Table of Contents

Altea this week

Welcome to your weekly distillation of all the best from Altea. Two new deals are coming in hot this week.

Live Deals

Altea Tequila SPV

- Investment size: $10k minimum

- Hold period: 3 – 5 years

- Potential IRR: 35% to 40%

- Fees: 2% management | 20% carry | nominal one-time subscription TBC

What’s the deal

Altea will acquire 50+ barrels of 100% agave tequila through this SPV to buy and hold for at least 3 years as the spirits age.

The barrels will be acquired, stored, and disposed of through our network of tequila brokers, private collectors, and exclusive brands in Jalisco, Mexico, over the course of 3 to 5 years.

Funding Status: $372k firm commits

What’s changed since last week

I’m chasing up final folks today, and then I will get the lawyers started this Monday.

Frank Auerbach Bundle

One Frank Auerbach Charcoal

- Investment size: up to $560k

- Duration: 3 – 10 years

- Potential IRR: 15% to 20%

- Fees: 1.5% management | 20% carry

Through the same London art connection that brought us Art Bundle I, which was oversubscribed by 25% and has returned 19% in three months, we have the opportunity to acquire a unique piece by legendary German/British artist Frank Auerbach.

What’s changed since last week:

This is ready for doc signing and wiring. If you’re investing in this and haven’t had a note about the process, let me know asap.

New Deals

Alf’s Macro Fund

- Strategy: Global Macro

- Target Return/Vol: 10%+ target return / 10-12% annualized vol

- Minimum allocation: $250,000 (less with an Altea SPV)

- Preferential fee structure for early investors

- Initial Offering Period: Summer 2024

- 2022 and 2023 performance: +25% and +11% total return

What’s the deal

If you’re into macro, you probably know Alfonso from the Macro Compass. If not, I encourage you to sign up.

His fund’s thesis revolves around (a) more aggressive use of fiscal deficits and significant demographic shifts in a world with (b) more volatile growth and inflation that will result in (c) abundant macro opportunities.

The minimum investment is chunky, but if there’s enough interest from smaller checks, we can potentially put together an SPV to get you in. [Read how that works and what the fees are]

Digital Marketing SPV

- Investment size: $2.5M ($5k minimum)

- Potential IRR: 20% to 30%

- Quarterly dividends

- Hold period: Long Term

- Exit opportunities: Yearly

- Diversified portfolio

- Fees: 10% share of distributions

What’s the deal

Onfolio Holdings and Onfolio Agency SPV will co-invest to acquire profitable marketing agencies. Onfolio will acquire, hold, and grow agencies that are already profitable. The investors (you) will participate via the SPV, which will make minority investments into the agencies Onfolio acquires. While Onfolio will hold these agencies forever, investors will receive quarterly dividends and can cash out annually if they wish.

🙋 RSVP to Dom’s Q&A session next week.

Previous Deals with New Activity

Alts 1

Q1 results out next week.

Events

Dom is talking about his Digital Marketing SPV next week. Make sure to RSVP.

Investor Field Trips

We should have a page put together for the Nashville trip soon. We’ve already locked in some killer guests and speakers.

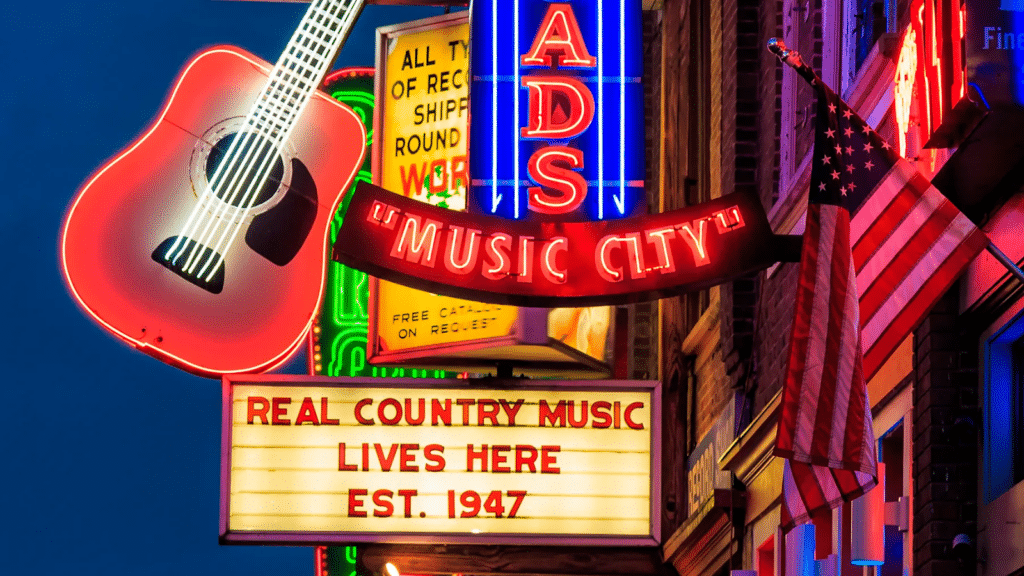

Nashville

A music-themed investing adventure to Music City, USA.

- Est. dates: October 21 – 25

- Est. cost: $7,000 – $9,000

That’s all for this week. Please shout if there’s anything else you’d like included in these updates. Or anything you think can be removed.

Cheers,

Wyatt, Stefan, and John