Last month, we published an issue on the economics of media bundling.

In that piece, we emphasized a crucial piece of information: Media is currently in the middle of a major consolidation phase.

With a weak ad market, ugly margins, and AI looming large on the horizon, media giants are looking for new sources of cash in all sorts of places.

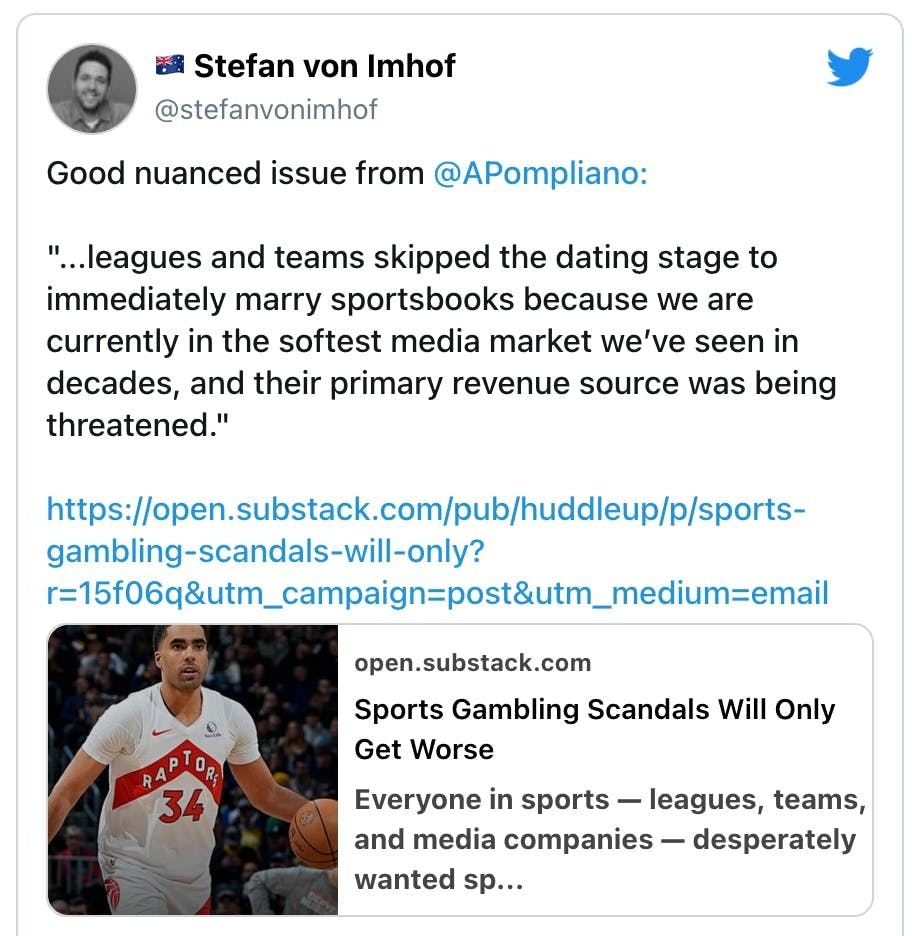

Some are turning to bundles and paywalls to increase revenue. Others are pivoting towards live events. And finally, as Americans may have noticed, sports media companies have thrown caution to the wind and fully embraced gambling.

Here at Alts, we’ve done a few things to stay ahead of the curve; and we’ve done it in our own way. You’ve probably heard of Altea, our new private community where we go on epic investor field trips.

You may have also noticed we recently introduced a paywall of our own. (Ironically, this issue is free to everyone!)

But regardless of whether you’re someone who regularly pays for content, or someone who U-turns the minute they see a paywall, three things are clear:

- Paywalls aren’t going away anytime soon

- There is only so much paid content a person can be expected to subscribe to, and

- There is a huge, unmet need for news bundling

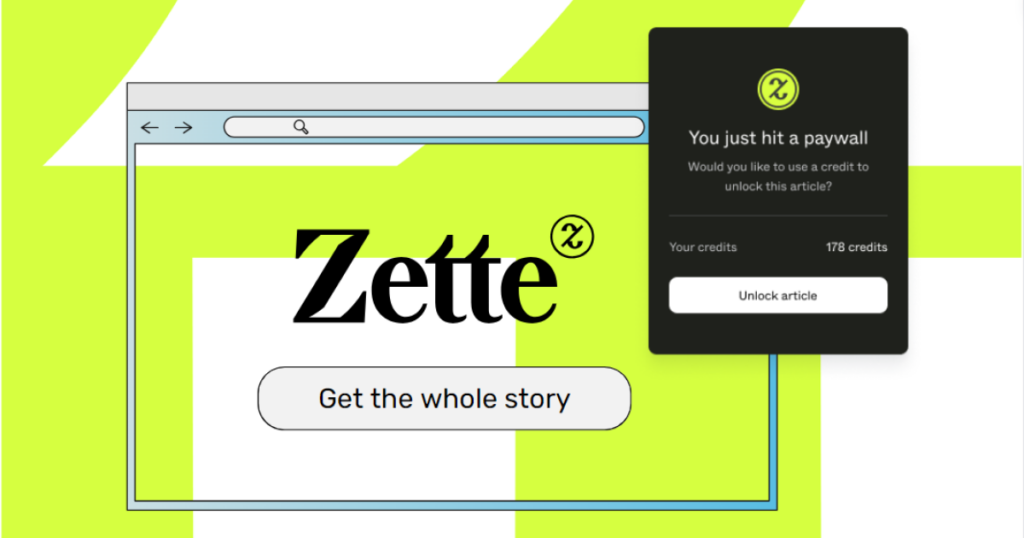

Today, we’re looking at one of the most important, exciting media tech companies to come across our radar in the past year: Zette.

Zette is a single subscription that lets you unlock paywalls at hundreds of publications.

Yes, this news bundling idea has been tried before, and yes, it has failed in the past. But times are much different now.

They’re off to a terrific start, their early bird round is open to both accredited and non-accredited investors.

Let’s find out more 👇

Note: This free issue is sponsored by our friends at Zette. As always, I think you’ll find it informative and fair.

Table of Contents

Newspapers are struggling

It’s no secret that newspapers and magazines are struggling.

In just the past few months, legacy publications like TIME, National Geographic, and the LA Times have cut jobs amid a persistent struggle to stay afloat.

That’s on the back of an awful 2023, where publications like The Washington Post, NPR, and Vox all had layoffs.

We all know why this happened. For decades, newspapers essentially had a monopoly on local advertising. The internet nuked all that.

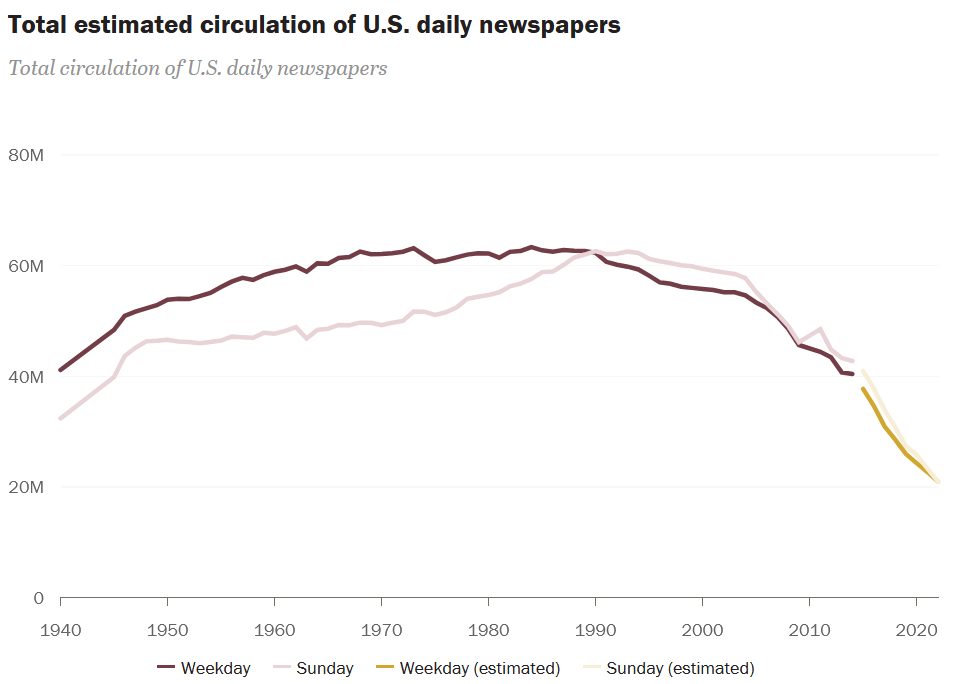

In 2003, weekday circulation for US dailies sat at 55 million and ad revenue was a healthy $45 billion per year.

But just ten years later, circulation had dropped by 15 million readers and ad revenue had fallen by more than half.

And sure, newspapers have adapted to the online world, with half of all their ad revenue now coming from digital advertising. But digital advertising has its own problems (which I won’t get into here.) Suffice to say, it hasn’t done enough to stop the bleeding.

The fundamental problem here is that newspapers now have to compete with social media and lean digital publications for eyeballs + ad revenue.

And while generating clickbait/ragebait is (unfortunately) a cost-effective way of drawing traffic, running a serious newsroom with a whole team of journalists gets mighty expensive.

In searching for a new economic model that actually works, paywalls seemed like a logical conclusion…

Paywalls showed promise..

Print newspapers have pretty much always been “paywalled.” Even today, you have to pay for a copy of the New York Times, whether you get it delivered to your house or buy from a shop.

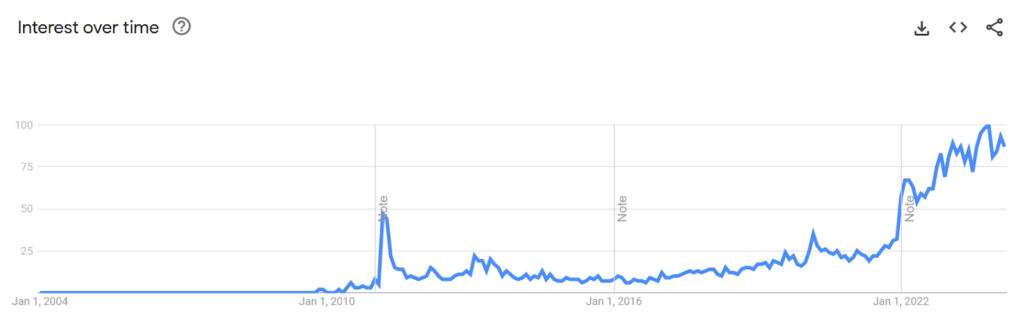

So it’s kind of odd that newspapers took so long to implement digital paywalls – but the practice really only went mainstream in the mid-2010s.

Today, paywalls are experiencing something of a renaissance. The rise of platforms like Substack and to a lesser degree, Memberful, prove that people are definitely willing to pay for written content.

..but paywalls only work for heavy readers

Here’s the real problem: paywalls only work for a very specific type of reader.

Most publications have found paywalls ideal for bona fide fans, who read on a regular basis, and ineffective for everyone else.

Think about it: If you encounter a random paywalled article online, how likely are you to pony up and read it?

Exactly. Although you might want to read that specific content, you’re not necessarily a committed fan of the publication.

These people are known as light readers, and paywalls aren’t a good fit for them at all:

- Paywalls usually unlock access to an entire publication’s archive. Why would light readers pay for all articles when they just want one?

- Paywalls usually come in the form of a subscription. Light readers don’t want to sign up for ongoing payments to content they don’t read regularly.

- Finally, light readers of one publication may be heavy readers of another — and there are only so many subscriptions you can manage before expenses start adding up.

Unsurprisingly, paywalled articles have a bounce rate of (get ready…) 99.7%.

Substack is an especially interesting case, because when Substack started out, their goal was to create a “utopia” with no advertising (paywalls only). But recently, even Substack has been quietly experimenting with creating an ad network for their top writers — much like Beehiiv and ConvertKit have today.

For mega media companies, paywall strategies are a double-edged sword. You capture more revenue from heavy readers, but you lose light readers, and organic web traffic.

It’s not that light readers are totally unwilling to pay for what they’re reading – it’s just that the traditional paywall approach of paying for a bunch of different subscriptions isn’t the right model.

Enter Zette.

Zette: Bundling paywalls (what a concept!)

Zette is solving the paywall problem with a fresh, sorely-needed approach.

The idea is simple: Pay one monthly subscription and receive credits, which you use to unlock paywalled articles at hundreds of different publications.

This is a huge improvement over ad-driven models

- Zette prices 30 credits at $9.99 per month, or .33 cents an article.

- On the back end, they target a 50/50 revenue split with publishers

- This is about 16.7 cents per article unlock.

- Estimates of the cost per thousand views (CPM) for digital ads is around $6.00. (This is just .06 cents per impression)

So on a per-article basis, Zette is hundreds of times more lucrative for publishers than the traditional model.

Having a single subscription has popular with users. Over 50,000 registered readers have already signed up. They’re on track to hit 1 million before next year.

What publishers has Zette connected to?

To date, Zette has signed on more than 100 publications, including prestigious outlets like Forbes and the New Scientist.

It might seem counterintuitive to target local newspapers first — shouldn’t you try to draw in bigger newspapers to provide the most value to readers?

Here’s the thing: smaller newspapers are exactly the types of outlets that has lots of light readers.

If you live in, say, Boston, you probably wouldn’t be willing to subscribe to a paper like The Miami Herald just to read an article about crypto. But every now and then, you might stumble across something really interesting. Zette to the rescue.

Is Alts on Zette yet?

This week I spoke with Zette’s founder Yehong Zhu to a) express my admiration, and b) see if we could connect Alts to Zette?

The answer was yes, but not yet. For two reasons:

- Zette works with publications that offer a fixed number of articles per month. Our All-Access Pass doesn’t work that way – one price gets you everything. But more importantly…

- Zette is starting out with small, broad-based newspapers. Yehong would like to expand to financial publications (including ours!) but that comes later.

Zette’s success is predicated on BD

Ultimately, Zette will only be as successful as the publications they partner with.

The more quality publications they have, the stronger their product becomes. They are bound by nothing except their own ability to really sell their service.

Investing in Zette is a bet that they’ll be able to continue bringing in names Big ones, too. I’m talking LA times, Boston Globe, Washington Post.

This is what will blast open the top of their funnel, keep the value prop high, and create a flywheel effect, where eventually publishers feel they have to partner with Zette if they want to generate revenue from light readers, not just heavy readers.

Does Zette have competitors?

So far, we’ve thrown around terms like “first” and “new” to describe Zette’s approach – but that’s not entirely accurate.

Bundled access to media has been popular model for a while now, just not with print media. Think about it: We have Netflix for TV/movies, Spotify for music, and Kindle Unlimited for books.

But this doesn’t exist for newspapers, magazines, or newsletters!

So has this been tried before? Why doesn’t Zette have competitors?

It’s been tried before — but not like this

There are actually a few other newspaper bundlers out there. Critically, though, all of them have either adopted a worse user experience or a worse payment model.

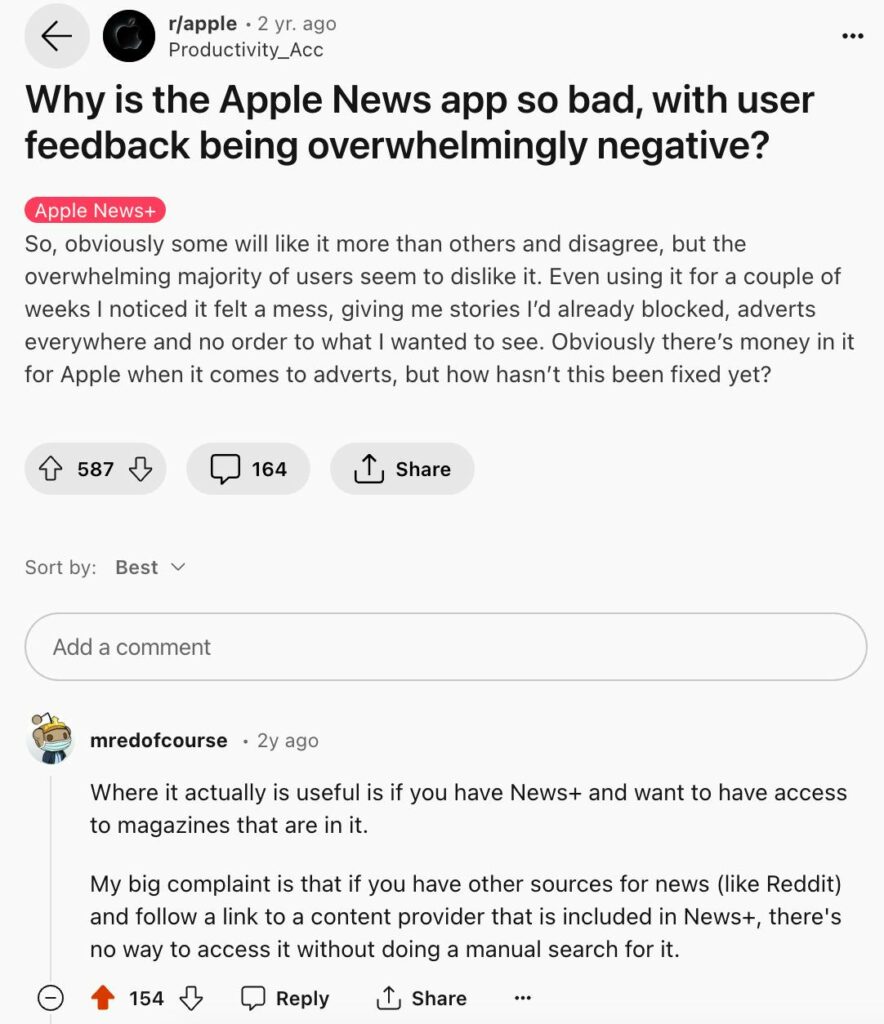

Apple News+

Apple News+ is one of the most high-profile newspaper bundlers, offering readers access to stories from major publishers like TIME, The New Yorker, and The Wall Street Journal for $12.99 a month.

Like Zette, Apple News+ is a subscription-based bundling service that pays publishers based on how many people read their articles.

Unlike Zette, however, the service fails to actually solve the problem of paywalls since (in typical Apple fashion) you can only access News+ articles within the app.

That means if you don’t have an Apple product, you can’t even use News+.

But it also means that if you’re browsing online and stumble across a paywalled article you want to read, you’ll need to go to the News+ app and relocate the article first (using a search feature that’s been subject to a number of user complaints). Ugh.

This is where Zette shines over News+, and why it truly offers something original. Instead of requiring new behavior to avoid paywalls, Zette works with the way you already browse.

Moreover, Zette doesn’t “force” users to pay for access to all the content from publishers like News+ does.

Instead, you spend credits only on the content you want, allowing Zette to keep costs down.

In fact, this is the problem that plagues competitors like Pressreader, which offers unlimited access to more than 6,000 publishers – at a healthy price of $29.99/month.

Blendle

Oh man, does anyone else remember using these guys?

Blendle, a Dutch firm, also made an attempt to do newspaper bundling, although they used a model built on micro payments.

Here’s how it worked: instead of purchasing an entire newspaper or magazine, Blendle offered users the ability to pay directly for single articles. Prices varied, but averaged around 50 cents.

At the time, Blendle generated a lot of hype, even securing investments from The New York Times and Nikkei.

Over time, though, the excitement faded as people realized the infeasibility of the micropayments model.

Three reasons why:

- The lack of a subscription meant Blendle had high user churn (and, by extension, the publishing partners).

- They needed to charge a higher price per article than Zette’s imputed cost.

- Psychologically, nobody likes to feel “nickel and dimed,” and direct cash micropayments do that. There’s a reason why successful microtransaction-based video games have you load up on a separate currency first, which can then be spent in-game. (like Fortnite’s “V-Bucks”).

In fact, Blendle was ultimately acquired by subscription-based firm Cafeyn.

Today, Blendle is no longer really a competitor to Zette. While the company did make an effort to break into the US market, their content remains focused on the Netherlands and Germany.

Doubtless, though, Blendle’s own difficulties with the micropayments model inspired Zette’s own approach, which blends (see what I did there?) a subscription charge with video game-esque credits.

Investing in Zette

Despite its recent stumbles, the news is still a massive industry, worth upwards of $60 billion.

IF Zette’s new model catches on, the rewards could be lucrative – both for the company and publishers.

But if there was ever a year for Zette to take off, it’s 2024.

Not only is there a US presidential election in November, making access to reliable news sources crucial, but Google is also phasing out third-party browser cookies in the second half of this year – which could make digital ads more challenging and less profitable.

Zette is open for investment on WeFunder right now, meaning both accredited and non-accredited investors can participate in their journey.

Best of all, they’re offering an early-bird valuation of $20m for the first $300k raised on WeFunder (just $140k left as of writing!). After that, the valuation rises to $22m.

Investment details:

- Minimum individual investment: $250

- Maximum individual investment (for non-accredited): See this calculator

- Maximum total raise: $1.235m

- Financial instrument: Simple Agreement for Future Equity (SAFE) – see here for an overview

- Use of funds: Majority for all-important publisher development

If you invest, you’ll be in good company – Zette had a $1.7m oversubscribed pre-seed round featuring top VC firms and startup accelerators.

Zette has made it clear that the current iteration of their product is just the beginning.

Currently, they’re building out a personalized AI-powered news feed for users – which, since Zette already has licensing agreements with the underlying publishers, doesn’t face the same legal uncertainty as some other AI tools.

Their new AI product is designed to surface the most interesting articles online, and their long-term goal is to become the new front page of the internet.

Reply if you’d like to chat with Yehong and the team.

See you next time, Stefan

Disclosures from Alts

- This issue was sponsored by Zette

- I have personally invested in Zette’s early bird round.

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains an affiliate link to Beehiiv

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Zette and their associated markets. Zette has agreed to offer an unconstrained look at its business, offerings, and operations. Zette is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.