Hello and welcome to Alts Cafe

This is your weekly quick-fire analysis on all things Alts investing.

TLDR:

- Some good news in real estate but it’s mostly driven by negatives

- Lots of institutional activity around crypto last week

- AI and EVs the only real bright spots in startup land.

Like these posts? Please give us a shout on your socials, we’d appreciate it.

Wyatt

Table of Contents

Macro View

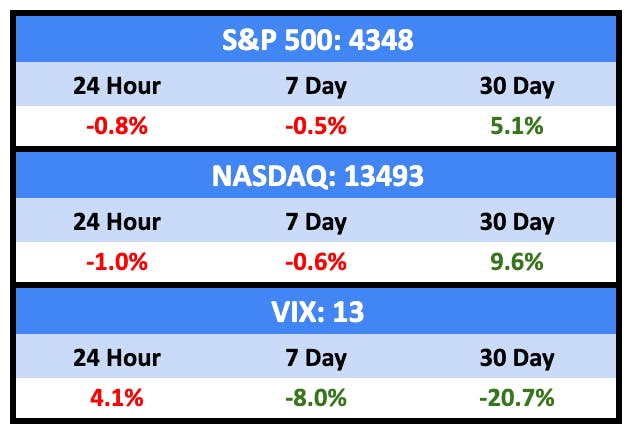

Mediocre week in the markets with some bad news coming out of Europe and not much positive from the US.

Russia had a half-assed coup, which was something.

Bullish News

- Texas has seen 27 straight months of jobs gains.

- Unemployment held steady at a 20-month high last week.

Bearish News

- The UK raised rates 50bps.

- There is over $100 billion worth of outstanding short positions on the US equities markets, a 14 month high.

What are we doing?

ALTS 1 fund news:

We’re still checking out an investment in the Deathcare space 👀

Real Estate

Bullish News

- Propped up by limited inventory, the typical U.S. home value climbed 1.4% from April to May, the strongest monthly growth since last June.

- US housing starts surged 22% in May — the biggest MoM jump since 2016.

- Builder confidence in the market for newly built single-family homes in June rose five points to 55.

- KB Home announced a 3% rise in revenue from increased demand and less supply.

Bearish News

- The Fed pause failed to pull mortgage rates down.

- Housing start applications are down double digits year over year.

- 1.2 million American homes worth a total of $336.7 billion are underwater — up 11% year over year.

- US homeowner equity decreased by over $100 billion year over year.

- US home inventory is down 40% compared to pre-Covid.

- US home listings fell 7% in May.

- CRE transactions are down 70% YoY.

- Vacancy rates of Silicon Valley offices are climbing.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

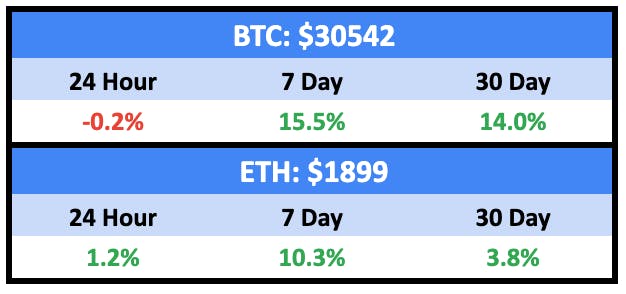

Crypto pumped last week with loads of good news coming out about institutional adoption.

Lots of greed, then a bit of fear, and we’re up 8 points on the week.

NFTs refuse to go up.

Bullish News

- The IMF is working on a platform for central bank digital currencies.

- Bitcoin is primed to pump if the BlackRock BTC ETF is approved.

- Invesco, which has $1.4 trillion AUM, is applying for an ETF as well.

- Japanese crypto firms, undeterred by dozens of counterexamples in the west, are trying to loosen margin trading rules.

- The institutional crypto exchange backed by Citadel and Fidelity went live.

- Deutsche Bank applied for regulatory permission to operate a custody service for crypto.

Bearish News

- Binance.US trading volume is down 75% YTD.

- Cryptocurrency custodian BitGo terminated its acquisition of rival Prime Trust. Prime Trust will probably collapse.

- Crypto.com has been trading its own book, and it’s not clear how much of a conflict there may be.

- Cryptocurrency infrastructure provider Wyre is winding down.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Own a piece of your favorite city.

Nada Cityfunds lets you invest in fast-growing cities as if they were funds. Think of it like an ETF for an entire city’s residential real estate.

The Cityfund of the Month is Dallas, where they have 19 properties.

Invest now and get free shares.

Startups

The Information has made its usually-paywalled The Information 50 list free to view for a couple months.

What’s The Information 50?

“The Information 50 Database tracks the venture-backed startups [their] staff identified each year as being the most promising based on revenue, business model, and growth prospects.”

Years 2020 – 2022 are available to view.

It tells a story you probably feel intuitively.

Companies that were hot in 2020 have done reasonably well with several 2x’ing to 10x’ing.

Those from 2021 are more mixed with several down rounds or flat rounds (if they were able to raise).

2022 is worse. Much much worse. Nearly all flat, down, or unfunded since they made the list.

Bullish News

- OpenAI is looking at building an app store.

- I honestly don’t know if this is bullish, bearish, or insane, but lots more SPACs.

- China is launching a $72 billion tax break for electric vehicles — the biggest subsidy of its kind anywhere.

- A copper and rare earth mining company backed by Bill Gates has just become a unicorn.

- SoftBank is getting back on the horse, switching to “offence mode.” The company lost nearly $7 billion last year.

Bearish News

- The social app IRL has shut down after its CEO was investigated for misconduct. 95% of its users were bogus.

- The co-founders of the bankrupt crypto hedge fund Three Arrows Capital (3AC) are launching a new VC fund.

- Canada will require Google and Meta to pay media outlets for news. What a stupid f-cking idea. And I say this as someone who puts out content myself.

- Startup shares are selling at a 61% discount on secondary markets. Capitulation, or catching falling knives?

- Uber is firing 200 people from its recruitment division. And probably not hiring many people any time soon.

- Not to be outdone, Singapore’s Uber, Grab, laid off 1,000 people.

- Tiger Global’s latest fund missed fundraising targets by 55% and is $10 billion smaller than its most recent fund.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our very clever friends at Bioverge and Nada.

- We hold BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- We are investigating an opportunity in the Deathcare space for our fund, and will say more as soon as there’s something to share.

- The Issuer [Bioverge, Inc.] will also be promoting the Offering through an arrangement with Alts.co, where the Issuer will pay $1,500 for placement in the Alts.co newsletter. The Issuer may increase this effort and the payment if the ad performs well, with payments set as a flat fee and not a percentage of amounts raised.