It seems like affordable housing is the evergreen topic of our lifetime:

- The ’08 crash reset the market, but then prices bounced back to even more absurd levels.

- Covid and remote work kicked housing demand into the stratosphere.

- While higher mortgage rates were supposed to bring prices down, so far they haven’t.

The situation today continues to be grim. Middle-income buyers (making $75,000 or less) can only afford 23% of listings on the market. This is half of what it was just five years ago.

But there are glimmers of hope.

Accessory Dwelling Units (ADUs) have become an attractive, practical alternative housing option. High demand for these has created an ecosystem of ADU startups who are using modular construction, prefabrication, and AI to reduce costs and construction time.

There is interesting stuff happening on the ADU financing side as well, including a new type of home equity agreement which I find especially fascinating.

I tag-teamed this issue with Alts community member and real estate agent Erin Hybart. Erin has watched the ADU ecosystem transform to meet demand as housing becomes perennially unaffordable.

Let’s go 👇

Table of Contents

What are ADUs?

Accessory Dwelling Units are small, independent residential units built on existing properties.

They’re also one of my favorite alternative investments. I first wrote about ADU economics way back in issue #6, right after completing my first build. The market has come a long way since then.

These secondary housing units come in roughly 6 different types, all of which offer extra living space. They can be detached (like a backyard cottage), attached to the main house (like a basement apartment), a garage (most common) or even a part of the main house.

ADUs include a sleeping space, kitchen, bathroom, and (legally) must have a dedicated entrance. The structure is typically built on-site, but some new companies pre-fabricate the entire unit and plop it right onto your backyard. (More on this later.)

There are some really cool ADU designs coming out these days:

- Classic cottages

- Modern, light-filled A-frames

- Artemis pods are inspired by the Moon Base of the Artemis Project

- Futuristic glass boxes

But the value isn’t really in the design, or even in the square footage.

You have to remember that in prime areas like California, the housing shortage is so severe that the land itself holds more value than the structure!

The reason why ADUs are such a great investment (especially in high-cost areas) is because they add capacity without the need to purchase additional land.

It’s a land arbitrage scheme. Like adding a second story to your home, except faster, cheaper, more customizable, and better for the rental market.

How much do ADUs increase property values?

ADUs benefit everyone. They add to the housing supply, and give property owners a new rental income stream.

But aside from the rental income generated, ADUs add square footage and at least one bedroom, which boosts property values.

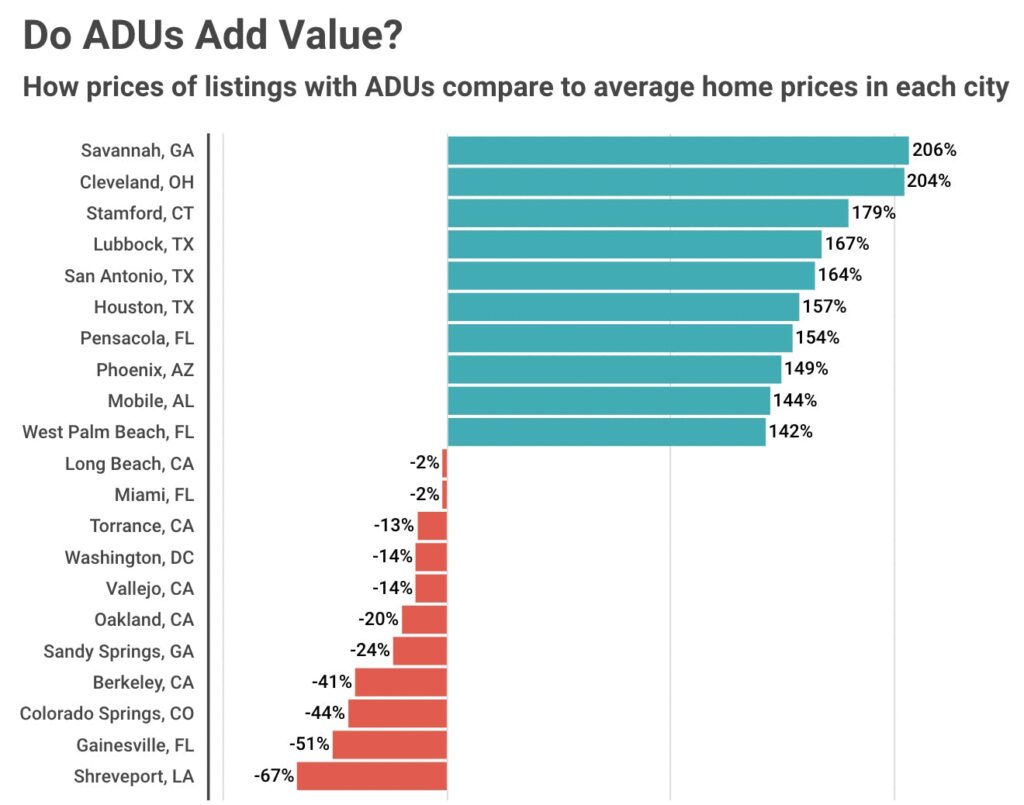

A company called porch.com scoured listings of the 500 biggest US cities on Trulia, and compared the prices of listings with an ADU, against the median single-family home price for each city.

They found houses with ADUs are priced 35% higher than units without one, and that building one increases the value of a property by 20-30%.

How many ADUs are there in the US?

There are an estimated 1.5 million ADUs in the US, meaning 1.8% of all occupied single family homes now have one. (This is higher than I would have guessed!)

Quick facts:

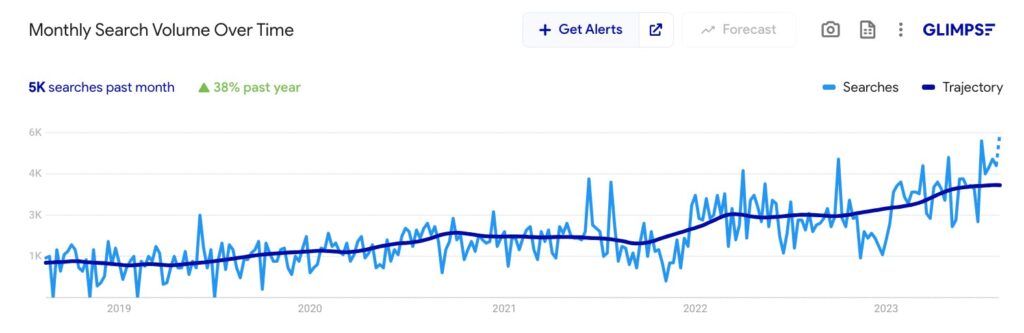

- ADUs are growing by 9% YoY. There are about 100k new units built per year (compared to 1.4m new homes built per year)

- The average cost of an ADU is $180,000, or $260/sq ft. (But they can be built for far cheaper. Ours cost $190/sq ft)

- Los Angeles is “ground zero” for America’s ADU economy. It has the most units, followed by Portland and Houston.

- ADU sale listings are growing fastest in Portland, Dallas (surprising given land is so cheap), and Seattle

As you’d expect, new startups are popping up to meet the demand for ADUs, financing, and ADU services.

Let’s explore ’em.

Construction startups

Cover

Cover is an LA-based startup that designs, permits, manufactures, and installs pre-fabricated ADUs.

Their standard model (the “S”) has a simple but elegant floorplan, starts at $369k, and can be ready in 6 months. Homeowners can also get a custom-built ADU starting at $514k, which includes a virtual walkthrough.

The units are both efficiently built and energy-efficient. Their innovative construction process equates to reduced annual energy usage by 75%.

Cover has raised $75m since 2014, and has been off to a surprisingly slow start. Part of it may be due to the fact that “Covers” are only available in the LA area.

But I think another part of it is that even the price for their entry model is still pretty high. It appears these guys are looking to become the “Apple of ADUs,” when the fact is, you can get quality pre-fabricated ADUs installed for a lot cheaper.

Cover reminds us of Tesla and Apple, in that it combines phenomenal product design with high-volume manufacturing expertise. – Stephen Oskoui, Managing Partner at Gigafund

Azure Printed Homes

Azure is a 3D printing company that can build an ADU at a fraction of the cost and time of traditional building methods.

They use recycled polymers (i.e. plastic food and drink containers) to cut costs and create beautiful, modern, environmentally-friendly units.

Azure’s primary units can be built for less than Covers (they start at $199k). Smaller backyard studio offices start at just $44k.

We’ve created production efficiencies by capitalizing on advances in 3D printing and creating a process that takes just 12 hours. We produce the entire structural skeleton, the exterior sheathing, the water control barrier, the exterior finish, the passageways for utilities, and the grounding for interior finishes, at a fraction of the time and cost. – Azure founder Ross Maguire

It’s a sustainable model, and one that other construction businesses will have to consider if they want to minimize their environmental impact.

Other ADU construction startups

- Geoship, a California startup building geodesic dome dwellings out of environmentally friendly bioceramic composites, pulled in more than a million dollars in its crowdfunding campaign.

- Boxabl manufactures tiny homes that unfold from a compact box shape. The Las Vegas-based startup was the largest crowdfunding fundraiser of 2022, raising over $140m from 40,000+ investors. (And they have another fundraising live on StartEngine)

Home Equity Investments (HEIs)

America’s largest buyer of mortgage loans is the infamous Fannie Mae. Fannie recently adapted their guidelines to accommodate ADUs, clearing the way for downstream financial firms to offer ADU loans.

This means ADUs are now eligible for all of the familiar home loan products, such as:

- ADU construction loans

- Renovation loans

- Refinancing loans

- Home equity loans

- Home equity lines of credit (HELOCs)

The problem is, many “house rich but cash poor” homeowners who would greatly benefit from an ADU don’t qualify for any of these loans. (It’s not that the ADU doesn’t qualify, it’s that the borrower may not qualify.)

So new financial products have sprouted up to fund these alternative real estate projects. The most interesting product is known as a Home Equity Investment (HEI)

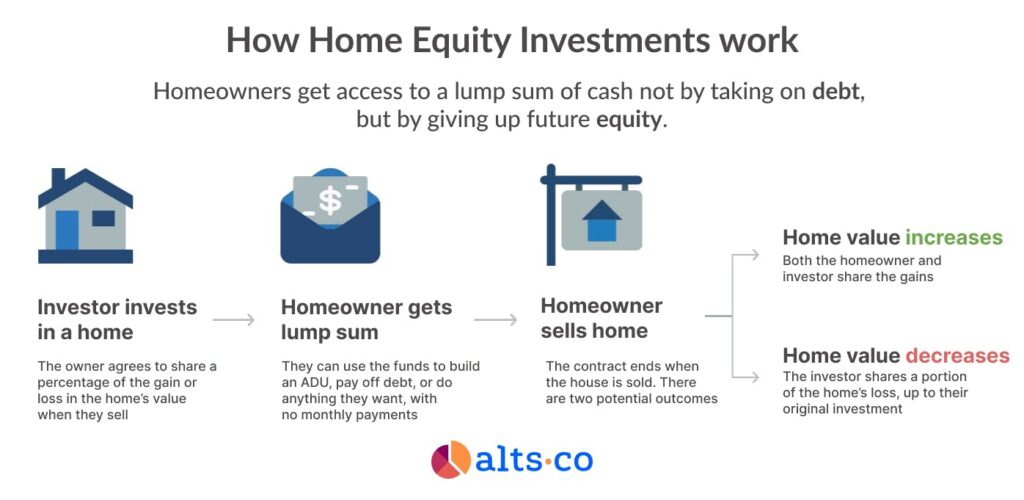

A Home Equity Investment allows an investor to provide a homeowner with a lump sum of cash in exchange for a percentage of the home’s future change in value.

It’s similar to a startup raising money in exchange for equity. It offers homeowners instant cash without them needing to take on debt, and gives investors a stake in the property’s potential appreciation.

This is a fascinating concept that hasn’t really existed before — at least not in a broad consumer sense. There is no debt, no monthly payments, and the equity is only paid when the home is sold (or at the end of a set term.)

Home equity investors take on all of the upfront risk!

As a homeowner, you’re not amassing debt like you are with a home equity loan. You’re not even selling current equity in your home like you are with a reverse mortgage. Instead, you’re selling a portion of your home’s future value in exchange for a lump-sum payment today.

It’s easy to see how this could be a terrific opportunity for homeowners. They can get the cash they need to fund their ADU without paying anything upfront, or making monthly payments.

Oh, and it’s not dependent on a high credit score, household income, or debt-to-income ratios. What matters is the home and its potential future value.

ADU financing startups

Here are some startups offering HEIs:

Unison

Unison made it through the ’08 crash and has been around the longest. But they also have stricter lending requirements.

- Founded in 2004

- Up to 15% of home’s equity can be utilized

- 620 credit score (higher than others)

- Maximum 70% LTV ratio

- Up to 30-year term

Unlock

Unlock has low credit score requirements, but the term only last 10 years. (This can actually be good for the homeowner)

- Founded in 2004

- Up to $500k

- Flexible income requirements

- 500+ credit score

- Some debt-to-income requirements

- Maximum 80% LTV ratio

- Up to 10-year term

Point

Point is similar, but offers a 30-year term up to $500k

- Founded in 2015

- Up to $500k

- No income requirements

- 500+ credit score

- Up to 30-year term

Hometap

Hometap is relatively new to the scene, and offers up to $600k — the highest of the bunch

- Founded in 2017

- Up to $600k

- 500+ credit score

- They take a minimum 25% equity in the property

- Up to 10-year term

Splitero

Unlike other companies, Splitero accepts investor properties owned by trusts and LLCs

- Founded in 2021

- Up to $500k

- No income requirements

- No minimum credit score

- Up to 80% loan-to-value ratio (LTV)

- Up to 30-year term

Other ADU services

There’s a growing market for ADU construction, design, and management services.

Symbium

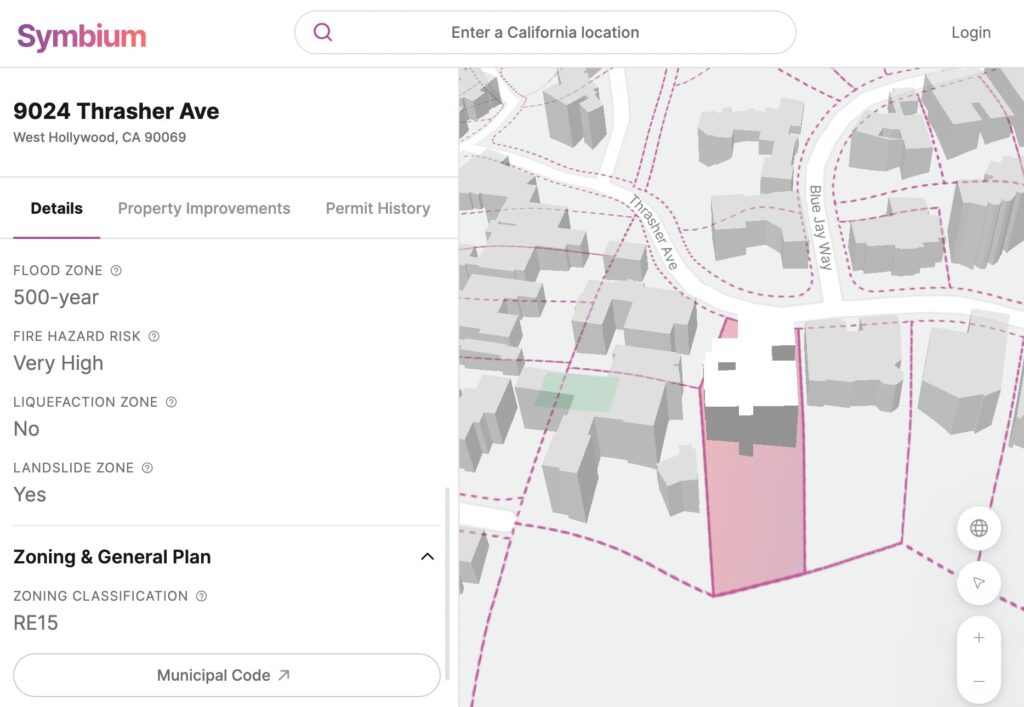

Symbium lets homeowners understand the potential of their property, and then manages their permits, inspections, and rebates.

They don’t do any actual building themselves, but they translate the mess of complex laws and regulations into simple workflows, including ADU assessments, and streamlining building permits for contractors.

Symbium has been recognized as a GovTech 100 Company for the past three years.

In 2022, they announced a partnership with the California Association of Realtors to produce tools and education for real estate agents.

SNAPADU

SNAPADU is a licensed contractor focused on the San Diego market.

They’re what’s known as a design-to-build ADU construction company; a one-stop shop for planning, permitting, and project management.

I used an ADU consultant when building mine, and let me tell you: working with a single company that handles the project for you is a dream come true.

Maxable

Maxable Space helps you find designers, builders, and prefab companies in your neighborhood.

Their YouTube channel is full of ADU content, and they regularly post updates on regulations changes, explore financing options, give design tips, and film ADU tours which should inspire you to get your project off the ground.

They’re pretty California-focused, but if you’re in the early stages of planning, this might be a good place to start.

Recent ADU legislation

ADU legislation has come a long way in the last few years.

Cities have begun embracing ADUs through zoning changes, passing legislation that reduces red tape and gets more ADUs onto the market quickly.

But sometimes it’s not quick enough. Fed up with local NIMBYism, many states have passed regulation that actually supersedes local laws.

California is one of the best examples. They continue to chip away at local control over the development of ADUs, and have made these small but mighty homes legal to build on almost any residential property.

(In Santa Barbara, where I used to live, ADUs were illegal until CA state law displaced city law. As soon as the state law kicked in, we jumped into the process, and were one of the first in the city to build a legally-permitted ADU.)

California’s efforts have paid off tremendously. They’ve seen a 1,669% increase in ADU permits, from 1,300 in 2016 to 23,000 in 2021 — encompassing about a quarter of America’s total annual ADU construction.

Most recently, California required local agencies to update their ADU ordinances through AB 2221 and SB 897, which stipulate that:

- Local governments must approve ADU applications within 60 days

- ADUs are now authorized on lots with multi-family dwellings

- Local agencies must allow ADUs to be sold separately from the lot’s primary dwelling if specified conditions are met.

California isn’t alone. Washington is leading the charge in adopting strong ADU legislation. According to Accessory Dwellings, this new HB 1337 policy includes:

- Owner occupancy is no longer required

- Allows at least two ADUs in all urban areas with single-family zoning

- Legalizes two-story ADUs (max 24ft)

ADU grants

California even has some new grant and loan forgiveness programs to help fund ADUs:

- Cal HFA (California’s Housing Finance Agency) provides up to $40k towards pre-development and non-reoccurring closing costs associated with the construction of the ADU.

- Napa County’s ADU program offers forgivable loans from $45k – $105k

- Alameda County’s AC Boost lets you borrow up to $210k in down payment assistance

- Finally, West Hollywood’s pilot program offers a 3-year loan with 1% simple interest and deferred payments

Closing thoughts

It’s hard to think of an alternative investment that does more good for the world than ADUs.

The chronic undersupply of housing is one of the most important social, economic, and political issues of our time. I am strongly in favor of anything that brings more supply online.

But I think what I love most about ADUs as a housing solution is how non-invasive it is. A big reason NIMBYs block new housing is because they feel housing developments are “out of character” with the rest of the neighborhood. But ADUs blend in, converting ugly garages into cool-looking dwellings, or planted sight-unseen in people’s backyards.

They don’t elicit nearly as many complaints, and thanks to new legislation, there’s not much your neighbors can do about it anymore anyways. If you want to build an ADU, increasingly you have the right to do so.

As startups continue to pour into the space, construction costs will continue to fall as well, giving the asset class even more impressive economics. (We will recoup the full cost of our ADU in just 3.3 years.)

I’m also really excited about what’s happening on the finance side. I think HEIs are a fascinating development in their own right. The idea of selling future equity in your home as if it were a startup is groundbreaking, and the topic warrants its own issue someday.

Yes, right now the ADU ecosystem is very California/West-Coast-centric. But with formerly cheap markets like Austin and Tampa becoming expensive, expect the ADU ecosystem to spread to the rest of the country (not to mention the rest of the world.)

Finally, I’m thankful governments are seeing what a no-brainer this stuff is; greenlighting new legislation, and paving the way for great ROI and more affordable housing.

I’m so glad this ecosystem is kicking into high gear. On a risk-adjusted basis, it’s probably the single best investment I have ever made. 🏡

Further reading

- ADUs are considered part of the primary home and you cannot sell them separately. But that could change.

- Real estate securitization marks the dawn of a new asset class.

- Alts community member Isaac French built an office/studio in his Texas backyard. He documented the process and it looks terrific.

- Another Alts community member Al Taylor is conducting a research study on housing. Those chosen for the study will get a $50 Amazon Gift Card. If you’re interested in participating, click here.

- Our friend Brad Cartier from The Briefcase often writes about ADUs

Disclosures

- Our ALTS 1 Fund has no ADU investments, and no investments in any companies mentioned in this issue

- Azure is a former sponsor of Alts

- This issue does not contain any affiliate links (It seems like it does, but nope)