Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

Last time, we featured a company that’s gamifying mental health called Oberit, and the feedback was fantastic.

This month, we’re looking at Contractor+, which helps tradesmen bid, schedule jobs, and get paid. The platform already has 35k+ members and is doing more than $360k per year in revenue.

It’s got a super low minimum investment — just $100.

Let’s get to the Big Deal

Contractor+

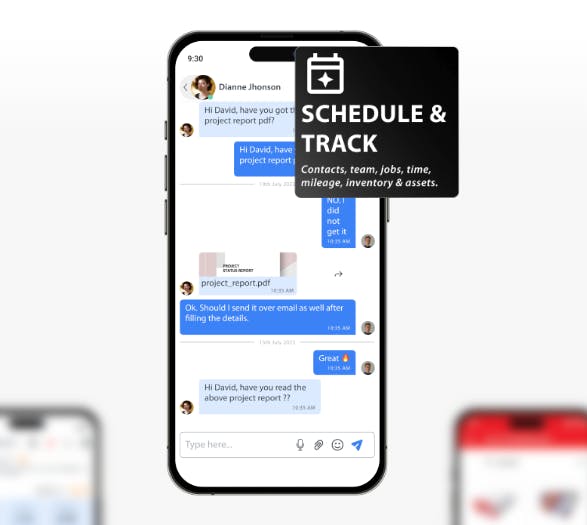

Contractor+ is a comprehensive app designed to help contractors manage their businesses more efficiently. It offers a wide range of features, including client and team management, job scheduling, estimates, invoicing and payments, contracts and e-signatures, tool library, time clock, and Quickbooks synchronization. The app aims to save time and increase earnings for contractors in over 35 industries, providing solutions like field service management, lead generation, and contractor websites.

The company is raising an equity round on WeFunder.

Deal Overview

- Investment type: Equity – Convertible Note (Prime + 1.25%)

- Valuation: $7.29m (early bird discount, rising to $8.1m)

- Raising: $1.5m total. The first $250k will be via convertible notes at the early bird rate.

- Minimum Investment: $100

Check it out: Funding Page

Dive into their super slick video to learn more.

TLDR of why I like it

Lots to like here:

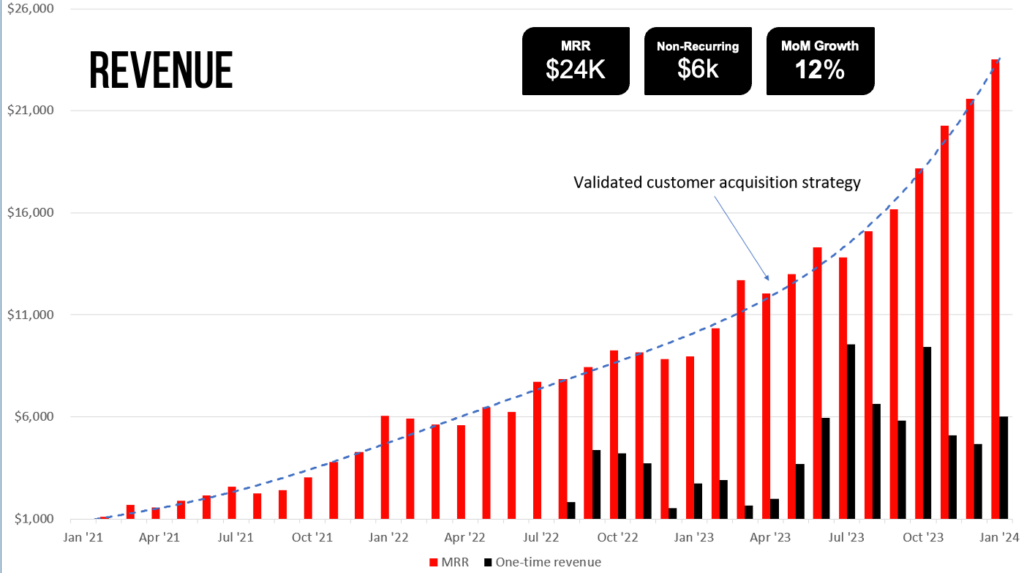

- Effective Capital Allocation: After the company’s last fundraise, growth went parabolic, increasing 10% MoM.

- High Market Potential: Targeting a fragmented industry with solutions for 35+ different contractor services.

- Technology-Driven Efficiency: Streamlining contractor operations, leading to time savings and increased earnings.

- Strong Growth Indicators: Demonstrated year-over-year growth and high gross margins.

- Scalable Business Model: A platform designed for expansion across multiple markets.

- Early Stage Investment Incentives: Convertible note with a favorable valuation cap for early investors.

- Comprehensive Feature Set: Offering client management, invoicing, payments, and QuickBooks integration all in one platform.

- Expanding User Base: Potential for rapid user acquisition given the broad applicability across contractor industries.

- Proven Leadership Team: The board of directors is composed of ex-SaaS executives with multiple nine-figure exits.

What’s the investment?

This is a convertible note at a valuation of $7.29 million.

What’s a convertible note?

A convertible note is a short-term debt instrument that converts into equity, usually in conjunction with a future financing round; essentially, the investor loans money to a startup with the intention of converting into shares of preferred stock during a later financing round, typically at a discounted rate compared to later investors. It’s a common tool for early-stage startups to raise capital efficiently, offering investors the opportunity to support a company’s growth while securing potential for equity gains.

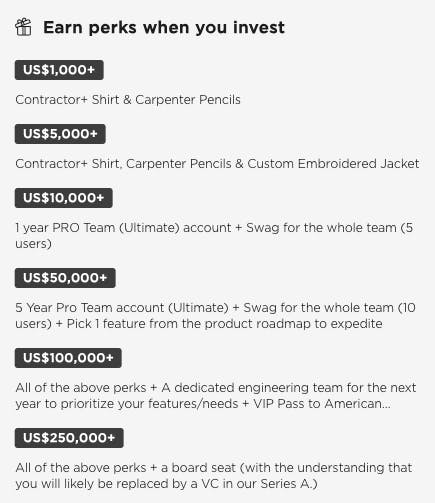

And like most crowdfunding campaigns, this one comes chock full of perks.

What’s the Big Deal?

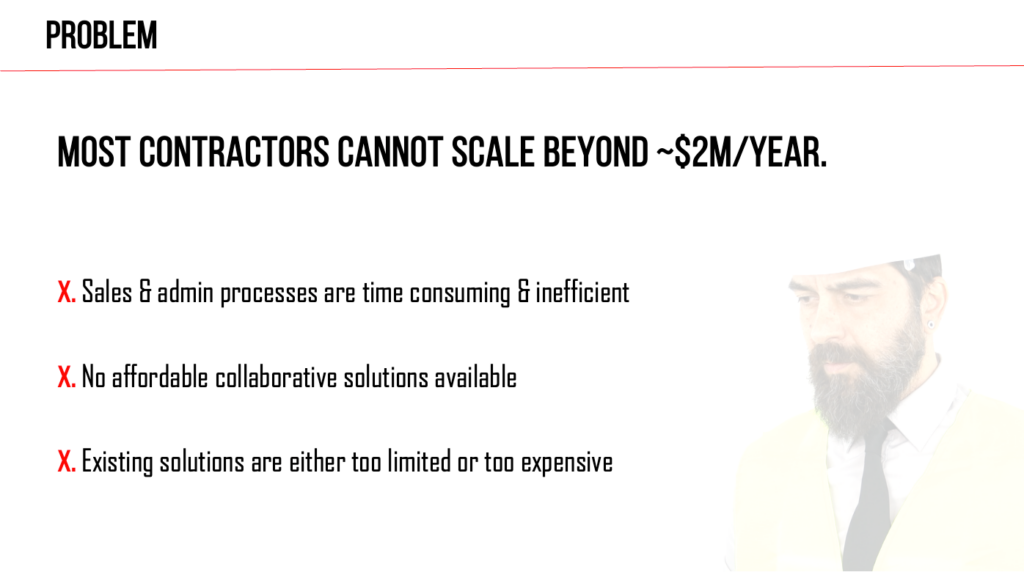

The Problem Contractor+ is Solving

Their funding page lays out the problem well.

Tradesmen struggle to scale past a few people on the team. They’re really good at fixing and building stuff but are generally pretty awful at all the boring admin. Most would rather stay small than deal with all the headaches.

The Contractor+ Solution

The platform deals with all the admin nonsense above in a seamless and robust way.

You can see how the platform works here:

How does Contractor+ make money

Contractor+ notes multiple revenue streams: Subscriptions, Payment Facilitation, Financing, Insurance Referrals & more.

Subscriptions

- Fremium: free

- Pro: $29/mo

- Ultimate: $49/mo

Contractor+ is simplifying this and increasing prices soon. This should lift ARPU to close to $200 per month for paying members.

Transaction fees: 70bps per credit card transaction, 1% up to $15 per ACH, and 50bps for consumer financing

Lead generation: partnership with an insurance company

Today, that adds up to an MRR of $24k alongside 5,500 monthly active users (800+ are paying). Assuming the new pricing strategy works, this would rise to as much as $150k MRR.

Contractor+ has other revenue streams in the works (quotes from CEO Justin Smith):

Material Override – from Supply Houses when our users submit their material purchase orders directly through Contractor+. We’re currently collaborating with the 1build team and working on a pilot with Lowe’s that ships next month; it will enable our users to place their orders with the click of a button inside our app.

Hardware & Addon Services – Bluetooth & GPS Tracking devices.

6Network Referrals – Monetizing how contractors send/refer work to one another.

Tool & Equipment Rentals – same/similar to material override, but for tools and equipment.

Lots of possibilities here.

Opportunity size

Contractor+ claims a $60B market opportunity with a CAGR of 19%.

This feels a bit high to me based on back-of-the-napkin TAM estimates:

Top-Down Approach

- Global Construction Market Size: The global construction market is projected to be several trillion dollars. For simplicity, let’s assume a conservative figure of $10 trillion.

- Segment Focus: Assume Contractor+ focuses on the residential and small commercial construction segment, which constitutes about 20% of the total market.

- Market Penetration: Targeting a realistic market penetration rate of 1% in the initial years.

Top-Down TAM Estimate: $10 trillion * 20% * 1% = $20 billion

Bottom-Up Approach

- Average Revenue per User (ARPU): Assuming an ARPU of $500 per year, reflecting subscriptions and additional services.

- Target User Base: Estimating the global number of small to medium-sized construction businesses and individual contractors at 2 million.

- Market Penetration: Aiming for a penetration of 5% within this target market over a medium-term horizon.

Bottom-Up TAM Estimate: 2 million * 5% * $500 = $50 million annually

Of course, these estimates are very rough, and I could be wildly wrong. Either way, the market is pretty big.

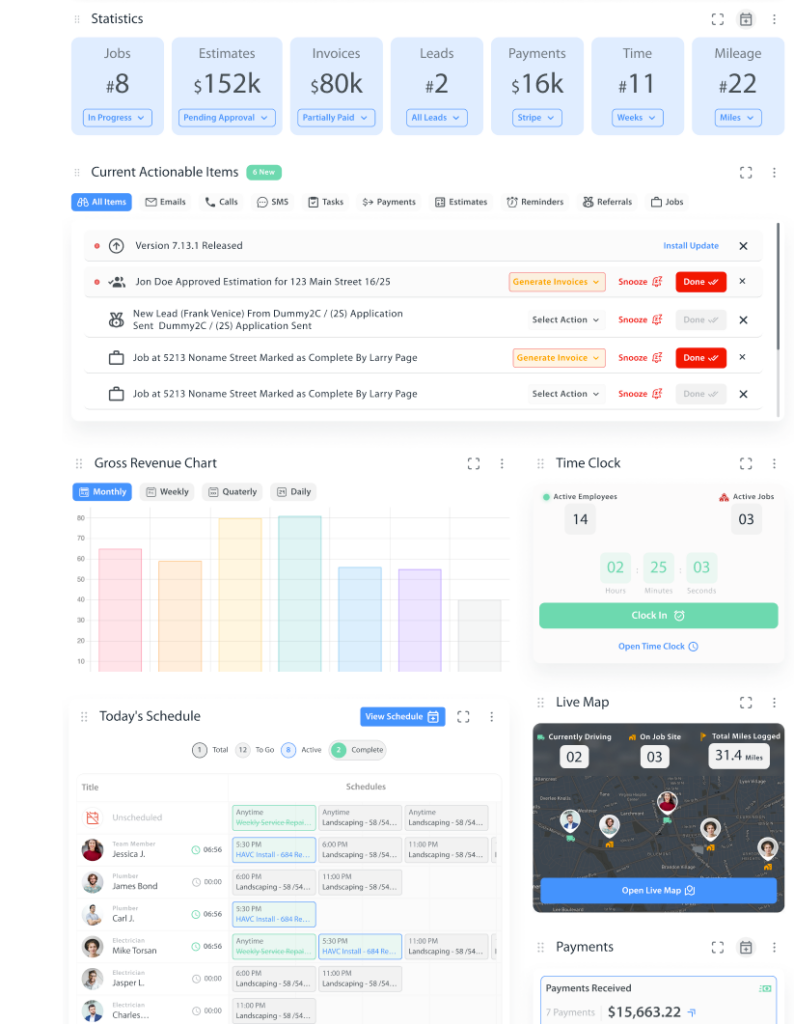

Traction

There’s a lot to like here, but this graphic tells the story best:

That MoM growth is remarkable and makes me worry a lot less about the inconsistency with the one-time revenue.

Other noteworthy data points:

- Revenue and Growth: $360K annual run rate with over 85% gross margins and a 162% growth year-over-year.

- User Base: 40,000 free users, 5,500 monthly active users, and 800+ paying customers.

- Platform Accessibility: Native web, iOS, and Android apps.

Partnerships: Collaborations with Thumbtack, Intuit Quickbooks, 1build, CompanyCam, and Square.

Valuation

Contractor+ is raising at a $7.29 million valuation for the early birds, rising to $8.1 million thereafter.

The risks

CEO Justin Smith identifies these as the biggest risks:

- Market Competition. As the field service management sector grows, so does the competition. Staying ahead requires continuous innovation and differentiation. However, I will say that our success does not solely depend on the successful execution of our marketplace play. The market is plenty big enough (and expanding) to build another $100m+/year business without the network-level collaboration piece.

- Technology Advancements. Keeping pace with rapid technology changes, especially around AI and mobile platforms, is crucial. Ensuring our Contractors Assistant AI really meets expectations demands significant ongoing investment, research and development. But, we’re really excited about this challenge as it gives us the opportunity to truly transform an industry. We’re building tools that will streamline processes that used to take contractors 2-3 hours, where they’ll now be able to do it in 2-3 minutes.

- Talent Acquisition and Retention on a Budget. Attracting and retaining top talent in software development, AI, and business development will be vital for our sustained growth and innovation. We’re thinking outside the box with compensation, tying salary growth with MRR, and incentivizing with equity, which has been received really well with our existing team. The trick to finding the best talent in India is getting to them before Meta and Microsoft and Google. In the US, where the bulk of our biz dev efforts are, we’re offering really high commissions and then tiering it down over time to get our BDRs to the $200k mark as fast as possible, where we’ll be able to retain the top talent.

- Customer Acquisition and Retention. Expanding our customer base while maintaining high satisfaction levels with existing users will be key, especially as we scale.

- Funding and Financial Management. Our current focus is on crowdfunding. This round will get us to $350K MRR (within 24 months), which will set the stage for a really strong Series A. This could introduce some pressure to scale rapidly which could lead to overextension, both financially and operationally. Our aggressive growth targets require efficient capital use, precise market targeting, and maintaining product quality and customer satisfaction. There’s also the risk of external market factors, including economic downturns or shifts in industry demand, which could impact our growth trajectory.

I would add:

- Technology Adoption: Resistance to adopting new technologies in the construction sector, especially among smaller contractors, could slow down the company’s user growth.

- Regulatory Changes: The construction industry is heavily regulated. Changes in regulations or compliance requirements could impact Contractor+’s operations and the features it can offer.

How to invest

Contractor+’s funding round is open now, and you can invest with a minimum of $100.

That’s it for this week.

If you have a deal you think we should share with our 230k members, please get in touch.

See you on the beaches

Disclosures

- Participation in Big Deals is a competitive process. Investment sponsors, founders, etc, submit their deals, and we choose the best of the best.

- Contractor+ compensated us for publishing this report.