Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea a month pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

Last month, we featured a high value whisky cask flipping opportunity, and it generated well over $1m interest from the community.

This month, we’re flipping the script and going with Aura — a startup in the mental health space with a super low minimum investment.

But you’ve got to be quick. The campaign closes Friday.

Here’s a promo code for a comped premium plan — exclusive to Alts.co members.

- ALTSCO at http://aurahealth.io/redeem

Let’s get to this month’s Big Deal.

Aura Health – Series A

Mental wellbeing is one of the most fundamental, unmet human needs today.

Already used by 7 million people, Aura is the world’s leading marketplace for mental wellness transforming the $4.8 trillion industry.

Interested? We’ve arranged an exclusive AMA session with founders Steve and Daniel Lee. It will be at 11:30am PST on Wednesday April 26th.

Deal overview

- Investment type: Series A

- Valuation: $60m

- Raising: $5m (oversubscribing but taking additional commitments)

- Minimum Investment: $750

- Campaign closes: Friday April 28th

- Check it out: Funding Page

- Read the SEC filing: Here

TLDR of why I like it

First, mental health is the elephant in the room. It’s still stigmatised, but that’s changing. Making it easy — and anonymous — to get help is an obvious onramp to this $4.8 trillion industry.

Second, the raise is already oversubscribed with investments from the likes of Cowboy Ventures, Reach Capital UC Berkeley SkyDeck, and angels from companies like Spotify, Meta, Strava, Life360, WeWork, and Masterclass. Aura is taking additional investments through next week.

Third, the team has solid traction — over 100k paying members and over 100m minutes spent on the app every year.

Finally, investing in startups right now is hard. There’s a lot of dross out there, and everyone is pulling back on everything. Finding a company that’s already profitable, is serving a massive audience in a growing industry, and is offered at a sensible valuation — that’s special.

How it works

This is a series A investment in Aura Health, which is a startup focussing on remote mental health.

Aura is raising through a Reg CF campaign, which means the minimum is low ($750), and it’s open to anyone — not just accredited investors.

Reg CF campaigns usually come with perks, and this one is no different. The more you invest, the more bonus shares you get.

Check out the Aura investment page.

What I like

Grace, my wife, is a trained psychotherapist, and so this is a topic I’m familiar with and a need I’m super aware of.

And as a dad who has sometimes struggled to be my best with three small boys, I’ve got firsthand experience with just how important it is to look after my own mental health. If I’m low, angry, tired, or short-tempered, I’m not going to be a great dad (or husband).

Opportunity size

And I’m not alone. The total addressable market for a company serving the mental health space is immense.

Aura quotes $4.8 trillion, which sounds like a helluva big number, but consider this. According to the American Center for Disease Control:

- More than 50% of Americans will be diagnosed with a mental illness or disorder at some point in their lifetime.

- 1 in 5 Americans will experience a mental illness in a given year.

- 1 in 5 children, either currently or at some point during their life, have had a seriously debilitating mental illness.

- 1 in 25 Americans lives with a serious mental illness, such as schizophrenia, bipolar disorder, or major depression.

And America isn’t unique: the numbers in Canada, the UK, Spain, and Mexico are similar. I stopped googling after those four countries, but I’d be surprised if these stats aren’t global.

And people are starting recognise the problem.

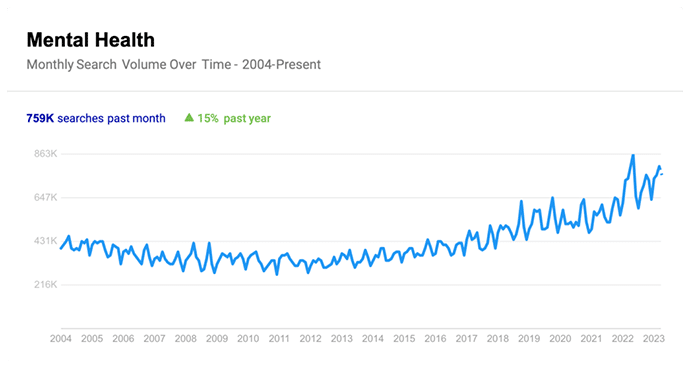

The increased focus on mental health is a trend that began ten years ago, but Covid and remote work have accelerated the industry. Search volume is up 15% year over year, and I expect the trend to continue.

Growth potential

Speaking of remote work, corporates are desperate to figure out how to (a) offer benefits employees care about and (b) keep distant employees healthy (and productive).

Some more stats for ya. Among HR professionals in the US:

- 88% believe offering mental health resources can boost productivity.

- 78% said those options can increase the organisational return on investment.

- 86% said the benefits can increase employee retention.

Among employees themselves, “35% believe mental health benefits are more important than salary or higher pay.”

If you download the Aura app (iOS , Android) and go through the onboarding flow, you’ll notice a questionnaire that specifically aims to get users to request Aura as a benefit at work. The team has identified the opportunity and are pursuing it aggressively.

Aura is already at 7m users, and there’s plenty of room to run here.

Profitability

Speaking of growth, despite increasing Aura’s user base significantly in 2022, I was super surprised to learn the company was profitable last year.

With $7m ARR, Aura has got to be one of the only consumer apps raising a Series A from this position of strength.

The team obviously read the economy quickly and nimbly shifted from outright growth phase to a focus on cash flow. It’s a good sign, and is something I’d expect from second-time founders like the Lee brothers.

Valuation

Given Aura’s profitability, I expected to see a premium valuation relative to other companies in the space.

But that’s not really the case. To see why, let’s look at the current Series A landscape for wellness companies like Aura.

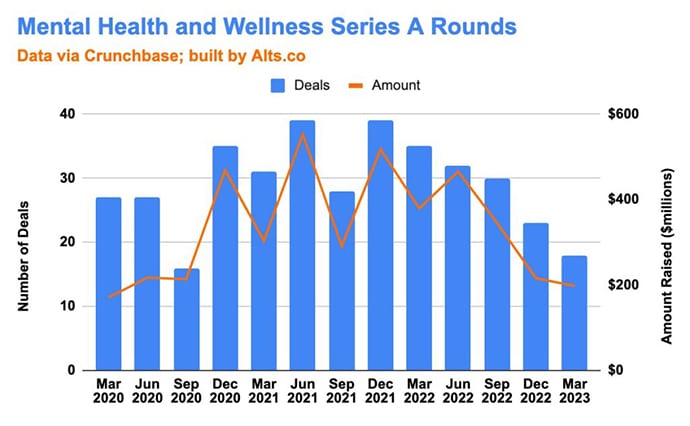

Like every industry not called “AI,” the number of Series A raises in the wellness industry peaked in late 2021 and has declined every quarter since then. No surprises or alarm bells there, and actually wellness companies have fared slightly better than the rest of the startups market (off 60% peak to trough relative to 70%).

It’s tricky to back into cohort valuations, because companies don’t always disclose that figure, but we can make some guesses along two fronts.

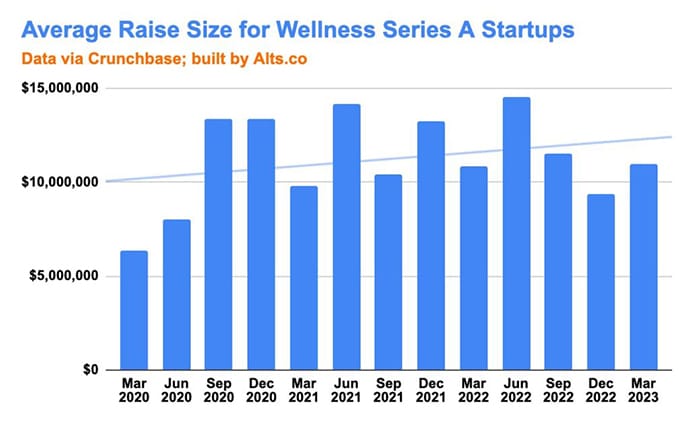

First, based on average raise size (chart below), most wellness startups are raising around $10m at series A. Assuming a standard 20% dilution, that gives us a $50m post money valuation.

Second, from what I’m seeing in the market right now, 8x to 10x multiples of ARR are sort of the sweet spot at Series A. Given Aura’s $7m ARR last year, that puts them at between $56m and $70m.

So those data points tell me (roughly) that Aura’s $60m post-money valuation is in the right ballpark — even a bit low given their profitability.

Calm (more on them below) raised at a $2B valuation at the end of 2020. Headspace, another competitor, was valued at $3B in summer 2021. And while neither would ever get that sort of valuation now, it does demonstrate there’s plenty of room for Aura to run.

Capital efficiency

I mentioned up top that Aura is raising $5m this round (and is oversubscribed). That’s around half what their peers are raising right now, which is a good sign.

Because Aura is profitable (and has figured out its unit economics), they can accelerate through this growth phase and onto a Series B with half as much money as the rest of the pack. That says a lot about the team’s capital efficiency — super important during a down economy.

How does Aura make money?

Aura monetises its 7m strong community in a two ways.

Paid subscriptions

The annual plan is $60 per year, and of the 7m members, 100k have opted to pay. Some percent have opted for the more expensive family plan as well.

Coaching sessions

Many content creators also offer private coaching sessions, which mostly range in the $50 to $150 per month range. Aura keeps 20% here.

Because the private coaching sessions are new, most of Aura’s projected $14m ARR for 2023 comes from paid subscriptions.

Gross margins are solid at 70%, which leaves a lot of money for user acquisition.

The risks

The economy is bad and getting worse

There’s no getting around it. It’s a tough market right now. The economy is brutal, and it’s probably going to get worse before it gets better. That goes double for Aura’s target market, which is currently white collar Americans — they’re the ones getting laid off first.

Here’s how Steve responded to this challenge:

- Our churn hasn’t increased due to the economy

- We’re, at the moment, targeting more affluent families who are less impacted by the economy. And at a low enough price point ($60/year), it’s something people are willing to prioritise while cutting costs.

The competition

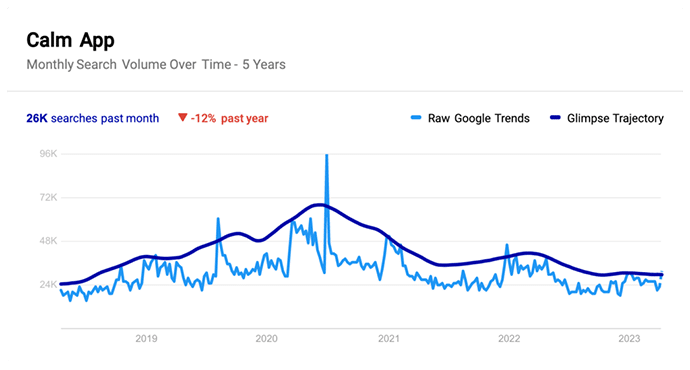

It’s a crowded market. The household name among wellness apps is Calm, which focusses on meditation, sleep, and anxiety. The meditation giant has well over 100m downloads.

I asked Aura’s CEO, Steve Lee, how they’re going to win:

“We are in a crowded space (e.g. consumer mental wellness) with big competitors – but we believe we have a far superior product and business model that allows us to scale. What Uber and Airbnb did through the marketplace model, we’re doing the same thing in mental wellness.”

The incumbents “provide one-size-fits-all libraries created by just a few coaches. You’re stuck learning from the same people.”

“Aura is a marketplace that partners with hundreds of coaches & therapists worldwide and brings their expertise to anyone. We have a 10-100x bigger content library across any mental wellness vertical, not just meditation, and our coaches offer live events & 1-1 coaching on our platform. What Spotify did to music, Uber did to transportation, Airbnb did to hospitality, we’re doing in mental wellness.”

For what it’s worth, I believe him. The fact they’ve got the marketplace side of things figured out — that they’re already past the chicken and egg stage — isn’t trivial. That’s a hard problem to solve.

The marketplace element gives Aura a sizeable unpaid salesforce — all the coaches and content creators. Every single one of them has an incentive to spread the word about the app. The platform’s biggest earners pull in over $100k a year — significant motivation to get more members on the app.

One last comment from me here. If I were an exec at Calm, I’d be worried.

Search volume for the app has declined 12% year over year while interest in wellness was up 15% and search volume for their wheelhouse — meditation – was flat.

I think they’re vulnerable.

How to invest

The round is open until April 28th, and you can invest with a minimum of $750 (though remember you get bonus shares if you invest more).

Still have questions? We’ve arranged an exclusive AMA session with founders Steve and Daniel Lee. It will be at 11:30am PST on Wednesday April 26th.

That’s it for May.

If you have a deal you think we should share with our 70k members, please get in touch.

See you in June 🚀

Disclosures

- Aura is an Alts sponsor; this was a paid deep dive.

- We have not invested in Aura through ALTS 1, nor do we have any personal vested interest in the company.