October 26, 2022

Read time: ± 4 minutes

New here?

The WC is a selection of five useful, interesting & notable insights, handpicked by our CIO Wyatt Cavalier.

Table of Contents

Why are Americans so fat?

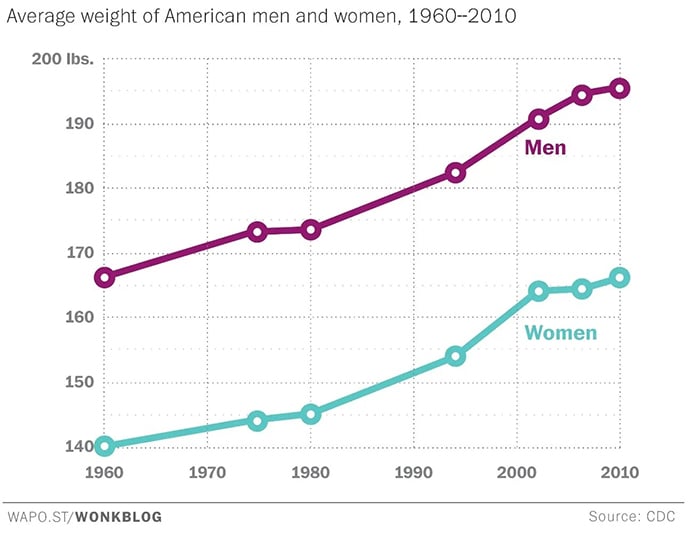

Americans have become fatter over the last sixty years, and no one knows exactly why.

This is best seen when you compare Americans today to their grandparents and counterparts abroad.

Men now average 200lbs, while women clock in at 171lbs.

American men are the third largest in the world, behind only Micronesia and Tonga. The average American man weighs a staggering 33lbs more than his French equivalent.

The biggest contributors include:

- Soda. It’s more sugary in America than in other countries, and Americans drink a lot of it.

- Americans are more sedentary than they used to be, mostly because their jobs are more office-based.

- Americans eat bigger portions and have more meat in their diets.

Other contributing factors include the in utero effects of smoking and excessive weight gain in pregnant mothers. Poor sleep, stress, and lower rates of breastfeeding are also thought to contribute to a child’s long-term obesity risk.

But if you want to really go down the rabbit hole, check out the comments on this:

Before the 1970s, everyone was hot & healthy.

— Carnivore Aurelius ©🥩 ☀️🦙 (@AlpacaAurelius) October 24, 2022

People ate more, smoked more, exercised less and they effortlessly kept off weight. It was WAY easier to be healthy.

But since then, obesity is up almost 5 TIMES.

Something is poisoning us and nobody knows what it is. pic.twitter.com/lESCtl7mrC

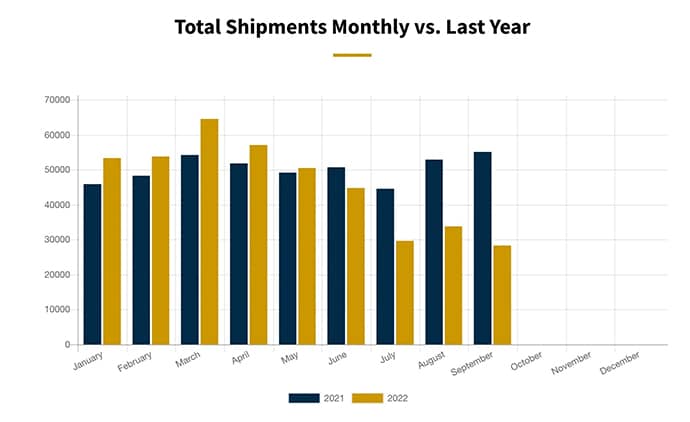

The rise & fall of RV garages

During the height of the pandemic, people bought all sorts of huge expensive toys. Boats, RVs, pallets of toilet paper, and more.

Despite the enormity of American homes and plots, there just wasn’t enough space to store all this great stuff.

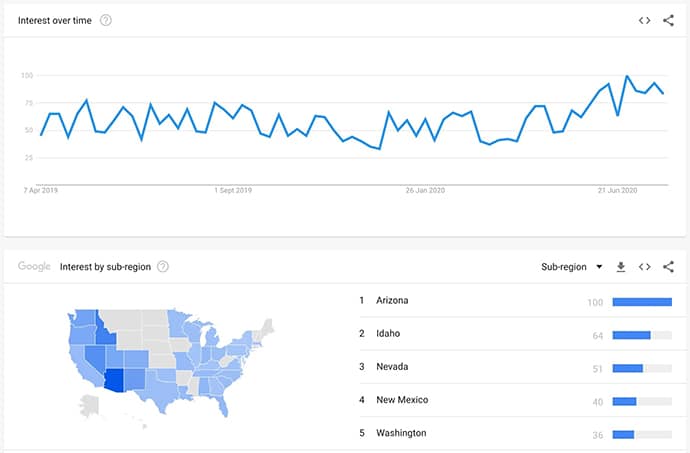

So, people started to build RV garages in (mostly) the western states.

But now RV shipments have begun to collapse (hello interest rates), with shipments around 50% below 2021:

And people don’t want or need their RV garages anymore. Search volume is down 50% since the peak as well.

What do you do with this sort of massive space that’s not suitable for anything else?

Wonder if the western states need more AirBnbs…

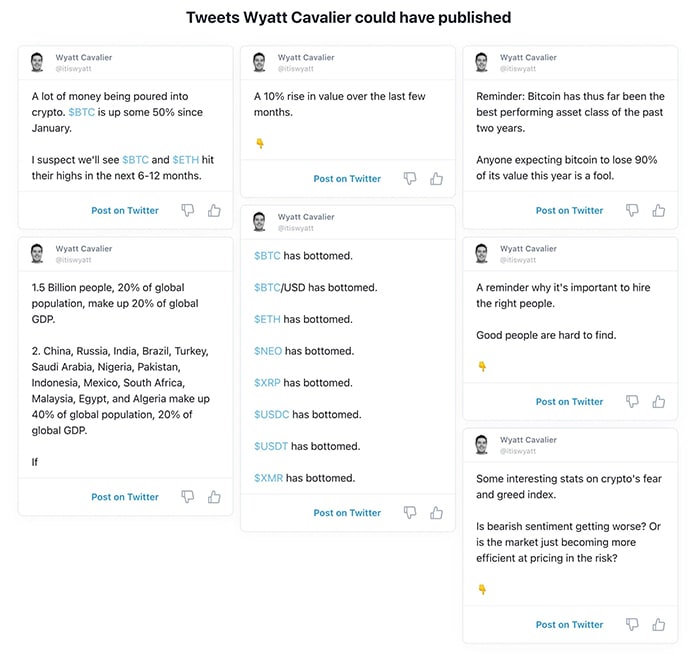

Artificial Intelligence is on fire

In this week’s Alts Cafe, I wrote a bit about how AI companies are hot hot hot.

So, I tried out a couple of tools that help with content. Results were mixed.

First up, TweetHunter.io, which scans your twitter history and generates some tweets it thinks you might like to send.

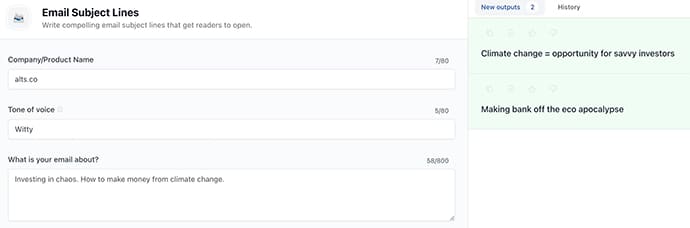

Second up, Jasper.ai, which just raised $125M in a Series A round.

I asked for help writing a subject line for point five below, and the results were actually pretty good:

The second one clearly worked — you opened this email, didn’t you?

I’m currently on the waitlist for lex.page (if you work there, let me in!) and will report back once I have access.

It’s meant to be excellent.

The rise & fall of COVID billionaires

According to Bloomberg, 58 Covid billionaires amassed fortunes during the pandemic.

But then things came crashing down.

Did you have it tough during Covid?

— Wyatt Cavalier (@itiswyatt) October 25, 2022

I lost my business.

But spare a thought for these guys, who lost billions.

👇

Most of these 58 guys (most are guys, only two are women), made a fortune during Covid by riding three trends/needs:

- Staying at home (14)

- Vaccines (10)

- Remote work (10)

But when things opened back up, the fortunes came crashing back down, because they lacked either (both) the foresight and the liquidity to diversify their holdings away from their one-trick pony.

Don’t shed too many tears, though.

They’re still up an average of around 60%.

Betting on chaos

People put a lot of time and energy into stopping horrible things from happening but very little effort into positioning themselves well, should they come to pass.

According to Glimpse, 1.4m people search for “climate change” every month, but only 2,200 search for “invest in climate change“:

Further, people write about how to “stop climate change” 25x to 30x more than how to “invest in climate change”:

From an investing point of view, it just seems sensible to allocate a decent chunk of your portfolio to ensuring you’re well placed if the worst-case scenario plays out. All those billionaires buying bunkers in New Zealand might know something we don’t.

The chaos you’re betting on could be climate change, nuclear war, or anything that you might see in the prologue of a film about a dystopian future.

What are the best investments to make if your assumption is a chaotic future? What would you bet on?

Last but not least, our podcast

In case you didn’t know this already, we have a podcast where we invite founders and CEOs to talk about anything and everything Investing. Topics vary from funds and crypto to artwork and farmland.

In this episode, Horacio spoke with Michael Episcope, the co-CEO at Origin Investments. Michael has helped build Origin Investments from a small real estate investment company to one of the best-performing companies with more than $1 billion of assets under management.

Michael talks about how Origin is navigating the current real estate market, its venture in Qualified Opportunity Zones, the funds it offers to investors, and more:

What caught your eye this week?

Cheers,

Wyatt