Welcome to your weekly distillation of all the best from Altea.

Table of Contents

Live Deals

Altea Tequila SPV

- Investment size: $260k ($10k minimum)

- Hold period: 3 – 5 years

- Potential IRR: 35% to 40%

- Fees: 2% management | 20% carry | nominal one-time subscription TBC

What’s the deal

Altea will acquire 50 barrels of 100% agave tequila through this SPV to buy and hold for at least 3 years as the spirits age.

The barrels will be acquired, stored, and disposed of through our network of tequila brokers, private collectors, and exclusive brands in Jalisco, Mexico, over the course of 3 to 5 years.

Funding Status: $482k soft commits (up from $200k last week)

What’s changed since last week

This one has enough interest now that I’ll look to close off commits next week. If you’d still like to get involved, please let me know ASAP.

I’ve added $3k to the capital required so I can be present when the tequila is barreled, and the CRT certifies the casks, adding an extra measure of diligence.

If firm commits come in over $263k, we’ll acquire more than 50 barrels. We get a slight discount on 75 and 100 barrels.

Frank Auerbach Bundle

One Frank Auerbach Charcoal

- Investment size: up to $560k

- Duration: 3 – 10 years

- Potential IRR: 15% to 20%

- Fees: 1.5% management | 20% carry

Through the same London art connection that brought us Art Bundle I, which was oversubscribed by 25% and has returned 19% in three months, we have the opportunity to acquire a unique piece by legendary German/British artist Frank Auerbach.

What’s changed since last week:

This is taking longer than anticipated because the transaction is more complicated than usual (part trade, part cash). The lawyers assure me this will be ready next week.🤞

Upcoming Deals

South Island, New Zealand NRL Expansion

What’s the deal

We’re working with an organization looking to expand NRL rugby to New Zealand. They’re raising a small working capital round of $200k to $300k to finalize the bid (which already has wide support).

What’s changed since last week:

Aiming to have them in on April 16th

SignalRank

What’s the deal

I love this one. SignalRank has produced an algorithm that picks Series B winners not by looking at the company itself but at the relative success of investors in their seed rounds (winners pick winners). They’re smashing traditional VC returns by outsourcing due diligence, running it through a scoring algorithm, and taking on micro-VC follow-on allocation. I’ll have something on this for you in early April.

What’s changed since last week:

No change

Agave Farmland

What’s the deal

After our trip to Mexico, there was significant interest in acquiring cash-flowing agave farmland. We may have found the right opportunity. There are ten hectares of prime roadside land available for around $1.1 million, which is a good price. There’s also room to build a distillery and accommodation for STRs. More to come on this.

What’s changed since last week:

Got some aerial photos

Previous Deals with New Activity

Alts 1

K1s are finally done.

This will be open for additional investment in April once we revise the prospectus, update the site, and finalise Q1 results.

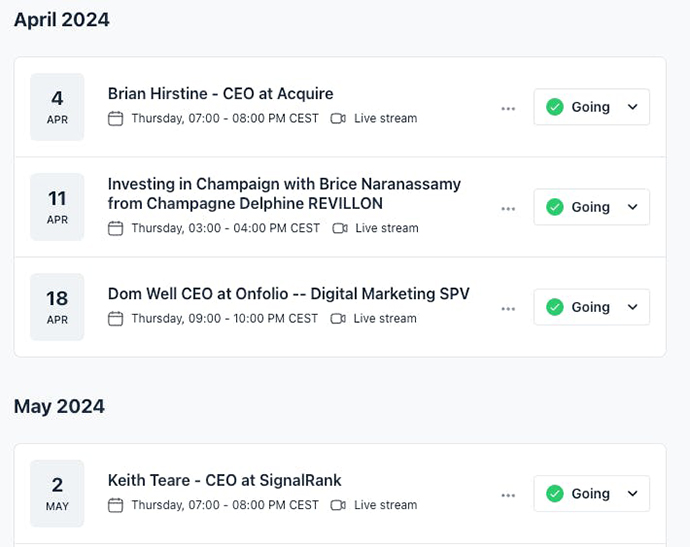

Events

The calendar is filling up. Four deals coming your way.

Investor Field Trips

We’ve locked in Nashville. Get your boots spit-shined and your guitar tuned.

We’ll offer a discount to the first few members who make a deposit. Let me know if you’d like to join.

Nashville

A music-themed investing adventure to Music City, USA.

- Est. dates: October 21 – 25

- Est. cost: $7,000 – $9,000

Why Nashville?

Nashville is the center of music production and publishing.

Its unique blend of historical significance, industry presence, and cultural diversity offers a fertile ground for exploring new investment ideas, and forging lasting partnerships in the music industry and beyond.

While Nashville is known for being the country music capital of the world, its music scene is incredibly diverse, encompassing genres like rock, pop, blues, and hip-hop.

The city is dotted with vibrant live music venues, recording studios, museums housing priceless memorabilia, countless festivals, and deluxe restaurants.

The fast-growing metropolis is also the home to a litany of music tech startups, as well as a booming real estate market.

It’s a city with a friendly business environment, oozing with history, culture, and investment opportunities to explore.

What you’ll do

The trip aims to strike a balance between engaging music-related experiences, investment opportunities, and interesting speakers — with plenty of downtime to relax and explore the city at your leisure.

Focus areas

- Music rights: Nashville has a unique concentration of industry professionals and royalties infrastructure, including legal and financial experts specializing in entertainment law and rights transactions.

- Music technology startups:

- Mozaic offers tools designed to streamline the music production process, including project management, rights administration, and payment tracking

- Artiphon designs and manufactures innovative instruments that cater to the digital age.

- Songfluencer is a marketing firm that specializes in the power of influencers and social media to promote music

- FLO is a social network as a collective of creators, entrepreneurs, and mavericks.

- Music memorabilia:

- Museums: The Country Music Hall of Fame and Museum and the Johnny Cash Museum are great places to see priceless collections.

- Private collections & art galleries: Nashville is home to renowned musicians who collect vintage instruments. Nashville also hosts music memorabilia events and auctions where collectors display and sell pieces from private collections not usually accessible to the public.

- Real estate: The Nashville metro area is among the fastest-growing regions in the US. Lots of good opportunities in multifam, hospitality, and industrial real estate

Other activities

- Live performance: You shouldn’t go to Nashville without seeing a performance at the Grand Ole Opry.

- Music Row: Guided tour of Music Row, the heart of Nashville’s entertainment industry.

- Studio tour: Tour the legendary RCA Studio B, where Elvis recorded.

- Record stores: The vinyl revival is in full swing here.

- BBQ & Bourbon: Nashville is known for its BBQ. And just a few hours from the Kentucky bourbon trail, Nashville has its share of high-quality bourbon distilleries as well.

- Entertainment: Golf Outing at the Grove, Paddle Wheel evening cruise, possibly a Tennessee Titans game

Who you’ll meet

We’re putting together an all-star list of speakers to share their experience and talk through the music investing landscape:

- Music technology startup founders

- Successful music publishers, producers, and songwriters

- Emerging artists

- A&R executives who can share their insights on the business side of music

- Venue owners and booking agents

- Alts community members who live in Nashville

By the end of the trip, you’ll…

- Understand how capital & talent flows through the music industry

- Become an expert in the nuanced world of music rights investing

- Be ready to deploy capital into a piece of music history, a music startup, or Nashville real estate

- Have toured some of the best live music venues in America

- Have eaten your weight in BBQ ribs

- Have lost at least one cowboy hat in a honky-tonk bar

- Be leaving with at least one country song stuck in your head

New Members

Please make sure to say hi to Amy and Dom, both of whom signed up this week.

- Dom runs Onfolio, a publicly traded portfolio of online businesses. He lives in Tapei.

- Amy is a co-founder at RAD Diversified and lives in Florida.

Pop by and make them feel welcome.

Chat

Morgan started a great conversation about a non-alcoholic agave canned cocktail company called Parch. They’re raising a seed round now. Make sure to pop by if FMCG is your thing.

That’s all for this week. Please shout if there’s anything else you’d like included in these updates. Or anything you think can be removed.

Cheers,

Wyatt, Stefan, and John