Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

Table of Contents

The Fading Allure of Macro Hedge Funds

Macro Hedge Funds, once effective diversifiers for traditional stock/bond portfolios, have seen their true alpha decline sharply over the past 15 years, according to recent studies.

While they have the potential to excel in bear markets, the diminishing returns of macro strategies prompt investors to question their value in portfolios.

Brazil: The Future of Fintech?

Brazil is emerging as a global fintech powerhouse, with instant payments infrastructure (Pix), innovative companies like Nubank, and a supportive regulatory environment.

Overcoming historical challenges, Brazil has produced 17 unicorns, propelling it to the forefront of the fintech revolution and offering valuable lessons for the rest of the world.

Read the full analysis on Brazil’s fintech ascent.

10 Tips for Working with Gen Z

“They don’t care that you have 20 years more experience than they do. In fact, they think it’s lame that you’re 20 years past them and you still don’t know how to sign a PDF on your computer.”

Michael Girdley

Gen Z has grown up with instant access to information, shaping their expectations for efficiency and practicality in the workplace. Likewise, they deeply value autonomy and being compensated for their results, rather than seniority or experience.

Overall, Gen Z is the most tech-savvy, socially aware generation to enter the workforce, but managing them comes with unique challenges. Girdley’s tips are an excellent foundation for learning this crucial modern skill.

The Big Four’s Ironclad Grip on S&P 500 Audits

The Big Four accounting firms—PwC, EY, Deloitte, and KPMG—dominate the S&P 500 auditing landscape, collectively earning $5.3 billion in audit fees in 2022. PwC leads the pack with a 35.7% market share, followed by EY at 27.6%, Deloitte at 22.7%, and KPMG trailing at 13.7%.

The manufacturing and finance sectors account for the lion’s share of audit fees, comprising nearly 69% of the total paid by the index.

Dive into the details of the Big Four’s audit dominance.

General Electric Splits into Three Separate Companies

After 131 years, General Electric has split into three separate entities: GE Vernova, GE Aerospace, and GE Healthcare Technologies.

CEO Larry Culp’s turnaround strategy involved selling off assets to pay down $100 billion of debt, followed by breaking up the company. The GE name, though still seen on appliances, was sold off to Chinese company Haier in 2016.

Read the full story on the end of an era at GE.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

2-minute rundowns of exciting startups every Monday morning.

Weekly strategies to build multi-generational wealth simply and safely.

Aussie-focussed market news that gives a solid non-US perspective on global finance.

Stock ideas

Here are three of my favourite stocks from this past week.

Analysis provided by public.com.

Remember to always DYOR.

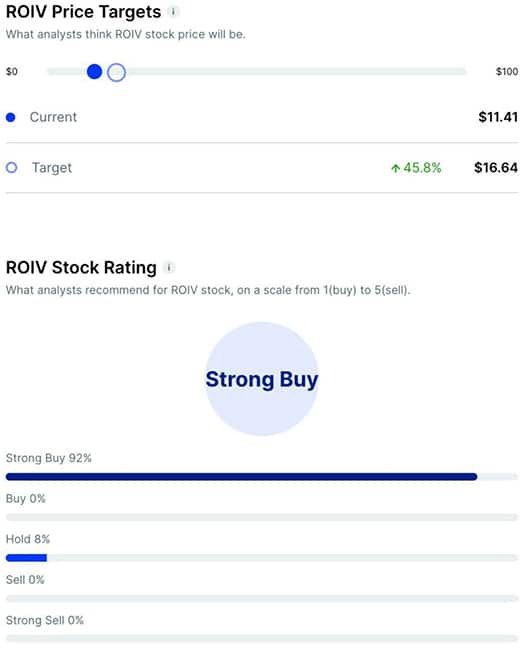

Roivant Sciences($ROIV)

Bull Case:

- New Product Pipeline: ROIV has one commercialized product (Vtama) with likely expansion approval this year and eight ongoing phase 2 and 3 trials.

- Positive Trial Results: Brepocitinib showed best treatment failure rates among active non-infectious uveitis studies in Phase 2.

- Upside potential: ROIV’s $20 price target based on buybacks offers substantial upside potential.

Bear Case:

- Legacy Shareholder Overhang: A large number of legacy shareholders looking to exit has created an overhang.

- Litigation Risks: While ROIV has interest in potential litigation proceeds, outcome and timing remain uncertain.

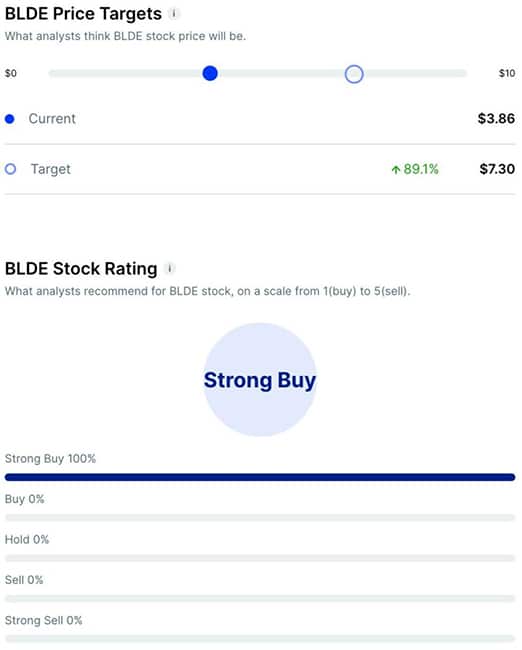

Blade Air Mobility ($BLDE)

Bull Case:

- Revenue Growth: Blade Air Mobility has grown revenue ~3x in two years.

- Path to Profitability: The company is expected to reach breakeven EBITDA this year and has $166M in cash, nearly 80% of its current market cap.

- eVTOL Opportunity: Blade is well-positioned to benefit from the upcoming commercialization of eVTOL aircraft, with Airbus expected to launch its own eVTOL in 2025.

Bear Case:

- Medical Segment: Despite strong overall growth, recent weakness in Blade’s key medical segment could indicate vulnerability.

- Execution Risk: As Blade expands into new markets, it may face challenges efficiently managing logistics, technology, and partnerships.

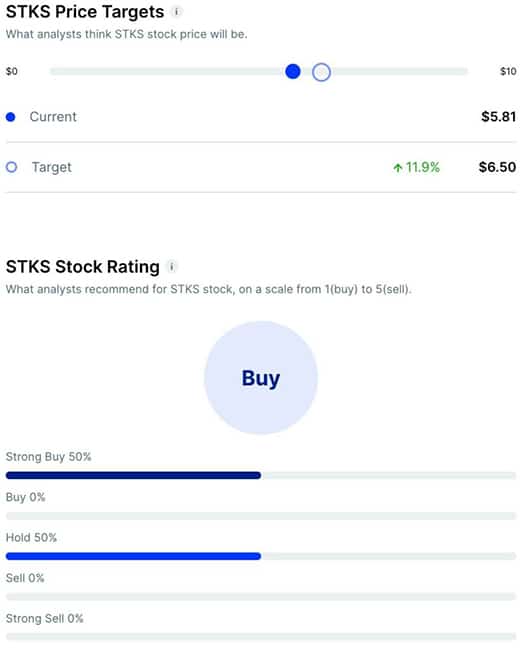

ONE Group Hospitality ($STKS)

Bull Case:

- Acquisitions: The $365M Benihana acquisition adds $575M in annualized revenue and $70M in EBITDA.

- Iconic Brands: Benihana is a 60-year-old iconic brand with potential to grow from 105 to 400 US locations.

- Reasonable Valuation: STKS trades at a discount to peers like Darden.

Bear Case:

- Expensive Financing: The acquisition is financed with costly debt at SOFR + 6.5% and 13% PIK preferred stock.

- Execution Risk: Realizing $20M in synergies and operating a 4x larger Benihana footprint carries significant risk.

- Shareholder Dilution: The financing includes dilutive warrants for Hill Path Capital, with over 5% dilution and more possible.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.