Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- Tough week for macro-watchers

- Mortgage rates approach 8%

- Trucking companies are going bankrupt

- The move toward private credit continues apace

- The SEC dropped its suit against Ripple

Table of Contents

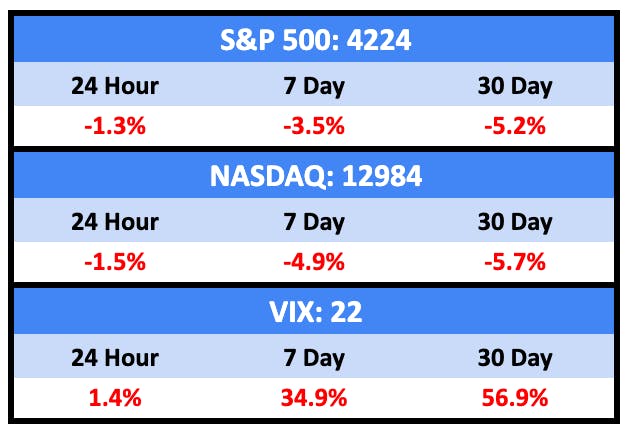

Macro View

Look at that volatility…again.

Bullish News

- Economists are turning optimistic about the U.S. economy. They now think it will skirt a recession, the Federal Reserve is done raising interest rates, and inflation will continue to ease.

- US retail sales rose 0.7% in September, well above the 0.3% Dow Jones estimate.

Bearish News

- China is preparing to navigate US sanctions if it invades Taiwan.

- The 60-40 investing strategy (60% stocks, 40% bonds) has had its worst year in generations.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📉

1%

Chance of Fed hikes rates in November

📈

91%

Chance credit card defaults will rise in Q3

📈

2.37%

National average house price increase in 2023

Lots of tech layoffs last week, and there’s a Kalshi market for that. Feels like a safe bet to me.

What are we doing?

ALTS 1 Fund news:

No change

Real Estate

Bullish News

- A new federal housing policy will make it easier for some home buyers to qualify for a mortgage by allowing them to include rental income from accessory dwelling units as part of their application.

Bearish News

- As mortgage rates approach 8%, demand is the lowest it’s been since 1995.

- Annual rent growth cooled again, to 3.2%, in September.

- America’s “tornado alley” is getting wider, which will lead to increased insurance costs.

- US homebuilder sentiment is at its lowest in nine months.

- Architecture firms reported a sharp drop in business in September, indicating that the commercial real estate market could experience more pain soon.

- Prima, a PE-backed farmer that is the largest producer of peaches in North America, filed for bankruptcy.

- And Martha Stewart’s indoor farm, AppHarvest, filed for bankruptcy earlier this year.

How to invest in real estate right now:

Don’t buy a peach farm.

Startups

Bullish News

- Fintech Plaid is considering an IPO.

Bearish News

- An AI company reliant on heavy consumer spending is going public via SPAC if you’re looking for something to short.

- Convoy, a trucking startup once valued at $3.8 billion, is shutting down.

- LinkedIn is firing 700 people.

- Because it has seen year-over-year revenue growth slow for eight consecutive quarters.

- But there’s no word if they’re offering the axed employees free access to LinkedIn Premium to help them find a new job.

- Ten out of 13 startups in the latest cohort of Surge, Peak XV’s powerfully influential early-stage program, specialize in AI and other deep tech sectors.

How to invest in startups right now:

Avoid trucking startups

Private Equity and Private Credit

Bullish News

- BlackRock says “tectonic shifts” are underway in US financial markets that will result in private credit funds financing more businesses while some banks struggle to compete.

Bearish News

- EQT is struggling to find buyers for its assets, so it’s trialing a program to offload them to LPs.

- With the economics of PE getting tougher, it’s time to bring in a new type of leader.

- China’s property market meltdown created a multibillion-dollar opportunity for distressed debt investors. It hasn’t paid off.

How to invest in PE and Private Credit right now:

Wait, probably.

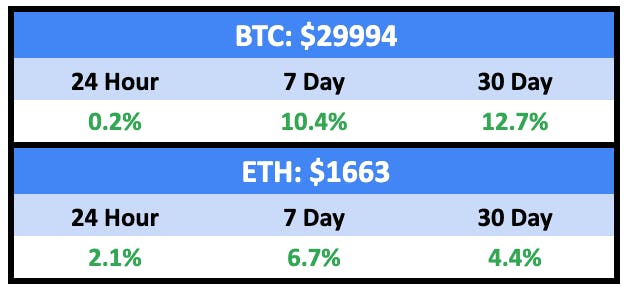

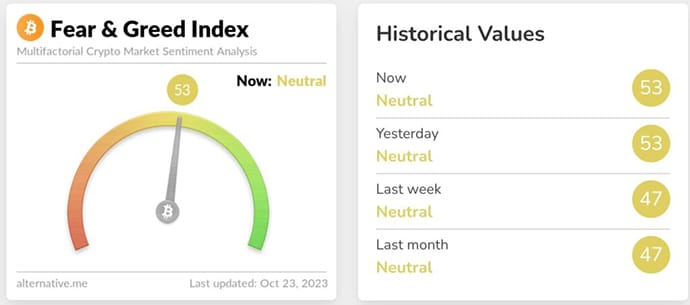

Crypto & NFTs

Here’s what you need to know:

Solid week for crypto as an ETF gets closer to reality.

Getting more optimistic.

Even NFTs were up.

Bullish News

- Ferrari has started to accept payment in cryptocurrency in the U.S.

- The SEC dropped its case against Ripple.

- The European Central Bank took a further step on Wednesday towards launching a digital version of the euro.

- Grayscale Investments filed a new registration statement with the Securities and Exchange Commission in its ongoing attempt to convert its Grayscale Bitcoin Trust into a spot bitcoin ETF.

Bearish News

- New York is suing cryptocurrency firms Genesis Global, its parent company Digital Currency Group (DCG) and Gemini for allegedly “defrauding” investors of more than $1 billion.

- Binance’s US unit has halted the withdrawal of dollars

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick hits

Collectibles

A long-lost prop from the original 1977 Star Wars film has sold in an auction for a record-breaking US$3.135m.

The prop, a 20-inch model of an X-Wing starfighter that was used in the climactic battle sequence of Star Wars: Episode IV – A New Hope, had been considered missing for decades before it was discovered in a cardboard box in the garage of the Oscar-nominated model-maker Greg Jein. Jein died in May last year at the age of 76.

That’s all for this shortened week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Perimtec.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.