Welcome to The WC — your weekly shot of awesome.

Today, we’ve got:

- The curse of optionality

- Fake people, real money

- The fall and rise of Saudi Arabian art

- Market timing doesn’t work

- RIP Charlie

- Link dump

Table of Contents

The curse of optionality

Despite overwhelming evidence that everyone’s quality of life is better today than any other time in recorded history, people are more depressed than ever.

Jack Raines, the guy who edits Exec Sum, has a few theories why.

All his points are compelling, but one stuck out to me — we have too much optionality.

Historically your options were limited by where you lived and which family you were born into. If your dad was a baker in a small French village in 1623, you had a pretty good idea of what your life was going to be like.

But today, we can theoreticaly live anywhere we want, pursue any career that takes our fancy, and build a family (or not) with an overwhelming pool of partners.

So we spend a vast amount of time wondering if we’ve made the right choices or if we’d be happier with the surfeit of other options available.

The FOMO is a dagger, and I think it’s going to get worse.

Fake people, real money

Related…if real humans don’t tick all your boxes anymore, AI is here to help.

Just in the last couple days, I’ve come across three different examples of AI replacing humans in perhaps unexpected ways.

First, there’s Anna Indiana, the virtual pop star whose mission is to produce a 24/7 stream of decent music without human intervention.

Hello world! I’m Anna Indiana and I’m an AI singer-songwriter. Here’s my first song, Betrayed by this Town. Everything from the key, tempo, chord progression, melody notes, rhythm, lyrics, and my image and singing, is auto-generated using AI. I hope you like it 💕 pic.twitter.com/0Cf42iyxHI

— Anna Indiana (@AnnaIndianaAI) November 24, 2023

So far it’s pretty terrible, but it’ll probably improve quickly and spawn copycats.

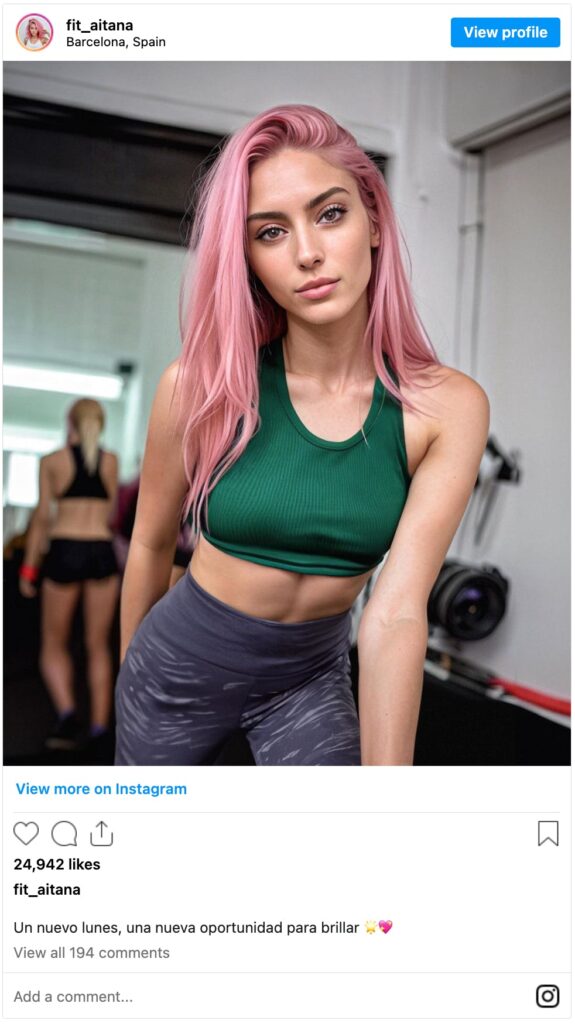

Then there’s Aitana Lopez, an AI fitness influencer with over 150k followers in Instagram that generates over $10k a month.

And finally, yesterday I spoke with Rohit Bhargava, CEO at One Future Football.

It’s a football (soccer) league comprising 100% fictitious teams and players. The teams play out abbreviated seasons, and fans can watch the games on YouTube. Nearly 8k people watched a pre-season match between Inter Nusantara and Paris St-Denis.

Each team is backed and promoted by real life stars like Patrice Evra and Nick Kyrgios.

All three of these projects aim to improve on our experiences in a way that real–flawed–humans can’t.

I don’t know where this ends.

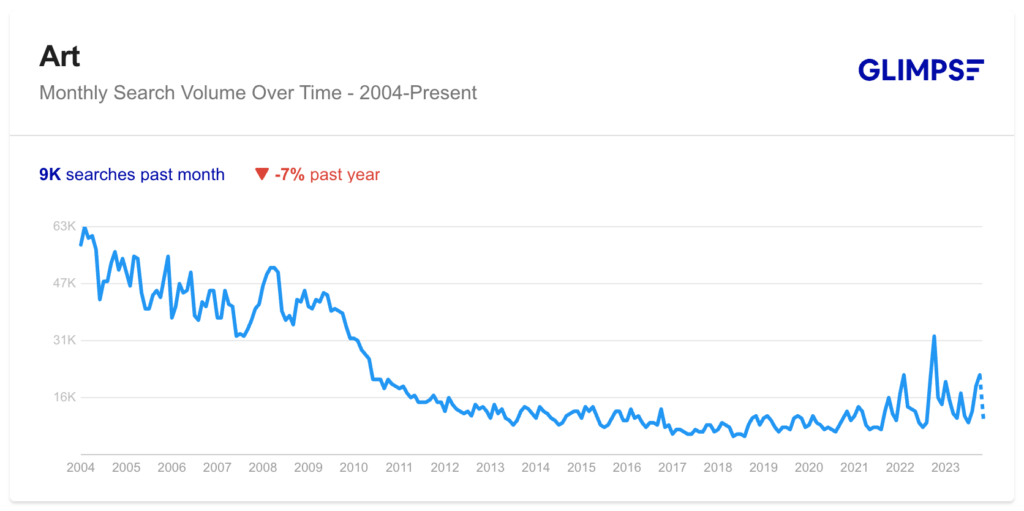

The fall and rise of Saudi Arabian art

I was corresponding with a community member the other day, and he shared a theory about where to invest in art.

He’s looking specifically at “important art” from developing countries.

Which got me thinking about, as ever, Saudi Arabia. Given the country’s push toward legitimacy, it would make sense the Kingdom might want to support art to increase its cultural influence and reduce its reputation for repression.

And so it goes.

While the Saudi art scene suffered badly in King Abdullah’s years, it’s made a comeback since 2020.

Records are falling.

#Saudi artist Mohammed Al-Saleem broke a world record for Saudi artists this week during @Sothebys 20th Century Art/Middle East sale in #London. Read more here https://t.co/zefXaAF5At pic.twitter.com/wkOoG3nDKl

— Arab News (@arabnews) October 24, 2023

A museum is exhibiting Andy Warhol.

And a London publisher is coming out with a book dedicated to the Saudi contemporary art scene.

While it’s typical for an artist to have powerful benefactors pulling the strings behind the scenes, never has an entire country got involved with such a clear imperative to drive up prices.

All of which tells me Saudi art is probably a good buy right now.

If you agree, you can check out this list of Saudi artists.

Before you do, check out these cautionary words from Nicho, our art broker:

I love your thinking here and the logic is good but there are lots of variables which make it an insecure investment. It will be hard to predict who will become the biggest blue chip artists…so it would be very risky to invest there at the moment.

Generally speaking, the art world is quite a liberal place, in my experience the artists who become blue chip from more authoritarian countries tend to be ones who rebel and are embraced by the established art world (Ai Wei Wei, Pussy Riot etc..)

While we’re here, severl bits of Saudi news dropped today:

- Saudi Arabia will host the prestigious 2030 World Expo.

- Saudi Arabia’s PIF has bought a 10% stake in London’s Heathrow airport

- You can now invest in a Saudi ETF.

If you pick up a piece of Saudi art, please share.

Market timing doesn’t work

Everyone wants to buy low and sell high, but there’s a problems with that strategy:

It turns out people are really bad at knowing when prices are high and low.

In fact, it’s reliably impossible to predict when to buy and sell.

Dimensional Fund Advisors (DFA) ran backtests on over 700 multivariate strategies, and only 30 of them produced excess returns. Not great odds.

Right, fine, so just focus on and execute those 30, right?

Except the specific variables that produced excess returns were fairly arbitrary, and even a slight modification reduced profits or led to losses. Basically those 30 winners just got lucky.

The only reliable strategy? Buy, hold, and forget.

RIP Charlie Munger

A lot will be said about the legendary investor, architect, and philanthropist today, and much of it will be more insightful than anything I could put to paper.

So instead of trying to be clever, I’ll let the man do that himself.

Bonus Links

Some excellent stuff I came across this week that didn’t quite make it in the WC:

- Silicon Valley’s worldview is not just an ideology; it’s a personality disorder.

- How ESG factors can boost PE returns.

- Why is there a cattle shortage?

- Two-thirds of Americans say AI could do their job.

- Eight new technologies that will change the world.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- Our friends at Oberit and EquityMultiple sponsored this issue.