Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- Financial Nihilism: Why Kids Love Crypto

- Rent Plummets In Austin

- Rolex Is Still King

- Small Business Thrives In Tokyo?

- AmexGBT’s $570 Million Acquisition of CWT

- Reddit’s IPO: Sitting On An AI Goldmine?

- 3 Stocks To Consider

Thanks for reading.

Wyatt

Table of Contents

Financial Nihilism: Why Kids Love Crypto

Desperate times call for desperate measures, and those measures are meme stocks.

Travis Kling’s “Financial Nihilism” explores the link between escalating living costs and the younger generation’s increased willingness to take risks for financial freedom, a trend he believes is only beginning.

Dive into Kling’s full analysis.

Rent Plummets as Construction Booms

“Landlords are offering weeks of free rent and other concessions to fill empty units. More single-family homes are selling at a loss.”

Despite rising shelter inflation nationwide, rents in Austin are dropping due to a surge in new apartment construction. With over 50,000 new rental units recently completed or under construction, tenants have gained leverage in lease pricing.

Great news if you want to move to Austin, but does the correlation hold true for other areas?

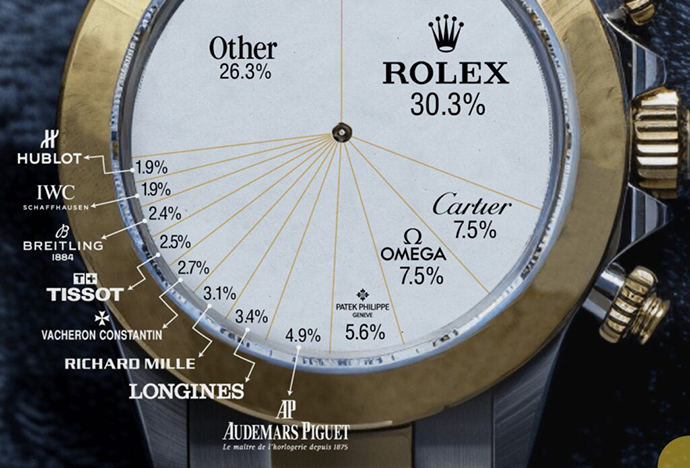

Rolex Dominates

The Swiss watch industry achieved record sales totaling $30 billion, with the “Big Four” brands—Rolex, Patek Philippe, Audemars Piguet, and Richard Mille—achieving a combined 43.9% market share.

Rolex solidified its dominant position, capturing 30.3% of the Swiss watch retail market.

Sales for the brand have surpassed $11.2 billion for the first time, significantly outpacing rivals like Cartier and Omega.

Tokyo’s Small Business Success Story

Tokyo has over 160,000 restaurants, more than 6 times that of NYC and 12 times that of Paris per capita. What’s more surprising than this sheer quantity, however, is how many of these restaurants are independently owned and operated.

What explains this thriving small business ecosystem?

- An array of Japanese policies to support small retail

- Small business associations to preserve iconic spaces

- “Pocket” neighborhoods accidentally created as firebreaks

How can other cities replicate Tokyo’s success?

AmexGBT’s $570 Million Acquisition of CWT

American Express Global Business Travel is acquiring rival CWT for $570 million, a major consolidation in the travel industry driven by the need for scale and advanced digital tools.

The acquisition reflects both the pressure to compete with online travel agents (OTAs) and AmexGBT’s confidence in the post-pandemic rebound of business travel, despite industry forecasts suggesting a return to pre-pandemic spending levels by 2024.

Credit Card Hackers Rejoice?

Reddit’s IPO: Sitting On A Goldmine?

On its trading debut, Reddit’s shares soared 48% above their offering price, despite monetizing its daily active users at only a fraction of Meta’s rate ($3.42 at Reddit compared to $12+ at Meta).

Advertising, however, is not Reddit’s long game: Its topic-focused structure has become a valuable reservoir for training AI models — an advantage clearly recognized in its $60 million deal with Google.

Read more about the numbers driving Reddit’s IPO

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

An easy, fast, and simple-to-read breakdown of complex financial topics for the financially curious investor.

Dedicated coverage for the must-know stories, with emphasis on the private market.

Daily trading ideas, strategies, and alerts from trading veteran Jeff Bishop.

Stock ideas

Here are my three favorite stocks from this past week.

Analysis provided by public.com. Remember to always DYOR.

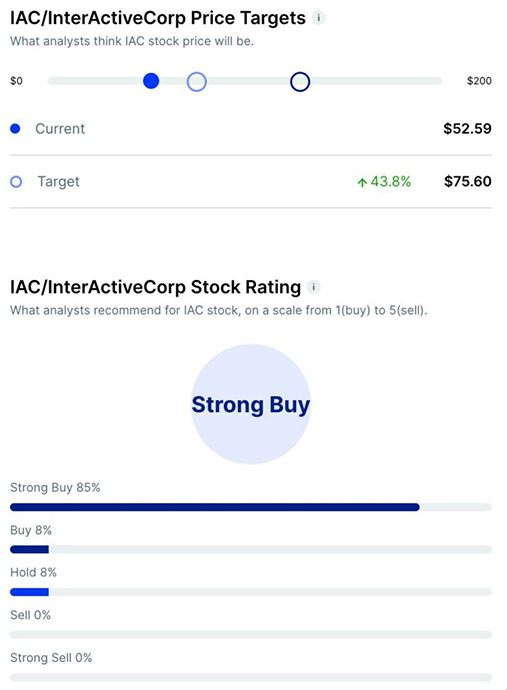

InterActiveCorp ($IAC)

Bull Case:

- Diversified Portfolio: IAC’s diversified portfolio spans online media, home services, and car sharing, reducing reliance on any single business.

- Stake in MGM Resorts: IAC’s 19.8% stake in MGM Resorts, valued at $2.9 billion, covers over half of IAC’s market cap.

- ANGI Homeservices Turnaround: ANGI is restructuring, with expected adjusted EBITDA of $120-150 million for 2024.

Bear Case:

- Undervalued Assets: The market assigns a negative value to IAC’s private assets, estimated to be worth $3.5 billion.

- Dotdash Meredith Integration Challenges: The acquisition of Meredith into Dotdash has led to lower-than-expected EBITDA and a scrapped business plan.

- Growth Slowdown: Key assets, such as Turo and Vivian Health, have experienced a slowdown in revenue growth.

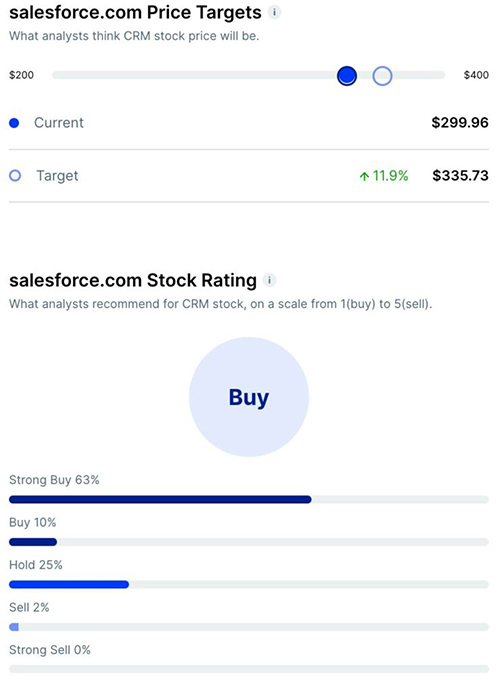

Salesforce ($CRM)

Bull Case:

- Strong Growth Potential: Salesforce’s new UE+ bundles are resonating with customers, expected to drive higher starting prices on renewals.

- Generative AI: Salesforce’s GenAI products are progressing rapidly with strong customer pilot interest.

- Improving Outlook: Salesforce is seeing public sector strength, and service growth is expected to accelerate.

Bear Case:

- Customer Caution: Over the past 12-18 months, clients have been breaking projects into smaller chunks, slowing growth.

- Post-COVID Softness in Marketing Cloud: Salesforce’s marketing cloud has been weak following strong retail performance during the pandemic.

- Competition in Health Cloud: Salesforce’s health cloud faces competition from established players, potentially limiting adoption.

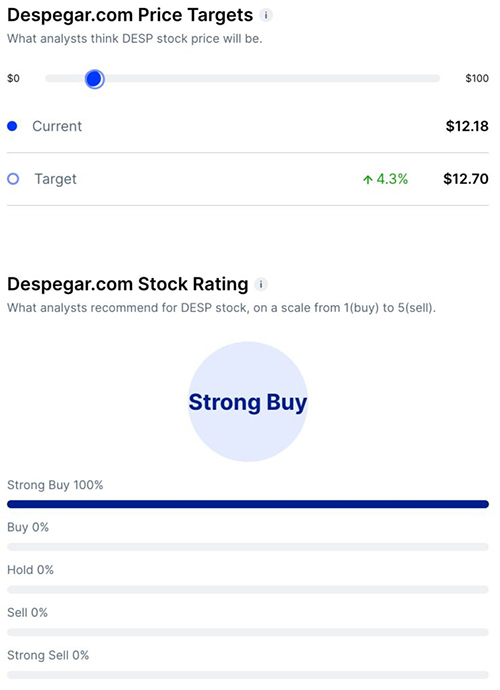

Despegar ($DESP)

Bull Case:

- Fragmented LatAm Travel Market: Despegar’s <5% market share in the ~$150 billion LatAm travel market presents significant room for expansion.

- Improving Profitability: Despegar’s shift towards higher-margin packages should continue to improve profitability.

- Untapped Opportunities: Despegar’s early-stage vacation rental listings and high-growth financial services revenue offer avenues for expansion.

Bear Case:

- Investor Neglect: As a small-cap stock trading below its IPO price, Despegar may struggle to attract institutional investors.

- Macro Risks: Operating in LatAm exposes Despegar to an emerging market discount due to macro and FX volatility.

- Capital Structure: Despegar’s complicated capital structure and volatile profitability may deter investors.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.