Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- The Fed will probably/maybe hold rates steady in December.

- What do Detroit and Saudi Arabia have in common?

- Signs of weakness in the AI startup community may open the door to competition.

- ESG is actually good for PE returns.

- Jim Cramer is bullish on BTC

Table of Contents

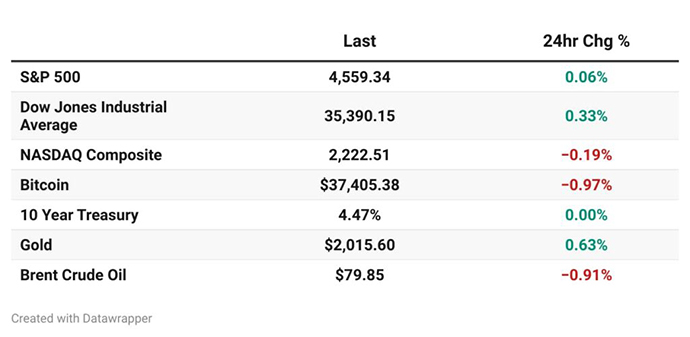

Macro View

Bullish News

- Fed Chair Powell and Chicago Fed President Goolsbee both indicated rates won’t rise anytime soon.

- More companies say it’s increasingly easy to find good employees.

- US Oct construction spending rose +0.6% m/m, stronger than expectations of +0.3% m/m.

Bearish News

- Federal Reserve Governor Michelle Bowman said she expects another Fed rate hike.

- S&P Global Ratings agrees.

- Slightly more Americans filed for unemployment benefits last week, but the overall number of people in the U.S. collecting benefits rose to its highest level in two years.

- The US Nov ISM manufacturing index was unchanged at 46.7, weaker than expectations of an increase to 47.8 and the 13th consecutive month of contraction in manufacturing activity.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

End of Year

4,593

15,994

November Numbers

3.86%

3.37%

176,911

December and Beyond

2% chance

1.76%

The markets aren’t expecting any surprises in December.

What are we doing?

ALTS 1 Fund news:

We’re drawing up the paperwork for our art acquisition.

Real Estate

When you can’t even fraud right.

From an SEC press release detailing a $35 million fraud + stock manipulation scheme.

The SEC’s complaint also alleges that Larmore and Cole Capital Funds LLC, an entity Larmore formed and controlled, issued a press release in November 2023 falsely stating that Cole Capital intended to purchase 51 percent of all minority ownership shares in WeWork, Inc., an unrelated public company, at $9 a share, more than nine times WeWork’s then-current trading price.

According to the SEC’s complaint, WeWork’s stock rose close to 150 percent in after-hours trading shortly after the press release was issued. The complaint alleges that Larmore purchased more than 72,000 call options in WeWork at a price far below the stock price in the days before the press release was published, hoping to execute the trades at profit after manipulating the stock price.

However, due to a delay in the issuance of the press release, most of the options expired before Larmore could exercise them.

Whoopsie.

Bullish News

- Amazon is eyeing up office space in Miami.

- Investment funds like Manulife Investment Management and Nuveen have hoovered up more than a million acres of American farmland.

- Most forecasts show lower home prices and lower mortgage rates in 2024.

- The Saudi residential market is hot.

- Airbnb is looking to fill homes left vacant by Japan’s declining population.

- American home prices rose by 0.3% in September and now stand 3.9% above its year-ago level.

- Metro Detroit home prices saw the largest increase, followed by San Diego and NYC. Vegas, Phoenix, and Portland slid the furthest.

Bearish News

- Costar: “With little to suggest a trend reversal or an inflection point, office building performance is expected to get worse before it gets better.”

- Hong Kong’s property market is stagnating.

- Luxury multi-family real estate is facing an oversupply problem.

- 54k people canceled home purchase contracts in October — more than 17%. Numbers were highest in Vegas, Florida, and Texas.

- Of sales that went through, more than a third featured a concession.

- The median price of both one-bedroom and two-bedroom rentals in the U.S. fell for a second month in a row in November.

How to invest in real estate right now:

Don’t

Startups

Bullish News

- Fast-fashion retailer Shein has confidentially filed to go public in the U.S. and is moving ahead with its long-awaited IPO.

- VC deal value for the retail fintech sector rose 53.2% in Q3 compared with Q2.

- Reddit is looking to IPO next year in the $15 billion range.

- VCs are getting more equity in later rounds than they were a couple of years ago.

- Drama at OpenAI is opening the door for competitors.

- VCs are focussing on an old but new market – black farmers.

Bearish News

- Prosus has written down the valuation of edtech giant Byju to below $3 billion, marking a steep drop from the $22 billion valuation the Indian startup hit just early last year.

- Stability AI, the London-based startup behind Stable Diffusion, is looking for a buyer.

How to invest in startups right now:

Early stage

Private Equity and Private Credit

Bullish News

- Research shows funds that make changes based on environmental or other ESG factors can increase PE IRRs.

Bearish News

- When investing in private credit, the deal’s vintage can make a big difference in returns.

How to invest in PE and Private Credit right now:

I feel a credit bubble

Crypto & NFTs

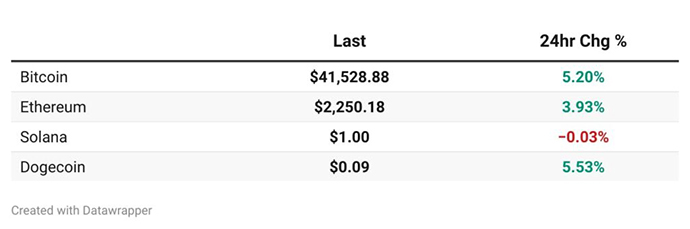

Here’s what you need to know:

Crypto is ripping.

Greediest reading in over two years.

NFTs managed to lose money last week while Eth shot up.

Bullish News

- Executives in the cryptocurrency industry called the start of a new bull run with a growing number of voices calling for fresh all-time highs for Bitcoin in 2024 above $100,000.

- The amount of circulating Bitcoin that is in profit hit a high of over 83% last week, the highest level since November 2021.

- Former Binance CEO Changpeng ‘CZ’ Zhao will have to stay in the U.S. ahead of his sentencing in February.

- Standard Chartered expects the price of Bitcoin to surge to $100k by the end of 2024.

- Bitcoin is now worth more than Berkshire Hathaway.

Bearish News

- Jim Cramer is bullish on Bitcoin.

- Binance announced it will delist Tornado Cash, and the token fell by 56%.

- Institutional traders are bullish on bitcoin, mixed on ether, and skeptical of altcoins.

How to invest in Crypto & NFTs right now:

It’s still accumulation season.

That’s all for this week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at InvestorPlace.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.