New here?

The WC is a selection of five useful, interesting & notable insights, handpicked by our CIO Wyatt Cavalier and pumped into your inbox every Wednesday.

Let’s go!

Table of Contents

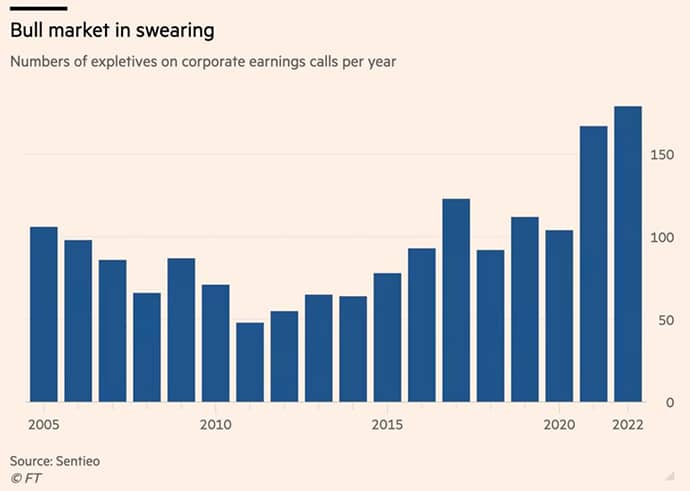

Bad times make bad language

There hasn’t been a lot to like about corporate earnings over the last year, so you may not be surprised to learn that the number of four-letter words recorded during earnings calls set a new record in 2022.

The biggest culprit was Ryanair’s Michael O’Leary. Below is a transcript:

I’m not a customer of Heathrow, I have no time for the (expletive)(expletive) that comes out of Heathrow, which is one of the greatest overcharging monopolies anywhere in Europe at smarming on about need for large cost increases when they can’t burn a pizza in a brewery. . . .

I do not have great confidence in the Boeing management in Seattle. In fact, I have very little confidence in them. And therefore I expect them to continue to (expletive) up deliveries or have delayed deliveries despite the fact that they have very few deliveries to make next year. But that’s where we are with Boeing.

I don’t know what it takes to burn a pizza in a brewery, but it sounds unpleasant.

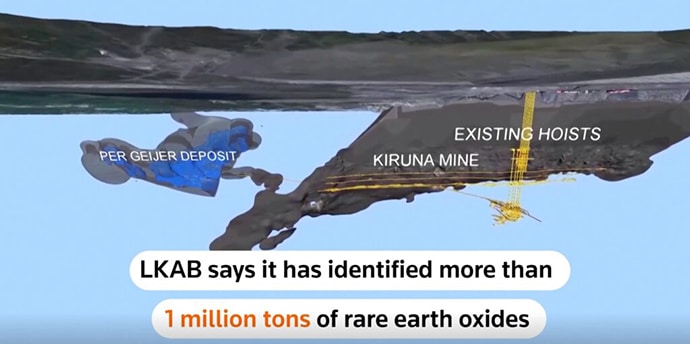

(Not so) Rare Earths

The subject of rare earth metals (and their processing) is a tricky one. They’re necessary for a great many technologies required to power sustainable energy — batteries, wind turbines, etc.

But they’re almost exclusively found and processed in one place — China.

A global reliance on one country for such a key piece of tech can make politics tricky (it’s tough to take a hard line on), for example — human rights abuse when you’re dependent on a country for your smartphones.

But Swedish state miner LKAB just found over one million metric tons of oxide-rich rare earth metalsone million metric tons of oxide-rich rare earth metals, which could go a long way toward achieving independence from China.

The case for space mining

Sticking with rare earth metals, let’s talk about space mining for a moment.

300m miles from earth, a potato-shaped asteroid called Psyche 16 orbits the sun between Mars and Jupiter. It’s around 150 miles across and contains 95% nickel and iron (very similar to the Earth’s crust).

Researchers estimate the market value of the metal in Psyche 16 to be up to $700 quintillion — enough for $93B per earthling. While that estimate is probably too high, there’s clearly a lot of money to be made harvesting minerals from space.

The expense of space travel is currently the biggest bottleneck, but costs there are diminishing quickly. Today, it costs 90% less to send 1kg to orbit than it did ten years ago, and the rate of savings continues to accelerate.

Sound like science fiction? It’s not as far off as you think.

A sensible first target might be 1986 DA, which has been reliably confirmed to contain over $11T worth of metals -— more than the entire global metal reserves:

- 10k tonnes gold;

- 100k tonnes platinum;

- 1B tonnes nickel;

- 10B tonnes iron.

It comes within 20m miles of the earth, which is near enough to be classified as a Near Earth Object.

A number of companies are working on the problem, most notably SpaceX. Others include Bradford Space, Kleos Space, iSpace, Moon Express, and many others.

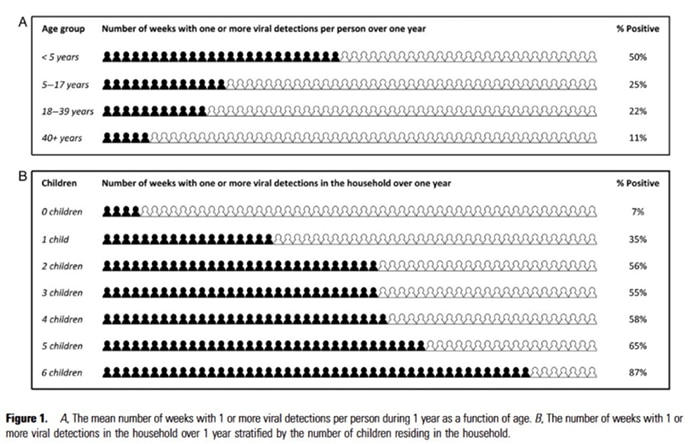

More proof your kids are killing you

A study in the USA confirmed what every parent already knows — that the more kids you have, the more likely you are to be sick.

It found that children under the age of 5 have a 50% chance of having a common respiratory virus at any given time. The more children there are in a household, the more weeks per year at least one person in the house will be shedding a respiratory virus.

If you have two or more children, at least one person in your home will be sick more often than not.

Six kids? Don’t even bother getting out of bed.

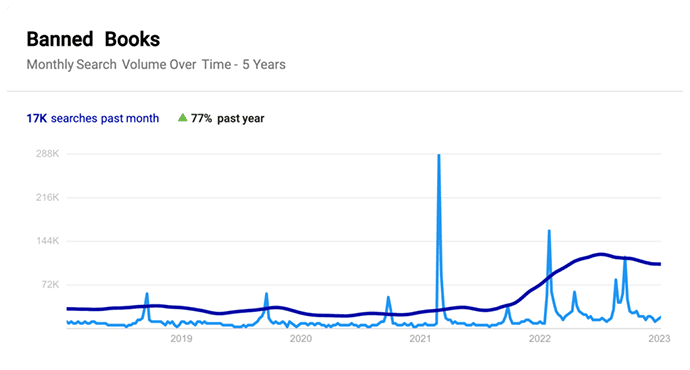

Is book banning on the rise?

Over the last couple of months, I’ve seen some anecdotal evidence that book banning (or challenging) was on the rise.

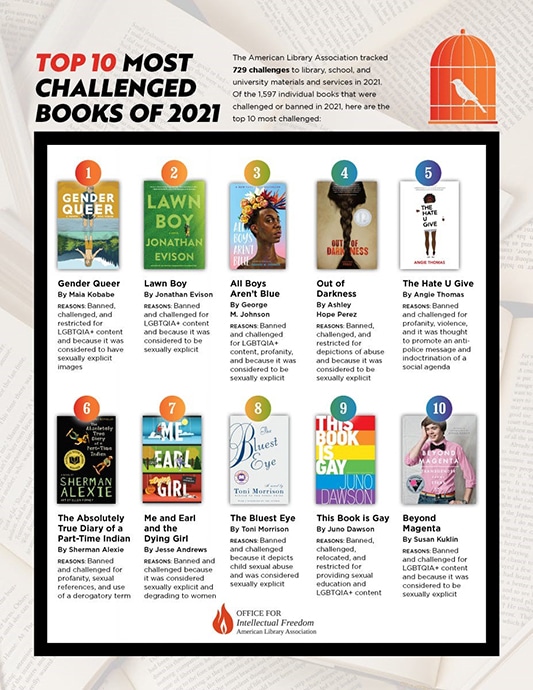

My sense was right. From the American Library Association (ALA):

“Between January 1 and August 31, 2022, ALA documented 681 attempts to ban or restrict library resources, and 1,651 unique titles were targeted. In 2021, ALA reported 729 attempts to censor library resources, targeting 1,597 books, which represented the highest number of attempted book bans since ALA began compiling these lists more than 20 years ago.”

Additionally, more than 70 percent of the 681 attempts to restrict library resources targeted multiple titles. In the past, the vast majority of challenges to library resources only sought to remove or restrict a single book.”

Google Search Volume backs this up:

There are clear trends in book challenges, with the top three and five of the top ten targeting LGBTQIA+ themes in 2021.

While I disagree with all book banning, I can sort of get the list above based on an ideological basis.

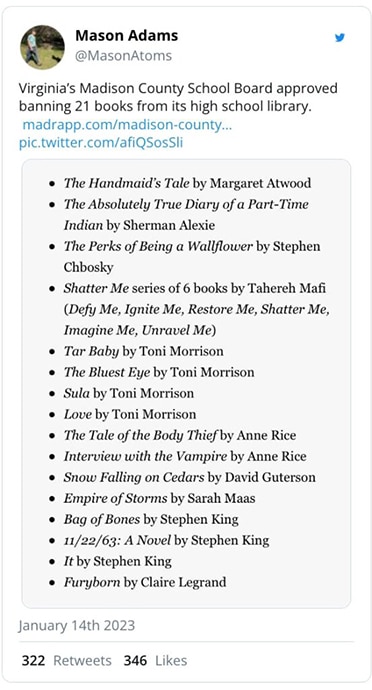

But some of it is just nonsensical. What is there to argue with 11/22/63 about? Like, you’re against time travel? Or JFK?

Finally, banning books from a local library is simply ineffective.

Unless you’re going to get it removed from the Kindle store and, you know, the internet as well, the material is always going to be available.

That’s all for this week.

Cheers,

Wyatt