Hello and welcome to Alts Cafe

This is your weekly quick-fire analysis on all things Alts investing.

TLDR:

- World Bank says expect slow growth through 2024

- Casinos are the best-performing REIT subclass

- Crypto and NFTs are both sinking again

- Startup fundraising is still brutal, but hey, SPACs are back

Like these posts? Please give us a shout on your socials, we’d appreciate it.

Wyatt

Table of Contents

Macro View

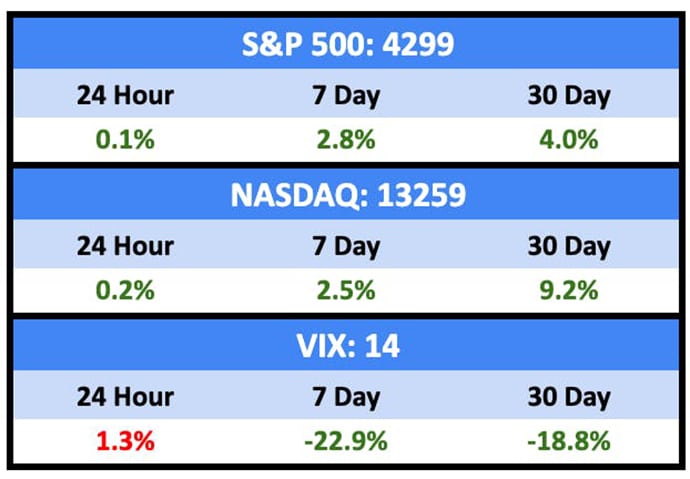

The S&P is officially somehow in a bull market, and the VIX is the lowest it’s been for years.

I guess everything is fine now!

Bullish News

- US household net worth rose by more than $3 trillion in the first quarter to $148.8 trillion.

- Unemployment in the US hit an eighteen month high. The higher employment goes, the sooner the Fed will stop hiking rates.

Bearish News

- The World Bank says growth will be slow through 2024.

- The EU slipped into a recession in Q1.

- Delinquency rates at Affirm are going nuclear.

- Corporate bankruptcies are at a 13 year high.

- Canada unexpectedly increased interest rates.

What are we doing?

ALTS 1 fund news:

We’re still checking out an investment in the Deathcare space.

Real Estate

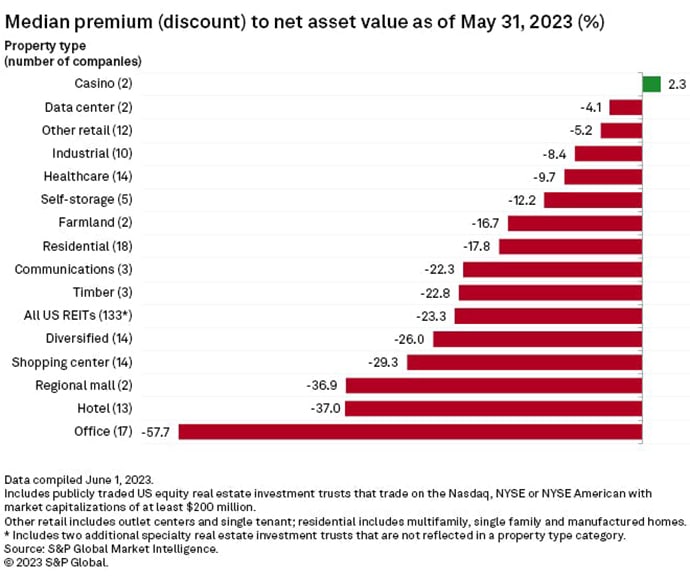

Let’s have a quick look at publicly traded US equity REITs, shall we?

All except one asset class is trading at a discount to the Trust’s Net Asset Value (NAV). Any guesses which it is? And which asset class is doing the worst?

No surprise offices are in the gutter, of course, but I was surprised the discount was 57.7%. That’s immense.

Malls and shopping centres weren’t a surprise either, but hotels’ presence at the bottom is confusing. People are travelling more than ever post-pandemic. Maybe they’re all going to casinos?

Bullish News

- San Bernardino and Houston saw the biggest net migration gains in the US last year.

- S&P Case-Shiller says home price declines may be over due to a lack of inventory.

- U.S. suburban office markets are recovering at a faster pace than downtown markets.

- Between 2010 and 2020, the share of Americans living in the suburbs grew by 10.5%, and that number has increased since then. Some 45% of millennials expect to buy a home in the suburbs.

- Google is trying to force people back to the office.

- Rents in Manhattan are going parabolic.

Bearish News

- Real estate fundraising is off 42% YoY.

- Investment purchases were down 49% YoY. But nearly one in five sales were to investors.

- Half of big multinationals plan to cut office space in next three years.

- Many homes in CA and FL are becoming uninsurable due to wildfire and hurricane threats. More than 32 million homes are at risk of hurricane winds in the US.

- More bad news for western high-end real estate.

- New York and LA saw the biggest net migration losses in the US last year.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

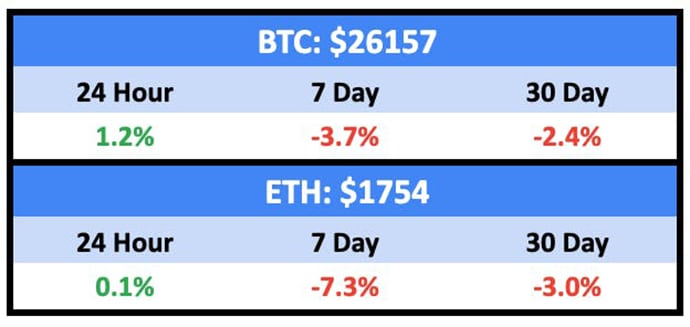

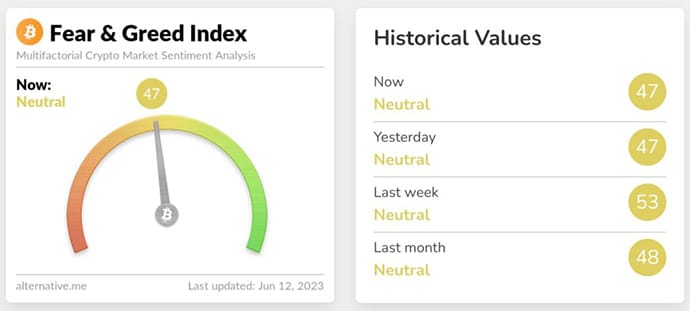

It was a shitty week for crypto.

People are getting nervous.

And it’s hitting NFTs hard.

Bullish News

- Do Kwon will probably spend the rest of his natural life in prison.

- Cathy Wood is long Coinbase, for whatever that’s worth.

Bearish News

- The SEC is coming after Binance big style, and it’s going to hurt.

- Yep, it’s hurting.

- Hurting more.

- Merit Peak, an offshore trading company controlled by Binance CEO Changpeng Zhao, received around $11 billion of client assets through a Seychelles-based firm set up to take customer deposits.

- And Coinbase.

- Someone front ran the announcement and made millions.

- The UK is pushing to regulate crypto.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- Secondaries fundraising is up 40% YoY.

- Three massive funds with ties to regional Chinese government or state-owned enterprises closed in Q1, accounting for about 68% of all of VC funding raised in Asia in Q1.

- Citadel, the investment firm, wants to pay AI startups to help it get an investment edge.

- The EU is investing 8.1 billion euros in tech innovation.

- At least one investment company is having success with growth stage fundraising.

- SPACs are back.

Bearish News

- UK venture capital investment has seen continuous quarterly declines since the start of 2022. Brexit FTW.

- VC fundraising is off 38% YoY.

- Funding for Europe’s venture-backed startups is forecast to decline from $83 billion in 2022 to $51 billion in 2023. That’s more than 50% less than 2021 numbers.

- More evidence emerging managers are being taken to the woodshed.

- Twitter ad sales have fallen 59% YoY.

- VC-focussed law firm Cooley is paying new associates $100k to defer for a year.

- Sequoia Capital will split off its Chinese affiliate, Sequoia Capital China.

- Data analytics software company Sumo Logic made widespread layoffs last week.

- Sequoia Capital–backed logistics startup Next Trucking, facing a slowdown in the trucking sector, is trying to sell itself.

- Carvana is managing to incinerate both investors’ and short sellers’ cash.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our very clever friends at Franshares

- We hold BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- We are investigating an opportunity in the Deathcare space for our fund, and will say more as soon as there’s something to share.