READ TIME: ±5 minutes

Hello and Welcome to our Alts Cafe – FIRST Edition!

This is everything you need to know about what’s going on in the world of alternative assets.

Best enjoyed with your morning cup of coffee. Let’s go!

Table of Contents

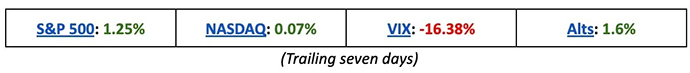

Pulse check: What’s the overall market doing?

Major indices

What are we doing?

We bought:

- 2017 Domaine Dujac Chambertin (12 bottles) on Rally @ $8.75/sh

- 2009 Domaine Leroy Richebourg (12 bottles) on Rally @ $19.80/sh

- 2003 Domaine de la Romanee-Conti la Tache on Rally @ $3.90/sh

Crypto

Here’s what you need to know:

- After a horrible couple of weeks, things are on the up:

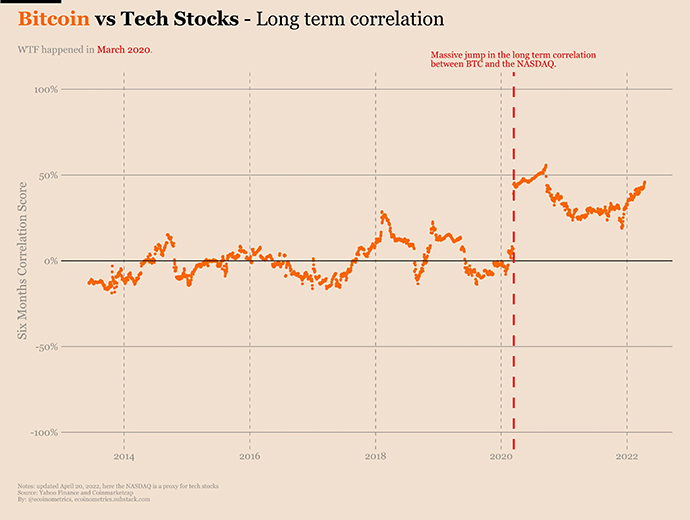

- Bitcoin advocates like to talk about how crypto in general and BTC, in particular, is a great way to diversify your portfolio away from the stock market. When the market goes down, Bitcoin doesn’t necessarily slide as well. Turns out that’s not true anymore.

Covid broke BTC. The jury is out on why this is now the case, but I think it’s probably because more traditional investors have started investing in crypto, and they’re moving all the components of their portfolios the same direction on the same day.

Here’s what to do with that info

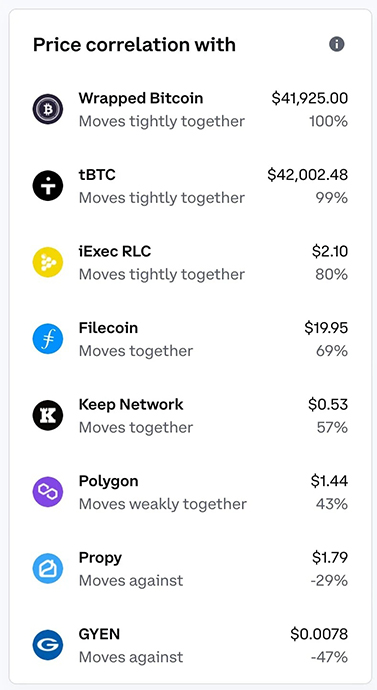

If you’re looking to fight correlation, Coinbase has a handy chart alongside each asset page that shows which coins move with and against each other.

NFTs

Here’s what you need to know:

- Moonbirds keeps going to the… moon. And I keep punching myself in the face for missing out.

- The guys at Framework Ventures claim there are now more NFTs indexed on opensea than Google has web pages. I’d love to see the source on this, because it sounds like horseshit. I’ve chased this up on Twitter.

Investor opportunities:

- There’s talk that A0kiverse is working on a collab with Rick and Morty. If this goes ahead, expect the floor price of the project to increase significantly.

- In terms of new mints, check out IKANI.AI. It’s (AFAIK) the first project to use participatory AI to generate digital art. The supply is only 800, and competition for whitelist spaces is fierce.

- Talking of new projects, Mindblowon Universe is getting a LOT of hype ahead of its mint, and whitelist spots are near impossible to come by. Expect a 10x for anyone who gets in on the mint.

Sports Cards

Here’s what you need to know:

- It’s been a rough week… And a rough start to 2022.

- Fanatics, the juggernaut that recently acquired Topps after winning away the rights to pretty much everything Topps does, is now valued at $27B.

Investor opportunities:

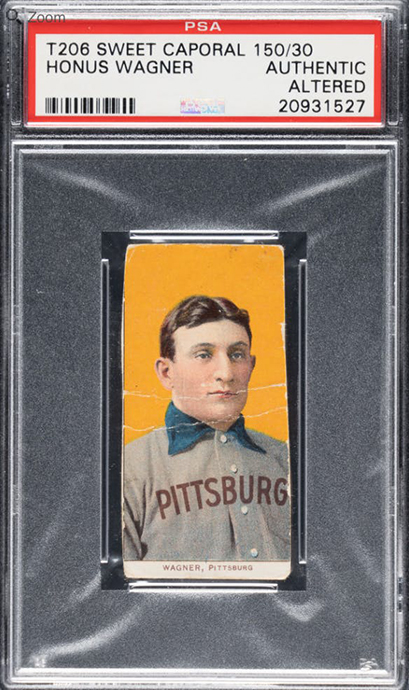

- Another Honus Wagner card is up for auction. It’s graded authentic but altered (looks trimmed). I expect it’ll sell for more than the 60% of a card that was auctioned off recently.

Books

Here’s what you need to know:

- Potter & Potter is hosting a Fine Literature & Modern Firsts auction that starts April 26.

- Among our top picks are a presentation copy of The Great Gatsby with an estimated value of $30,000 to $50,000, an inscribed presentation copy of Robert Frost’s North of Boston with an estimated worth of $10,000 to $15,000, and an inscribed presentation copy of I, Robot with an estimated value of $3,000 to $5,000.

Investor opportunities:

Limited Editions are a great way to get started with book investments. Here are a few of my favorites right now:

- Brandon Sanderson Kickstarter – this is the guy who created the fantasy Cosmere universe and finished off the Wheel of Time series. It’s already raised $41M.

- Go Set A Watchman: Limited Signed Edition by Harper Lee £2000

Wine

Here’s what you need to know:

- What’s up with wine on fractional platform Rally? If you’re looking for a bargain, check out their #17DUJAC collection.

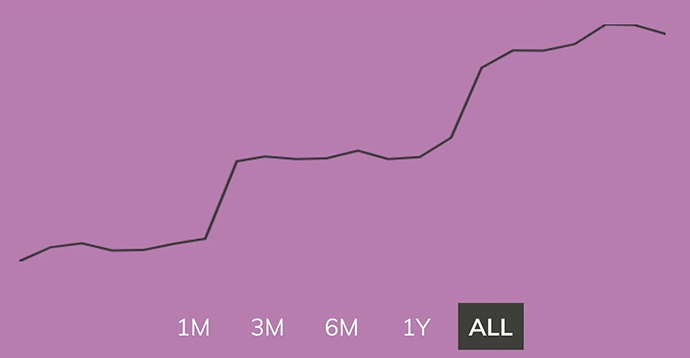

The vintage’s performance on the open market:

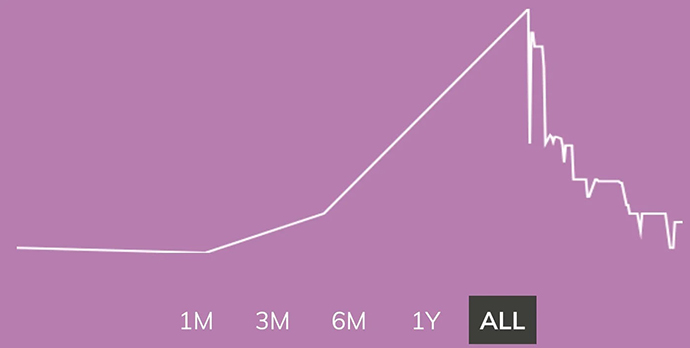

Compared with the vintage’s performance on Rally:

Investor opportunities:

As well as that 2017 Dumaine Dujac Chambertin, the charts for these vintages look much the same:

- 2009 Domaine Leroy Vosne-Romanee les Beaux Monts

- 2009 Domaine Leroy Richebourg

- 2003 Domaine de la Romanee-Conti la Tache

So we loaded up on all the above. Cheers!

Whisky

Here’s what you need to know:

- Sotheby’s is auctioning off a Karuizawa 36 Views of Mount Fuji Full Set, and I’m really looking forward to the outcome.

- Vint.co recently fractionalized and sold off an identical set, valuing it at $187k, which is $10k above the high end of Sotheby’s estimate. Bidding is currently at $140k with two days to go.

Investor opportunities:

- Kagoshima’s Kanosuke Distillery (one of the most talked about new Japanese distilleries) just announced that they will release a single malt 2022 limited edition bottle. Japanese whisky was up 42% last year, so I’m keeping an eye on this. (Kanosuke)

Film Posters

Here’s what you need to know:

Heritage is featuring a massive film posters auction this week with all the usual suspects.

The star of the show is an original Dracula poster from 1931 in Fine/Very Fine condition. Classic horror films often take top billing at these events, and this is no different. Estimates go as high as $250k, and it’s already up to $144k.

Pulp sci-fi also does well here for some reason, and a copy of Attack of the 50 Foot Woman is already past $15k.

Star Wars is, as always, very popular as well, with twenty different posters available.

Investor opportunities:

Alternate film posters are a fantastic entry into investing in the asset class. They’re often limited editions and routinely sell for 2x to 5x on the secondary market. Here are a few of our current favorites:

You can see this in action in May with Heritage’s Alt Film Posters auction.

Art

Here’s what you need to know:

- Sotheby’s is hosting its third edition of Natively Digital, a generative art auction producing both physical and digital pieces.

- It’s a collection of remarkable, unique artworks co-curated with Robert Alice. It showcases some of the earliest, raw NFTs built on pre-Ethereum chains alongside newer, complex NFTs that showcase the cutting-edge technical innovation, etc.

- They source emerging crypto artists and ‘old masters’ to exhibit their works from across four continents.

Investor opportunities:

Notable items include a piece of abstract digital art by Dmitri Cherniak and an AI digital painting by Pindar Van Arman.

Real Estate

Here’s what you need to know:

No one has any idea what to make of the American real estate market…

lies, damned lies, and statistics evidently. just fucking Zillow search yr market https://t.co/xB2ASAlq5n

— nate (@natefc) April 21, 2022

Investor opportunities:

We’re working hard on trying to understand this better… More to follow in the coming weeks (and sign up to the Real Estate newsletter if you’re not already).

Vinyl

Here’s what you need to know:

The Vinyl Revival is alive and well with Record Store Day coming up this Saturday.

Investor opportunities:

Pop in your zip code to see if you’re near one of the 1,400 participating record stores – many of them are issuing limited release albums to mark the day. Loads of international locations as well.

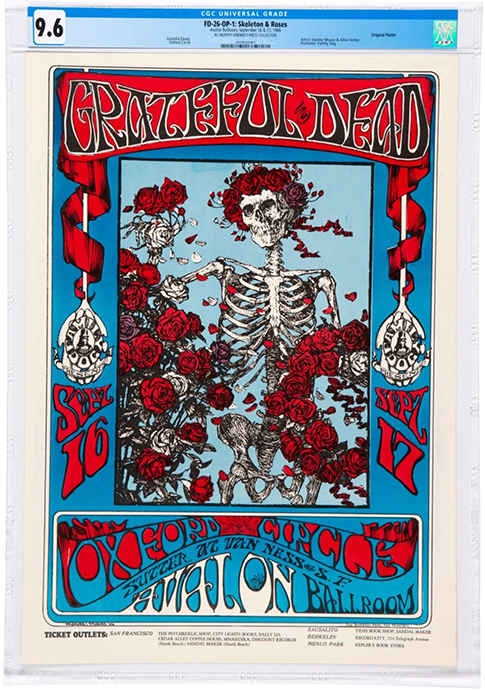

Concert Posters

Here’s what you need to know:

Concert posters keep setting records.

Over the weekend, an ultra-rare Beatles 1966 Shea Stadium poster sold for $285,000 vs the most recent sale of $150k. This is a record for both this particular poster and for the concert poster category as a whole.

Meanwhile, a Grateful Dead 1966 “Skeleton & Roses” poster sold for $137,500. This was a record high for any grade of this particular poster.

Investor opportunities:

Check your attic for old posters.

That’s all for this week. Hope you enjoyed your coffee and our first Alts Cafe.

Any comments, questions or concerns – respond to this email. And don’t forget to fill out our survey, it will help us make the content you want to see. (Unless you really don’t want an extra $50.) Cheers,

Wyatt