well-run company. I’ve got to tell you that government business is a good business. It’s a buy. I like it very much.

-On Tyler Technologies ($TYL)

You’re fine. I like the new deal. I think it’s gonna give a couple of quarters. It’s a good lift and you’ve got a 3% yield. I would certainly hold on to that.

-On Cisco Systems ($CSCO)

Let’s ring the register. That thing is a no. That stock has gone up too much. I’m kaching kaching on that one.

-On Kodiak Gas Services ($KGS)

I like it. They had a good quarter. They have a good defense business. I like IT defense work, and they own that franchise. It’s very very positive.

-On Palantir ($PLTR)

I think you’ve got a nice gain there. I would do some ka-chinging. I think it’s great but that’s an airline. All airlines are trades.

-On United Airlines ($UAL)

BREAKING: Jim calls it quits to "spend more time with family…thanks for all the laughs"

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 1, 2024

Been a helluva run Jim! pic.twitter.com/EEyw9GycGp

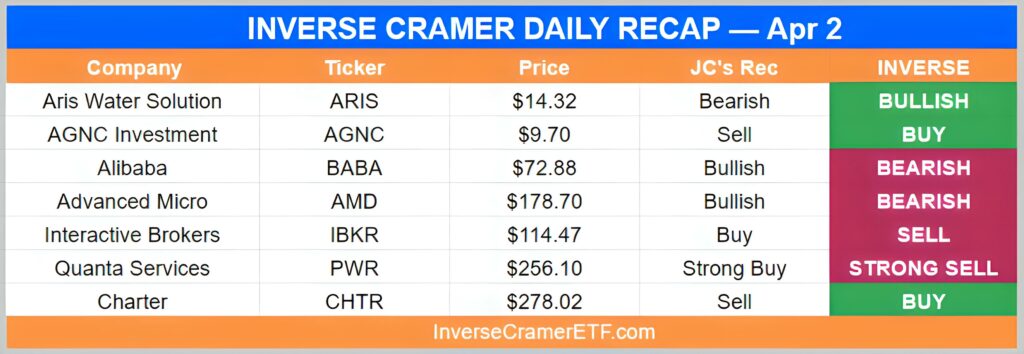

Tuesday, Apr 2

No. Take a look at how that stock has done over any period. It just goes down. I don’t want you to touch that stock.

-On AGNC Investment ($AGNC)

If you have to own one, it’s gonna be Alibaba. That is the one that has the most American-like financials. I’m not a fan of Chinese stocks but BABA is the one to own if you want to go there.

-On Alibaba ($BABA)

No, that’s an awful stock. I mean that may actually be the most awful stock that I know. I’ll put that in a pantheon of awful. Pantheon, Awful, Charter.

-On Charter Comms ($CHTR)

Oops pic.twitter.com/qeMdUPTQNS

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 28, 2024

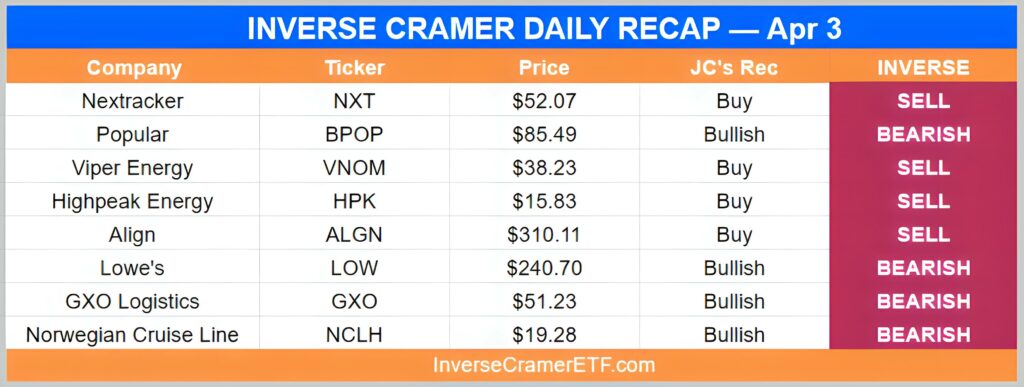

Wednesday, Apr 3

Nextracker is good. Shugar came on recently and told us a good story. I would be a buyer of that stock right here for $52.

-On Nextracker ($NXT)

Viper is a good stock. It’s got a good yield. It’s got mineral rights. I think it’s really an excellent idea right here, given the fact that we’re in an inflationary environment for minerals and oils. I think you’ve got a good one.

-On Viper Energy ($VNOM)

Norwegian is good, but Royal is better. RCL is my guy and sticking to it.

-On Norwegian Cruise Line ($NCLH)

Cathie Wood making bold claims about 80% of vehicles being EV in just a few years .. I thing this PAINFUL…

— Jim Cramer (@jimcramer) April 3, 2024

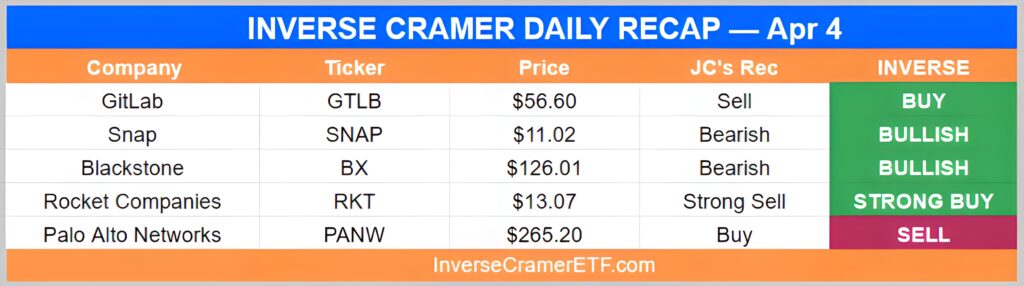

Thursday, Apr 4

I didn’t like their last quarter. I went over to find toothcomb, there was nothing there that made me feel terrific about a high multiple stock.

-On GitLab ($GTLB)

Snapchat did not have a terrific quarter. You don’t have much luxury here. You’ve got about 3 weeks to make a move. If it bounces here, you can get it below $12.13, that’s what I prefer. Otherwise, it’s a couple of points downside from here.

-On Snap ($SNAP)

Lots of confusion about rates and the market. The rally did NOT stall because of fed speakers and we have to stop giving them that power to screw up the narrative.

— Jim Cramer (@jimcramer) April 4, 2024

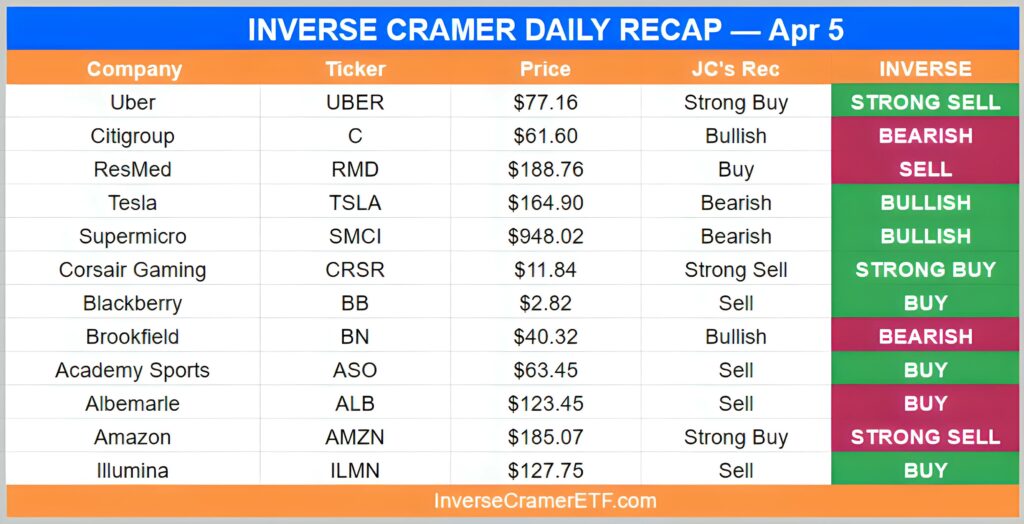

Friday, Apr 5

I like Uber. It’s very well run. The stock is a buy, buy, buy.

-On Uber ($UBER)

I feel better about Citi, I had it for a long time. But it doesn’t mean I’m not in favor of Wells Fargo.

-On Citigroup ($C)

Tesla got itself in some sort of like a House of Pain. He’s got to change.

-On Tesla ($TSLA)

SMCI is complicated, I’m an Nvidia guy hold it don’t trade it. I’m not gonna go on SMCI because it’s not as good as Nvidia.

-On SMCI ($SMCI)

No. I happen to have a blackberry for lunch and it doesn’t taste that good either.

-On Blackberry ($BB)

No, no, Illumina is not good. You want Danaher, same business, better company.

-On Illumina ($ILMN)

Cramer Classic

$META now up 430% since Jim went bearish and teared up on national TV😂 https://t.co/NLI1zbnXMx pic.twitter.com/3XR51s1m4g

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 5, 2024

Weekend Bonus

I knew it pic.twitter.com/NeeLxzLLk4

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 5, 2024

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue is sponsored by Yieldstreet

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.