Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- The USG didn’t shut down (yet)

- Few bright spots in Real Estate, but the AI boom is helping

- Cracks are forming in one for the first AI unicorns

- Private debt is on a tear

- Two more big crypto thefts

Like these emails? Support our sponsors!

Wyatt

Table of Contents

Macro View

The market threw up all over itself in anticipation of a shutdown that didn’t happen (yet).

Bullish News

- Against all odds, the US government didn’t shut down over the weekend. The continuing resolution gives Congress 45 days to work things out.

- And betting markets think there’s a 45% chance it’ll shut down then.

Bearish News

- Small biz bankruptcies are on the rise.

- Twitter is cutting half its election integrity team ahead of the US presidential elections next year. Chaos is bad for everyone’s business.

- More bad news for consumers and those who service them:

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📈

81%

Chance of Fed hikes rates in November

📈

77%

Chance mortgage defaults will rise in Q3

📉

2.32%

National average house price increase in 2023

Kalshi markets are forecasting a 45% chance the USG shuts down at the next possible opportunity — in mid-November.

What are we doing?

ALTS 1 Fund news:

No change

Real Estate

Bullish News

- The AI boom is bringing a few folks back to the office in SF.

Bearish News

- Sales of newly built homes decreased 8.7% last month, well below expectations of a 2.2% decline.

- Overall US housing starts were down 14.8% in August.

- And multifamily units were down 44% YoY.

- Single-family rental growth fell to a three-year low in July.

- But St Louis fell the most, rising over 7% YoY.

- Things keep getting worse for China’s Evergrande.

- Fitch is forecasting hotel revenue to decline in 2024.

- The rent-stabilised multi-family market in NYC is so bad developers are taking 44% haircuts to unload the properties.

- Now Atlanta’s office market is in trouble.

How to invest in real estate right now:

avoid

Startups

Bullish News

- Competition for top AI startups is so hot VCs are leveraging relationships with chip providers to get on the cap table.

- Apple’s Jony Ive may be teaming up with OpenAI to build a phone (or other piece of hardware or nothing at all).

- Meanwhile OpenAI is set for a $90 billion valuation.

- Spacetech startups are thriving in countries like India, Japan, Saudi Arabia and the UAE.

- Amazon is investing $1.25 billion in AI startup Anthropic, with the option to increase the investment to $4 billion. The move pits Amazon against other tech giants like Microsoft and Google in the competitive AI field. via SuperPower Daily

Bearish News

- Jasper, an AI company that raised at a $1.5 billion valuation in June, has cut its valuation by 20%.

- 11% of 2023 fundraises have been down rounds, the highest since 2020.

- But down rounds hit 36% in 2008 and 59% in 2002.

- Enterprise SAAS deals are down 55% YoY.

- And if you remove Stripe and OpenAI, and it looks much worse.

- Both a16z and Sequoia lost ±75% on their late-stage investments in Instacart. They each invested $50 million at a $39 billion valuation.

How to invest in startups right now:

avoid secondaries

PE & Private Credit

Bullish News

- Private debt fundraising has overtaken VC and is second only to PE among private market strategies.

- And the sector is on pace to raise more than $200 billion in new capital for the fourth year in a row.

- 80% of PE funds are targeting investments in the $730 billion fashion and luxury industry.

Bearish News

- Billions of dollars are locked in zombie PE funds.

- Just five distressed debt funds have closed so far this year, a big drop from last year’s pace.

How to invest in PE and Private Credit right now:

Wait, probably.

Crypto & NFTs

Here’s what you need to know:

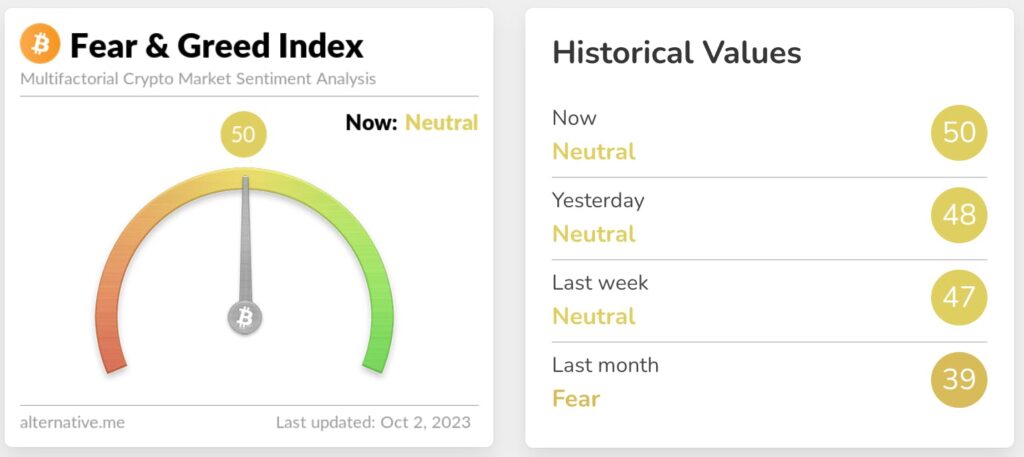

Crypto smashed it last week.

And confidence rose to boot.

Even NFTs were up.

Bullish News

Bearish News

- Less than a month after Ripple said it had agreed to acquire custodian Fortress Trust, the crypto company is backing out of the deal.

- JPMorgan’s British retail bank Chase will ban crypto transactions.

- Hackers stole around $200 million from crypto firm Mixin.

- And DPRK hackers stole $70 million from CoinEx.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Thanks for reading.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Strategic Metals Invest and Cortex Technology Capital.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple bucks.