Hello and welcome to Alts Cafe 👋

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- Inflation jumped for the second month in a row

- Commercial real estate distress is rising

- Nvidia is going on a shopping spree

Table of Contents

Macro View

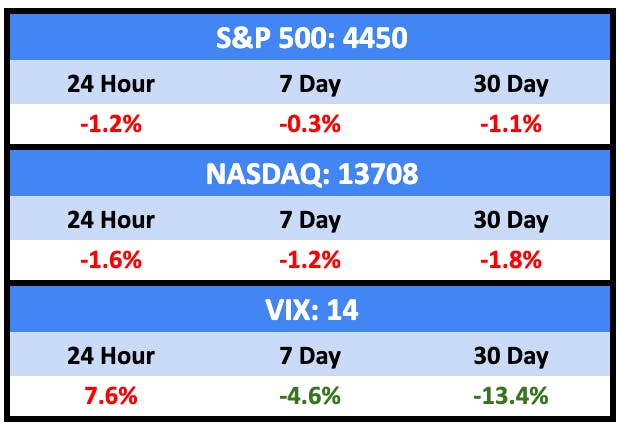

Big Fed meeting this week off the back of higher-than-expected inflation.

Bullish News

- Cox thinks used car prices have bottomed, signalling a rebound.

- Treasury Secretary Janet Yellen said she’s increasingly confident that the US will be able to contain inflation without major damage to the job market.

- The $VIX hit 12.82 last Thursday, its lowest close since January 2020.

Bearish News

- August inflation numbers in the US came in higher than expected, which could mean another round of rate hikes.

- And this was the second straight monthly increase.

- Bloomberg catches up to what I’ve been shouting about for months. The US consumer is about to crack.

- The UAW went on strike.

- The ECB hiked rates again.

- The markets think interest rates will stay above 4.5% through the end of 2024.

- After adjusting for inflation, US retail sales fell 2% over the last year, the 10th consecutive YoY decline.

Forecasts

📉

1%

Chance of Fed rate hike this week

📈

70%

Chance mortgage defaults will rise in Q3

📉

2.33%

National average house price increase in 2023

xxx

What are we doing?

ALTS 1 Fund news:

No change

Real Estate

Bullish News

- It’s been a good month for shopping malls. Outlet malls have seen foot traffic grow 18% and renovated indoor malls saw a monthly increase of around 7%.

Bearish News

- The distress rate for commercial mortgage backed security (CMBS) loans across the 20 largest American markets in August was 7.2%, up from 4.5% a year ago.

- New apartment construction in the US is down 50% from two years ago.

- And for the first time in decades, U.S. apartment rents are rapidly flattening

- US residential mortgage demand is the lowest it’s been since 1996.

- And more than half of American homeowners have a mortgage of $2,000 or more. A quarter pay more than $3,000.

- Demand for vacation homes is at a seven year low.

- New Jersey and Illinois are the two markets at highest risk of decline.

How to invest in real estate right now:

avoid

Startups

Bullish News

- CalSTRS is sticking with its allocation to emerging managers.

- Nvidia is on an M&A spree, buying up “anything that smells like AI.”

Bearish News

- The share of angel, seed, and early-stage VC deals in healthcare IT has plummeted to 26.2% so far this year, compared with an average of 49.1% in the 2020-2022 period.

- But teletherapy & behavioral health have been bright spots.

- Proptech companies like Divvy, Opendoor, Compass, Redfin, Better.com, and Homeward have got hammered thanks to higher interest rates.

- Fintech is in big trouble too.

How to invest in startups right now:

Sell your AI company to Nvidia.

PE & Private Credit

Bullish News

- Transacted reports nearly 36 percent of private equity-backed companies granted equity to non-management employees in Q2, up from 25% two years ago.

- Blue Owl Capital is getting closer to its $10 billion private credit loan.

- Deutsche Bank has launched a private credit service to look after both institutional and HNW clients.

- Private credit is making a move for asset based lending, according to Rob Camacho at Blackstone.

- In Q2, Q2 2023, perpetual capital–investment funds with an indefinite life and flexible exit timelines–in the hands of seven publicly-traded private equity giants surged by 13.2% year-over-year, totalling around $1.2 trillion.

- More than half of family offices increased exposure to private credit in 1H 2023 while 38% boosted their PE holdings.

- Middle-market PE continues to shine.

- US High Yield spreads moved down to 3.78% last week, the tightest we’ve seen since April 2022.

Bearish News

- Several PE groups are suing the SEC to further water down fund oversight rules.

How to invest in PE and Private Credit right now:

Wait, probably.

Crypto & NFTs

Here’s what you need to know:

Bitcoin fell below $25k for the first time in three months, but it bounced back.

Getting greedier

NFTs continue to slide

Bullish News

- Franklin Templeton filed to offer a spot BTC ETF too.

- PayPal is rolling out a crypto off-ramp, which should increase liquidity.

- The G20 is pushing for a speedy implementation of a cross-border framework for crypto assets.

Bearish News

- Binance US’s president — and 100 more staffers — left the company.

- Why crypto might stay in a bear market for-e-ver.

- The SEC came down hard on Stoner Cats, saying they’re unregistered securities.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick Hits

Music Rights

Alchemy Copyrights is buying out Round Hill Music Fund’s entire catalogue comprising more than 150,000 songs, including Backstreet Boys’ “I Want It That Way” and the Beatles’ “She Loves You.”

Alchemy is paying $469 million.

You can check out Round Hill’s top 50 earners on Spotify.

https://open.spotify.com/embed/playlist/4P46C6opRHt0reXwyy7dRt?theme=0

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Jurny

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.