Welcome to Startups Insider for Feb 14th, 2022 – FREE edition. We analyze deals across AngelList, Republic, WeFunder, and more.

Today, we’re taking a look at the Storybook app, an infant sleep app that helps parents get their babies to sleep using a combination of massage, stories and music.

Currently open for reservations on Republic, we’re going to do a deep-dive on this investment opportunity and give you our take based on our own research and analysis.

Let’s go!

Table of Contents

Investment Overview

Opportunity

The total addressable market (TAM) for baby products is projected to hit $25B by 2028, and recent product launches have shown that parents are willing to pay a premium for great products. The company itself claims a $46B TAM in the US, but they don’t provide a source. The baby sleep component is expected to be around $1.7B.

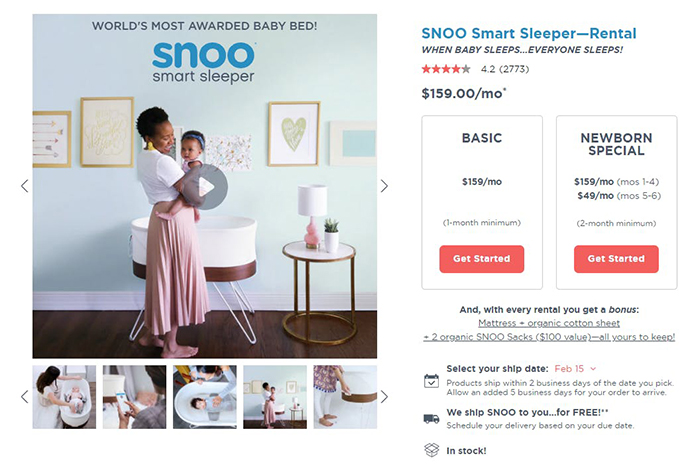

One recent example, Snoo, launched premium bassinets starting at $1,200 in 2016. Analysts and non-parents might scoff at four-figure bassinets that “jiggle” babies to sleep, but the Snoo works, and exhausted parents around the world will pay anything for a good night’s sleep.

The bassinets are so popular that lucrative rental markets have sprung up to help parents enjoy the benefits of the Snoo at a more approachable price point.

The opportunity is 8/10. This is a big market and consumers are willing to pay for top products.

Problem

Speak with any new parent, and you’ll understand anecdotally that getting a baby to sleep through the night is a big problem. But there are quantitative points to back this up:

- There are over two billion google search results for “how to get a baby to sleep”

- Guides from Healthline and the Mayo clinic that help new parents sleep have 15M and 60M referring links, respectively.

- Healthy infant sleep is crucial to cognitive development, and deeper-sleeping babies are less likely to experience unwanted weight gain

Problem: 8/10. Just talk to any new parent. They’re very tired.

Solution

The Storybook app combines bedtime stories with infant massage to help babies and children sleep.

Massage releases melatonin, while increasing bonds between the child and parent. Oil-based massage has even been found to help prevent bacterial infections.

According to the company’s site, parents report that four in five children sleep better using the product, and nine in ten have a better connection with their children.

Ignoring reviews in the Apple app store from parents who didn’t know that the app would charge them money, users are very positive about the product.

Solution: 8/10. Massage is distinct from other approaches, and appears to be an effective practice if done correctly. Storybook helps ensure massage is done correctly.

Product

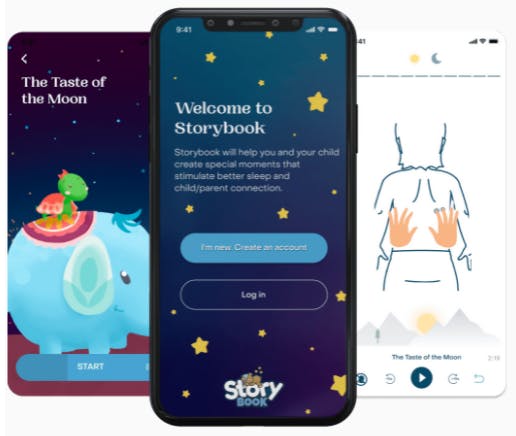

The app coaches parents in massaging their child to sleep, while reciting a bedtime story.

Take a look here:

The UI and UX is excellent. The app is enriched with adorable children’s book-style illustrations and lullaby-style music.

Some stories are evocative of Calm or Headspace, both of which are immensely popular apps in the meditation space. In fact, I wonder if it could act as a stand-in for those apps for parents who subscribe anyway.

The product is 7/10. Great UX, UI, illustrations, music etc. It’s severely lacking App Store Optimization and is very hard to find on the App Store. This is an important aspect of a new product, so we’ve deducted a couple points for poor discoverability.

Team

Dani Vega and Francisco Cornejo founded Storybook in 2019. Francisco was a CMO at Honda. Dani is an infant massage instructor and has been a children’s book author for the last decade.

The idea was founded in a very personal experience, which Dani tells beautifully in this post.

Storybook’s talent now includes a Growth Advisor from Airbnb, a product manager from Trivia Crack, and a board that includes scientists and experts from the International Association of Child Sleep.

Putting together a team with backgrounds working on successful apps plus advisors from sleep organizations is a great start for a young startup focusing on infant sleep.

Team is 8/10. They have industry background and experience they can bring to the table.

Business model

Storybook is free to download, with a $49.99 yearly subscription plan.

Without a subscription, parents can access 5 stories. If they want to access all stories and the massage techniques, users can upgrade to a premium subscription.

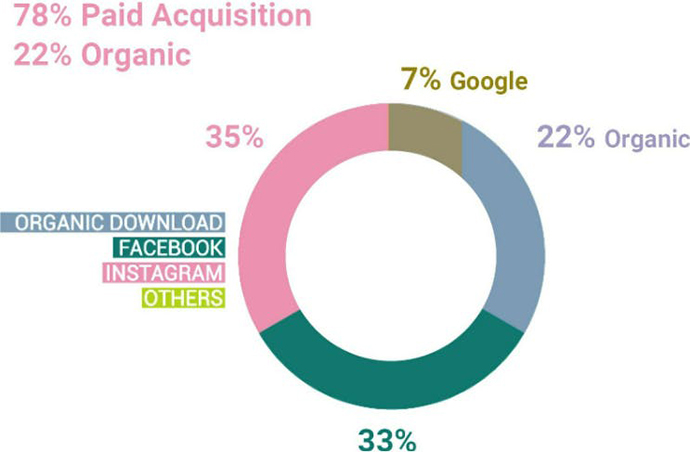

Their customer acquisition model is a bit more elaborate. Storybook has seen its best success in heavily marketing over Facebook and Instagram, with over two thirds of their customers coming from paid ads. Very relevant channels for their target market… But expensive.

Perhaps a referral campaign would be effective.

Currently, lifetime value is $66 with a customer acquisition cost of $42, but the team plans to increase this ratio from 1.5:1 to 3:1.

Francisco told me many parents use Storybook until their child is 12 years old, so there’s reason to think that retention is going to be a core focus for the business strategy.

He couldn’t tell me a churn rate, but I found this from the Discussion section of Republic:

Over the last few months, we have seen cohorts net renewing between 18-30%. Our stronger cohorts haven’t reached a year yet but we aim to be renewing over 40% (that’s above industry average)

Francisco added:

“After A/B testing different price points we have found an opportunity to increase the yearly price to 89.99 USD. Hence, since a few weeks ago in most countries we have increased the price between 50-85% without a significant affection to the conversion rates.”

Given the number of free downloads that don’t convert to paid customers, Storybook might want to consider running ads in the free version.

Business model is 7/10. If they can crack organic acquisition (and boost retention), they have a decent chance at hitting their target 3:1 LTV/CAC ratio.

Competition

There are dozens of generic white noise apps for infant sleep, but only three apps that actively help parents.

- The first is Huckleberry, an app that uses AI to schedule infant sleep. Of the four (Storybook included), Huckleberry is the best App Store optimized for “infant sleep”.

- Another is Cradle. Cradle, like Huckleberry, tracks infant sleep progress and helps set milestones.

- The third is Lullaai, whose app provides sleep coaching reading material for parents, while playing white noise for the children.

I asked Francisco his thoughts on his competition. He feels they complement Storybook. I agree; These four apps all work together.

Competition is 5/10. None of Storybook’s competitors do what Storybook does, and can’t anytime soon. If Storybook were to take off, though, they don’t currently have many moats to discourage direct competition.

Traction

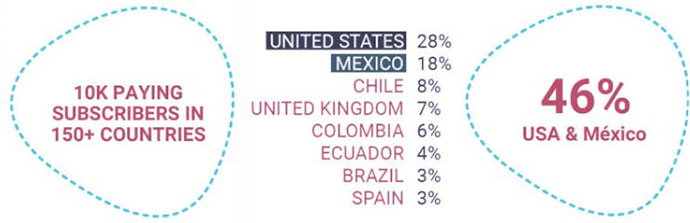

Storybook has over 9,000 paid subscribers, 3,000+ 5-star reviews, $393K revenue in 2020 and 1.5M downloads globally, with the US and Mexico being their biggest markets.

Their ARR as of September 2021 was over $500k, and their vision, per the pitch on Republic, is to get to $100M ARR:

It’s worth noting that unless the team has other revenue levers to pull (we mentioned ads above), or plans to significantly improve freemium to paid conversion, they’ll need to onboard 200M customers to hit this target.

Storybook is backed by Jason Calacanis, an early investor in Uber, and Shaun Mcbride, who is also an investor with a large social media presence. Calacanis is a new parent himself, and has parents among his investor following.

Traction is 9/10. You can’t really ask for more traction from an app this new.

Valuation

Storybook has not posted a valuation. They will likely take their September ARR and assign something around $1.5M. That’s high from a revenue perspective, but conservative given the adoption rate.

Without cumulative revenue data for 2021, the valuation could be between $1.5M to $3M.

In their report they benchmark themselves against Calm. The market is smaller for Storybook, but at Calm’s $2B valuation, even a fraction of that is significant. Calm’s annual price is $70, and $400 for a lifetime subscription. Calm partners with companies to offer Calm as a perk.

If Storybook successfully imitates Calm’s strategy, they may carve out a niche within the well-being app market.

Storybook provides in their memo:

Research estimates the current market size at $46B. According to the report, the baby sleep market expects to reach $1.735B, growing at a CAGR of +8% between 2021 and 2028.

Our view

How to invest:

Currently, Storybook is only taking reservations. This is not very different from investing.

There are reserve tiers with perks:

- $200, which comes with a 1-year subscription and 3 3-month subscriptions to share

- $500, which come with a lifetime subscription and 4 3-month subscriptions to share

- $10,000 which makes you an early hire

These perks obviously benefit parents or people who know parents best.

Startups we passed over

Here’s the shortlist of other opportunities we reviewed before settling on True Made Foods for this week’s write-up:

RentBerry:

- Problem: Similar to Nuovo, RentBerry is pursuing digital nomads. 8/10 opportunity.

- Solution: Similar to Nuovo, Rentberry is offering flexible leasing. 8/10 solution.

- Why We Passed: Similar to Nuovo, RentBerry is burning cash. 5/10 execution.

BeanStox:

- Problem: Too few Americans invest in the stock market. 5/10 problem, what Americans need is more disposable income.

- Solution: Robo-Financial Advisors for all. 7/10 solution: Scalable financial advising is smart.

- Why We Passed: Fantastic founding team, but they’re burning money, it’s a flooded market, and free competition makes for thin margins. So 7/10 competition, and 5/10 execution, since they could only charge $5/month, making only $60k last year in revenue.

Qui Tequila:

- Problem: There isn’t one. Plenty of Tequila brands. 1/10 opportunity.

- Solution: Yet another tequila company. 1/10 solution. Not even a cannabis-infusion tequila?

- Why We Passed: It’s losing money. 0/10 execution. How do you lose money selling alcohol?