Welcome to The WC.

Five useful and interesting things others aren’t talking about, dropped in your inbox every Wednesday.

Thanks for the kind words after last week’s issue. It means a lot.

We’re always looking for new fans. If you like what you read here, forward it on.

Wyatt

Table of Contents

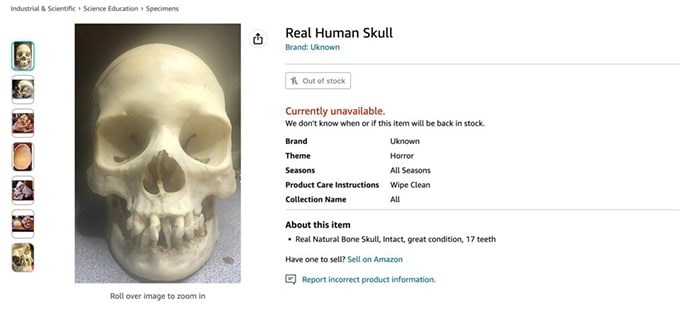

The bloody market for human remains

The gory news that Harvard’s morgue manager was caught stealing then selling human remains got me thinking.

If you somehow missed the macabre news:

Cedric Lodge, 55, of Goffstown, New Hampshire, stole dissected portions of cadavers that were donated to the school in the scheme that stretched from 2018 to early 2023.

Lodge sometimes took the body parts — which included heads, brains, skin and bones — back to his home where he lived with his wife, Denise, 63, and some remains were sent to buyers through the mail, authorities said. Lodge also allegedly allowed buyers to come to the morgue to pick what remains they wanted to buy.

There’s a small but thriving market for human remains, which aren’t actually regulated that closely!

Incredibly, there are no specific federal laws prohibiting the sale of human remains, and only a few states outlaw the practice.

So just how lucrative is it?

According to the Death Investigation Training Academy, here’s what you’d fetch for viable human organs on the black market:

- Kidney: $90k to $200k

- Liver: $157k

- Lung (each): $120k

- Heart: $57k to $119k

- Corneas: $30k

Nonviable parts are worth less:

- Head: $1,000

- Face (yes): $600

- Skin: $10 per square inch (seems low?!)

Altogether, a fully viable recently deceased human body goes for between $500k and $1 million.

“Scientists” are working out how to 3D-print organs to cash in on this market. With a human heart worth 3x its weight in gold, I’m surprised horrific body harvesting stories aren’t more prevalent.

Are you an accredited investor or qualified purchaser?

A lot of investment opportunities cross my desk every week, and many of them aren’t always a great fit for the broad Alts community. Usually because minimums are high and LPs have to be accredited investors or qualified purchasers.

If you’d like to get some of these in your inbox, fill out this quick form certifying your investment status.

I’ll pass along the good stuff.

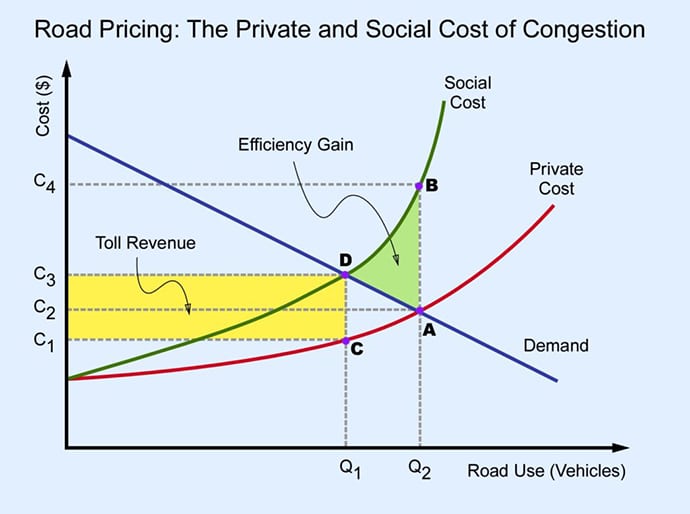

Driving in New York

New York is set to join London, Stockholm, Milan, and other global leaders next year as it imposes downtown congestion pricing.

Cars that pass through the city’s central business district must pay a toll of somewhere between $9 and $23 (the fees aren’t fixed yet.)

Taxis will only pay once a day, and nighttime fees will be halved. The aim is to reduce the number of cars and traffic while generating funds for the city.

The need for this has been recognized for well over 100 years, and several proposals have been put forward in the 21st century, but this is the furthest the idea’s got.

The economics of congestion pricing is fairly straightforward.

One factor to bear in mind if this comes into effect — because people who live in the congestion zone are exempt from the fee, home prices there will go up slightly.

If the saving is around $5k per year, you might see prices go up by 5x to 15x that amount.

Rent will go up as well.

There are lots of other externalities, like busier roads elsewhere, increased taxi fares, pricier parking outside the zone, and so forth.

I battled the London congestion charge for about five years, and you just sort of get used to it — but you’d never drive downtown during the daytime.

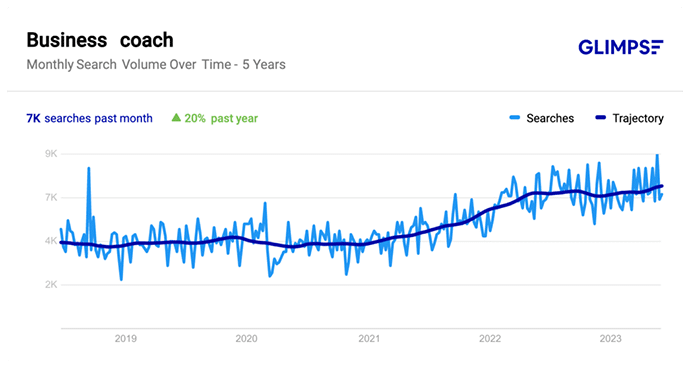

The business of business coaching

I’ve been helping a friend sort some things out in her life with a focus on the business she’s launching. It’s sort of half being a friend, half therapist, and half business coach. (I’m bad at maths)

It’s something I like doing and would potentially like to do more, and there’s obviously a market for it — estimates range between $10 billion and $20 billion per year in the US for business coaching. And the need for it is growing.

Every business coaching website, webinar, Facebook group and Twitter account feels scammy though. It’s like if $300 per hour therapists tried to sell you a webinar or $197 masterclass first.

How do people with legit needs (and ability to pay) find legitimately good coaches to help them?

Are you a (non-scammy) business coach? Have you used one?

Where’s the marketplace for top-tier coaches that aren’t just trying to make a buck?

Dunking on Binance

I’ve been dunking on Binance a lot lately in Alts Cafe (sign up here!), and I feel very smug that our fund, ALTS 1, pulled our bitcoin and ethereum off the platform months ago.

If you like car crashes and want to know more about just how screwed they are, check out this Twitter thread.

I really didn't want to do a Tweet thread on the @SECGov suit against @binance, but then I read it and…

— Compound248 💰 (@compound248) June 5, 2023

…it's absolutely FULL of GEMS. I can't not do it.

Example – Binance CCO in 2018:

"we are operating as a fking unlicensed securities exchange in the USA bro."😱😂

🧵👇 pic.twitter.com/8bkCMRvTqb

Bonus Section!

This got great feedback last week. If people continue to find it helpful, I’ll continue. If not, I’ll blow it up faster than three young kids has exploded my waistline.

What I’m reading

Not investing related, but a stunning read – A Heart that Works by the hilarious Rob Delaney.

What I’m listening to

Kate Bush’s Running Up that Hill has just passed 1 billion downloads thanks to Stranger Things (and her own brilliance)

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by Masterworks and Techvestor

- Our ALTS 1 Fund has no holdings in any companies mentioned in this issue

- I own no human remains, and don’t know anyone who does (I hope)