Welcome to the WC, wherein you’re trapped in my mind for eight to ten minutes weekly.

Little break last week in observance of Juneteenth, but the WC comes at you hard today.

We’ve got:

- The securitization of everything

- Avocados

- IPv4 ISPs

- Sandalwood trees

Let’s go.

Table of Contents

The securitization of everything

“In 2001, securitization was a loser convention show. 100 maybe 200 people would show. $500 billion later, you get this.”

One of the many standout lines from The Big Short.

Asset securitisation is a financial technique that turns assets generating future cash flows into marketable securities. This can help businesses get immediate funds and spreads the risk of those assets to multiple investors. The instruments have continued to proliferate despite the 2008 GFC.

And it’s getting wackier as market makers search for more obscure and profitable assets to securitise.

- Sotheby’s is securitising art loans

- Latham helped Cogent securitise IPv4 ISP addresses

- Subway is securitising its franchises

- BNP is securitising heat pumps

- Samara is doing the same with ADU mortgages

Brian wrote about Aircraft leasing just two weeks ago, Stefan talked about securitising athletic contracts a few months ago, and I talked about catastrophe bonds in March. You can even securitise life insurance, which Stefan morbidly dove into in April.

And then of course there are Bowie Bonds, the OG music royalty play.

All of which is an elaborate introduction to this issue where I do a medium dive into the securitisation of several different assets.

Would you like to know more?

The Big Short: Inside the Doomsday Machine: Michael Lewis. This book explains the build-up of the housing and credit bubble during the 2000s and documents the financial crisis of 2007-2008, providing a great background on asset securitization and its risks.

Securitization: Structuring and Investment Analysis: Andrew Davidson, Anthony Sanders, Lan-Ling Wolff, Anne Ching. This book dives deeply into the mechanisms and financial modeling of securitization, offering insights into both structuring deals and investing in them, relevant to understanding modern securitization practices.

The Subprime Solution: How Today’s Global Financial Crisis Happened, and What to Do about It: Robert J. Shiller. Nobel laureate Robert Shiller gives a readable account of the subprime mortgage crisis, shedding light on how securitization played a central role and suggesting how to prevent similar crises in the future.

The Bond King: How One Man Made a Market, Built an Empire, and Lost It All: Mary Childs. This biographical book on Bill Gross details his career in the bond market, including his involvement in mortgage-backed securities, providing a personal angle on the impact of securitization.

Avocados

The first thing to say about this one is that Stefan did a deep dive into Avocado investing and that AGRI is a sponsor of ours.

You should definitely read the whole thing, but here’s the gist:

The avocado market is booming, especially in Asia, and AGRI Developments has put together an opportunity to invest in Hass avocado trees in the Philippines. Avocado demand is soaring due to the increasing middle-class population, but supply isn’t keeping up, leading to high prices, particularly in Asia.

AGRI Developments, an alternative asset management company, is offering investors a chance to own avocado trees in the Philippines. They have secured the land and necessary approvals, and the area’s ideal climate and proximity to export hubs make it a promising venture.

The investment involves owning specific avocado trees over a 25-year term, with potential returns analyzed through IRR, not just yield.

The most interesting bit for me is the analysis one of our members did on the deal subsequent to one of AGRI’s ads in an earlier piece on vertical farming.

The spreadsheet he produced is an excellent framework for the analysis of the securitisation of any asset and is patricularly good for assets where maybe you don’t know where to begin (make a copy of it to do your own).

You should also check out Tridge to check wholesale prices for various commodity-based assets. It’s super instructive.

All the juiciest data costs money, but you can get a sense for things with a free account.

From the table above, you might wonder if the price of Hass avocados has peaked. Or maybe it’s seasonal?

Would you like to know more?

Agriculture as an Alternative Investment – This book provides a detailed overview and analysis of those new technologies with the greatest potential to disrupt agriculture products and processes by improving productivity and the management of food loss and waste, making a more efficient and sustainable use of resources and enhancing food security.

IPv4 ISPs

I freely admit I had no idea what this was when I came across it. Assuming you might be in the same boat, a quick primer.

What are IPv4 ISPs

IPv4 is a system that gives unique addresses (like 192.168.1.1) to devices on the internet, enabling them to find and communicate with each other. It has a limit of about 4.3 billion addresses, which is why a new system, IPv6, is being introduced to accommodate more devices.

If something new (IPv6) is coming out, why would you want IPv4?

The protocol is still widely used, the transition is slow, and there are a limited number of IPv4 addresses.

Will IPv4 still be valuable when the transition is complete? If so, how will the value change? How long will it take?

While IPv4 addresses will decrease in value as the transition to IPv6 progresses, they will still hold some value for specific uses and legacy systems for an extended period. The complete transition to IPv6 is a gradual process that may take more than a decade.

Ok so that’s what they are. With that in mind, this is what’s going on:

Cogent Communications Holdings has securitized about 12.6 million IPv4 addresses, raising $206 million by issuing secured notes. They will primarily generate income by leasing these IPv4 addresses to internet service providers and other businesses that need them. This income is backed by the high value and demand for IPv4 addresses, which are in limited supply. The securitization setup ensures a steady and predictable cash flow from these leasing activities.

Sounds boring! But the lucrative stuff usually is.

Prices for individual IPv4 addresses generally range between $30 to $60, depending on the block size. Larger blocks (e.g., /16) tend to command higher prices, with averages around $52 per IP address, while smaller blocks may sell for around $36 per address

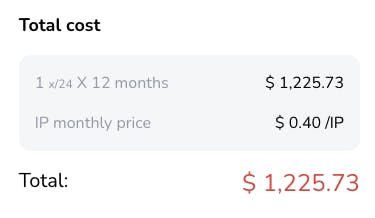

To lease an IPv4, buyers have to cough up maybe $0.40 per month per IP.

The cheapest I found was $0.25 per month.

Assuming the $30 addresses go for $0.25 and the $60 ones are $0.40 per month, that gives an annual return of 8% to 13%

It looks a bit less rosy if you assume the value of each addresses decreases by perhaps 5% a year due to IPv4 being phased out, of course.

Would you like to know more?

The Economics of the Transition to Internet Protocol version 6 (IPv6): An OECD study that examines the economic ramifications of migrating to IPv6, offering policy recommendations and analysis of the costs and benefits.

Sandalwood trees

The other day, we got an application from a potential Altea member saying his best investment had been in Hawaiian sandalwood trees.

Which of course led me to wonder how much money you can make investing in Hawaiian sandalwood trees, and how it works.

What are sandalwood trees and why are they valuable?

Sandalwood treesnare a group of hemiparasitic plants known for their fragrant heartwood and essential oils. The most prized species is Santalum album, commonly known as Indian sandalwood. These trees are native to South Asia and are also found in Australia, Pacific Islands, and Hawaii.

They’re valuable because people are willing to pay a lot of money for sandalwood heartwood, which is sort of the tree’s inner core. Each tree has perhaps 25kg of this fragrant material, and it takes 25 to 30 years for the tree to mature.

The heartwood and essential oils have a wide range of applications in perfumery, cosmetics, traditional medicine, and religious practices.

Ok so you have a tree that takes 25 years to grow, and it produces 25 to 30kg worth of material at the end.

Input costs are minimal, and because you have to plant another crop with it (the trees are bloody parasites and require a host to grow), you can generate some minimal cash flow while you wait for the sandalwood to mature.

Based on my super rudimentary research, I was able to generate 21% to 29% IRRs growing and harvesting sandalwood.

But this team got a 58% IRR, and it seems like they know a lot more about it than I do.

There are no shortage of investment vehicles for the stuff:

Dhatri Sandal Farms suggests a 21:1 ROIC over 25 years (that’s about 11.6% IRR)

Quintis owns 12,000 hectares in Australia

Sanvi lets you buy a one hectare-sized plot to grow your own

Would you like to know more?

Sandalwood Investing Strategy: How To Invest In High-Grade Sandalwood: Sandalwood Investment by Leopoldo Capoccia. There are no reviews for this book, and it might be trash. LMK if you buy it and read it.

Growing Sandalwood: Step By Step Beginners Instruction To The Complete Growing Techniques & Troubleshooting Solutions A range of aromatic woods derived from trees in the Santalum genus is collectively known as sandalwood. Sandalwood oil is extracted from the fragrant heartwood of these trees.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- Our friends at Sidebar sponsored this issue.