Welcome to The WC — your weekly shot of awesome.

Today, we’ve got:

- OpenAI reminds us about platform risk

- Big Finance is falling behind in AI

- Other stuff I write that you might enjoy

- A temperature check on the American economy

- Prepare to be disappointed

- Link dump

Table of Contents

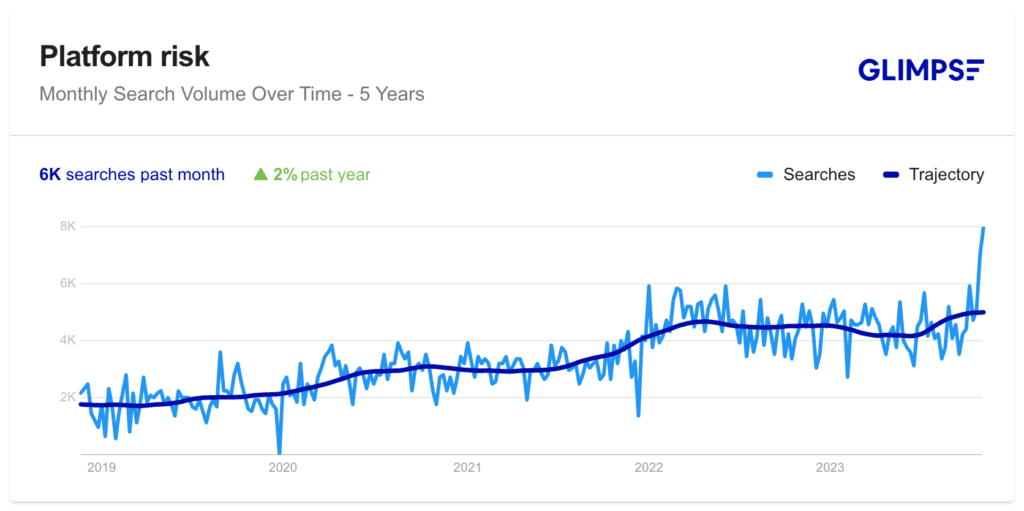

OpenAI reminds us about platform risk

Platform risk is when an investor or company relies heavily on a specific platform for its operations, sales, or services. This reliance could be on a digital platform (like a social media site or a cloud service) or a physical platform (such as a specific manufacturing technology or supply chain system).

There are lots of examples of platform risk burning companies and investors.

Zynga/Facebook: Zynga, once a major player in social gaming, faced significant challenges when Facebook, the platform where most of its games were hosted, altered its algorithm.

Companies on Twitter’s API: Several businesses that were heavily reliant on Twitter’s API suffered when Twitter made changes to its API access policies.

Fractional Investing: Very popular in 2020 – 2022, investing platforms like Rally and Collectable took in millions of investor dollars. Today, Collectable is liquidating most of its assets without communicating why to its shareholders, and there’s so little liquidity on Rally that investors can’t get their funds out [disclosure, I’m one of those investors].

It’s something that all business owners and investors need to be aware of. While awareness is growing, most people, including myself, forgot about it with respect to OpenAI.

And now we’ve suddenly remembered! Whether you’re launching a shitco startup that’s little more than a ChatGPT wrapper, counting on AI to accelerate your business, or just hoping it’ll write a term paper, you can’t always rely on someone else’s platform.

Speaking of AI

Speaking of advances in AI, I’m seeing more chatter about institutional investors trying–and failing–to use AI to get an edge.

There have been lots of advances in personal finance via robo-advisors and portfolio helpers, but big asset managers are falling behind — and they’re worried.

From Institutional Investor:

“Institutional investors say that artificial intelligence will be “transformational” and help them better manage and use data to create new business opportunities. But even the biggest investors don’t have the comprehensive and holistic data strategy needed to unlock that potential.”

Medium-sized firms, those with $100 billion to $500 billion AUM, are in the worst shape, but smaller and larger firms “significantly lag” as well.

Blackstone, which went all in on AI eight years ago, is a notable exception.

There are a number of huge opportunities here, and companies like SIX are taking advantage of the need for out-of-the-box solutions for these firms.

I think there’s something here for our community as well. If you work at a firm looking to embrace AI, or if you’re deeply interested in the space and would like to write about it, please let me know.

Speaking of our newsletters

If you enjoy the WC, you might want to know about a the other newsletters I write for Alts. We’ve just launched a few new things, and I encourage you to check them out:

Finance Wrapped: All the best investing newsletter content curated into one weekly digest – weekly Fridays.

Swaggy Stocks: If you’re into meme stocks, trends, and other silly stuff, this may be for you – weekly Sundays.

Stocks and Equity: Most daily market update emails are useless and boring. I’ve created the one I’d like to read – weekday mornings.

I also write Alts Cafe, which comes out on Mondays, but hopefully you already know about that one.

Enjoy!

How’s the economy going?

One of the many “guy” accounts on Twitter went viral the other day with a post asking his followers for a “temperature check on the economy.”

Temperature check on the economy 🌡️

— CarDealershipGuy (@GuyDealership) November 19, 2023

For anyone in the car business – how's your month going?

(please state what region you're in)

Some of the responses were illuminating:

- Phones not ringing, and people not coming into the showroom compared to last year around this time. We are selling cars, but the last two months have been noticeably slower. Most of the guests coming in want a cheap car that does not exist. You can feel the tightening of the economy big time. People are out of money, and inflation is a silent killer for those trying to make it month to month.

- Tough sledding. My litmus test is a local Toyota store that always pumps metal. Up until two months ago, their average days on lot for new inventory was less than a week. Today, it’s over 45 days. That tells me a lot, especially because we are in a market where the economy has remained relatively steady

- 30% of our sales staff across the dealer group will not be able to survive on this month’s income. Sales for the past three months have been at record lows. Yet, ironically, our seasoned staff is still thriving. Only the strong will survive.

- Inconsistent but picking up as OEMs start to get in the incentive game. YTD sales across 15 stores (FL, NY, CT) are down about 20 percent on average.

You’ve got to take all this sort of stuff with a huge grain of salt, but themes and trends can be instructive. Anecdotes also usually predate hard data.

Prepare to be disappointed

I won’t go too far into this because I don’t want your email service provider to chuck us in the spam bucket, but if you want to learn about a thriving industry built off the back of a wildly popular platform (😱), you may be interested in this story.

TL;DR: if you’re paying money to chat with someone on OnlyFans, you may actually be talking to a guy in his mom’s basement.

Bonus Links

Some excellent stuff I came across this week that didn’t quite make it in the WC:

- 20 STEM Christmas gift ideas for little learners.

- Can bamboo be big in construction?

- Wild Canadian pigs are invading northern US states.

- The Cambridge Dictionary named ‘hallucinate‘ its word of the year.

- The cost of Thanksgiving dinner is down slightly from last year.

- Space travel could increase the risk of erectile dysfunction in male astronauts.

Disclosures

- Our friends at Overlooked Alpha and EquityMultiple sponsored this issue.