October 17, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

The Big Picture

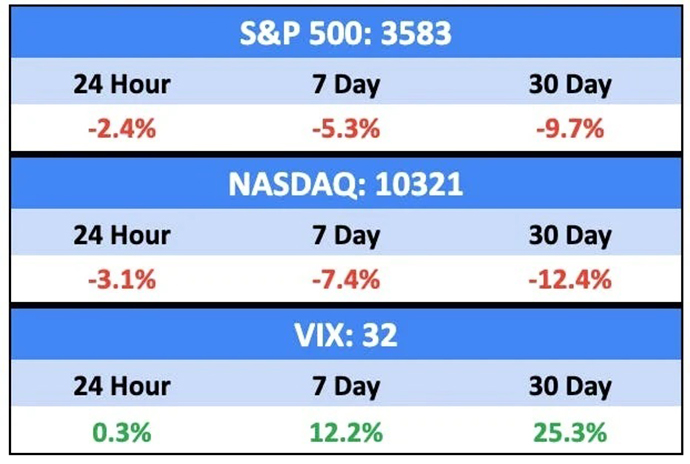

On Thursday, the S&P 500 hit its lowest close since November 2020. Undeterred by hotter-than-expected inflation data and rising jobless claims, major US averages surged 2%+ on Friday.

Overall, the markets were down 5% to 7% for the week, while volatility continued to rise.

The Fed’s saying they’ll keep raising rates until inflation and jobs are under control. The beatings will continue until morale improves.

The only thing that’s going to shift this market is a collective view that the beatings have finally done their job:

- Higher than expected inflation;

- Fed will increase rates more than expected;

- Fed will normalize/reduce rates sooner than expected.

And that’s basically what we saw last week – there was a 76% chance of a 75bps rate hike in November, and now that’s jumped to 96%. Similarly, the likelihood of a 75bps bump in December rose from 29% to 61%.

The markets are forecasting an interest rate stabilization in March 2024, rather than May, with nearly a 40% chance that there will be a rates reduction by the end of 2023.

Bullish News

- The US added 263k jobs in September, and unemployment fell from 3.7% to 3.5% on a decline in labor force participation.

- US PPI rose 0.4% in September and 8.5% YoY, a higher-than-expected monthly increase.

- The Federal deficit fell by $1.4T in FY 2022.

- Global money market funds saw $89B of inflows in the first week of October, the largest weekly injection into cash since April 2020.

Bearish News

- Global wealth is on track to decline by more than 2% this year.

- The IMF cut 2023 global growth forecast and warned that the ‘worst is yet to come’.

- Hedge funds were down 6.18% YTD in September.

- Hurricane Ian may have caused ~$67B in insured losses.

- US banks are expected to set aside $4B for potential losses from bad loans.

- 30Y Treasury climbed as high as 3.941% to its highest level in nine years.

- US consumers expect household spending growth of 6%, the biggest one-month decline ever.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

No changes here.

Crypto

Here’s what you need to know:

Crypto continues to be delightfully boring while outpacing the equity markets.

Bullish News

- Hong Kong-based fund manager About Capital acquired a 60% stake in top Chinese crypto exchange Huobi Global at a supposed ~$3B valuation.

- Crypto exchange FTX and Visa will launch a crypto debit card in 40 countries.

- BNY Mellon will add crypto to custody manager services in a digital asset push.

- Coinbase secured a Singapore crypto license.

- Google is partnering with crypto exchange Coinbase to let cloud customers pay in crypto starting next year.

Bearish News

- A Binance-linked blockchain was hit by a $570M crypto hack.

- US Treasury fined crypto exchange Bittrex $29.3M for violating multiple US sanctions and Bank Secrecy Act.

- Portugal will start taxing crypto gains in next year’s budget plan.

- Crypto trading firm NYDIG laid off ~33% of staff.

- The crypto ecosystem is becoming less decentralized, according to a Morgan Stanley report.

What to do with that info:

Despite the bear market, institutional capability and capital continue to flow into crypto. It could (and probably will) sink lower if the equities markets tumble further, but the long-term signs are good if you’re accumulating.

Real Estate

Here’s what you need to know:

It’s all on the shoulders of inflation, which I talked about more in-depth before, so there’s actually not a lot to say about real estate this week.

Home prices will continue to come down, and rents have started moving that way as well.

Bullish News

- Redfin reported the first drop in average US monthly rent in quite some time.

Bearish News

- China’s holiday home sales fell 37.7% YoY.

- Average US 30-year mortgage rate surpassed 7%.

- Investors are rapidly pulling out of UK property funds after bond market shock.

What to do with that info:

Wait as long as possible to buy that new house you’ve been eyeing up.

NFTs

Here’s what you need to know:

NFT trading volume ticked up slightly last week after hitting an eighteen-month low the week prior.

While NFTs continue to slide down the slippery slope, they’ve outperformed equities over the last 30 days, which is something.

Bullish News

- Damien Hirst burned 1,000 of his Currency physical pieces last week. The physical pieces have been fetching $10k to $15k each at auction.

Bearish News

- The SEC is probing Bored Ape creator Yuga Labs over unregistered offerings.

What to do with that info:

Blue chip pieces could just as easily double as they could decline 50% over the next six months.

Startups

Here’s what you need to know:

The startups/investing market continues to decline YoY, as investors wait to see what’s happening with equities.

Bullish News

- VC firms are buying up battered public tech stocks, as start-up market stalls.

- Big tech’s hiring freeze is unlocking a rich talent pool for US startups.

- Kanye West (Ye) is acquiring the conservative social media app Parler.

Bearish News

- Prop-tech Pacaso laid off 100 employees, 30% of its staff.

What to do with that info:

We’re shopping for acquisitions.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt