Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite 🙃

Table of Contents

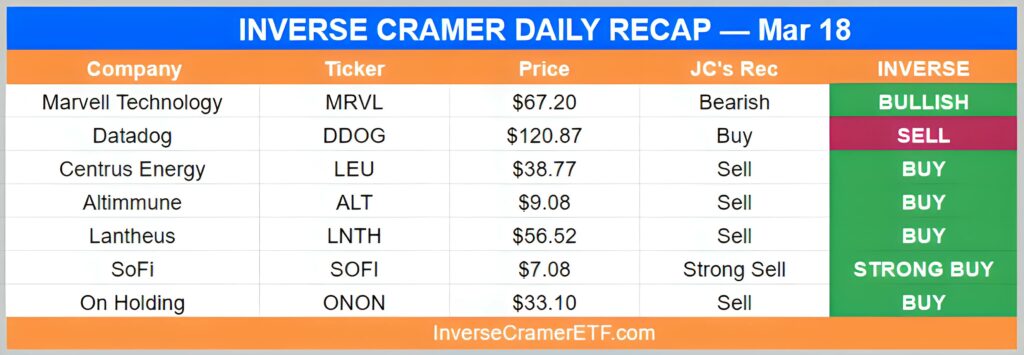

Monday, Mar 18

It had a mixed quarter, see part of the business is on fire, but the other part is not at fire at all. That’s why I’m saying we’ve got to wait. We’ve got to get closer when the rest of the business turns around. It’s not there yet.

-On Marvell Technology ($MRVL)

People like it. It is a dynamite company. It is a buy. It is expensive but they really know what they are doing.

-On Datadog ($DDOG)

Very speculative situation. I love the balance sheet, I love what the company is doing, and you want to be a little diversified because you’re going all in like the uranium energy company.

-On Centrus Energy ($LEU)

They were doing great and then they did this convertible bond that wrecked the stock. The stock has been in the dog house ever since and I don’t like it when I tell people to buy a stock that’s been staying in a dog house.

-On SoFi Technologies ($SOFI)

Nvidia just announced a new chip that’s 4x faster than its previous$NVDA once again saving the global economy pic.twitter.com/9F3iXQlhyR

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 18, 2024

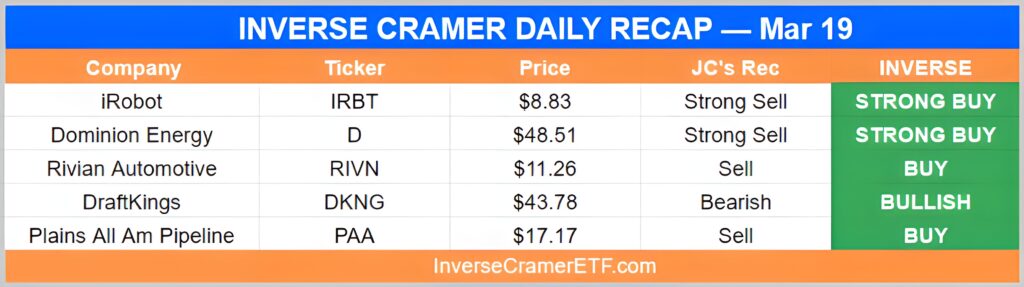

Tuesday, Mar 19

Keep buying those iRobots, they’re on sale at Costco, but the stock is a (Sell, Sell, Sell)

-On iRobot ($IRBT)

I don’t like Dominion. I think they made a lot of mistakes in their balance sheet. Can’t let you out of the house of pain with that one.

-On Dominion Energy ($D)

My wife says I want to buy Rivian, but I’m worried about the balance sheet. It’s a well-run company, but I’d rather buy the car than the stock.

-On Rivian Automotive ($RIVN)

I agree it’s a great company, but football season is over, I think it’s gonna pause. I want a pause on that one, I don’t want you to buy it right here, let it come in.

-On DraftKings ($DKNG)

If this actually proves to be the top it will solidify the fade Cramer in eternity https://t.co/55odmg2bO9

— Jack Raines (@Jack_Raines) March 19, 2024

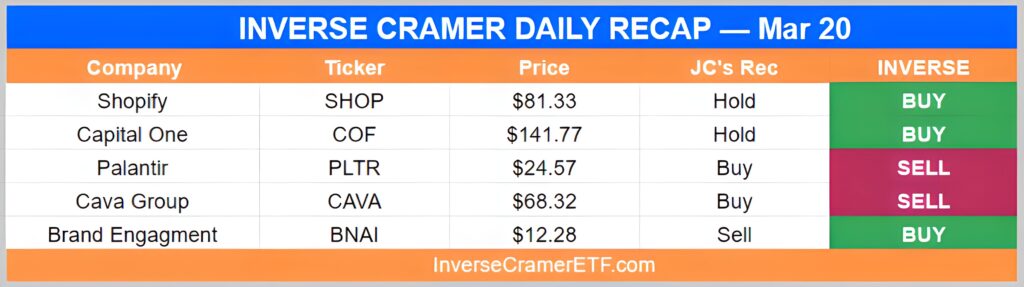

Wednesday, Mar 20

I like e-commerce. I like Amazon more than Shopify. But I think Shopify does a terrific job for medium-sized businesses. I would stick by it.

-On Shopify ($SHOP)

Capital One is terrific. Management is great. I say stick with that one. It is a good company.

-On Capital One ($COF)

I like Palantir. I like the quarter last time. It’s a good company.

-On Palantir ($PLTR)

We’ve been very clear on Cava. It got too hot, then it came down, we said buy, buy, buy. It’s been right and we’re sticking with it but don’t forget Chipotle is the king.

-On Cava Group ($CAVA)

Nothing to see here, just chicken wings trading at 145x earnings

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 20, 2024

Probably nothing pic.twitter.com/6pMzD0VnwO

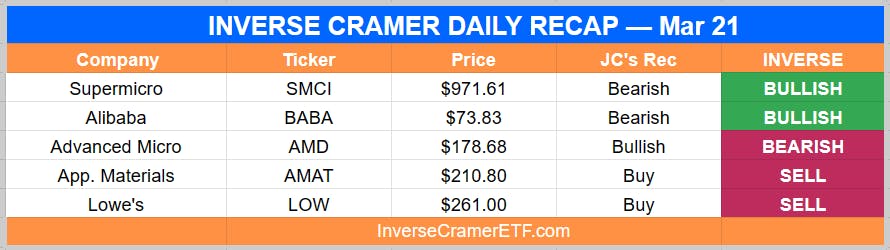

Thursday, Mar 21

I would rather buy Nvidia a hundred points higher than it is rather than SMCI. That’s how I feel about it.

-On Supermicro ($SMCI)

It’s so hard. If we trusted the Chinese to do the right thing, can they do the right thing by working really hard, then I would say buy it. But right now they seem to be inclined to attack the rich people including the people who run that company. So we’re going to hold off.

-On Alibaba ($BABA)

I like AMD here. I think it has been in the penalty box long enough that I’m in the Nvidia land but I haven’t lost sight that Lisa Su is one of the greatest managers of all time. It’s time for me to think can I own both for my capital trust, Nvidia and AMD? I think I can.

-On Advanced Micro ($AMD)

Lowe’s is really good and Marvin Ellison is a great CEO. Lowe’s almost had its all-time high. Home Depot is great too. Both of those are good. Either one is a great buy right now.

-On Lowe’s ($LOW)

Last word until tonight: I have liked Apple's stock since it was $5. I have seen so many of these fear waves occur because Apple has some of the least loyal shareholders-but also some of the most. The least are bailing because they never knew the company anyway

— Jim Cramer (@jimcramer) March 21, 2024

Friday, Mar 22

I like Arm very much. I wanted to be sure about that lock-up expiration, and it looks like it’s coming (Buy, Buy, Buy). You’ve got a good situation over there. I’m going to be a buyer.

-On Arm Holdings ($ARM)

I would have told you to sell the stock but you can’t anymore, why? Because Jim Whitehurst is now in charge, and he’s a winner (Buy, Buy, Buy). I’ve changed my mind on the stock because he has now run it.

-On Unity Software ($U)

I’m not gonna tell you to sell the stock. Hold it if it drops down, and buy more, but I can’t tell you to sell it, it’s too good.

-On General Electric ($GE)

I’ve been hard on Teva because I like Lilly, but Teva’s situation is improving and it’s ridiculously inexpensive. They actually have good scientists there, so I’m not knocking Teva anymore. As a matter of fact, I’m gonna go in on Teva.

-On Teva Pharma ($TEVA)

"The name of the company is WingStop. It is a cutting edge high-tech chicken wing chain out of the Midwest awaiting imminent patent approval on the next generation of AI integrated wings" pic.twitter.com/AkXcQlssAm

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 22, 2024

Weekend Bonus

Satya with one of the hardest CEO quotes ever

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 20, 2024

“We are below them, above them, around them” pic.twitter.com/P9I5jZbsL4

That's because they are ecstatic! pic.twitter.com/cBTXZ9zE2Y

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 22, 2024

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue has no external sponsors

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.