Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

Table of Contents

Toyota’s £8B Futuristic City: A 2,000-Person ‘Living Laboratory’

Toyota’s ambitious Woven City project, a sustainable smart city at the foot of Mount Fuji, is nearing completion with the first residents expected to move in by the end of 2024.

Marketed as a ‘mass human experiment’, this £7.8 billion futuristic city will serve as a testing ground for Toyota’s self-driving vehicles and renewable energy technologies.

With sensors embedded throughout the city to gather data on traffic patterns and ‘smart homes’ running on hydrogen, Woven City aims to be a model for sustainable urban living.

As long as my mailing address isn’t “123 Prius Road,” count me in.

Bitcoin Is Cool – But Have You Heard of M-Pesa?

Before the world caught on to the potential of digital wallets and blockchain technology, M-Pesa emerged in Kenya as a pioneering mobile money service.

Launched in 2007 by Safaricom, it capitalized on the ubiquitous presence of mobile phones to offer banking services, effectively turning a simple SIM card into a bank account accessible via text message.

Present day, as the company expands globally and explores integrations with e-commerce giants like Amazon, it is poised to take on the lucrative remittance market.

Do Magazine Covers Contain Market Signals?

“The plural of anecdote is not data.”

For decades, speculators have popularized a theory that magazine covers predict market movements. For example, the 2017 Barron’s cover about Apple reaching a $1 trillion market cap, has been a recent favorite “proof point.”

Barry Ritzholtz isn’t buying it. He argues that cherry-picking memorable covers is prone to selective perception and hindsight bias and that truly useful market signals from covers are exceedingly rare.

Is there any merit here whatsoever?

Is The Fed’s Independence at Risk?

Historically, central banks have had to balance monetary policy with fiscal policy set by governments, sometimes leading to conflicts and periods of “fiscal dominance” where the central bank’s independence is compromised.

With rising debt levels and governments unwilling to cut deficits, the Fed may increasingly have to consider debt sustainability when setting interest rates, limiting its ability to fight inflation effectively.

How likely is this scenario?

The White House Wants To Fix Housing Affordability

The White House unveiled a comprehensive plan to address the housing affordability crisis, which includes mortgage relief credits, seller tax credits, down payment assistance, cheaper refinancing, incentives for developers, and rental relief.

While some measures like tax credits for buyers and sellers may provide short-term relief, others such as down payment assistance programs could set a dangerous precedent by increasing demand without addressing the supply issue.

Will these changes actually make a dent in the problem?

Private Equity Firms Are Turning Your Favorite Songs Into Bonds

Private equity firms invest billions in the music industry, morphing hit songs into asset-backed securities. With streaming revenue providing a steady cash flow, investors are willing to pay up to 30 times the annual royalties for these tracks.

This trend has seen the music securitization industry grow from $55 million in 1997 to an estimated $5 billion in 2024, with major players like Apollo acquiring the royalties of artists like Daft Punk and Pink Floyd for $1.8 billion.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Learn to build beautiful businesses. Weekly strategies, insights, and lessons from SMB expert Michael Girdley.

Weekly insights about private credit and case studies about making hard money loans directly to real estate investors.

Crypto made simple. Actionable alpha 3x a week.

Stock ideas

Let’s check in with Yellowbrick Road, which highlights 15 weekly stocks. Here are three of my favorites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

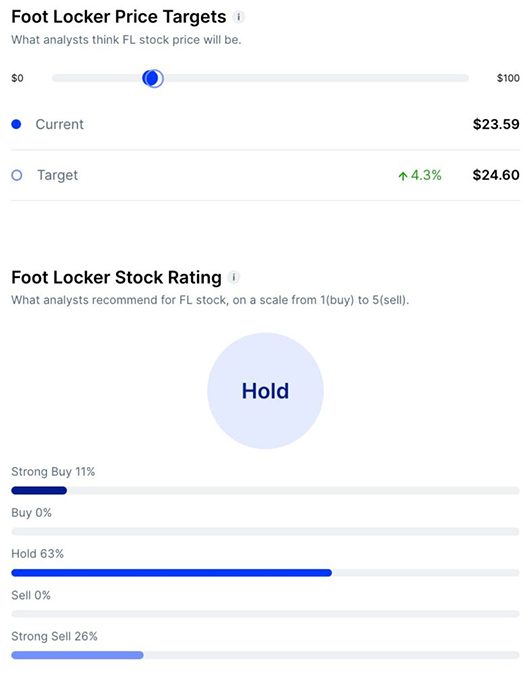

Foot Locker ($FL)

Bull Case:

- Lace Up Strategy: CEO Mary Dillon’s plan is driving positive momentum by expanding sneaker culture and enhancing omnichannel capabilities.

- Partnerships: Foot Locker is enhancing its relationship with key partners like Nike, leading to improved margins.

- Cost Savings: The company achieved $135 million in cost savings.

Bear Case:

- Weak Guidance: Foot Locker issued conservative FY 2024 guidance across revenue, gross margin, and operating income.

- Deferred Targets: The company pushed back its long-term financial targets from 2026 to 2028.

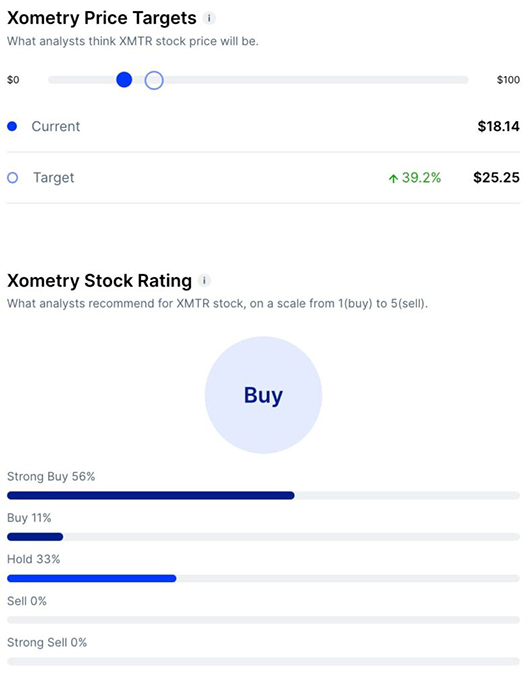

Xometry ($XMTR)

Bull Case:

- Innovative Marketplace: Xometry’s instant quoting and AI enable transparent pricing, faster lead times, and integration with CAD and procurement systems.

- Expanding TAM: With a $260B addressable market and potential to expand to $800B+, Xometry has significant growth runway.

- Strong Customer Loyalty: 96% of revenue from existing buyers demonstrate high customer loyalty.

Bear Case:

- Execution Risk: Xometry’s success relies on quality suppliers, managing custom manufacturing complexity, and efficiency at scale.

- Profitability Challenges: Spread-based model and pricing risks on newer manufacturing techniques may pressure Xometry’s path to profitability.

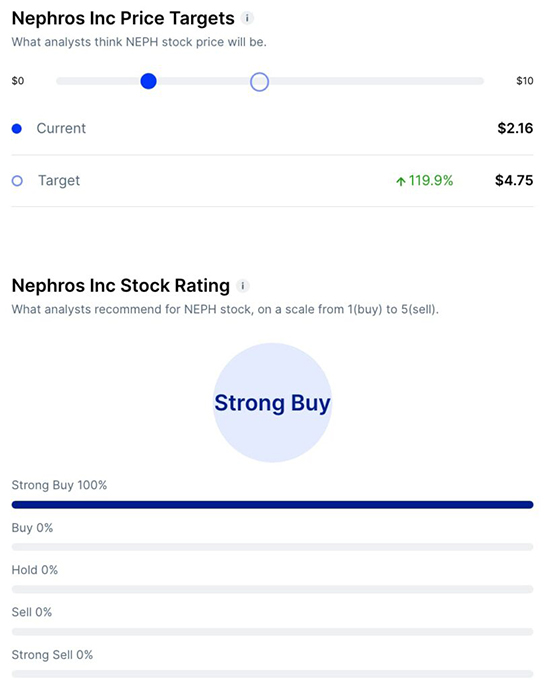

Nephros Inc ($NEPH)

Bull Case:

- Focus: Nephros has shifted to its core water filtration business serving 1,000+ hospitals and 6,000+ dialysis clinics.

- Partnerships: Secured exclusive distribution with Donastar for commercial filters; recurring revenue model with 55-60% gross margins.

Bear Case:

- Cash flow: Not yet generating significant cash, which may limit ability to fund future growth.

- IP protection: Patent protection may be insufficient to protect products from competitors.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.