Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

For the first time in ages, more than half the global population thinks the stock market is set to crash.

Results vary widely by country, but only 31% of survey respondents think the stock market won’t crash in 2023.

Bullish News

- Global equity funds drew their first weekly inflow in 10 weeks.

Bearish News

- For the first time since 2018, larger hedge funds outperformed smaller hedge funds. Bigger funds are more likely to focus on quantitative, arbitrage, and other strategies that don’t rely on rising markets to generate profits.

- Japanese inflation rose to a 41-year high of 4%.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Here’s what you need to know:

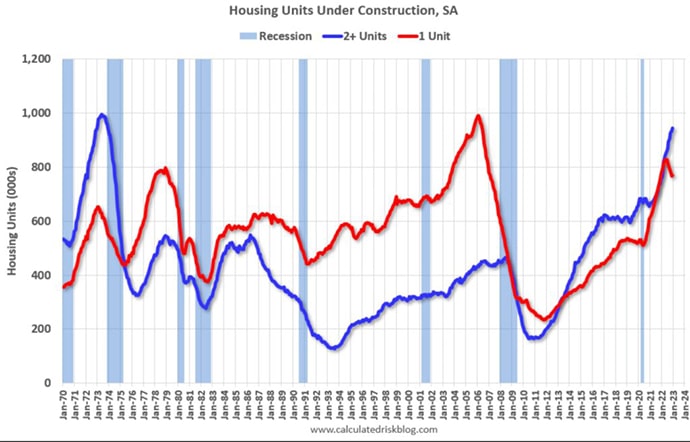

Perhaps surprisingly, there’s a record number of total housing units under construction in the US.

Nearly all of them are scheduled for delivery in 2023, which is going to add a lot of supply to an already declining sales and rental market.

Single-family homes will be delivered first, and starts there have been declining for the last ten months already. But multi-family starts have only just turned negative month on month.

Expect to see rental yields come down significantly in 2023.

Bullish News

- Nada.

Bearish News

- Housing starts were down 22% YoY in December 2022. Housing permits granted were down 30%.

- The price of a Manhattan apartment declined for the first time since early 2020, with the median price down 5.5%

- 2022 was slowest year for US home sales in nearly a decade.

- KKR limited redemptions from its real estate funds as redemption requests topped 8%, well over its 5% quarterly limit. Recall Blackrock did the same thing a few weeks ago.

How to invest in real estate right now:

Sit on your hands or chase yield. [Unchanged]

Crypto & NFTs

Here’s what you need to know:

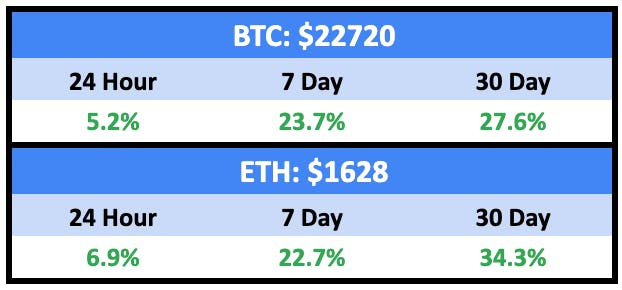

Bitcoin topped $23k over the weekend, placing it well above its 200 day moving average (± $19,600).

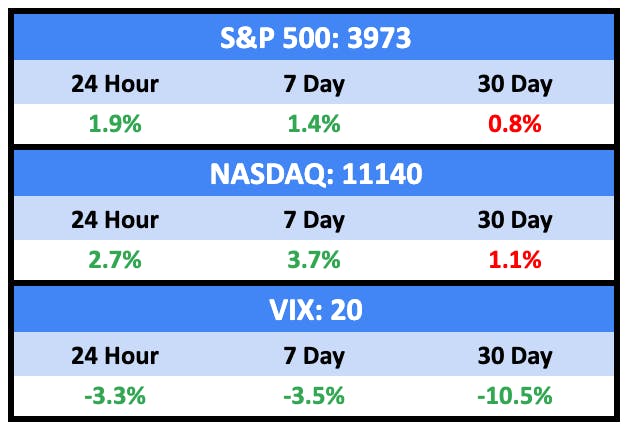

It was another solid week, as sentiment has stabilized, while prices continued to surge:

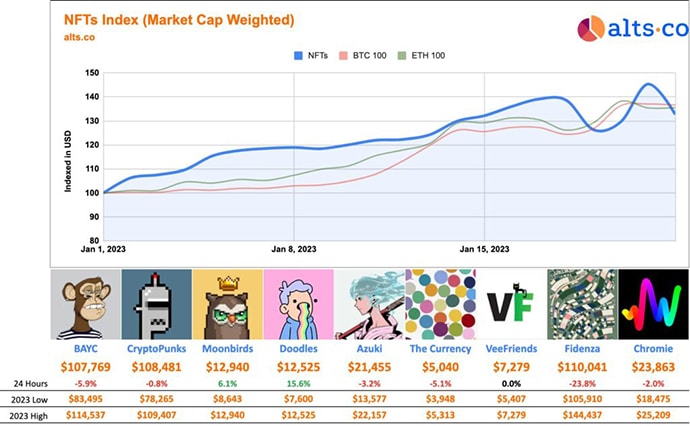

NFTs look a bit choppier but continue to accelerate.

Bullish News

- Crypto markets regained the $1 trillion capitalization mark for the first time since November.

- PROOF Collective’s popular Grails series is back with season III out now. There are some new mechanics you may want to familiarize yourself with (ALTS 1 holds both the PROOF NFT and a Grails III mint pass).

- Bored Apes are minting their sewer passes.

- The Blur NFT marketplace aggregator is launching their $BLUR token 14 February.

- Remember Nouns? You can buy their first comic for about $5.

- Someone is snapping up all the Hoodie Punks at the 200 ETH + price point.

Bearish News

- Crypto lender Genesis filed for Chapter 11 bankruptcy protection in New York. They owe over $3.5B to their top 50 creditors.

- The Winkelvei lost $1.2B in Three Arrows Capital and $175M in FTX.

- There may be a problem with the Binance BUSD pegs…

- Crypto-friendly Signature Bank will no longer handle transactions of less than $100,000 for crypto exchange customers.

How to invest in Crypto & NFTs right now:

Here’s a great primer on how to invest in the Web3 gaming ecosystem.

Startups

Here’s what you need to know:

If you’re a startup (or your portfolio companies are) banking with Silicon Valley Bank, it’s going to be a lot harder to borrow money soon. Silicon Valley Bank shares were up big last week on pretty mediocre earnings.

But there could trouble on the horizon for SVIB. From 2019 to 2021, the bank increased its exposure to housing debt by 700% to $99B. They bought $88B worth of ten-year mortgages at 1.63% (Ouchtown).

If the bank were forced by the SEC to mark down those securities, its equity would be $400m+ underwater.

If the bank were to see deposit outflows (they are!), they’d be forced to raise equity or sell some of those securities at market price (i.e. a big loss). Both those scenarios are bad, so the bank must keep its money on its books.

Expect them to tighten lending and credit soon. Read this entire thread for more.

In other news, AngelList was out with their 29 page State of US Early-Stage Venture & Startups. It includes this very confusing chart, which confirms it’s “bad times” in VC Land.

There aren’t too many surprises in the report, but I was surprised to see Pre-Seed valuations held steady through the year at around $10m given the bloodbath in later rounds (Series B valuations were down 50%).

Bullish News

- 2022 was a record year for African startups funding with $4.8B raised. Nigeria and Kenya took in the most funds.

- Former FTX US president, Brett Harrison, raised $5M for another crypto startup called Architect.

- At Davos, European Commission President Ursula von der Leyen announced the bloc would turbocharge its green subsidies to help European businesses remain “competitive” on the world stage. The proposal aims to counterbalance a $500B green package offered by the US.

Bearish News

- Google sacked 12k members of staff via midnight email. They’ve also decided to defer 20% of bonuses. This sort of thing doesn’t often end well.

- Twitter has around 1,300 employees today, from 7,500 in November.

How to invest in startups right now:

Look at Africa and Latin America.

Quick Hits

Sports cards

Sports cards are quietly up 7.4% in 2023.

Comic Books

A big auction wrapped up last week at Heritage. Overall, it was a rough auction, with many top-tier books dropping 35% or more from recent highs.

Some of the highlights:

- A 9.2 graded copy of Amazing Fantasy #15 (first Spider-Man) sold for $810k, which is 30% higher than its last sale in 2019, but it was well below consensus fair market value of $1.05m before the auction.

- Superman #1 CGC 5.0: Sold for $675k inline with $700k FMV

- Batman #1 CGC 6.0: $552k, well above $370k FMV

- Tales of Suspense #39 (first Ironman): $108k, which is in line with FMV but well below the most recent sale in Nov 2022 of $168k.

- Two copies of X-Men #1: $108k and $102k. A 30% to 40% haircut compared to late 2021 and mid-2022 numbers.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.