Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- Ctrl Altman Delete

- Bad news is good news. Both the CPI and PPI came in cold. Kalshi is predicting a 76% chance of a rate cut by July 2024

- US mortgage rates are down from 8.0% to 7.4%.

- VCs finally had a positive quarter

Table of Contents

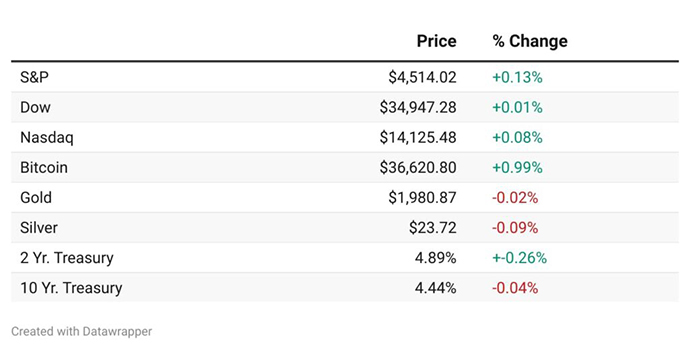

Macro View

Bad news is good news. Both the CPI and PPI came in cold.

Bullish News

- The CPI print came in colder than expected, with inflation up less than expected, year over year.

- The PPI, which measures wholesale prices, fell 0.5% in October against the expected 0.1% increase. That’s the biggest decline in more than three years.

- Money market traders are now forecasting a 62% chance of a Fed rate cut of at least 25bps by May.

- And UBS thinks the Fed will cut nearly three full percentage points in 2024 (I disagree).

- A Labor Department report showed weekly jobless claims rose more than expected, cementing bets that the Fed will not need to raise rates further.

Bearish News

- Bad news is good news for the Fed, but it may mean a recession is imminent. Weakening jobs data, souring retail sales, worsening NFIB data, and rising credit card delinquencies will become a problem at some point.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📈

99%

Chance the Fed will hold rates steady in December.

📈

97%

Chance credit card defaults will rise in Q3

📉

1.95%

National average house price increase in 2023

The Fed is locked into holding firm in December, and credit card defaults are on the rise. House price increases keep decreasing, too. So what’s new?

November unemployment numbers will be released on Dec 8th. Kalshi is forecasting 178k new jobs against 150k from October.

The next CPI report comes out on 12th December, and Kalshi is forecasting a 3.22% YoY rise, just a hair above the previous print.

Finally, Kalshi is predicting a 76% chance of a rate cut by July 2024, which sounds a bit low to me.

What are we doing?

ALTS 1 Fund news:

We’re drawing up the paperwork for our art acquisition.

Real Estate

Bullish News

- The share of first-time buyers in the housing market ticked upward this year, but remained near record lows.

- US mortgage rates are down from 8.0% to 7.4%.

- The biggest U.S. homebuilder by volume is upping the number of homes it plans to sell over the next year despite higher mortgage rates and inflation cutting into its profits during its latest quarter.

- Four sunbelt cities are poised to boom.

- But investor home purchases in the Sun Belt are down 40%.

- Owner occupiers can now purchase up to four units with only 5% down, down from 15%.

- Blackstone is reportedly the leading bidder for Signature Bank’s commercial property loans.

Bearish News

- German housebuilding is on the brink of collapse as construction projects are being canceled and orders are slowing.

- The size of unfinished, pre-sold homes in China is about 20 times the size of developer Country Garden as of the end of 2022. “We estimate that there are around 20 million units of unconstructed and delayed pre-sold homes,” said Nomura’s Chief China Economist Ting Lu.

- After being the poster child for the booming American housing market during the pandemic, Austin has seen its fortunes reverse.

- Private lenders for CRE are getting tighter. “Debt is available, but not in the same amount as before, and it is also meaningfully more expensive.”

- The 69 total leases WeWork wants to abandon in North America as part of its Chapter 11 filing are tied to roughly $1.85 billion of commercial mortgage-backed securities (CMBS) loans.

- Related, the current delinquency rate for loans in CMBS is 4.76%, but it is expected to approach 10.51% in the coming years.

- Realtor.com parent company Move Inc.’s revenue declined 16% to $142M in the fiscal first quarter.

- Two copycat lawsuits (in SC and NYC) have cropped up in the wake of the landmark Sitzer/Burnett suit. Surely more to come.

- Private real estate investor Hazelview halted redemptions on its $1.4-billion fund.

- Shorting REITs perceived as vulnerable to higher rates has been a popular trade this year but not a successful one.

How to invest in real estate right now:

Don’t

Startups

Sam Altman, who many consider the face of AI, was ousted as CEO at OpenAI. After a dramatic weekend that can only be described as the next “Barbarians at the Gate,” he was ultimately replaced by former Twitch CEO Emmett Shear.

Satya Nadella, CEO at Microsoft, hired Altman to “lead a new advanced AI research team.” Former OpenAI President Greg Brockman and other “colleagues” will join him. Nadella has acquired OpenAI’s most useful components (the talent), promising them unlimited resources and computing power, and left a husk behind for Shear.

New OpenAI CEO Shear has said he wants to slow down OpenAI’s development to ensure proper guardrails are in place. Sheer has said some fairly…problematic…things in the past, which will probably be an issue at some point.

Bullish News

- Because consumers are bad at maths, Affirm is thriving in the high-rate environment.

- After five consecutive quarters of negative performance, venture capital funds delivered a return of 0.2 percent in the second quarter this year.

- Menlo Ventures has raised $1.35 billion for funds targeting AI startups, and Khosla Ventures is closing in on raising $3 billion across three funds.

- Coatue raised a $1.4 billion growth fund

- But had to reduce fees to get it across the line.

Bearish News

- Over the last 15 years, the FDIC has spent over $45 billion bailing out VC firms and other wealthy depositors. Signature Bank, Silicon Valley Bank, and First Republic Bank cost over $31 billion alone.

- Kyle Vogt resigned as CEO of Cruise late Sunday following the recent suspension of Cruise’s operations on public roads. Perhaps he’s looking for a job with his former co-founder at OpenAI.

- As bad as 2022-23 have been for both startups and VCs, The Information found some analysts who think 2024 will be worse.

- In the third quarter of 2023, 178 VC funds raised an aggregate of $16.5 billion, the lowest quarterly total since 2015.

- And seed rounds are set for their worst year since 2017.

- Mike Rothenberg, a former VC known for hosting lavish parties, was convicted on 21 counts of defrauding investors.

- Brex revenue growth slowed to 1% in Q3 against a tough post-SVB blowup comp in Q2.

How to invest in startups right now:

Give Sam Altman all your money.

Private Equity and Private Credit

Bullish News

- BridgeInvest, a private CRE mortgage lender, is on track to receive applications for $40 billion of loans in 2023 compared to just over $20 billion in 2022.

- Private equity could be targeting the NFL, women’s teams, and stadiums next.

- Germany’s football (soccer) league, the Bundesliga, is selling up to a 10% stake in its media rights for up to €1bn.

- There’s a private credit buying spree going on.

Bearish News

- Private equity firms that amassed more than $1.5 trillion of assets in China in just two decades are now struggling to offload once-promising investments.

- Carlyle is reducing the target for its pan-Asia PE fund by 30%, citing a lack of demand.

How to invest in PE and Private Credit right now

Invest in sports.

Crypto & NFTs

Here’s what you need to know:

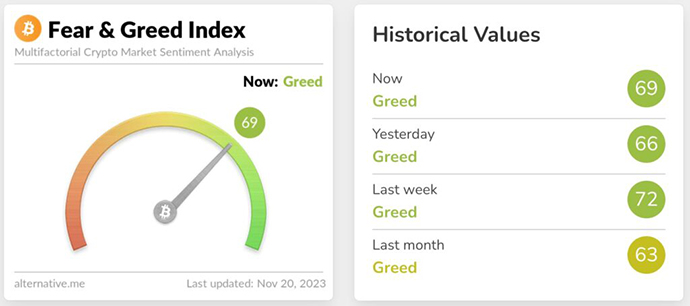

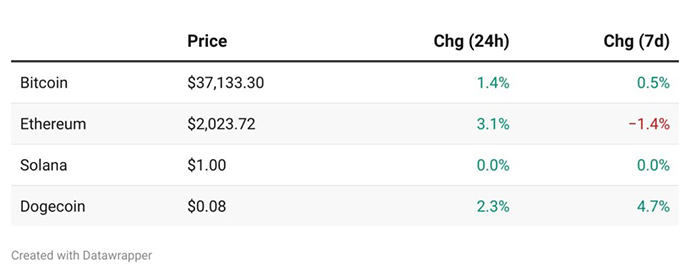

Crypto gave back some gains before popping back into the green.

Slightly less greedy.

NFTs slumped into the weekend as well.

Bullish News

- Central bank digital currencies have the potential to replace cash, but adoption could take time, said Kristalina Georgieva, managing director of the International Monetary Fund.

- Prominent crypto analyst Benjamin Cowen has predicted BTC will go to $100k by 2025.

- Cathie Wood expects trillions of investor dollars will flow into spot bitcoin ETFs and the digital-asset industry at large in the next decade.

- Bitcoin derivatives markets are pointing to a 2021-esque bull run.

- Net crypto inflows have surpassed $1 billion this year. There have been more inflows during the last seven weeks than all of last year.

- NFT volume hit a three-month high.

- But it’s still less than 10% of 2022 numbers.

- A new stablecoin called Midas is launching soon. It’s backed by US Treasuries.

- In January, CBOE will become the first regulated U.S. exchange to offer spot and future BTC and ETH markets on a single platform.

Bearish News

- Someone fraudulently filed documents for a new iShares XRP Trust under BlackRock’s name, which set XRP alight. BlackRock confirmed it wasn’t them, which caused XRP to come back to earth.

- Cryptocurrency exchange Poloniex has had its hot wallets drained by hackers with an estimated loss of around $114 million.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

That’s all for this week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at EquityMultiple

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.