Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite

Table of Contents

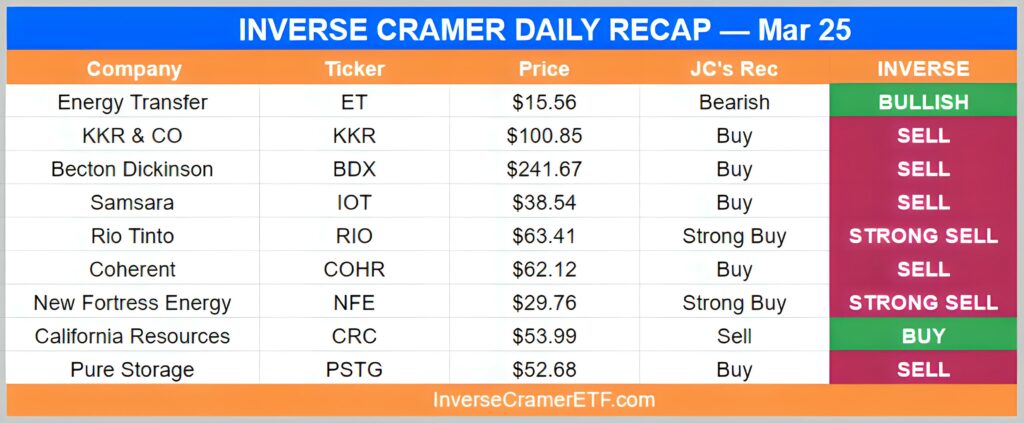

Monday, Mar 25

They’re very good at what they do. I’ve known them for 40 years. They are just really good. Stock has a big run now. I think they could make more money than they have.

-On KKR & CO ($KKR)

The stock has been getting crushed. It’s really inexpensive. I think it’s a buy. It’s been flat for months, I think it’s time to buy the stock.

-On Becton Dickinson ($BDX)

This is the hottest stock. It’s going to make money. It’s really good. This is a dev ops shop, where they can develop hardware software in a platform. People love these kinds of stocks, they can’t live without them.

-Samsara ($IOT)

It’s a great company to buy here. A mineral company is a terrific idea.

-On Rio Tinto ($RIO)

I think this company is a buy (Buy, Buy, Buy). Wes Edens is absolutely terrific to what he does.

-New Fortress Energy ($NFE)

BREAKING: Jim Cramer just said: "we are big fans of Bitcoin"

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 25, 2024

Uh oh

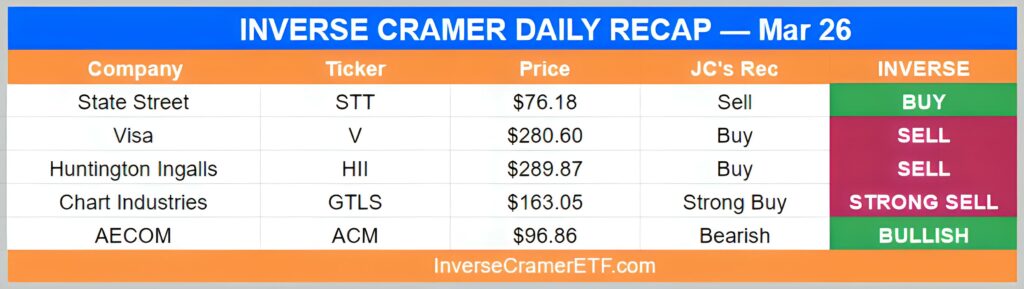

Tuesday, Mar 26

No. I actually want earnings leverage right now, it’s why people like Citi. I like Wells Fargo and Morgan Stanley.

-On State Street ($STT)

I like Visa very much here. I like that settlement that was announced today. It’s gonna clear their heads a little bit. Visa is too close to its all-time high. If it comes a little, I’ll be a buyer.

-On Visa ($V)

This is a very good navy contractor that I have liked ever since the spin-off dating years and years ago. Now it had a very big run, but I think it can go higher. It’s a winner, not a loser.

-On Huntington Ingalls ($HII)

I discovered this stock. This was a company that we owned for a long time. It is absolutely terrific, it sells 14x its earnings. You’re on a good one. It’s good for industrial gases. Stay on that stock.

-On Chart Industries ($GTLS)

tired: turning your spare room into a bitcoin mine

— Troy Osinoff 🕺 (@yo) March 26, 2024

wired: turning your backyard into a cocoa farm pic.twitter.com/xoPPnAHCSX

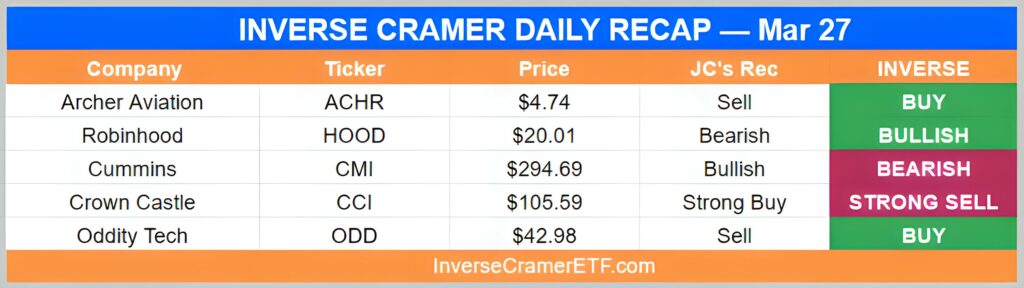

Wednesday, Mar 27

I can’t recommend that stock. It just has no earnings power. There are so many good stocks right now, we don’t need that.

-On Archer Aviation ($ACHR)

I think that Greyhound bus has left the station, and I’ve got to wait. The thing doubled in no time. We don’t buy doubles here.

-On Robinhood ($HOOD)

Jennifer Rumsey is doing such a fabulous job. I don’t want you to sell on the Cummins. You just got to pull extra money and buy the GE. As a matter of fact, I forbid you from selling Cummins, but you can buy GE.

-On Cummins ($CMI)

Actually at this level with a 6% yield, I would buy some more. It’s good idea, and I haven’t felt that way with Crown Castle for ages.

-On Crown Castle ($CCI)

It's over pic.twitter.com/KsNhRitUPv

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 27, 2024

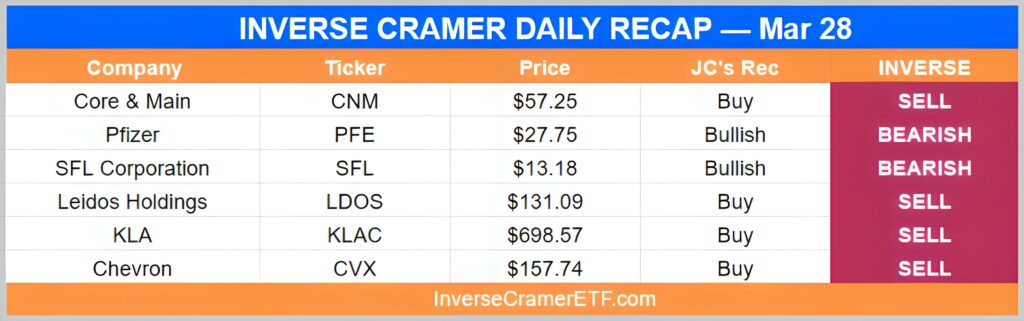

Thursday, Mar 28

Pfizer has been the worst. Let’s get Pfizer a chance. They got this really good acquisition Seagen. Let’s give it some time here.

-On Pfizer ($PFE)

Leidos is a great defense contractor that is actually not struggling to get money out of Congress. It’s a winner. I don’t want to get out of that horse yet.

-On Leidos Holdings ($LDOS)

Celebrating my daughter beating cancer with an extra-special Lightning Round pic.twitter.com/7Pv0SDPMgC

— Jim Cramer (@jimcramer) March 28, 2024

Congratulations to Jim and his daughter, she beat cancer. Go show him some love!🙏 https://t.co/OKuYs8dZjq

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 28, 2024

Friday, Mar 29

Good Friday

Cramer Classic

Average fintwit investor https://t.co/Jz4Fftwa8e

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 27, 2024

Weekend Bonus

Zuck and Huang jersey swap. BULLISH pic.twitter.com/2sMfasZPX8

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 27, 2024

Cocoa prices are up +260% over the past year

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 25, 2024

Willy Wonka would have made a killing pic.twitter.com/DhemuOEKlt

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue is sponsored by EquityMultiple

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.