Hiya,

Today’s version of the Big Deal features two opportunities, but they’re only available to accredited investors and qualified purchasers.

Those in the community who have already self-certified with Alts as an accredited investor or qualified purchaser received the full briefing this morning.

This is a slightly redacted version for everyone else.

If you’re accredited, plesae click below to self-certify, and we’ll send you the entire briefing.

Here’s what we’ve got for you:

- A blue chip VC fund of funds available only to qualified purchasers

- An unique real estate fund from an emerging manager with a unique thesis

Let me know what you think. Love these? Hate these? More like this? More of something else?

If you see a deal in the wild we should feature, please let me know.

Table of Contents

Opportunity 1

This opportunity is for qualified purchasers only, I’m afraid.

👔 Deal overview

- Portfolio Managers: [confidential]

- Minimum Investment: $250k (negotiated down from $5m)

- AUM:

- Firm > $6.0b

- Fund VIII: $750m target

- Projected Returns: 15% to 20% IRR

- Investor requirements: Qualified purchaser (what’s this?)

- Liquidity: 12 years with possible add ons

- Fees:

- Management fee: 0.70% annually

- Incentive Fee: 5%

- Arrangement fee: 1% one time

- GP commit: 1%

Fund and firm

This is a fund-of-funds manager currently managing over $6.0 billion in AUM.

They’re currently raising their 8th vintage of the flagship fund-of-funds offering, which has historically included difficult to access funds like Benchmark, Sequoia, a16z, FirstRound, Founders Fund, Addition, Accel, Y Combinator and more.

Their $2.5 billion worth of distributions have included exits from companies like Slack, LifeLock, Coinbase, Zoom, Snowflake, Pinterest, Palantir, Crowdstrike, Docusign, and Github.

Strategy

The fund is targeting 11-13 core manager allocations with an estimated ~$55M commitment to each fund. They will primarily focus on US managers (with some ex-US exposure), and primarily allocate to technology companies.

The firm targets funds with a 2.5x multiple and a net IRR in excess of 20% for its underlying managers. Four of their first five vintages generated TVPI in excess of 3.0x, with Fund II at 4.9x and Funds III and IV at 3.3x (data as of 3/31/23). They also typically generate a ~10% annual premium over public market equivalents.

What I like

[confidential]

The risks

[confidential]

If you want the full briefing available to our accredited investors, please self certify below.

Opportunity 2

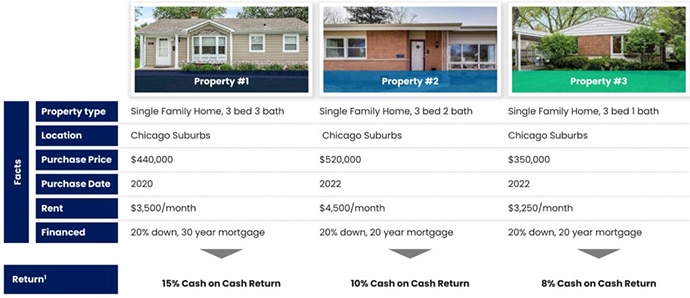

This is a deal I stumbled across in the depths of Twitter, and I love the thesis. The fund has strict and unique criteria:

- Single family homes

- Top tier high school districts

- Three year leases

It’s run by an emerging manager who has made a few investments like these for his own portfolio.

This deal is for accredited investors only.

👔 Deal overview

- Portfolio Manager: [confidential]

- Minimum Investment: $100k (subject to waiver)

- AUM: $10m target for year one, $30m – $60m total

- Projected Returns: 14.6% to 15.1%

- 8% preferred return

- Investor requirements: Accredited investor (what’s this?)

- Liquidity: 10 – 15 year hold period

- Fees:

- Management fee: 1.5%

- Incentive Fee: 20% to 25% depending on share class and timing

- GP Commit: Less of 3% or $300k

Fund and Firm

This is their first fund.

It’s driven by the manager, who has a background in consulting with BCG and an undergraduate degree from Wharton.

He’s executed this strategy privately over the last three years, which has given him confidence to institutionalise.

This is very much a bet on an emerging manager with a good idea.

Strategy

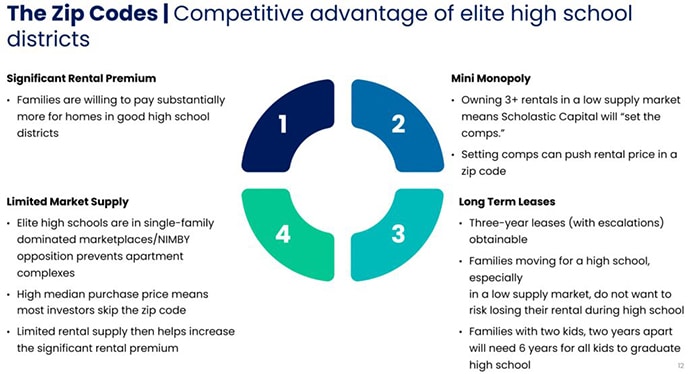

The fund is carving out a specific niche:

- Class A single family homes

- In elite public high school districts

- In the upper midwest

- Offered with three year leases

- In-house property management

In their view, this provides several significant advantages

Gross yield in these zip codes tends to outperform other comparable areas.

What I like

[confidential]

Risks

[confidential]

If you want the full briefing available to our accredited investors, please self certify below.

That’s it for this issue.

If you see any fantastic investment opportunities the rest of our accredited community should review, please let me know.

Cheers,

Wyatt

A friendly reminder that we don’t endorse or otherwise recommend either of the opportunities above. Nothing here is investing advice, and you should always do your own research.