Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- Why Is Housing Unaffordable?

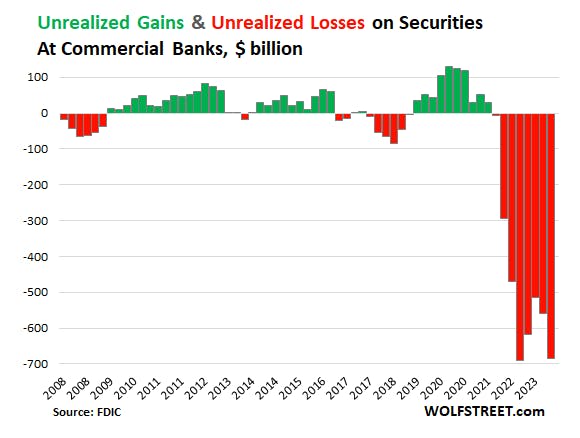

- “Unrealized Losses” on Securities Held by Banks Jump by 22% to $684 Billion in Q3

- A Bull Case For The Startup Building “Google Flights” For Construction

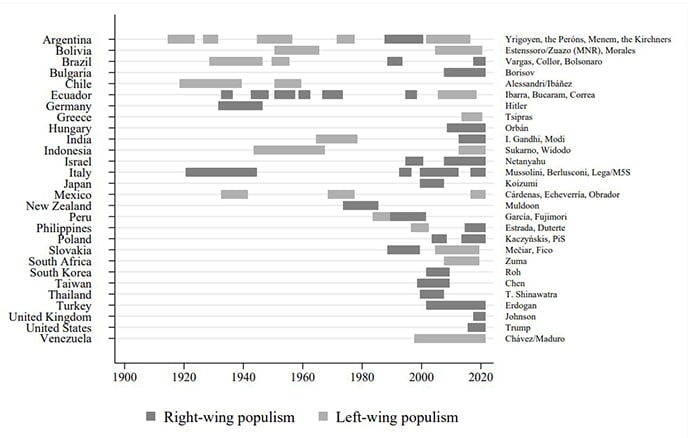

- Populist Politics and Their Long-Term Economic Effects

- Which Companies Are Building Moats?

- Clashing Views on Fossil Fuels and Carbon Pricing at COP28

- How Coinbase is Targeting Millennials to Drive Crypto Adoption

- 5G Stocks… Worth Keeping An Eye On?

Table of Contents

Why Is Housing Unaffordable? Exploring the Role of Supply Elasticity

In many cities (like San Francisco), natural and legal constraints on building new homes make it hard to produce new housing, so the supply is inelastic–price increases a lot; quantity increases only a little.

This essay (and video) dives deep into the reasons behind soaring housing prices, urging us to consider the less obvious forces shaping our urban landscapes.

Are we overlooking potential solutions to make housing more accessible?

“Unrealized Losses” on Securities Held by Banks Jump by 22% to $684 Billion in Q3

via Wolf Street

‘Unrealized losses’ on securities at FDIC-insured commercial banks have risen sharply. But what does this mean for the stability of our banking system?

This significant increase highlights the complex interplay between rising interest rates and banking regulations. One of the key takeaways is the effect of the Fed’s policies, as noted:

As has been proven now beyond a reasonable doubt, easy money is like a virus that turns brains to mush.

Read more from Wolf Richter.

A Bullish Case For The Startup Trying To Be “Google Flights” But For Construction

via CrowdScale

The BuildClub is a California-based startup that aims to revolutionize the construction industry by infusing data and technology, likened to the “Google Flights for building materials.”

The company’s transition from on-demand delivery to a platform that compares prices from various hardware/material stores and its future plans to introduce innovative quoting tools and AI-driven blueprint analysis make several investors quite bullish.

Get the full analysis here.

Populist Politics and Their Long-Term Economic Effects

Opting for populist leadership might come with a heavy economic cost, as evidenced by a potential 10% reduction in a nation’s economy over 15 years. This raises an important question: how exactly do populist leaders impact the economies they govern?

Joachim Klement explores the intricate ways in which populist policies can reshape national economies, from increasing trade barriers to expanding government deficits and debt.

Which Companies Are Building Moats? Techniques for Early Detection

Building moats in the business world isn’t just about having a competitive edge; it’s about foreseeing which companies are in the process of constructing these moats.

But how can you spot these early moat builders, the next Googles or Apples in the making?

Investment Talk delves into the essentials elements of moat construction, from brand loyalty to management execution.

Clashing Views on Fossil Fuels and Carbon Pricing at COP28: The Debate Intensifies

COP28 focused on to the economic implications of climate change, with IMF’s Georgieva advocating for an increase in carbon pricing to $85 per ton by 2030, highlighting its financial effectiveness in reducing emissions.

However, contrasting financial perspectives emerged, notably from the UAE’s Sultan Al Jaber, who questioned the economic feasibility of a complete fossil fuel phase-out.

These discussions highlight the intricate financial challenges continuing to unwravel in global climate policy.

How Coinbase is Targeting Millennials to Drive Crypto Adoption

via Daily Dough

Coinbase’s latest ad campaign has struck a chord with many, tapping into the emotional and financial struggles of millennials.

The ad cleverly juxtaposes the traditional financial norms that have been ingrained in society with the harsh reality faced by young people today.

As the ad unfolds, it becomes clear that Coinbase is positioning cryptocurrency as a liberating alternative to the conventional financial system. The message is clear: there is a better way, and it lies in the power of cryptocurrency.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

The Informationist

The Informationist simplifies one economic concept every week. Lightweight and high value per minute spent.

Equity Espresso

Aussie-focussed market news that gives a solid non-US perspective on global finance.

Trends.vc

Discover new markets and ideas.

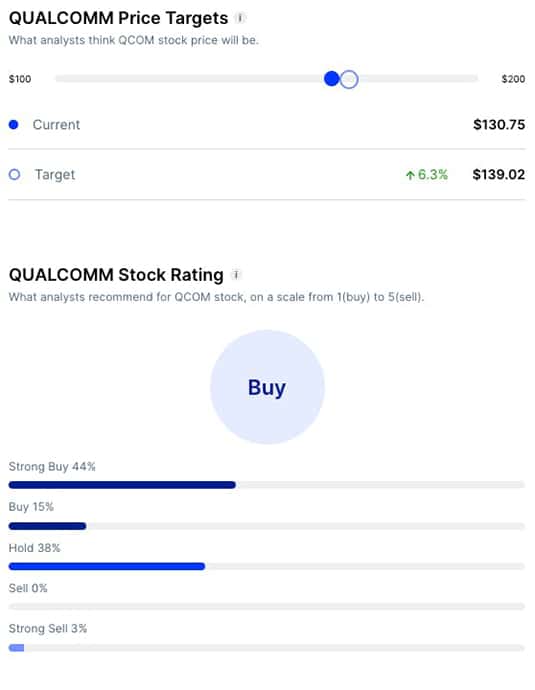

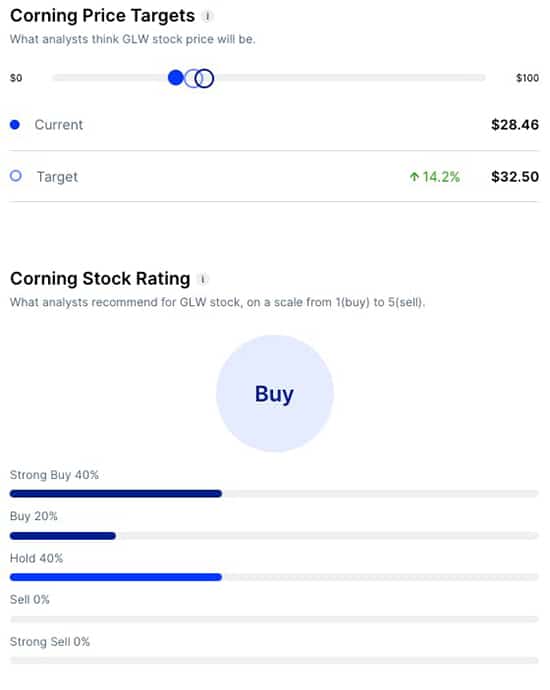

Stock ideas

2023 was an interesting year for telecom companies and hardware providers. Many reduced investments after heavy spending in preceding years, while smartphone sales dipped.

Nonetheless, the growing shift to online work, education, and commerce in emerging markets could make some 5G stocks worth paying attention to.

Analysis provided by public.com. Remember to always DYOR.

Qualcomm ($QCOM)

Bull Case

- 6G Technology Leader: Qualcomm’s pioneering work in 6G positions it as a frontrunner, offering potential new revenue streams and sustained innovation.

- Diverse Revenue Streams: Beyond 6G, Qualcomm’s Snapdragon platform diversifies income sources, reducing market segment dependence.

- AI Integration: Qualcomm’s AI chip investments promise growth as AI becomes vital in smartphones, connected cars, and IoT devices.

Bear Case

- Tech Competition: Fierce tech competition poses a threat. Maintaining innovation and market leadership is crucial for growth.

- Regulatory Challenges: Past regulatory issues can disrupt business. Ongoing regulatory scrutiny may hinder progress.

- Market Reliance: Despite diversification, Qualcomm heavily depends on the smartphone and telecom markets. Industry downturns can impact revenue and profits.

Corning ($GLW)

Bull Case:

- Fiber-Optic Demand: Corning benefits from increasing demand for fiber-optic cables in the 5G era.

- Diversification into 5G: Corning’s SpiderCloud E-RAN technology expands its revenue with on-premise 5G networks for businesses.

- Attractive Valuation: GLW stock offers a reasonable valuation at 17 times forward earnings and a 3.9% dividend yield.

Bear Case:

- Market Competition: Competition in fiber-optic and 5G tech sectors may limit market share and profitability.

- Technological Challenges: Rapid tech advancements could be a challenge if Corning lags behind industry standards.

- Economic Sensitivity: Economic downturns may impact demand, particularly in the construction and telecom sectors, affecting financial performance.

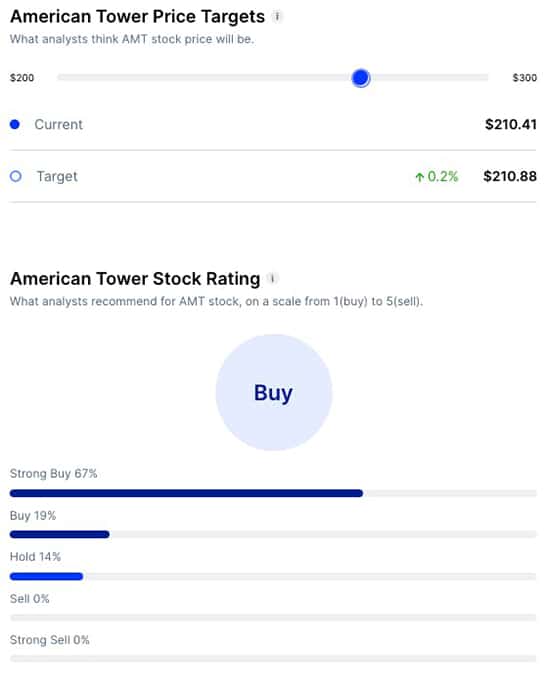

American Tower ($AMT)

Bull Case:

- Global Tower Ownership: AMT, a leading REIT in data centers and towers, owns over 220,000 cell phone towers worldwide, benefiting from the 5G expansion.

- Diverse Revenue Streams: With 40,000+ U.S. towers and a strong presence in growth markets like Brazil and India, AMT taps into both mature and high-growth regions.

- Data Center Growth: Expanding into data centers aligns AMT with the growing communications market, enhancing revenue prospects.

Bear Case:

- Regulatory Risks: As a REIT, regulatory changes may impact operations or tax status.

- Economic Sensitivity: Downturns can affect tower demand, impacting revenue and profitability.

- Competition Challenge: Rival tower operators and infrastructure providers could threaten AMT’s market position and growth.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click through.

- This newsletter was brought to you by our friends at Honeycomb Credit.

- Nothing above is financial advice. DYOR, you filthy animal.