Hello and welcome to Alts Cafe

This is a quickfire look at what’s driving your alts week.

TLDR:

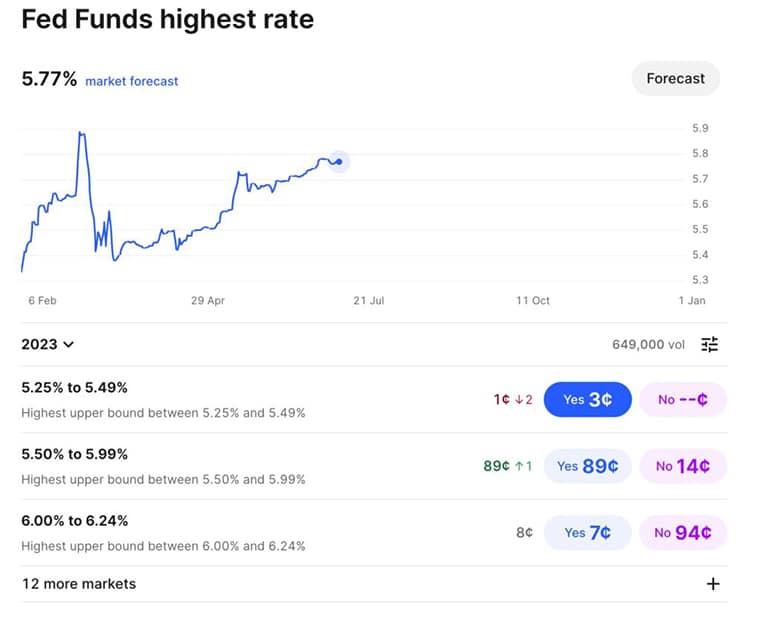

- We spotted an arb opportunity with the Fed funds rate.

- The student loan tsunami and rising property taxes could wipe out the economy.

- Supply and demand continue to rule the US residential RE market. There’s not much demand, but there’s even less supply.

- A big win for Ripple labs (and Coinbase).

Table of Contents

Macro View

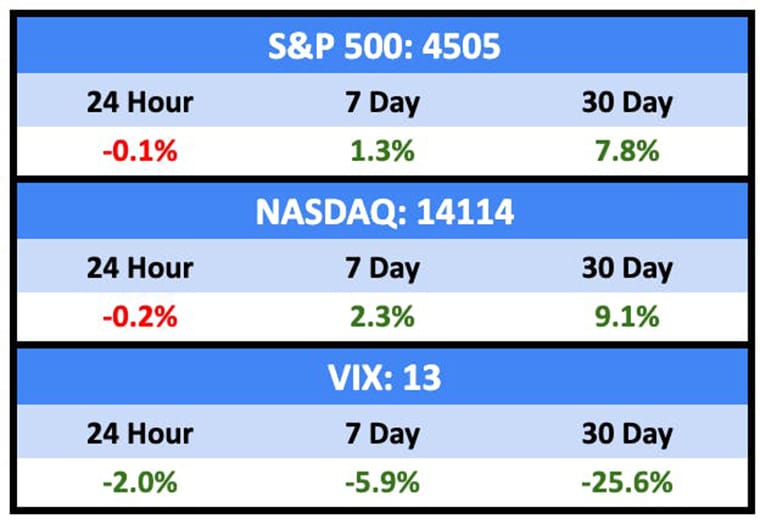

Another week another victory for the US economy as inflation gets pounded into the ground.

Bullish News

- Inflation dropped to 3%.

- Despite Fed comments to the contrary, markets are predicting only a 36% chance of two more rate hikes in 2023 with a consensus forming around one more hike. The first rate drop is forecast for May 2024.

[weird thing]

Kalshi, a predictions market, is showing that 96% of punters are betting on two or more rate hikes. There’s an arbitrage opportunity here if you’ve got the inclination.

Bearish News

- The 27 million student borrowers in the US will have to start paying back $1.1 trillion in loans, which will hit the economy like a sledgehammer.

- China is sliding into deflation. Their export markets are in free fall.

- Investors have pumped $7.8 trillion into cash funds, an unprecedented sign of market weakness.

- The latest jobs report shows the market is still strong — which will tempt the Fed to continue hiking rates.

What are we doing?

ALTS 1 Fund news:

Nothing at the moment

Real Estate

I want to give a quick shoutout to Briefcase. It’s a bi-weekly newsletter focussing in real estate, and I frequently get several story ideas from them. If you like what I write about real estate and want more like it, I encourage you to check them out.

Bullish News

- Bain Capital is raising money for a third real estate fund with a $3.75B target.

- Some cash-flush AI companies are soaking up vacant offices in SF. Hope landlords are tying them up with longterm prepaid leases.

- Over 20% of mortgage applications in regional powerhouses SLC, Indianapolis, and Louisville were from Gen Z homebuyers.

- The LP exodus from Blackstone’s REIT seems to have subsided.

- Big real estate funds are still getting filled.

Bearish News

- A lot has been written about the awful office vacancy situation in SF and NY (and it’s really really bad), but it looks like the situation in Philadelphia is even worse.

- Existing-home sales are expected to tumble to a 12-year low by the end of 2023.

- Foreclosure filings in 2023 increased 13% year-over-year and are 185% higher than two years ago (but are still lower than historic norms).

- Rent growth in the US seems to be slowing down.

- Ashford Hospitality Trust handed back the keys to 19 hotel properties across Texas, Nevada, and Georgia.

- Property taxes on US homes are rising quickly. Paired with increased mortgage rates, this could drive home prices down.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

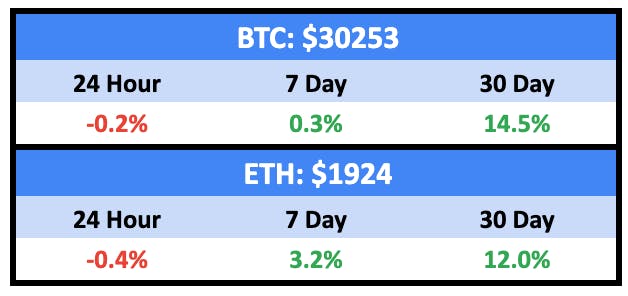

Bitcoin is up 90% on the year, and ETH has notched 68% returns.

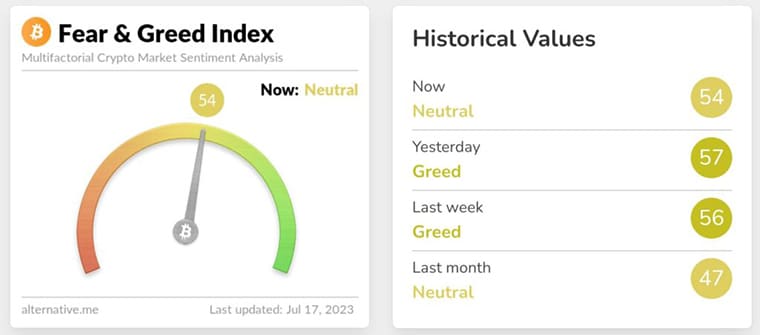

But investors were fairly placid last week despite the big ruling in the Ripple case.

It was a big week for NFTs led by Punks and Fidenza

Bullish News

- A judge ruled Ripple Labs did not violate federal securities law by selling its XRP token on public exchanges. The decision sent various market soaring.

- Bitcoin ETFs are getting closer.

- Standard Chartered says BTC could hit $50k by the end of 2023 and $120k by the end of 2024.

- Shares of Coinbase are up 84% over the last month.

Bearish News

- Circle, the company that issues the popular stablecoin cryptocurrency USD Coin, has laid off staff and stopped investing in “non-core activities.”

DisgracedFormer Celsius CEO Alex Mashinsky was arrested.- Tom Brady lost $30 million when FTX collapsed (lolz). Giselle lost $18 million.

- The SEC says Coinbase knew it was breaking the law.

- BNB, Binance’s coin, is being heavily shorted.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- Sapphire Ventures in Menlo park is earmarking $1 billion to enterprise AI investments. This lets them tell investors they’re on the AI train without forcing them to invest the funds in that sector if it blows up.

- Liquid Death, the “irreverent” water company, is looking to IPO.

- OpenAI’s Sam Altman is using his SPAC to take Oklo, a company he’s invested in and chairs, public.

- Investments in late stage companies seem to have stopped declining.

- AI startup Hugging Face (wut) is shopping offers at a $4 billion valuation.

Bearish News

- The SPAC that merged with Turkish ride-sharing company Marti tanked nearly 50% on the first day of trading.

- EV supply is outpacing demand, causing supply gluts and price cuts.

- Biotech and pharma companies saw their worst quarter for venture capital since 2019 in Q2 this year.

How to invest in startups right now:

Don’t be one of these people.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Diamond Standard and BeatBread. If you subscribe to Briefcase, we get a couple bucks. Same with Kalshi.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.