Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

TLDR:

- Despite solid earnings, the US stock market threw up all over itself

- Everyone thinks rate cuts are coming.

- The real estate market is beginning to segment itself into winners and losers

- There’s big trouble in actual China

- The sports memorabilia market could hit $227 billion by 2032

Table of Contents

Macro View

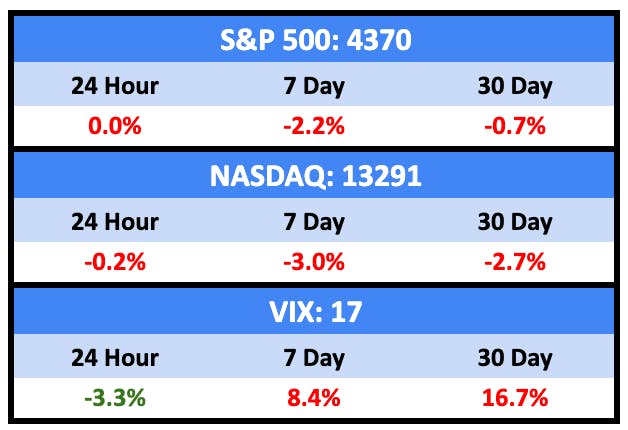

It was a tough week on the markets despite lots of pretty good news.

Bullish News

- Whispers of a Fed pivot (rate cut) in 2024 are growing louder. Goldman is betting on Q2.

- But the Fed minutes reported “significant” risks of continuing inflation.

- US retail sales keep pumping.

- But a record number of Americans are homeless.

- And excess savings US households built up during the pandemic will be gone by the end of Q3.

Bearish News

- Ratings agency Fitch thinks US banks are in big trouble.

- Bond yields have hit a 15 year high, crippling lending markets.

- Argentina devalued its currency by nearly 18% and hiked its benchmark interest rate by 21% to 118% following a shock primary election win by far-right libertarian Javier Milei.

Forecasts

34%

Chance of Fed rate hike in 2023

3.21%

3%

Chance of a US recession in 2023

What are we doing?

ALTS 1 Fund news:

Nothing here

Real Estate

Bullish News

- Total value of US homes hit a record $47 trillion in June

- But American homes are still 40% cheaper than UK equivalents.

- Contrary to a widespread figure, local and regional lenders don’t hold 70% of US commercial real estate debt. It’s closer to 32%.

- Demand for high-end apartment rentals is outperforming other segments in recent quarters.

- RE funds are raising billions to scoop up distressed properties.

- US housing inventory has nearly doubled since its January 2022 low.

Bearish News

- The 30-year fixed rate climbed to 7.09%, the highest rate in 20 years.

- And mortgage demand is down 26% YoY.

- A spike in home construction in wildlife-adjacent areas in California is increasing wildfire risk and insurance liabilities.

- US office vacancy was 18.2 percent last quarter, the worst in 30 years.

- But only 10 percent of all U.S. offices account for 80 percent of the occupancy decreases since the pandemic

- The Chinese real estate market continues to deteriorate.

- And the rest of the Chinese economy is in big trouble as well.

- And the number of Chinese hedge funds has declined for the first time since 2012.

- Because they can’t hit their fundraise targets.

- And Zhongzhi Enterprise Group, which manages $137 billion, announced a probable debt restructuring.

- And China Evergrande Group filed for Chapter 15 bankruptcy in New York.

How to invest in real estate right now:

Wait.

Startups

Bullish News

- Abnormal Security, an AI-powered email security startup, said it has crossed $100 million in ARR.

- Hedge funds went big on AI in Q2.

- South African early-stage accelerator and investor Founders Factory Africa (FFA) raised $114 million.

Bearish News

- Investment in proptech was down 66% in the first half of 2023.

- Tesla is slashing prices in China again.

- Fintech startup Ramp is raising several hundred million from investors at a $5.5 billion valuation, 32% lower than its previous valuation.

- Vesttoo, an Israeli startup that aims to use artificial intelligence in the insurance industry, filed for bankruptcy.

How to invest in startups right now:

The tide has started to go out on AI startups…I expect to see a significant percent fail through the end of 2023.

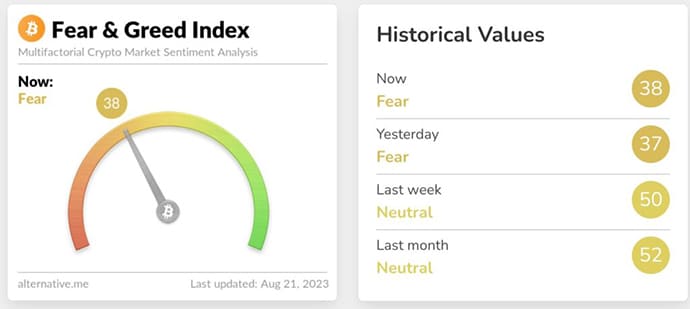

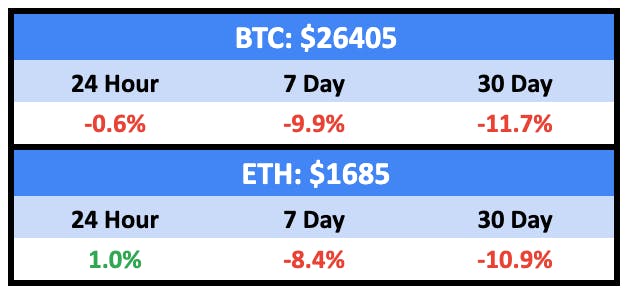

Crypto & NFTs

Here’s what you need to know:

It was a bad week.

A really bad week.

A really really really bad week.

Bullish News

- SBF is going to jail for witness tampering — a really really bad jail.

- And he used money he stole from FTX customers to make more than $100 million in political campaign contributions

- Coinbase secured approval to offer cryptocurrency futures to U.S. retail customers.

- BitGo, a provider of wallet solutions, raised $100M in Series C funding, at $1.75 billion valuation.

Bearish News

- Bitcoin fell by 11.5% from Aug. 16 to Aug. 18, resulting in $900 million worth of long positions being liquidated and causing the price to hit a two-month low.

- Binance is shutting down its buy-and-sell service Binance Connect, formerly known as Bifinity.

- And it filed for a protective court order against the U.S. Securities and Exchange Commission.

- Prime Trust filed for bankruptcy.

- A group of investors have sued Sotheby’s saying the auction house took part in “misleading promotion” to boost the profile of BAYC NFTs.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick Hits

Art

Christie’s and Sotheby’s are both vying to secure the estate of Emily Fisher Landau, the noted art collector who died in March at the age of 102.

The estate is estimated to fetch up to $500 million, which could turn around a fairly awful year for art auctions.

In May, one of the season’s most-anticipated auctions, of the estate of collector Gerald Fineberg at Christie’s New York, totaled just $153 million, compared to an estimate of $163 million to $235 million.

Sotheby’s UK profit was off 24% last year.

Vintage Autos

Sotheby’s is auctioning off a 1962 Ferrari 330 LM / 250 GTO. It’s expected to sell for for up to $60 million.

Meanwhile, a burnt out wreck from the 1960s sold for £1.5 million.

Sports Memorabilia

A report out this week says the memorabilia market could grow 22% per year through 2032 to reach $227 billion.

Related, a pair of Mickey Mantle items sold for more than $9 million combined late Saturday night in Heritage Auctions’ Summer Platinum Night sale.

A 1952 Topps card graded SGC 9 sold for $4.5 million, but that was topped by a home flannel worn by Mantle in 1958, which netted $4.68 million.

On a less happy note, the WSJ has a piece this week on cash-strapped collectors being forced to liquidate their collections.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at xxx and xxx.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.