Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

Today we’re exploring music royalties, through the lens of a company called JKBX.

The platform is promising a deep, meaningful set of songs that will be available to both accredited and non-accredited investors.

On a personal level, I think this is the most exciting music investment platform to ever hit the market, period.

Let me show you why 👇

Table of Contents

Streaming is eating the world

Let’s say you’re relaxing at home, listening to your favorite music on Spotify.

You probably think each time you stream a track, it puts a little money in the artist’s pocket, right?

Well, in reality, the payout might be going to someone who’s never touched an instrument in their life. (It’s not a good thing or a bad thing, just a fact!)

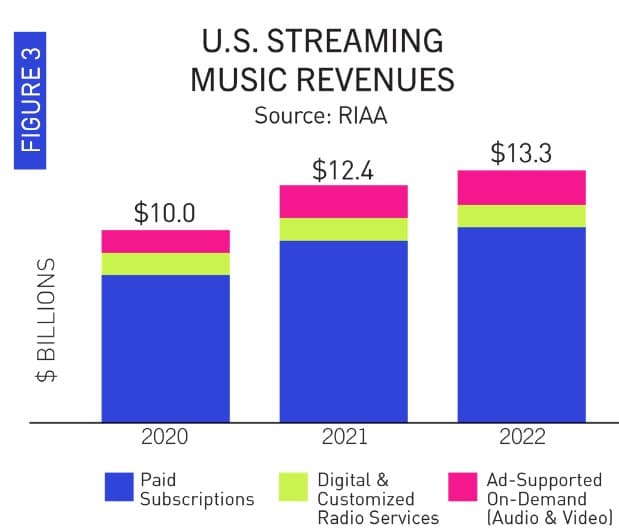

The revenues generated by a piece of music are known as royalties, and they come in many forms. Streaming royalties are by far the most dominant. Last year, streaming made up 84% of all US recorded music revenue.

Licensing fees from TV, movies, and commercials can be lucrative, but streaming is eating the world. Thanks to streaming royalties, songs have become stable, revenue-generating assets.

Usually, the artist, label, publishers, and songwriters get paid for each stream. But what many people don’t know is that the right to profit from a song can actually be sold.

Today, innovative companies like JKBX take these steady revenue streams, and securitize them into investable assets.

It all started with Bowie

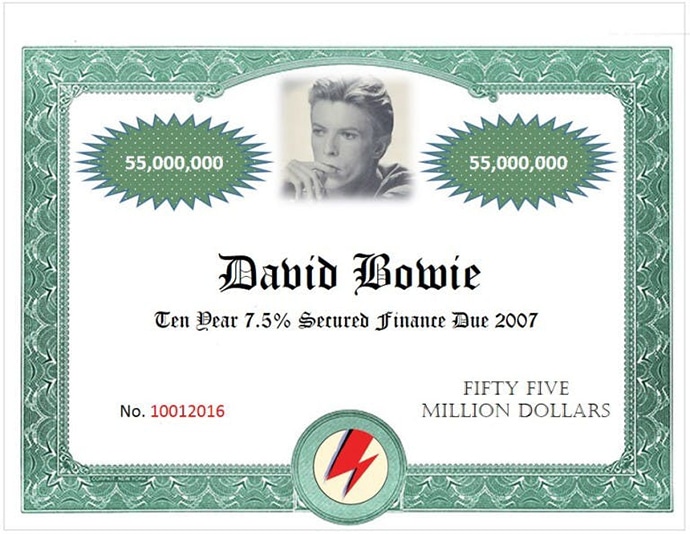

In 1997, music legend David Bowie got paid $55 million to essentially lease out his music catalog for 10 years.

Securitizing royalty income streams can be done in a bunch of different ways. But fixed-rate structures are no longer common. Instead, these securities usually just pass through the cash flow from the royalties. (Think of it like a stock dividend).

If you don’t own your masters, your masters own you.

– Prince, Rolling Stone Magazine, 1996

David Bowie must have read this article, because a year later he had the brilliant idea to partner with investment banker David Pullman and issue a new type of security he called “Bowie Bonds,” which are considered the first example of music securitization.

Bowie Bonds offered investors a unique investment opportunity, where for just $1,000 they got a 7.9% interest rate over the course of a decade. The collateral for the bonds were the royalties from Bowie’s past and future album sales, and his live performances.

So, how did he spend the $55 million? A good chunk went to buying back the rest of his masters from his old business manager. 😏

Bowie’s catalog was later re-sold for $250 million.

Today, artists routinely sell their catalogs. Justin Bieber, Dr. Dre, Sting, and most recently Katy Perry — who didn’t own all her masters, but sold her stake:

So who’s buying these catalogs?

In the past songs and albums mostly been scooped up by PE firms and forward-thinking hedge funds.

But one of the biggest stories here is a huge music rights investment fund called Hipgnosis.

Hipgnosis Songs Fund

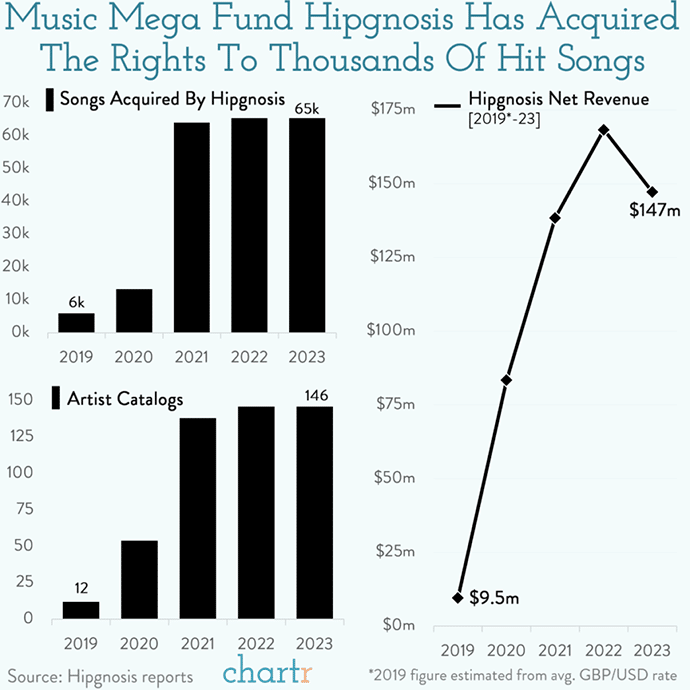

Over the past 5 years, a mega music fund called Hipgnosis has bought over 65,000 songs, including entire catalogs from Shakira, Barry Manilow, Nelly, and hundreds of other artists.

Originally founded by Merck Mercuriadis and Nile Rodgers (the guitarist from Chic), the fund has now amassed more than $2 billion worth of music. When it comes to acquiring song rights, Hipgnosis is the fund to know about.

Hipgnosis is comfortable shouldering all of the risk of paying upfront, though our friends from Chartr put it, Hipgnosis may be slightly “overstuffing” their playlist portfolio…

But so far it has paid off. And their portfolio is powerful not only because of the caliber of songs it contains, but also because Hip is known to actively manage their catalog; meaning the songs continue to get played in new ways (TV, movies, etc.), and meaning streaming continues to grow for the songs in their portfolio.

A market with unique benefits…

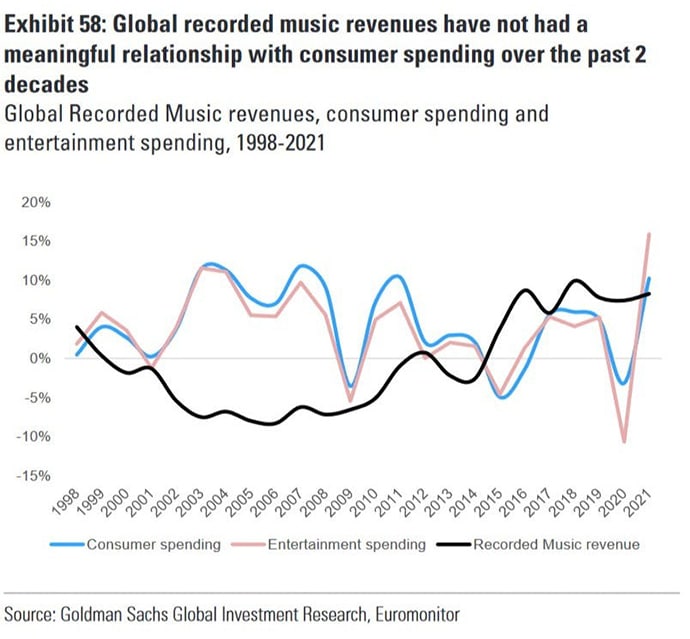

Music is a fascinating investment because its consumption is relatively unrelated to economic activity – in fact, people might want to listen to music more during a recession.

Music revenue has had essentially no correlation with overall consumer spending in recent history.

This low correlation makes music an excellent diversifier. And while the average return on such an idiosyncratic asset class is a bit hard to determine, industry revenue continues to climb, driven largely by growth in streaming.

Intriguingly, you may also be able to depreciate your royalty shares over time. This results in favorable tax treatment for the asset class, similar to real estate. (But consult with a tax professional to dig into the details here).

Aside from all these financial benefits, investing in royalty shares is also a passion play. It serves as an excellent way for fans to connect with artists by owning a piece of the revenue stream of the work they enjoy.

In that sense, it’s similar to how fans of publicly traded sports teams enjoy purchasing their team’s stock, like Manchester United ($MANU).

But before JKBX came to town, fans had a difficult time accessing tracks from popular artists.

…and some unique risks

Investors have no control over how the underlying assets are used. That right usually lies with the record label (or more technically, whoever owns the “master”)

In a sense, investing in music royalties is like investing in a tech company.

The founder still calls the shots — you have no say in how the business is run. But you can share in the profits.

Problems with investing in royalties

There are three big issues with royalty investing:

- Selection and quality

- Liquidity

- Regulation

JKBX wants solve all of them.

Here’s how:

Problem 1: Selection and quality

In my opinion, the big problem with royalty platforms right now is the lack of high-quality music on offer.

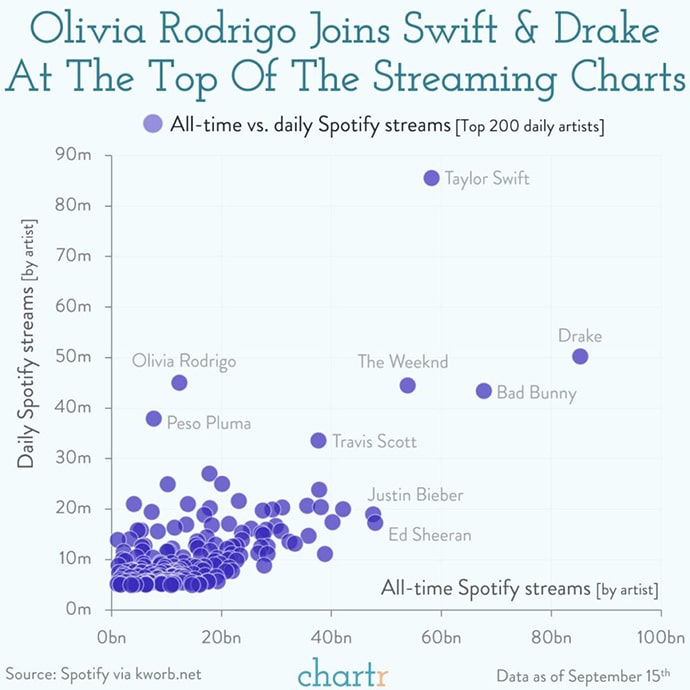

The music industry famously follows a power law. The most popular artists are many, many times more financially successful than less popular artists.

Having popular artists is critical to get people onto the platform.

Since part of the attraction is allowing fans to connect with their favorite musicians, it’s really important to make sure you have a good selection.

Some existing platforms like Royal.io have had a few solid offerings, including songs by Nas and The Chainsmokers. Not bad.

But until now, there has yet to be a platform with the industry connections necessary to cultivate a well-rounded set of high-profile investment offerings. So many of the artists/tracks on other platforms are (in my opinion) “tier 2” and below.

And yes, it’s still possible to make money from smaller, less popular artists. But there’s an argument to be made that high-profile songs might make the most financial sense as investments because of their streaming strength.

JKBX doesn’t have this problem at all.

Their platform will feature some of the most famous artists in the world.

Check this out:

- “Halo” as recorded by Beyoncé

- “Welcome to New York” as recorded by Taylor Swift

- “Rumour Has It” as recorded by Adele

- “Counting Stars” and “Apologize” as recorded by OneRepublic

- “Happier” as recorded by Ed Sheeran

- “Already Gone” as recorded by Kelly Clarkson

- “Lean on” as recorded by Major Lazer feat. MØ & DJ Snake

- “Sucker” as recorded by Jonas Brothers

- “Burn” as recorded by Ellie Goulding

This fall, following SEC qualification, customers will be able to purchase Royalty Shares of these hit songs, which entitle them to a portion of royalty income.

Trading will officially begin on the platform later this year, after they get final approval from both the SEC and FINRA.

Problem 2: Liquidity

Royalties can become more valuable over time:

- If artist income is higher than anticipated

- If growth prospects increase

- If a slew of new users creates new demand

But there’s no way to monetize any of this appreciation if you can’t sell your initial investment!

If you want an active investment market, you need liquidity. Royalties are no different. A functioning resale market gives users the confidence to invest, and creates the possibility of capital appreciation.

Some existing royalty investment platforms (like Songvest, who we did a Deep Dive on last year) don’t yet offer a secondary market.

Others platforms have a secondary market, but struggle to maintain sufficient liquidity for it to function properly.

But JKBX is planning on addressing the liquidity issue head-on, by working with market makers to ensure there is a buyer for each and every seller.

This sounds like an easy and obvious solution, but it takes a lot of work, money, and expertise to put into place.

If JKBX can pull this off, they will be one of the first fractional investment platforms (that I know of) that has ever done this. Huge!

Problem 3: Regulation

Finally, many platforms lack the regulatory clarity necessary to give users confidence in the offerings available.

Whether or not royalty income streams are securities can depend on the exact nature of the arrangement. Some platforms, including RoyaltyExchange, have tried to skirt the security question by offering NFTs of songs.

Leveraging the blockchain to try and get around SEC rules isn’t new, but using NFTs can severely limit legal protections for buyers. And when it comes to Royalty Shares, legal protections are incredibly important.

Possession might be nine-tenths of the law, but with intellectual property, there’s no physical property to take possession of – ownership is entirely determined by the appropriate contracts.

In addition, without sufficient regulatory oversight, investors don’t always receive adequate disclosure about what they’re actually buying. Considering that there are many different types of royalties that investors can purchase (including mechanical, synchronization, and publishing rights), precision about what’s actually on offer is vital.

How does JKBX work?

Unlike previous music royalty platforms, they’re focused on solving the fundamental challenges necessary for individual investors to effectively trade on the market.

Royalty Shares are the securitized music assets that will be offered by issuers on the JKBX platform. When purchasing Royalty Shares, you receive a contractual right to receive a specified portion of royalties, fees, and other income streams embodied in the income interests the issuer receives that relate to royalty rights for a specific music asset or a compilation of music assets. For the sake of clarity, you do not receive any additional rights or licenses, including but not limited to copyrights, trademarks, voting rights, or commercial/personal usage rights.

Royalty Shares are securities

Like other royalty platforms, JKBX will allow fans to invest in shares of the income generated from music royalties, entitling them to a portion of certain income streams from specific music assets. JKBX has clarified that it believes “Royalty Shares” are indeed securities. Once securitized, this entitles investors to protections of state and federal security laws.

This proactive approach to regulation should grant users some peace of mind in a market that hasn’t always provided much clarity. The offering of Royalty Shares, though, is still pending SEC approval.

Liquid secondary exchange

JKBX is seeking regulatory approval for the acquisition of a broker-dealer license, which is key to their plan of unlocking liquidity for investors.

The firm has already partnered with GTS Securities, one of the largest market makers on the NYSE, to support competitive trading on the JKBX exchange.

But putting all the pieces together will take time, and the potential for regulatory hiccups could keep investors from trading their shares anytime soon.

Creator Program

Finally, one unique aspect of JKBX worth noting is its commitment to support recording artists and songwriters through its innovative Creator Program .The program pays recording artists and songwriters (together referred to as “Creators”) while giving them the opportunity to create their own artist page on the platform.

When a songwriter or producer sells the rights to their work, they do not need to get the consent from the original recording artists.

Through the Creator Program, JKBX is going out of its way to make sure recording artists are aware of their listings on the marketplace, defying the industry norm.

The team

JKBX has an all-start team with deep experience and music industry connections.

Scott Cohen, CEO

Scott Cohen is a music industry legend.

In 1997, Scott co-founded The Orchard, the world’s first digital distributor of music. He sold it to Sony, then became Chief Innovation Officer at Warner Music Group, one of the “big three” recording companies.

Whitney-Gayle Benta, Chief Music Officer

Whitney has 20 years of experience in the music industry, most recently serving as the Global Head of Artist & Talent Relations for Spotify.

Before that, she helped launch Diddy’s Revolt TV and Media network and worked for MTV.

Sam Thacker, COO

Sam Thacker released two studio albums and toured nationally early in his career. He later had a stint at McKinsey followed by a career helping startups achieve profitability and growth.

The JKBX Rollout

JKBX is rolling out in several stages, the first of which launched in September.

Phase I – Reserve

Today, you can set up an account on JKBX.com and indicate your interest in the first assets to be made available on the platform. By reserving shares, you’ll help JKBX gauge interest in the offerings and be the first to know when you can purchase the shares once the platform’s primary and secondary markets (Phases II and III) launch.

Note that reservations made at this stage are just non-binding indications of interest. They require no money down, and you won’t be forced to purchase the shares you’ve reserved. But they will ensure you’re part of the first to be notified when the assets are ready for purchase.

Phases II and III – ETA Fall: Invest & Trade

Pending SEC qualification of JKBX’s Regulation A offering, the primary market will get up and running and investors will actually be able to make purchases on the platform. At this stage, the “Reserve” button goes away, and Royalty Shares will be issued via direct listing.

The final phase of JKBX’s rollout depends on FINRA approving their broker-dealer acquisition, which is in process of happening this fall.

Closing thoughts

Let’s be clear: Investing in music royalties is still mostly the domain of large institutions.

Case in point: remember the Bowie Bonds we talked about? They were all purchased by insurance giant Prudential.

Institutional domination of this space shouldn’t really be a surprise. Securitizing and valuing music rights isn’t easy, and all of the “best” inventory went to funds like Hipgnosis, leaving little left for retail investors.

On a personal level, I feel JKBX is most exciting music rights platform to ever hit the retail market. I love the idea of investing this asset class so much, but I haven’t pulled the trigger yet, because I’ve been so bummed by the selection.

When I first saw the songs JKBX was offering, I knew they would do well. This is it, I thought. This is the blue chip stuff you want.

I’m also especially excited by the prospect of their secondary market backed by market-makers. If they can pull that off, it’ll be truly groundbreaking stuff.

At that point, JKBX will have achieved their vision of becoming a fully-fledged marketplace for buying and selling music, and the big winner will be everyday retail investors.

That’s music to my ears. 🎵

Interested in connecting with the JKBX team? Email us and I’ll make a personal introduction.

Further reading

- Last year I signed up for a newsletter called Trapital, and it’s become one of my favorites. I especially loved his recent deep dive on Why Saudi Arabia will Invest More in Music.

- Los Angeles-based Alchemy Copyrights will acquire UK-listed Round Hill Music Royalty Fund, which owns the rights to Bruno Mars and Bonnie Taylor, for $469m

- The always great Pudding showed that 25% of artists who “made it big” on Spotify came from TikTok

- You’ve probably heard of crypto mining farms, but what about streaming farms?

- Music artists are startups, and Silicon Valley is knocking

- Matt Pincus sold Songs Music Company for $160 million. His next move? A $200 million music holding company.

- There are a ton of sites that let you create AI music. This one is pretty good.

Disclosures

- This was a paid deep dive by JKBX

- Our ALTS 1 Fund has not yet invested in any songs on the JKBX platform

- I have not yet personally invested in any songs on the JKBX platform, but I intend to

- This issue contains no affiliate links.

The information contained herein neither constitutes an offer for nor a solicitation of interest in any securities offering. Any offer, solicitation or sale of any securities will be made only by means of an offering circular or prospectus. No money or other consideration is hereby being solicited, and will not be accepted without such potential investor having been provided the applicable offering document. Joining the Jukebox Platform neither constitutes an indication of interest in any offering nor involves any obligation or commitment of any kind.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of JKBX. JKBX has agreed to offer an unconstrained look at its business & operations. JKBX is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.