Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea a month pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

Last month, we featured a mental health startup revolutionising wellness.

This month, we’re going industrial with a deep dive into LiquidPiston, a company reimagining a much-maligned piece of tech that’s largely unchanged since the 1800s — the internal combustion engine (ICE).

Let’s get to this month’s Big Deal

LiquidPiston

LiquidPiston reinvented the internal combustion engine from the ground up making it far more efficient, powerful, and clean than anything currently on the market. It can run on any type of liquid fuel including hydrogen and other sustainable cleaner options.

They’re raising an equity round

Interested? Check out the investment details below.

Deal overview

- Investment type: Equity

- Valuation: $184m

- Raising: $30m

- Minimum Investment: $1,000

- Campaign closes: XXX

- Check it out: Funding Page

- Read the SEC filing: Here

TLDR of why I like it

There’s a lot to like here:

- Genuinely huge problem to solve

- Massive addressable market

- Simple patented technology

- Limited downside

Read on to judge for yourself.

What’s the investment?

This is an equity investment in LiquidPiston, which is a tech company building out a reimagined internal combustion engine.

LiquidPiston is raising through a Reg A campaign, which means the minimum is low ($1,000), and it’s open to anyone — not just accredited investors.

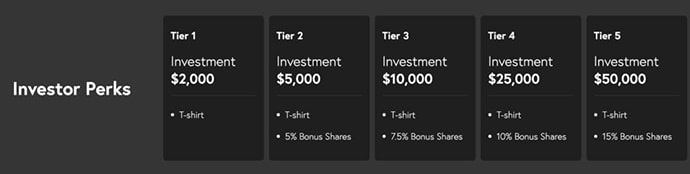

Reg A campaigns usually come with perks, and this one is no different. The more you invest, the more bonus shares you get.

Check out the LiquidPiston Investment Page.

What I like

Before we dig into the economics of this thing, we need to understand what LiquidPiston makes and the problem it’s solving.

The Problem

Transportation consumes nearly 30% of fossil fuels globally, and while the internal combustion engine was invented in the 18th century, it hasn’t changed very much since then.

Despite improvements in fuel efficiency and emissions reduction, the same Diesel and Otto (gasoline) thermodynamic cycles are still used today that were first wheeled out 200+ years ago.

They’re inefficient, big, and spout out tonnes of CO2 and other environmentally harmful emissions. Tim Urban did a fantastic breakdown of the ICE problem several years ago.

The LiquidPiston Solution

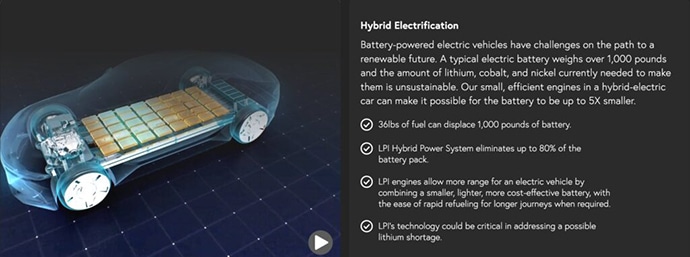

The team at LiquidPiston have built a new type of ICE that’s smaller, more efficient, and can run on any type of liquid fuel. It’s also demonstrated it can run on gaseous fuels like propane and hydrogen.

Here’s how it works.

I’m not going to pretend to understand the mechanics behind the engine, but here’s the upshot:

- There are only two primary moving parts

- It’s up to 5 times smaller and lighter than comparably-powered piston engines

- It’s up to 30% more fuel-efficient than piston diesel engines

- As a result, it’s a much better partner in a hybrid-electric configuration

Because it has fewer moving parts and less metal, it’s cheaper and operationally simpler than comparable engines as well.

Opportunity size

It’s obvious to me there’s a lot of money in engines. Everything mechanical needs one.

But just how big is the market? It’s $400 billion big.

To validate this, I looked at some publicly traded companies that are in the same business, more or less.

- Daihatsu Diesel Mfg (6023.T): Market cap $20 billion

- Westport Fuel Systems (WPRT): Market cap $121 million

- Workhorse Group (WKHS): Market cap $158 million

- Ricardo plc (RCDO.L): Market cap $357 million

- Cummings (CMI): Market cap $31 billion

The aspiration here is to disrupt Daihatsu and Cummings taking significant market share from the legacy incumbents. A lofty goal, but it’s proof the market is big enough.

There’s also a big market for the LiquidPiston engines beyond automobiles, which is where I think most people mentally go when you talk about engines.

The US Government. They’ve secured a number of contracts ($30 million worth) with the US Defense Department, and the applications there are numerous. From drones to UAVs to portable generators, the military consumes a lot of energy and is consistently looking to improve its capabilities.

Urban air mobility. We’ve talked about air taxis before, and while they may seem like niche sci fi stuff from the Jetsons, widespread use is closer than you think.

Disaster response. When there’s a hurricane in Haiti or a tsunami in Tokyo, first responders and relief workers can’t rely on solar power or the grid. Gensets powered by LiquidPiston engines promise to be lighter and more transportable than anything currently on the market.

But cars are the bulk of the market here, and it’s not unreasonable to wonder how big a role an internal combustion engine — regardless of how small and efficient it is — can play when the world is moving toward electric vehicles.

The company has two answers to that.

From Per Suneby, VP of Corporate Development at LiquidPiston:

First, as user, vehicle manufacturers, and infrastructure trends are proving out, a significant percentage of vehicles are and will be hybrid electric – ie, use fuel as stored energy and use a fuel-burning engine to drive a generator to charge the on-board batteries which in turn power the electric motors.

This hybrid approach relieves range anxiety because extensive charging station buildout to cover close to 100% of any country is going to take decades. Plus, depending on where you are, the grid may not have the capacity or yet benefit sufficiently from cleaner electric power generation.

For these and other reasons, LiquidPiston is betting that demand for hybrid electric vehicles will accelerate along with BEVS as increasing volume and various government incentives drive down the cost of electric and partially electric vehicles and key components like batteries. Hybrid electric vehicles can use much smaller batteries which reduces weight and cost.

Second, the LiquidPiston engines can run on liquid or compressed hydrogen as well as various biofuels. these can all be produced sustainably via biodegesters or solar-powered hydrolysis of water.

Toyota recently showcased the first liquid-hydrogen fuelled race car in Japan, and why mass production is a way off, the technology and demand is there.

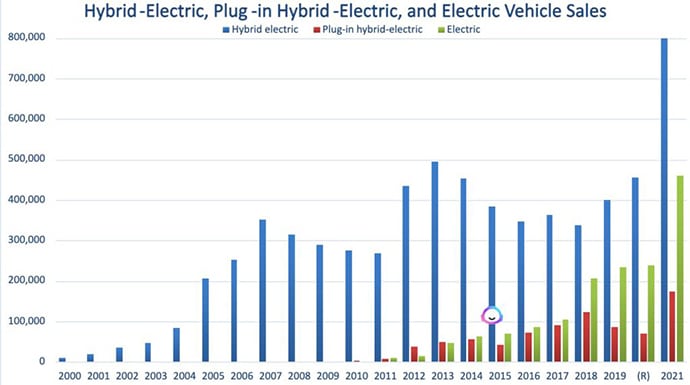

For what it’s worth, the hybrid opportunity feels bigger to me. It’s already a well-known consumer product, and despite all the hype EVs have been getting, hybrid sales continue to increase in the US.

There’s plenty of demand to soak up a lot of these engines.

Growth potential

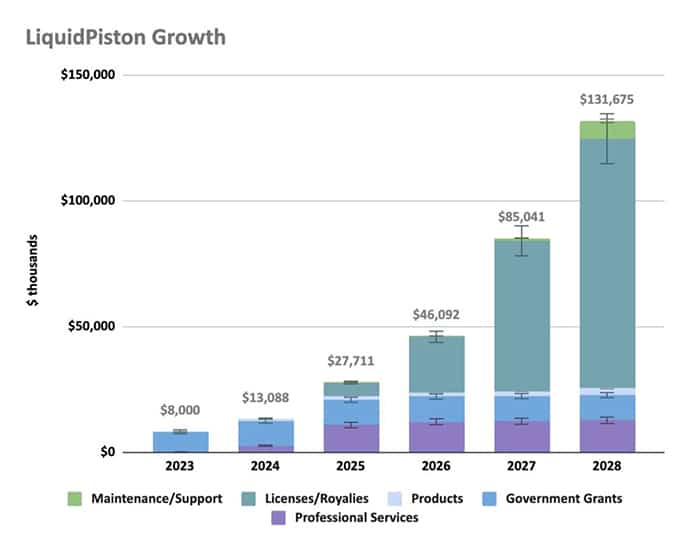

LiquidPiston, like any good tech company, has ambitious growth plans. Their strategy goes something like this:

- Use government contracts and grants to fund R&D, industrialisation and commercial introduction through 2025.

- Licence their engine technology to vehicle / generator / etc original equipment manufacturers (OEMs) for broad-based market coverage and high margin revenue.

It’s a simple but sensible growth strategy that becomes exceptionally capital efficient by 2025 or so. EBITDA margins are forecast at a slim (but profitable) 6% in 2023 but grow to 76% by 2028 when licensing comprises 75% of revenue.

Valuation

And that presents a completely different valuation profile to e.g. Cummings, which returns an EBITDA margin of 13.5% and a P/E multiple of 12.5x.

Cummings trades around 1x revenue, whereas I’d (wildly) guess a more mature LiquidPiston would command 15x to 20x revenue in 2028 based on a P/E of 30x to 40x and 50%+ annual growth.

That puts the company’s valuation between $3 billion and $4 billion in 2028, which is a sensible potential exit date.

The risks

Auto manufacturers are moving to electronic vehicles

First, escalating tensions between China and the west (see IP theft, above) present possibly the biggest tailwind for LiquidPiston, because the majority of rare earth metals processing happens in China. That puts pressure on the supply of batteries for electric vehicles, which will drive demand for a hybrid electric solution for which the LiquidPiston engine is well-suited.

Should those tensions soften, or should capacity be built on friendlier shores, that will dampen demand for their reimagined internal combustion engine.

Second, the company is relying on government contracts and grants to fund its R&D for the next few years. If those programmes are cut or the funds are allocated elsewhere, LiquidPiston will have to raise another equity round, take on more debt, or slow development.

While those aren’t the only possible headwinds, they’re the two that stick out the most to me.

While neither of them drive the company’s value to zero — there’s still value in the tech they’ve built out — either one could reduce LiquidPiston’s exit valuation by perhaps 90%.

The competition

LiquidPiston currently holds 82 patents based on their engine, and no one else is building an engine quite like this right now. Which isn’t to say someone else couldn’t build another super efficient lightweight internal combustion engine.

But the real threat is electric vehicles that don’t need a liquid fuel component – if battery technology can become 40x 50x more energy dense and we can achieve a ubiquitous clean grid at some point in the future. How you feel about this company depends a lot on how you feel about the likely outcomes there.

Hardware is hard

I don’t usually like investing in hardware, because the iteration cycle is so long.

But that’s mitigated significantly by how simple this piece of kit is. It’s only got two primary moving parts, and those parts have been proved out already.

It’s also easy for foreign companies to steal hardware and produce it more cheaply.

Again, though, I don’t think this is a problem with LiquidPiston. It’s backed by patents, and its biggest customers won’t be the kinds of organisations that buy cheap knock off tech. They’re global behemoths like the US government and automakers.

How to invest

The round is open now, and you can invest with a minimum of $1,000 (though remember you get bonus shares if you invest more).

That’s it for this week.

If you have a deal you think we should share with our 95k members, please get in touch.

See you on the beaches

Disclosures

- DealMaker is an Alts sponsor; this was a paid deep dive.

- We have not invested in LiquidPiston through ALTS 1, nor do we have any personal vested interest in the company.