Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

Last time, we featured an opportunity to invest in an artist who’s about to. Didn’t get the email? Make sure to let us know you’re an accredited investor.

This month, we’re looking at Oberit, an early-stage HealthTech company that’s advancing the mental health and addiction recovery category with AI-powered, incentive-based behavioral change.

It’s got a super low minimum investment — just $100.

Let’s get to the Big Deal

Oberit

Oberit is a healthtech company advancing the mental health and addiction recovery category with:

- AI-Powered Relapse Intervention

- Data-backed mental health and addiction treatment app for a healthier lifestyle

The company is raising an equity round on WeFunder closing at the end of 2023.

Deal Overview

- Investment type: Equity – SAFE

- Valuation: $6m (early bird 20% discount, rising to $8m)

- Raising: $500k

- Minimum Investment: $100

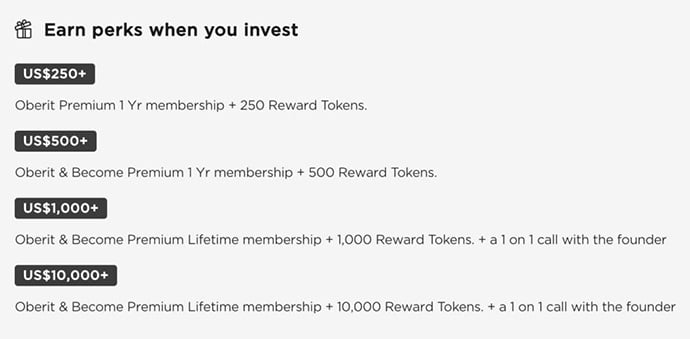

- Alts member perks: Invest over $250 and receive perks like 1 Year Free Premium membership to the Oberit app for 2.5X rewards multiplier plus a welcome rewards bonus.

- The campaign closes the end of year

- Check it out: Funding Page

Dive into their super slick video to learn more.

And listen to Will’s revealing podcast interview.

Will does a great job illustrating the importance of well-being, particularly regarding addiction.

TLDR of why I like it

I’ve tried gratitude journals, books, podcasts, and all sorts of other options before with no luck.

But I’ve been using the Oberit app for a few weeks now to help me focus more on positivity and drink a bit less, and I’ve found some success with it.

It’s app-based, which suits my specific preferences, and I like the push notifications that remind me of what I should be doing and thinking about every day.

The best and most effective mechanic, though, is gamification. Gamification isn’t new — it’s been an underlying part of the app-design ecosystem and lexicon for a decade — but I’ve never seen it applied to wellness like this.

You can see some of the stuff I’m able to “buy” with my coins above. (PS Sign up with my referral link, and I get 50 more coins!).

It encourages you almost to fake it until you make it, which is a fantastic onramp to well-being.

What’s the investment?

This is a SAFE investment in Oberit capped at $6 million, rising to $8 million once the next threshold is met. If you’re unfamiliar with a SAFE, do your homework.

Like many crowdfunding campaigns, several potential perks come with your investment.

What’s the Big Deal?

The Problem Oberit is Solving

Globally, it is estimated that over 1.5 billion individuals, equivalent to approximately 20% of the population, are grappling with addiction or mental health challenges. These figures have exhibited an upward trend, potentially exacerbated by the COVID-19 pandemic, economic inflation, recessionary pressures, and employment uncertainties.

This escalation in addiction rates presents significant detriments, both to individual well-being and economic stability.

In terms of treatment, there appears to be a pronounced gap in the availability and accessibility of affordable and efficacious resources for long-term recovery. Current data suggest that a majority of those in need do not receive adequate treatment, with less than 10% accessing therapy. Furthermore, the rate of relapse within the first year of recovery is reported to be close to 90%.

Lifestyle factors, namely tobacco use, alcohol consumption, illicit drug use, insufficient physical activity, and suboptimal nutrition, have been identified as leading contributors to conditions that account for a substantial proportion of global mortality.

The Oberit Solution

Oberit disrupts harmful habits by incentivizing users with its currency, “Oberit Coins,” earned through health-positive activities. These coins can be exchanged for products or discounts off top-rated health and wellness brands like Oura, Olipop, Thorne, LiquidIV, Tenzo, Beam, and 100s more, encouraging a sustained engagement with the app.

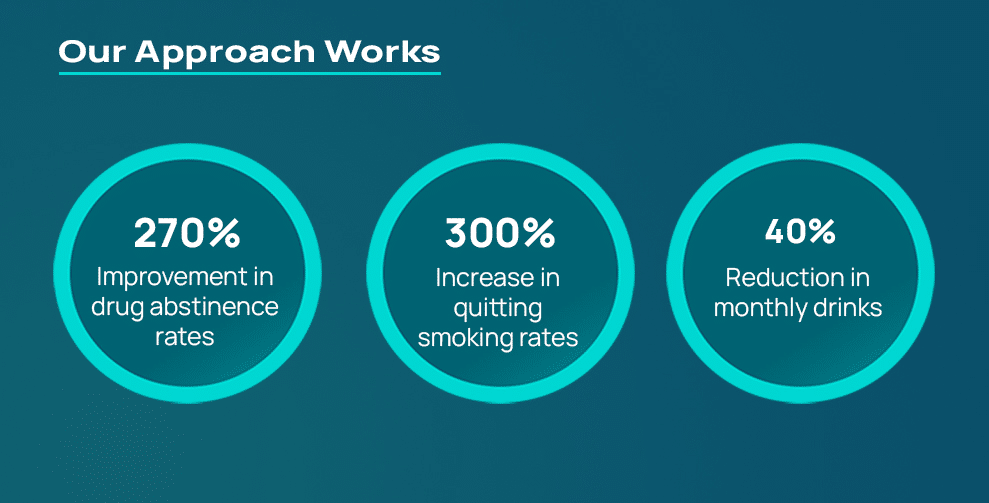

The app’s approach, termed “Contingency Management,” aims to replace detrimental behaviors with beneficial ones, leading to healthier lifestyles. The reported results are significant.

Oberit also anticipates integrating AI to identify and intervene in potential relapses, notifying support networks, although the effectiveness of this feature remains to be evaluated.

How does Oberit make money

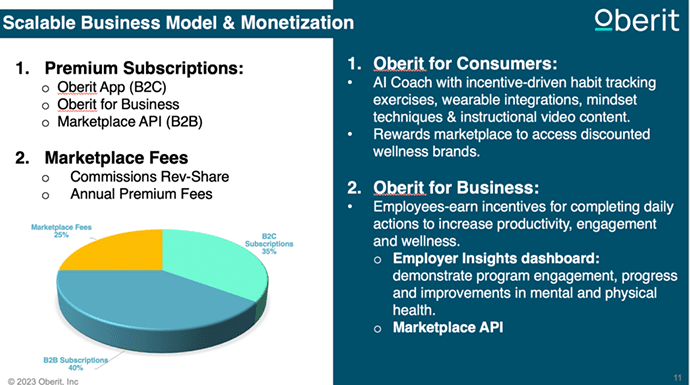

Oberit possesses various revenue streams to support its expansion and aims to achieve an Annual Recurring Revenue (ARR) exceeding $27 million by 2026:

- Paid subscriptions (B2C and B2B)

- Revenue from marketplace providers

In July 2022, Oberit completed the acquisition of the ‘Become Program,’ which not only contributes to its revenue but also aligns with its mission to prevent relapse. The program enhances Oberit’s offerings by adding group meetings, a dedicated channel for group interactions, masterclasses, guided meditations, meetups, and an additional tier of community support.

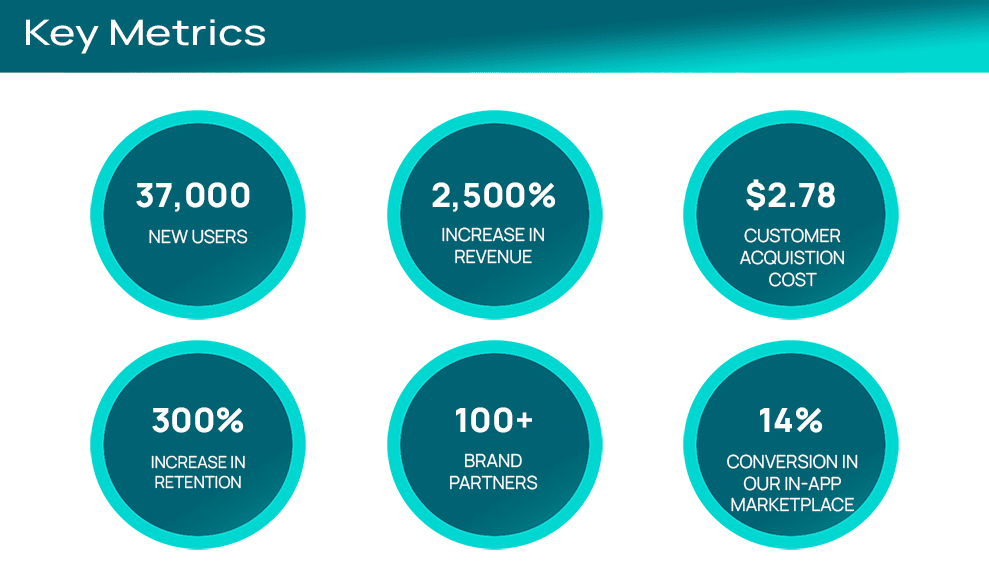

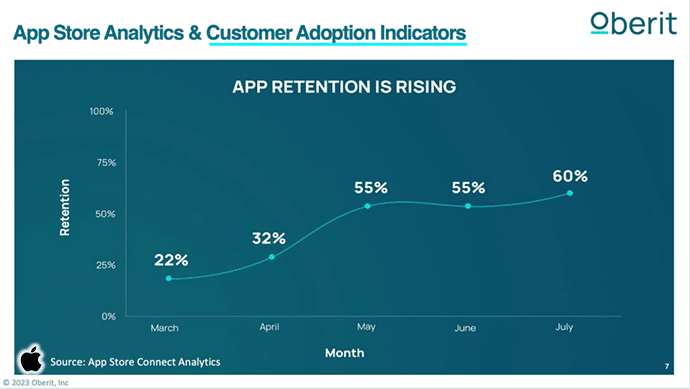

Increasing user retention has been a primary focus for Oberit, which has demonstrated significant progress over the past year. The app has ascended to the 75th percentile in the Health and fitness category across the Apple App Store.

This milestone represents a fivefold increase over the average engagement level. This achievement places the company among the elite applications with high user engagement.

Opportunity size

There are a number of tailwinds supporting the $7 trillion Oberit is going after.

- Increased Health Awareness: There is a growing global awareness of health and wellness, partly due to the aging population and the associated rise in chronic health conditions.

- Technological Advancements: Innovations in technology, including mobile health apps, wearable devices, telemedicine, and AI, have made health and wellness services more accessible.

- Preventive Health: There is a shift towards preventive healthcare to avoid the high costs associated with chronic diseases, with more people investing in their health proactively.

- Mental Health Recognition: Mental health is receiving greater recognition as a critical part of overall well-being, increasing demand for mental health services and products.

- Corporate Wellness Programs: Employers are increasingly investing in wellness programs to reduce healthcare costs and improve employee productivity and retention.

- Government Initiatives: Public health initiatives aimed at reducing healthcare expenditure promote the use of wellness programs.

- Personalization: The trend towards personalized health and wellness plans, powered by data analytics and personal health records, is expanding the market.

- Global Middle-Class Expansion: The growing global middle class, particularly in emerging markets, has more disposable income for health and wellness.

- Cultural Shifts: A cultural shift towards natural and organic products, mindful living, and holistic health approaches is driving demand.

It’s a big market that’s going to continue to grow.

Traction

The company has reported substantial metrics quickly, indicating its impact on user engagement. These achievements have drawn investments totaling ~$590,000 from angel investors, Limitless Ventures, a private equity firm, and crowdfunding.

Highlighting the efficacy of its marketing strategies, the company has maintained an average Customer Acquisition Cost (CAC) of $2.78. This figure suggests a cost-effective approach to user acquisition and growth. The results are available for evaluation to ascertain the company’s performance in this area.

Valuation

Oberit is raising at a $6 million cap for the early birds, rising to $8 million thereafter.

The risks

Three main risks for me.

Chicken and egg:

The company’s reliance on a marketplace monetization model necessitates a substantial base of active users and the provision of appropriate products and offerings. If the marketplace does not scale as anticipated, there is skepticism regarding the company’s ability to realize adequate profits in the future.

Future funding:

There is no guarantee that the company will secure additional equity financing or choose to convert the securities during such financing. Moreover, the company may not experience a liquidity event, such as selling or going public through an IPO. In the absence of either securities conversion or a liquidity event, investors may retain their securities indefinitely. The securities are subject to significant transfer restrictions, potentially leading to high illiquidity without a secondary market for trading. These securities do not represent equity stakes, confer no ownership rights, offer no claim to assets or profits, and lack voting rights or influence over company decisions.

Small team

The company’s future is highly dependent on its small management team, and the departure of any key members could negatively impact the organization. There is skepticism regarding the company’s ability to attract and retain the necessary personnel to grow the business effectively. The current team’s centrality to operations means their loss could be particularly detrimental, with no assurance of successful recruitment to fill these critical roles.

How to invest

Oberit’s funding round is open now, and you can invest with a minimum of $100.

That’s it for this week.

If you have a deal you think we should share with our 95k members, please get in touch.

See you on the beaches

Disclosures

- Participation in Big Deals is a competitive process. Investment sponsors, founders, etc submit their deals, and we choose the best of the best.

- Oberit compensated us for publishing this report.