Welcome to Video Games Insider. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems across the world of NFTs.

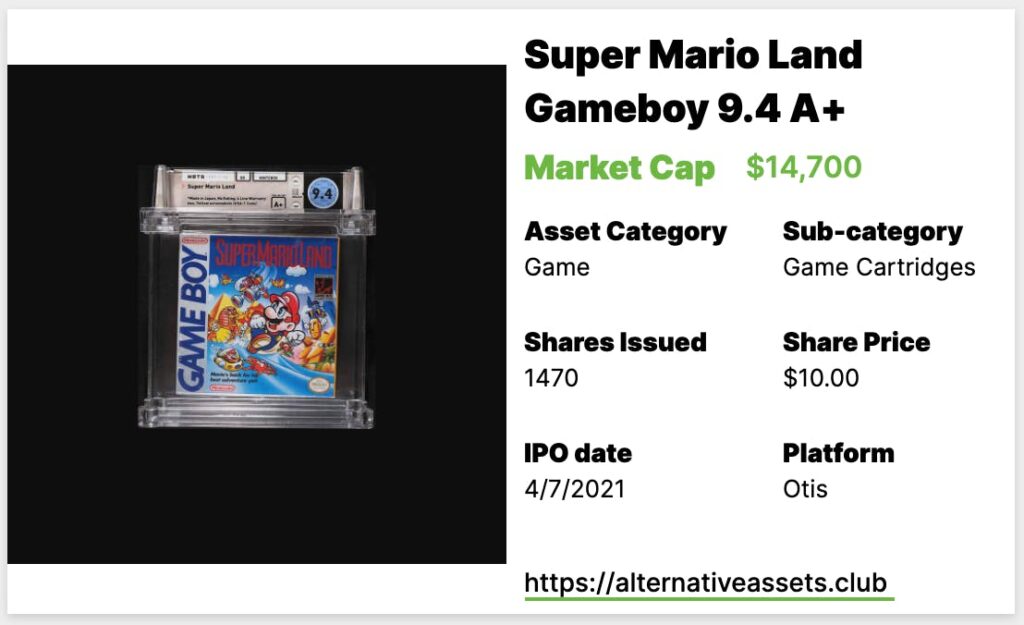

This week Adam’s done a deep dive into the Super Mario Land Game Boy cartridge that will IPO on Otis 7th April 2021 at 5pm EST (this is later than usual).

Table of Contents

What is Super Mario Land – Game Boy – 9.4 A+?

Originally released in 1989, this is a copy of Super Mario Land for Game Boy graded as a 9.4 A+ by WATA. This is a “yellow screenshots” copy, which is a later production run than the “green screenshots” variation that constituted the first production run.

As a reminder – go read about the WATA scale if you haven’t before. The grade is the main driver of a video game’s value and understanding its meaning is crucial. The first number represents the condition of the item (in this case, the unopened box) on a 10-point scale, with increments of .5 until 9, and then increments of .2 until 10.

The second part of the grade is the seal grade – the condition of the factory seal. This scale goes from C to A++. A+ is the 2nd highest grade.

It IPOs on Otis at 5 PM EST on April 7th for $14,700.

Add IPO to calendar

Cultural Relevance

You know Mario – he’s the most widely recognized and popular video game character of all time, regularly topping lists like this. The Mario series, including the classic side-scrollers, Mario Kart, Mario Party, Mario Tennis, Mario Golf and many others, is the best-selling and highest grossing video game series of all-time.

Super Mario Land was a launch title for the first Nintendo handheld video game console, the Game Boy. While there had been handheld video game consoles before, the Game Boy was a massive success (ultimately selling over a hundred million units worldwide combined with the later Game Boy Color) and essentially redefined what was possible in that sphere.

Though Super Mario Land was not bundled with the Game Boy (Tetris was), it did go on to sell 18 million copies. Though not as widely regarded or remembered as its NES or SNES Mario game counterparts (though it predates all but the first two), it is still a seminal game in video game history. Here’s an interesting article that goes further in-depth into its history.

For people in their 30s and 40s, the Game Boy is a huge cultural touchstone. Just seeing this beginning screen made me a bit wistful.

Inferred Value – > $15k

[Detailed Analysis Available to Insiders Only]

Asset Growth TTM

Growth Outlook and Future Catalysts

Mario isn’t going anywhere and will continue to feature in numerous games across platforms. In March, Super Nintendo World was opened at Universal Studios in Osaka, and there are plans for a Super Nintendo World to open in the U.S.

The recent record sale of NES Super Mario Bros. got a lot of media attention and that can only be good for Super Mario Land. I’d expect the next highly graded copy of it to come up for auction to surpass the recent sale.

If the video game market continues to heat up, this game will certainly benefit from that, but the bellwether for this game is NES Super Mario Bros — if it continues to set records, expect Super Mario Land to follow suit. Even if the video game market has a pullback, which would not be surprising after a rapid appreciation, I expect the blue chip assets to operate somewhat independently.

Category Strength

The Video Game Cartridges category returned a 59% ROI in Q12021.

Subcategory Strength

Risk Profile

Asset Liquidity

This will have a roughly 30 day lockup period then will trade daily.

Platform Risk

Intangibles

NES:Game Boy – Super Mario Bros:Super Mario Land. Nothing will be as iconic or as blue-chip as the original NES Super Mario Bros., but Super Mario Land is as blue-chip as it’s going to come for Game Boy games.

Disclosure: Adam plans to buy shares of this during the IPO.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and runs Flippa’s Due Diligence program, and can offer the same service to you.

Subscription Options

Start your free trial of Insider.

Deep research and investment insights, now on thirteen alternative asset classes.