July 20, 2022 | ± 4 minutes

New here? The WC is a random mix of useful / interesting / notable stuff that gets pumped into your inbox every Wednesday.

Last week’s most clicked link was to agridme, the cow investment vehicle that guarantees up to 20% returns (more on this below)

Let’s go!

Table of Contents

It’s all gone pear-shaped for Elon

No, I’m not talking about the billionaire’s physique.

Elon Musk tweeted a nasty tweet about bill gates having a slight belly. Most men pushing 70 years have some belly fat. Look at a shirtless Elon Musk vacationing in Greece. Musk is 20 years younger than Bill Gates, & he looks like the pillsbury doughboy. https://t.co/Y1Pk3nOvSR pic.twitter.com/MKO4xHfKSk

— Arctic Friend (@FriendEden100) July 18, 2022

In case you’ve had something better to do with your life than track this ridiculous saga:

- Elon tried to buy Twitter when it was super expensive.

- Then the market went down a lot, but he was stuck with his overstuffed offer.

- And that (among other things) made Elon not want to buy Twitter.

- So, Elon made up some stupid reasons why he shouldn’t have to buy Twitter.

- Twitter is saying that Elon still has to buy Twitter.

- Elon sad.

- Twitter is now suing Elon, and he tried to push back the date of the trial (that he’s going to lose), but that’s failed now. So, the trial where a court tells Elon he’s going to have to pay the $1B breakup fee is now set for October.

Oh, and Elon had a ninth child a couple of weeks ago. Which is either great or terrible, depending on how he feels about having nine children.

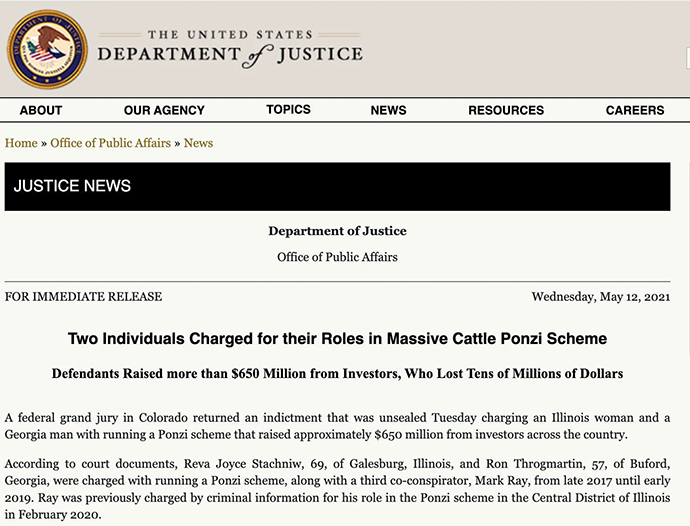

Cattle Ponzi schemes are a thing

Last week, I talked about investing in cattle. It’s a big thing.

I got a super helpful email from Superstar reader Jeremy Gratil who pointed me to this story about a previous (and similar) cattle fund that turned out to be a nine-figure Ponzi scheme.

First thing to say is that this is all completely inconclusive so far. Lots of supposition and speculation but no proof.

I’ve dug into it a bit, and here’s what I’ve found so far:

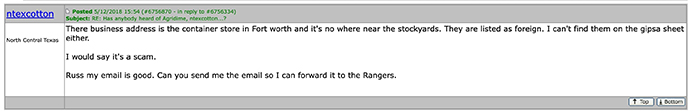

There have been a few forum discussions on the company, and everyone suspects it’s a Ponzi scheme. The prices seem off, there’s no way to guarantee profits (more in a second), and there’s this –

Here’s what Brian, our CFO has to say about it:

I agree that the “guaranteed return” gives me pause.

- From my time working in the poultry industry, the two main variables for chicken (or beef) are the feed input costs (corn/soybeans) and realized selling price. By promising a guaranteed return, Agridime is assuming the risks of these two inputs. They can hedge the feed input costs through corn and soybean future contracts.

- However, on the selling side, my limited understanding of the beef industry is that the meat processing plants are a consolidated industry with a few large players dominating the market (four players control 82% of the beef processing industry). They are price makers, not takers, and I’ve heard stories of cattle ranchers struggling because the prices they are selling to the processors, in some cases, don’t cover their costs.

- Agridime states that they can sell the cattle for on average $6.00/lb. Looking at current consumer prices, depending on the cut of meat, prices per lb range from $4.99 to $10.72, with an average of $6.91. This is retail … the meat processors seem to charge between .70 and .90/lb, based on a quick online search.

- So, the margins seem pretty tight (depends on if their $6/lb sales price factors in the meat processing charges). So between the feed costs and sales price being dependent on retail and meat processing capacity/rates, Agridime is exposed to loss on contracts. If a contract does lose money, since they’ve guaranteed a return, they would either need to dip into their own capital, or, under the Ponzi scheme scenario, use new investor money to pay out completed contracts.

Even though the address is a PO box in a strip mall, the company does exist, as far as I can tell.

The most legitimate scenario I can think of is one where they sell the cows to themselves to support their retail meat operation.

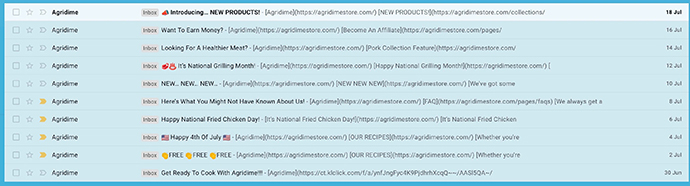

And to be fair, they do have a heck of a tenacious retail operation.

Based on what I read in the forms, the final sale price of a decent-sized cow is around $2,500 to $3,000.

If that’s the case, they’re paying you 15% interest on a $2k loan for a year. And they can “guarantee” the sale price because they’re the ones buying it from you.

Going to dig into this more.

Bordeaux is literally on fire

Now, I’m not a tin-foil hat kind of guy, but this feels fishy.

Apparently, Bordeaux has a bit of a grape glut – they’re producing too many grapes and therefore – too much wine, and that means the scarcity and value of the region’s bottles is going down.

There’s not enough demand to meet supply.

So there are lots of (probably drunken) meetings going on in the region, trying to figure out how to artificially reduce that supply (they are very, very against marketing and other base activities that would juice demand).

The most commonly-mooted idea is to uproot the vines – destroy some grapes.

Apparently, the cartel-forming piss-ups aren’t going well, though, and no one can agree what to do about it all.

But then this happened:

So far, the fire isn’t near any of the vineyards, but there’s quite a lot of talk about the smoke harming the grapes, reducing the quality of this year’s vintage.

Which would make the supply/demand problem worse rather than better…

If you want a job done right…

Russia fined Google eleventy billion monopoly dollars

Google and YouTube, which are surprisingly still active in Russia, haven’t been doing a good enough job censoring news about the Ukraine War (sorry, “special military operation”). And uncle Vlad isn’t happy about it.

Roskomnadzor, which is not a robot shaver but the regulator that’s fined Google, accuses the tech giant of spreading “fakes about the course of the special military operation in Ukraine, discrediting the armed forces of the Russian Federation.”

Based on today’s exchange rates, the 21B ruble fine is around $370m.

If I were Google, I’d roll the dice, wait for the currency to collapse, and pay in Doritos.

Finally, some good news

Gas prices are down below $4.50/gallon in the US this week.

This is great news… unless you’re a Bordeaux grape.

Cheers,

Wyatt