Welcome to The WC — your weekly shot of awesome.

Today we’ve got:

- Inefficient markets on Kalshi

- The golden age of microbrews may be over

- An STR cottage industry

- What do you default on first?

- A man you should hire immediately

Table of Contents

Prediction markets

Prediction markets should (theoretically) be fairly efficient. Wisdom of the crowds and all. Just for fun, here are a few that might be worth a look (via Kalshi).

July 26 Fed decision

Both Kalshi and the CME predict 98% to 99% chance of a rate hike. Given Janet Yellen’s comments last week, I’d probably put $10 on no change at those odds.

Atlantic major hurricanes

The NOAA doesn’t have any idea what’s going to happen this year, though it’s trending toward a “normal” hurricane season. They say there’s a 70% chance of between one and four category 3+ hurricanes this year.

Over on Kalshi, you can bet on two or more at around 1:9 (bet 89 cents and get back a dollar). That seems like a safe bet if you don’t mind having your money tied up through November.

US credit rating downgrade

This market started during the congressional shut down crisis, but it’s still up on Kalshi. You can bet on “no downgrade” at around 1:6 (bet 84 cents to get a dollar). That feels very safe to me.

Long live brewpubs

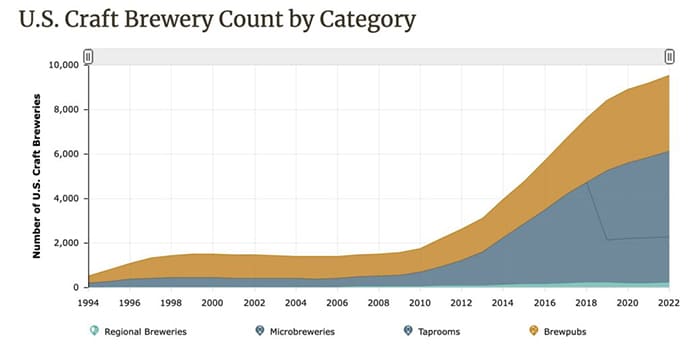

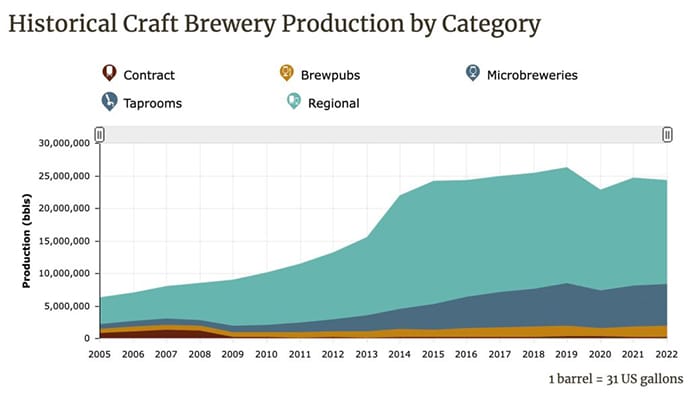

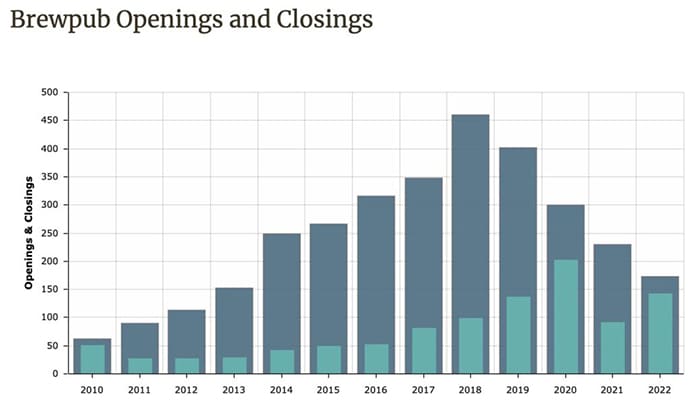

The golden age of craft beers may be coming to an end.

While the number of craft brewers continues to rise.

The volume of actual beer sold has been flat for nearly a decade.

So there’s more and more competition entering a saturated market.

The first victim?

There’s a reckoning brewing for brewpubs.

Montana, perhaps surprisingly, features the highest search traffic for brewpubs.

And it’s possible that thirteen brewpubs in Missoula, which boasts a population of 78k people, is more than the market can sustain.

Which is a shame, I think. Because I believe all restaurants should either be brewpubs or TexMex.

The second victim? Anchor Brewing. The oldest craft brewery in the US is looking to shut its doors, because apparently the beer isn’t very good and there are better options nearby.

The company’s owner, Sapporo Holdings of Japan, is open to a buyout offer from current employees or external investors.

Potentially an opportunity…

[shout out to Chartr, where I saw this first]

The STR market is getting real

Gone are the days where buying a home at 2% and putting it on AirBnb was easy cash in the bank.

Returns are down, home listings are up, and guest growth is flat.

So unsurprisingly, an entire economy has grown up to help AirBnb hosts limit downside and maximise upside.

Specifically, a niche cottage industry has developed to help potential buyers find the best homes for sale. Here’s how they work:

- Every day, they pull all the new listings off home portals like Trulia and Zillow

- Run them through analysis tools like AirDNA

- Underwrite the listings, and

- Send out an email with the best homes for sale

They all include expected rental income, based on comps, plus monthly expected expenses, expected cash flow, expected occupancy rate, & forecasted cash-on-cash return.

Several that I’ve found include

The Offer Sheet

Free email

- Two homes daily

Paid plan – $19/mo or $199/yr

- Nine homes daily including the best ones

- Private Facebook Group

- Airbnb starter kit (Amazon shopping list)

FindMySTR

Free email

- One or two homes daily

- All properties have CoC returns at least 15%

Paid plan – $49/mo or $499/yr

- Five to ten homes daily

- Access to their proprietary tool to run searches yourself filtering by price and geography

Deals Done For You

Free email

- Infrequent free emails

Paid plan – $59/mo or $397/yr

- Twenty homes 3x per week

- All properties have CoC returns at least 12%

- Access to a network of brokers and lenders

As far as I know, there are no equivalents in France, China, Italy, or Brazil (the rest of the top five countries by number of listings). Which sort of makes sense:

- The US generates more STR gross revenue than the rest of the top ten combined

- Property portals in the US tend to be more standardised and mature (so they’ll have API deals etc)

Are there any other newsletters doing the same thing that I’ve missed?

Are you an accredited investor? If so, I’ll add you to our private distribution list for off-market investment ideas.

The canary in the coal mine

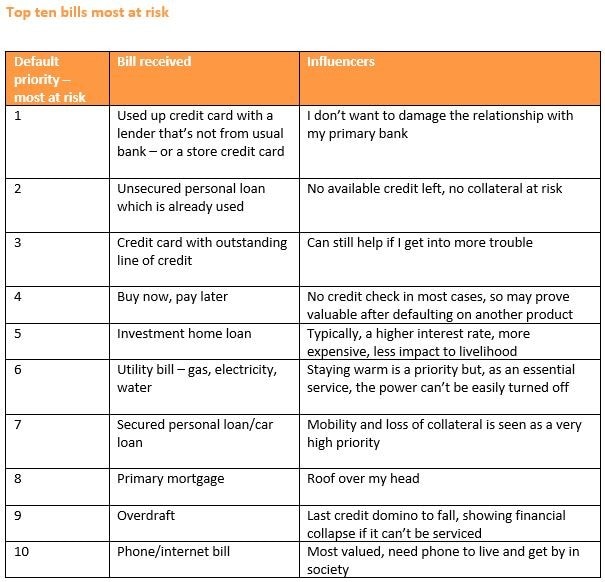

If you were short on cash — like really short on cash — which bills would you choose to ignore first?

Probably not your mortgage. Probably not your electric bill.

It’s your credit card. Specifically a credit card that is already maxed out (and are therefore useless) and was issued by a bank you don’t use for anything else.

The last to go? Mobile phone bills. You can’t get a job without one. You can’t get directions to the benefits office without one. Fact is, society has evolved to the point that getting anything done without a smartphone is a real challenge. Plus, Angry Birds.

Historically speaking, consumers are eight times more likely to default on a credit card bill than a mortgage. The exception to that? 2008, when 30% of American homes were underwater.

Consumers — each the CEO of their own household — are remarkably predictable and pragmatic when it comes to cascading waves of defaults.

So what should look at if we — like I do — think the economy could get worse before it gets better.

Credit card defaults

US credit card debt hit $980 billion last quarter, a new record.

Of that nearly $1 trillion debt, severely delinquent credit card debt — more than 90 days late — has ticked up from around 3% to 4.5% in the last two quarters.

Auto loans

Some scary stats:

- One in six Americans have an auto loan of $1,000 or more.

- 60 day loan delinquencies are the highest they’ve been since 2006

- 4.6% of borrowers under 30 are more than 90 days delinquent. That’s up 50% YoY and the highest it’s been since 2009.

Both credit card and auto loan delinquencies are at historically normal’ish levels, so there’s not necessarily a panic yet.

But they’re two stats I’ll keep a close eye on when the next Fed consumer debt report comes out August 8th.

Oh yeah, and student loan repayments start again this autumn.

Hire this person to do things for you 💼

If you need someone to overdeliver for your brand agency, you should hire this man.

I got let go from my job in the middle of a cost of living crisis, with twins in childcare & 3 months after losing my Mum to cancer. She always encouraged me to be creative so here's my Rap C.V. https://t.co/kFY4y1ShQt

— Matt Box (@mattboxxx) July 25, 2023

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by Fat Tail Investment Research. There are also a couple affiliate links sprinkled in.

- Our ALTS 1 Fund doesn’t have a stake in anything here.