Hello and welcome to Alts Cafe

This is a quickfire look at what’s driving your week.

TLDR:

- Jobs are hot. Rates will keep rising (probably).

- Commercial real estate is getting ugly. Gov’t asking lenders for help.

- NFTs can’t get their act together.

- Why Elon won’t sue Zuck.

- VC investing down 50% YoY in Q2

Table of Contents

Macro View

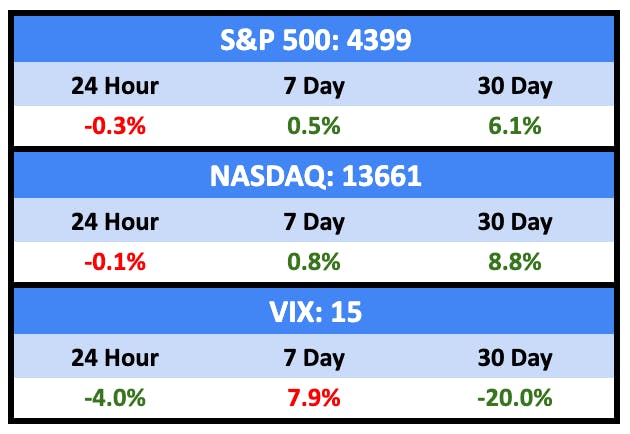

Everything sunk last week as the jobs report came in hotter than expected, and the Fed said it’ll keep raising rates.

Bullish News

- Junk bond deals are back, which indicates an increased appetite for risk.

- New car sales in the US were up 13% YoY, well above estimates.

Bearish News

- The jobs market came in hot hot hot, which means…

- The Fed says it’s probably going to hike rates a couple more times in 2023.

- 16 of 18 members of the Fed are in favor of at least one more hike. 12 of the 18 are in favor of two hikes.

- The market is only pricing in a 33% chance of two or more hikes.

- The US Supreme Court struck down President Biden’s student loan forgiveness plan. This will suck $400 billion of disposable income out of the American economy, though it should help curb inflation.

What are we doing?

ALTS 1 Fund news:

Nothing at the moment

Real Estate

Bullish News

- The US gov’t is interceding on debtors’ behalf as CRE tumbles.

- Over two million people have moved to the American southeast over the last two years.

- The Mormon church is using its $100 billion war chest to build 100 new (very expensive) temples worldwide.

Bearish News

- The CRE crash is about to smash hammer small domestic banks.

- SF office vacancy rate is now at 31.8% and climbing.

- Multi-family loans are in trouble as well.

- Housing inventory is negative YoY.

- Mortgage rates are above 7.2%.

- Rental prices are flat MoM and up only 5.8% YoY.

- The Chinese property market continues to struggle.

- Re-insurance rates jumped 50% for California and Florida last week, which will flow through to retail home insurance rates soon.

How to invest in real estate right now:

I’m still out of the real estate market [no change.

Crypto & NFTs

Here’s what you need to know:

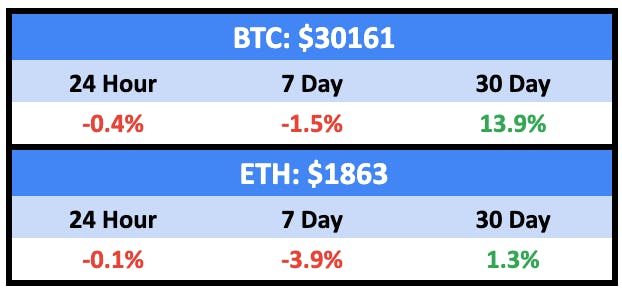

A mixed week for crypto ending down slightly.

Sentiment has gone south a bit.

NFTs just can’t get their act together.

Bullish News

- Longtime crypto bear Larry Fink is now a bull.

Bearish News

- Azuki NFT holders got margin called last week when the floor dropped 61%.

- Crypto funding fell for the fifth straight quarter.

- Binance General Counsel Han Ng, Chief Strategy Officer Patrick Hillman and Senior Vice President for Compliance Steven Christie have all quit the disgraced crypto exchange.

- The exchange’s market share in the US fell below 1%.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

The real steel cage match began last week as Zuck launched Threads, a Twitter clone rival. Elon has already threatened to sue.

He won’t sue because

- Discovery would reveal far too much evidence of how

criminallypoorly he’s been running Twitter, and - He’d lose

But Twitter can still beat Threads.

Threads has a couple huge advantages:

- Meta’s userbase of around 3 billion people is a huge audience to easily onboard Threads users

- Meta (Zuck) is much friendlier to / with advertisers and regulators

But…

No one wants to maintain a presence on both Twitter and Threads — they’re too similar and do the same job for most people.

And while Threads has already topped 100 million users, very few people have established themselves there yet in terms of followers and identity. The people who follow me (and who I follow) on Instagram are very different to Twitter. I can’t even download the app from the Spanish app store.

Elon’s got a couple months to repel this threat before Twitter becomes a glorified Truth Social.

To do that, he’ll have to slaughter a number of sacred cows he’s introduced since his takeover, most notably the mangled algorithm and relentless surfacing of blue checks in comments and discovery.

He won’t do that, though.

I’d say it’s time for Elon to tap out, but he never should have got in the octagon in the first place.

Bullish News

- Green bonds have overtaken fossil-fuel backed debt for the first time.

- No surprise here, but AI is one of the only tech bright spots in 2023.

Bearish News

- Peer Street, a property investment platform, has gone bankrupt.

- VC investing was down 50% YoY in Q2.

- FrontRow, a learning platform featuring celebrities, shut down.

- Because recent tech layoffs focussed more on female-dominated jobs like HR and marketing, women have been disproportionately affected by the firings.

- ChatGPT mania is slowing down as it looks like most of the early adopters are already onboard.

- Affirm continues to be one of the worst-run and most ill-conceived companies in tech. They’re killing Returnly, which they paid $300 million for two years ago.

- Crypto deals are still getting done, but they’re much tougher to get past due diligence.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at WebStreet and FameSwap.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.